Voorlichtingsavond PGO Treasury Management & Corporate Finance

| 20-10-2017 | Robert Dekker |

Op donderdag 9 november 2017 vindt de voorlichtingsavond voor de Postgraduate opleidingen, waaronder de opleiding Treasury Management & Corporate Finance, van de School of Business and Economics van de Vrije Universiteit Amsterdam plaats.

Op donderdag 9 november 2017 vindt de voorlichtingsavond voor de Postgraduate opleidingen, waaronder de opleiding Treasury Management & Corporate Finance, van de School of Business and Economics van de Vrije Universiteit Amsterdam plaats.

Deze voorlichtingsavond is bedoeld voor geïnteresseerden die per 1 februari 2018 willen instromen. Dat kan, omdat wij de opleiding modulair georganiseerd hebben, dat ons in staat stelt 2 keer per jaar studenten te laten instromen namelijkper 1 september en per 1 februari.

Een ieder die geïnteresseerd is in de opleiding is van harte welkom om een indruk van de opleiding te krijgen en kennis te maken met de programmadirectie, docenten en (ex-)studenten.

De ontvangst is om 18.00 uur in de Foyer van de Agorazalen. Vanaf 18.30 uur vinden de voorlichtingsrondes plaats. Om 20.30 uur begint de voorlichting voor de opleiding Treasury Management & Corporate Finance. Na afloop is er gelegenheid om vragen te stellen.

Programma

18.00 uur > Ontvangst met koffie/thee en broodjes

18.30 uur > Voorlichtingsronde 1

19.30 uur > Voorlichtingsronde 2

20.30 uur > Voorlichtingsronde 3 – Treasury Management & Corporate Finance (RT)

Na afloop > Gelegenheid tot vragen stellen

Locatie

Vrije Universiteit Amsterdam, Agorazalen, De Boelelaan 1105 (hoofdgebouw, 3e etage)

Aanmelden en informatie

Wij weten graag vooraf op hoeveel mensen we kunnen rekenen. Aanmelden kan via VU PGO voorlichtingsavond

Voor vragen/contact

Nicole Lijs

Postgraduate opleiding Treasury Management & Corporate Finance

020-598 2171/ [email protected]

Robert Dekker – Program director postgraduate program treasury & corporate finance at the VU University

[button url=”http://www.treasuryxl.com/community/experts/robert-dekker/” text=”View expert profile” size=”small” type=”primary” icon=”” external=”1″]

Traditionally, banks provided the infrastructure to enable payments to take place. Nowadays, there are many different third party online payment services that compete directly with the bank models. We came across an interesting article detailing the rise of a mobile payment platform with a large customer base in China, which is bigger than well-known services such as Paypal. It is part of the Alibaba Group who already have a large presence in Europe via AliExpress – after making a large impact on European online shopping, will they make an impact on the payments systems?

Traditionally, banks provided the infrastructure to enable payments to take place. Nowadays, there are many different third party online payment services that compete directly with the bank models. We came across an interesting article detailing the rise of a mobile payment platform with a large customer base in China, which is bigger than well-known services such as Paypal. It is part of the Alibaba Group who already have a large presence in Europe via AliExpress – after making a large impact on European online shopping, will they make an impact on the payments systems? We all have these topics we know are important but never get the highest priority. Until it is too late. Cybersecurity is one of them. Do you want to be the treasurer named in the newspapers? Finding examples and input on-line is not hard. Only this morning these articles popped up through LinkedIn:

We all have these topics we know are important but never get the highest priority. Until it is too late. Cybersecurity is one of them. Do you want to be the treasurer named in the newspapers? Finding examples and input on-line is not hard. Only this morning these articles popped up through LinkedIn:

According to a recent Juniper Research study “Blockchain Enterprise Survey”, IBM is seen as the number one provider of blockchain to business, well ahead of its competitors. These results are based on a survey of 400 business users from organisations actively considering, or in the process of deploying blockchain technology. Of the surveyed 43% ranked IBM first, followed by Microsoft (20%) and Accenture.

According to a recent Juniper Research study “Blockchain Enterprise Survey”, IBM is seen as the number one provider of blockchain to business, well ahead of its competitors. These results are based on a survey of 400 business users from organisations actively considering, or in the process of deploying blockchain technology. Of the surveyed 43% ranked IBM first, followed by Microsoft (20%) and Accenture.

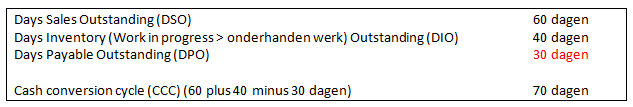

Waarom aandacht voor werkkapitaalbeheersing? Professionele services organisaties zoals advocaten, accountants maar ook andere tijd schrijvende organisaties kenmerken zich door een uiterst loyale cliënt opstelling. Loyaal in de zin dat de cliënt vraag centraal staat en dat deze vraag zo spoedig mogelijk beantwoord dient te worden. Als het probleem van de cliënt is opgelost is de professional tevreden. Op zich is daar niets mis mee. Maar dan……..

Waarom aandacht voor werkkapitaalbeheersing? Professionele services organisaties zoals advocaten, accountants maar ook andere tijd schrijvende organisaties kenmerken zich door een uiterst loyale cliënt opstelling. Loyaal in de zin dat de cliënt vraag centraal staat en dat deze vraag zo spoedig mogelijk beantwoord dient te worden. Als het probleem van de cliënt is opgelost is de professional tevreden. Op zich is daar niets mis mee. Maar dan……..

Last Tuesday

Last Tuesday

Eind deze maand stuurt de AFM weer een voortgangsrapportage inzake de uitvoering van het Uniform Herstelkader Rentederivaten naar de Tweede Kamer. Volgens berichtgeving vorige week in het FD zal daar in staan dat de banken vrijwel geen voortgang geboekt hebben. Het blijkt dat “van de bijna 20.000 gedupeerde MKB’ers er slechts een handjevol een schadevergoeding heeft gekregen en pas enkele tientallen een voorstel voor schadevergoeding[1]”

Eind deze maand stuurt de AFM weer een voortgangsrapportage inzake de uitvoering van het Uniform Herstelkader Rentederivaten naar de Tweede Kamer. Volgens berichtgeving vorige week in het FD zal daar in staan dat de banken vrijwel geen voortgang geboekt hebben. Het blijkt dat “van de bijna 20.000 gedupeerde MKB’ers er slechts een handjevol een schadevergoeding heeft gekregen en pas enkele tientallen een voorstel voor schadevergoeding[1]”

TIS and 2FX Treasury organize a webinar that we would like to bring to your attention. On October 19th between 04:00 and 04:45 PM TIS and 2FX Treasury will host: Corporate Payments Optimization: How to reduce complexity in your business. An interesting session for treasury professionals.

TIS and 2FX Treasury organize a webinar that we would like to bring to your attention. On October 19th between 04:00 and 04:45 PM TIS and 2FX Treasury will host: Corporate Payments Optimization: How to reduce complexity in your business. An interesting session for treasury professionals.