Introduction core team Treasurer Development

| 19-10-2017 | treasuryXL | Treasurer Development |

Earlier we informed you about the Treasurer Development initiative. The members of the core team of Treasurer Development aim to contribute to raising the professional level of corporate treasury and increase acceptance and recognition of corporate treasury. Starting point for them is the treasurer as a person.

Earlier we informed you about the Treasurer Development initiative. The members of the core team of Treasurer Development aim to contribute to raising the professional level of corporate treasury and increase acceptance and recognition of corporate treasury. Starting point for them is the treasurer as a person.

In the kick off meeting a core team was created; these are the members:

- Janneke Nonkes, former group treasurer and coach

- Robert Dekker, manager of the post graduate Register Treasurer program at the Free University in Amsterdam and treasury consultant at KPMG

- Frans Boumans, responsible for the minor treasury management program at the University of Applied Sciences in Utrecht and former banker

- Pieter de Kiewit, recruitment consultant and owner of Treasurer Search

All core team members work independently in this initiative. They do not represent each other or treasuryXL as a core team member. They aim to inspire, inform and deliver positive criticism. The opinions expressed by a member of the core team are attributed to that person and these opinions are independent and not necessarily shared and/or endorsed by all the other members. treasuryXL is the communication platform for Treasurer Development. Blogs, discussions, round table meetings, curriculum build-up and adviser are all results that can and will be the result of Treasurer Development.

First initiative coming from Treasurer Development is a cooperation between Frans Boumans and treasuryXL. All of us will start blogging on related topics. Janneke and Pieter will develop a free of charge telephone quick scan in which treasurers can brainstorm about their career development. Robert will inform you shortly about curriculum developments in the Register Treasurer program. Both the Hogeschool Utrecht and the Vrije Universiteit will want to brainstorm with you about guest lecturing, internships and graduation projects.

So far, the first responses on this initiative are very positive. We are open for suggestions and look forward to informing you further.

treasuryXL

[icon icon=”envelope” color=”” size=”tiny” with_circle=”0″ link=””] [email protected]

[icon icon=”phone” color=”” size=”tiny” with_circle=”0″ link=””] 06-21303744

Traditionally, banks provided the infrastructure to enable payments to take place. Nowadays, there are many different third party online payment services that compete directly with the bank models. We came across an interesting article detailing the rise of a mobile payment platform with a large customer base in China, which is bigger than well-known services such as Paypal. It is part of the Alibaba Group who already have a large presence in Europe via AliExpress – after making a large impact on European online shopping, will they make an impact on the payments systems?

Traditionally, banks provided the infrastructure to enable payments to take place. Nowadays, there are many different third party online payment services that compete directly with the bank models. We came across an interesting article detailing the rise of a mobile payment platform with a large customer base in China, which is bigger than well-known services such as Paypal. It is part of the Alibaba Group who already have a large presence in Europe via AliExpress – after making a large impact on European online shopping, will they make an impact on the payments systems? We all have these topics we know are important but never get the highest priority. Until it is too late. Cybersecurity is one of them. Do you want to be the treasurer named in the newspapers? Finding examples and input on-line is not hard. Only this morning these articles popped up through LinkedIn:

We all have these topics we know are important but never get the highest priority. Until it is too late. Cybersecurity is one of them. Do you want to be the treasurer named in the newspapers? Finding examples and input on-line is not hard. Only this morning these articles popped up through LinkedIn:

According to a recent Juniper Research study “Blockchain Enterprise Survey”, IBM is seen as the number one provider of blockchain to business, well ahead of its competitors. These results are based on a survey of 400 business users from organisations actively considering, or in the process of deploying blockchain technology. Of the surveyed 43% ranked IBM first, followed by Microsoft (20%) and Accenture.

According to a recent Juniper Research study “Blockchain Enterprise Survey”, IBM is seen as the number one provider of blockchain to business, well ahead of its competitors. These results are based on a survey of 400 business users from organisations actively considering, or in the process of deploying blockchain technology. Of the surveyed 43% ranked IBM first, followed by Microsoft (20%) and Accenture.

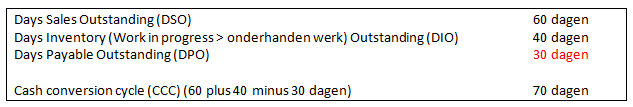

Waarom aandacht voor werkkapitaalbeheersing? Professionele services organisaties zoals advocaten, accountants maar ook andere tijd schrijvende organisaties kenmerken zich door een uiterst loyale cliënt opstelling. Loyaal in de zin dat de cliënt vraag centraal staat en dat deze vraag zo spoedig mogelijk beantwoord dient te worden. Als het probleem van de cliënt is opgelost is de professional tevreden. Op zich is daar niets mis mee. Maar dan……..

Waarom aandacht voor werkkapitaalbeheersing? Professionele services organisaties zoals advocaten, accountants maar ook andere tijd schrijvende organisaties kenmerken zich door een uiterst loyale cliënt opstelling. Loyaal in de zin dat de cliënt vraag centraal staat en dat deze vraag zo spoedig mogelijk beantwoord dient te worden. Als het probleem van de cliënt is opgelost is de professional tevreden. Op zich is daar niets mis mee. Maar dan……..

Last Tuesday

Last Tuesday

Eind deze maand stuurt de AFM weer een voortgangsrapportage inzake de uitvoering van het Uniform Herstelkader Rentederivaten naar de Tweede Kamer. Volgens berichtgeving vorige week in het FD zal daar in staan dat de banken vrijwel geen voortgang geboekt hebben. Het blijkt dat “van de bijna 20.000 gedupeerde MKB’ers er slechts een handjevol een schadevergoeding heeft gekregen en pas enkele tientallen een voorstel voor schadevergoeding[1]”

Eind deze maand stuurt de AFM weer een voortgangsrapportage inzake de uitvoering van het Uniform Herstelkader Rentederivaten naar de Tweede Kamer. Volgens berichtgeving vorige week in het FD zal daar in staan dat de banken vrijwel geen voortgang geboekt hebben. Het blijkt dat “van de bijna 20.000 gedupeerde MKB’ers er slechts een handjevol een schadevergoeding heeft gekregen en pas enkele tientallen een voorstel voor schadevergoeding[1]”

TIS and 2FX Treasury organize a webinar that we would like to bring to your attention. On October 19th between 04:00 and 04:45 PM TIS and 2FX Treasury will host: Corporate Payments Optimization: How to reduce complexity in your business. An interesting session for treasury professionals.

TIS and 2FX Treasury organize a webinar that we would like to bring to your attention. On October 19th between 04:00 and 04:45 PM TIS and 2FX Treasury will host: Corporate Payments Optimization: How to reduce complexity in your business. An interesting session for treasury professionals.