Risk Management – what does it mean

| 24-5-2017 | Patrick Kunz |

You might visit this site, being a treasury professional with years of experience in the field. However you could also be a student or a businessman wanting to know more details on the subject, or a reader in general, eager to learn something new. The ‘Treasury for non-treasurers’ series is for readers who want to understand what treasury is all about.

Our expert Patrick Kunz tells us more about an important task of a treasurer: Risk Management

Background

One of the main task of a treasury is risk management, more specifically financial risk management. This is still broad as financial risk can result from many origins. Treasury is often involved in the risk management of Foreign currency (FX), interest rates, commodity prices and sometimes also balance sheet/profit loss. Furthermore insurances are often also the task of the treasurer.

Exposure

To be able to know how to reduce a certain risk the treasurer first needs to know about the risk. Often risk positions are taken outside of the treasury department. The treasurer needs to be informed about these risk positions. FX and commodity price exposure is often created in sales or procurement while the interest rate risk is created in the treasury department itself (although this is not always the case). In an ideal world the treasurer would like to know an exposure right after it is created. Often IT solutions or ERP connections with treasury help with that.

Policy

Once the exposure is know the treasurer needs to decide whether it is a risk position or not and whether he wants to mitigate this risk by hedging it. Let me explain this with an FX example: A EUR company who buys goods in USD is at risk for movements in the EUR/USD rate. However, if the company is able to sell these goods at the same time they are bought (a sales organization), for USD then the net exposure could be lower. Risk Exposure is therefore lower as only the profit needs to be hedged.

Risk appetite of the company determines if the treasurer needs to take action on certain risk exposure. Some companies hedge all their FX exposure. The reason for this is often because FX risk is not their core business and therefore not a business risk. Non-core risk needs to be eliminated. Commodity risk is sometimes not hedged as this is the company’s core business or a natural hedge as the companies is also producer/miner and seller of the commodity. Other companies have more risk appetite and hedge only amounts above a certain threshold. Due to internal information restrictions, delays or accounting issues and the fact that some currencies are not hedgable most multinationals always have some FX exposure. In the profit and loss statements you often see profit or losses from FX effect, either realized or non-realized (paper losses).

Hedging

Once you know the risk position the treasurer needs to determine how to reduce the risk of that position. He does that by hedging a position. A hedge is basically taking an opposite position from the risk. Preferably the correlation of these positions is -1 which means that both positions exactly move in opposite directions, thereby reducing the risk (ideally to 0). For FX the treasurer can sell the foreign currency against the home currency on the date the foreign currency is expected, either in spot (immediate settlement) or forward (in the future), removing the FX exposure into a know home currency exposure.

Certain vs uncertain flows

Important about hedging is the way you hedge. A hedge can commit you to something in the future or a hedge can be an optional settlement. This should be matched with the exposure. If the exposure is fully certain then you should use a hedge which is fully certain. If an exposure is only likely to happen (due to uncertainty) then you should use a hedge that is also optional.

Example1: a company has a 1 year contract with a steel company to buy 1000MT of steel every month at the current steel price every month. The goods need to be bought under the contract and cannot be cancelled. This company is at risk for the steel price every month because the steel price changes every day. The treasurer can hedge this with 12 future contracts (1 for every month) locking in the price of the steel for 1000MT. The future contract also needs to be settled every month matching the risk position. 0 risk is the result.

Example2: company X is a EUR company and looking to take over company Y, a USD company. The company needs to be bought for USD 100 mio. Company X has the countervalue of this amount in cash in EUR. The companies are still negotiating on the deal. Currently the EUR/USD is at 1,10. The deal is expected to settle in 6 months. Company X is at risk for a change in the EUR/USD rate. If the deal goes through and the rate in 6 months changes negatively then X needs more EUR to buy USD 100 mio. making the deal more expensive/less attractive. There is a need to hedge this. If this would be hedged with a 6M EURUSD forward deal the FX risk would be eliminated but there is still the risk that the deal is cancelled. Then X has the obligation out of the hedge to buy USD 100 mio. which they have no use for. This is not a good hedge. A better hedge would be to buy an option to buy USD 100 mln against EUR in 6 months. This instrument also locks in the EURUSD exchange but with this instrument the company has the option to NOT use the hedge (if the deal is cancelled) matching it ideally with the underlying deal.

Conclusion

For a treasurer to do effective risk management he needs information from the business to determine the risk exposure. Furthermore he needs to assess the certainty of this exposure; how likely is the exposure to happen. With this information, together with the pre-determined risk appetite (whether or not written down in a policy confirmed by senior management), the treasurer can decide if and how to hedge the position. The certainty of the exposure determines the hedging product that is used.

Hedging products can be complex. Banks can structure all kinds of complex derivatives as hedging products. It is the task of the treasurer to determine the effectiveness of a hedge; a treasurer if often expert in these product and their workings. Hedging could have impact on accounting and sometimes profit/loss consequences but that is beyond the scope of this article.

Treasury, Finance & Risk Consultant/ Owner Pecunia Treasury & Finance BV

Dit is een verslag en korte samenvatting van mijn presentatie die ik mocht houden op het Financial Systems evenement. Afgezien van een gênante vertraging door mijn gebrekkige Powerpoint skills was het een prettige sessie afgerond met een pittige discussie tussen experts in de zaal. Eerst een korte samenvatting:

Dit is een verslag en korte samenvatting van mijn presentatie die ik mocht houden op het Financial Systems evenement. Afgezien van een gênante vertraging door mijn gebrekkige Powerpoint skills was het een prettige sessie afgerond met een pittige discussie tussen experts in de zaal. Eerst een korte samenvatting:

Our expert Carlo de Meijer is our blockchain specialist and publishes his articles on a regular basis. We present his latest article about blockchain and supply chain finance in a shorter version.

Our expert Carlo de Meijer is our blockchain specialist and publishes his articles on a regular basis. We present his latest article about blockchain and supply chain finance in a shorter version.

You might visit this site, being a treasury professional with years of experience in the field. However you could also be a student or a businessman wanting to know more details on the subject, or a reader in general, eager to learn something new. The ‘Treasury for non-treasurers’ series is for readers who want to understand what treasury is all about. Today our expert François de Witte will explain de difference between long term and short term debt.

You might visit this site, being a treasury professional with years of experience in the field. However you could also be a student or a businessman wanting to know more details on the subject, or a reader in general, eager to learn something new. The ‘Treasury for non-treasurers’ series is for readers who want to understand what treasury is all about. Today our expert François de Witte will explain de difference between long term and short term debt. François de Witte – Founder & Senior Consultant at

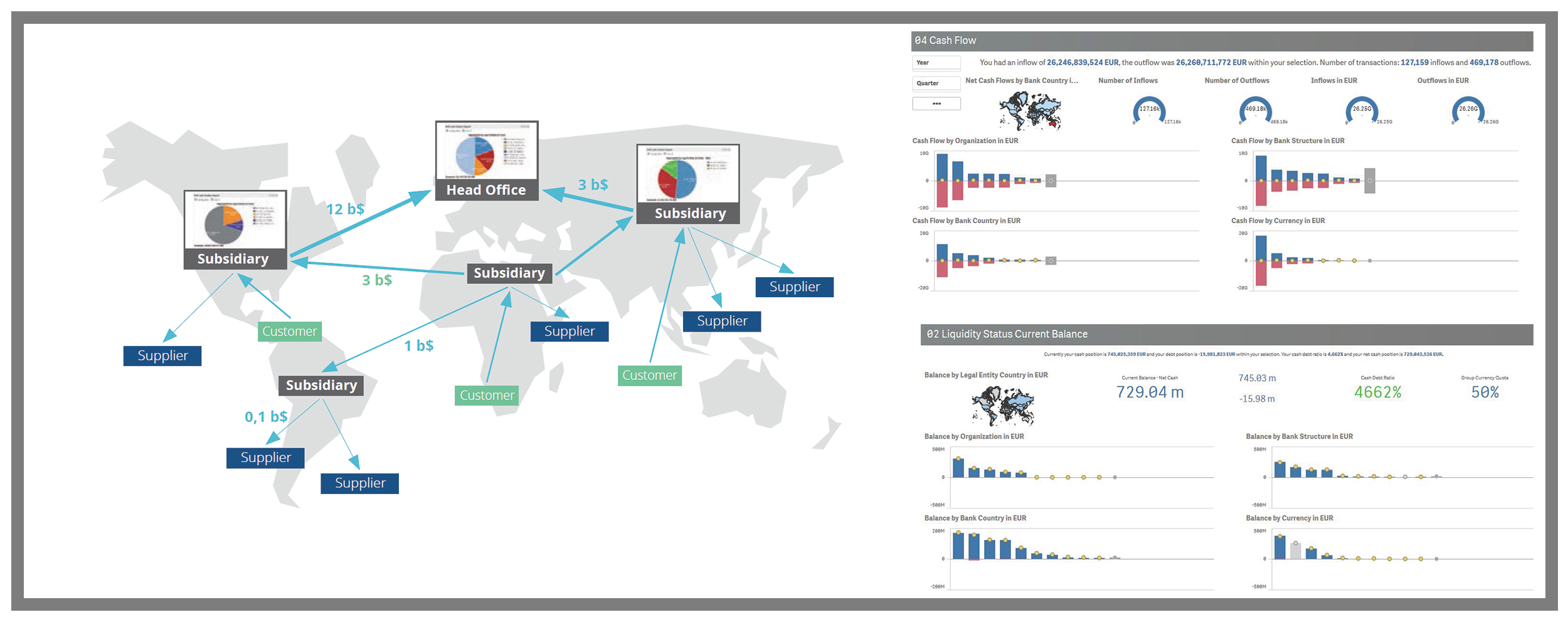

François de Witte – Founder & Senior Consultant at  How do strategic professionals decide on the best path to success for their company? The key is in transparency and real-time reporting. If it comes to the responsibility of the treasurer or financial professional this means deciding about company-wide cash flow and liquidity levels, bank, customer and supplier relations and working capital.

How do strategic professionals decide on the best path to success for their company? The key is in transparency and real-time reporting. If it comes to the responsibility of the treasurer or financial professional this means deciding about company-wide cash flow and liquidity levels, bank, customer and supplier relations and working capital.

In 2016

In 2016

MIFID II – you read about it frequently. And there are more abbreviations: you will also find MIFIR and MIFID I. As a banker you will know what we are talking about. As a treasurer or financial professional you are supposed to understand what MIFID II will bring you. We think it is time to zoom in on this subject and present a short summary.

MIFID II – you read about it frequently. And there are more abbreviations: you will also find MIFIR and MIFID I. As a banker you will know what we are talking about. As a treasurer or financial professional you are supposed to understand what MIFID II will bring you. We think it is time to zoom in on this subject and present a short summary. Annette Gillhart – Community Manager treasuryXL

Annette Gillhart – Community Manager treasuryXL