PSD2 – has it hit the ground running?

| 18-01-2018 | treasuryXL |

On the 13th January 2018, PSD2 came into force. In previous articles we have discussed the meaning of this legislation. To recap – it is a directive to regulate the payment market and payment service providers, whilst also opening the market to non-banks. This should lead to a uniformity in products, technical standards and infrastructure. PSD2 will allow customers of banks to voluntarily use third party providers to process and initiate their financial transactions.

On the 13th January 2018, PSD2 came into force. In previous articles we have discussed the meaning of this legislation. To recap – it is a directive to regulate the payment market and payment service providers, whilst also opening the market to non-banks. This should lead to a uniformity in products, technical standards and infrastructure. PSD2 will allow customers of banks to voluntarily use third party providers to process and initiate their financial transactions.

In the UK the process has gone even further – Open Banking has been enacted. Fintech companies are now in the position of taking over the ownership of the customer relationship that banks now have – assuming this is what the customer wants. The traditional relationship between a bank and a customer is now under threat. Banks, which have traditionally applied a one shop for all your financial transactions approach, will possibly have to change and look more like an App store from which customers can choose the services that they want.

To effectively compete in this new market will mean focus on data mining and achieving an economy of scale. It is not inconceivable that tech giants such as Google, Facebook or Amazon could start offering financial services on the back of their sizeable databases. Whereas banks have invested heavily over the years in their payment processes, new technology means that the costs are far lower for a new entrant.

But will PSD2 truly open the European market for financial services? Research indicates that we very seldom interact beyond our own national borders. The cost of banking, credit cards, mortgages, car insurance etc. differ greatly within the EU. A survey that was commissioned by the European Commission concluded that 80% of Europeans would not consider purchasing a financial product from another EU member state. Any dreams of one Europe are rudely interrupted by such research and public opinion. This is not to say that public opinion could not change – rather that the current market is not very elastic.

So PSD2 is up and running – how about the banks? PwC published a report in December 2017 after conducting interviews with senior executives in European banks. Just 9% reported they were ready, despite 66% saying it would affect their operations. Furthermore, a report was published today by the Dutch Data Protection Regulator stating that the legislation does not take privacy requirements enough into account. This despite the legislation being passed more than 2 years ago.

Eventually banks that are early to design their products specifically for this legislation and bring them to market could establish a clear lead on their opposition. Also, if the public reluctance to transact cross-border was to diminish, it is possible that – in the future – we could be purchasing our mortgages in Finland, our credit cards in the UK and our car insurance in Hungary!!

If you want more information please feel free to contact us via email [email protected]

Have you ever heard the dogma that people only use 10% of their brain capacity? Fortunately, this statement is a

Have you ever heard the dogma that people only use 10% of their brain capacity? Fortunately, this statement is a

Leningen worden vaak gezien als een goede manier om lange termijn investeringen te financieren. Een (gecommitteerde) meerjarige lening levert veelal zekerheid voor de middellange termijn. “Voor meerdere jaren vastgelegd” blijkt in de praktijk vaak niet waar te zijn. Leningen worden afgesloten als een aanvullende vorm van financieren, naast rekening courant, lease en/of andere leningen. Hoewel het aangaan van de meerjarige financiering ‘an sich’ niet heel risicovol hoeft te zijn, zijn de voorwaarden dit soms wel.

Leningen worden vaak gezien als een goede manier om lange termijn investeringen te financieren. Een (gecommitteerde) meerjarige lening levert veelal zekerheid voor de middellange termijn. “Voor meerdere jaren vastgelegd” blijkt in de praktijk vaak niet waar te zijn. Leningen worden afgesloten als een aanvullende vorm van financieren, naast rekening courant, lease en/of andere leningen. Hoewel het aangaan van de meerjarige financiering ‘an sich’ niet heel risicovol hoeft te zijn, zijn de voorwaarden dit soms wel.

My father was a civil engineer and would have liked one of his kids to follow in his footsteps. Regretfully for him we all went in different directions, me landing an engineering degree of the wrong type. What I did like to learn from my first business management professor was about creating bridges between various functional areas. That is what I have been doing as a recruiter for almost 25 years, the last 8 solely in corporate treasury. Why treasury?

My father was a civil engineer and would have liked one of his kids to follow in his footsteps. Regretfully for him we all went in different directions, me landing an engineering degree of the wrong type. What I did like to learn from my first business management professor was about creating bridges between various functional areas. That is what I have been doing as a recruiter for almost 25 years, the last 8 solely in corporate treasury. Why treasury?

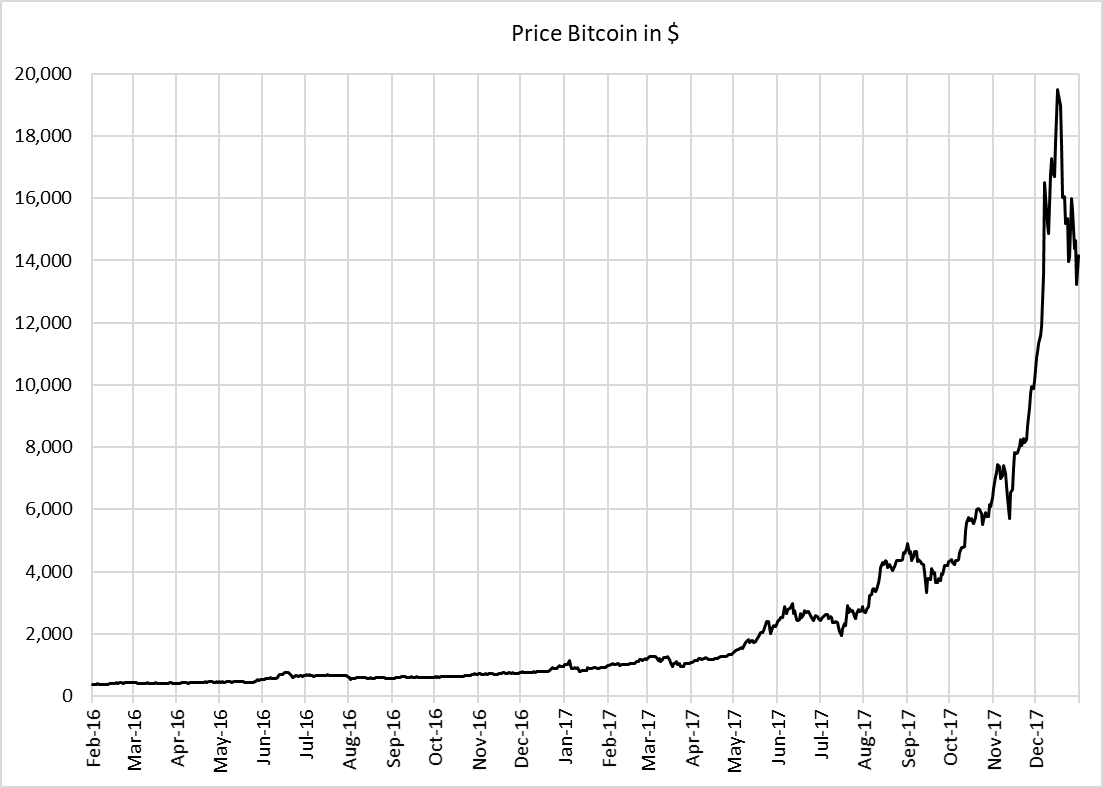

Having spent my working life in international finance, I have patiently listened to all the news about the Bitcoin over the last few years. During 2017 whilst the Bitcoin was on a spectacular price rise, my interest was awakened in this new phenomenon – is this the future? I attended seminars, read articles, learnt the difference between the Bitcoin and the Blockchain, searched and investigated via the web, and tried to form an opinion. These are my findings:

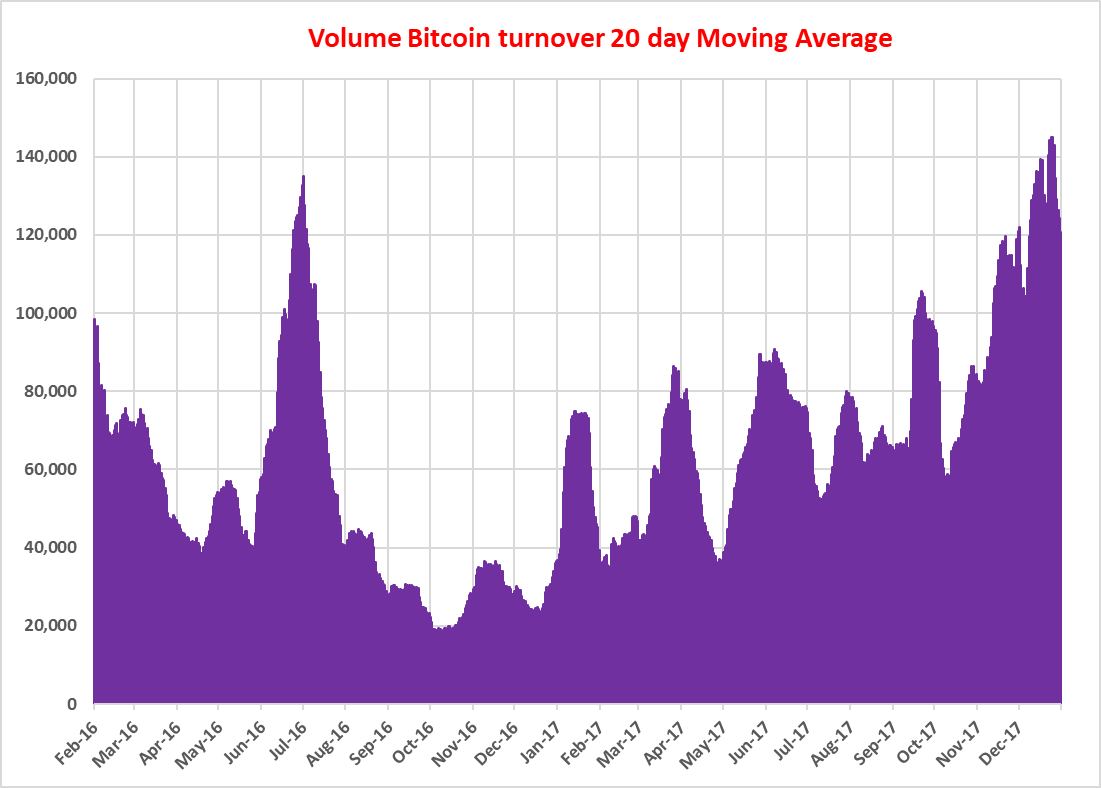

Having spent my working life in international finance, I have patiently listened to all the news about the Bitcoin over the last few years. During 2017 whilst the Bitcoin was on a spectacular price rise, my interest was awakened in this new phenomenon – is this the future? I attended seminars, read articles, learnt the difference between the Bitcoin and the Blockchain, searched and investigated via the web, and tried to form an opinion. These are my findings: Such a stellar performance should mean that the trade volume has increased dramatically.

Such a stellar performance should mean that the trade volume has increased dramatically. The daily volume in September 2017 when the price was about $4,000 was the same as the start of February 2016 when the price was about $400. I had to create this chart as all the data I could find related to the $ value of turnover – which was phenomenal – and not the actual number of Bitcoins traded. Normally, when an asset sees a huge increase in price, this goes together with a corresponding increase in turnover. Clearly this has not happened with Bitcoin – why?

The daily volume in September 2017 when the price was about $4,000 was the same as the start of February 2016 when the price was about $400. I had to create this chart as all the data I could find related to the $ value of turnover – which was phenomenal – and not the actual number of Bitcoins traded. Normally, when an asset sees a huge increase in price, this goes together with a corresponding increase in turnover. Clearly this has not happened with Bitcoin – why? Money Market outlook

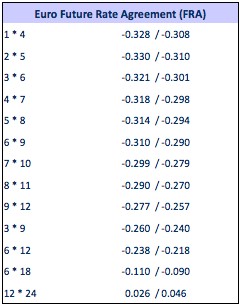

Money Market outlook

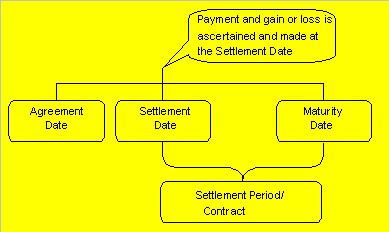

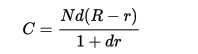

where N is the notional of the contract, R is the fixed rate, r is the published -IBOR fixing rate and d is the decimalized day count fraction over which the value start and end dates of the -IBOR rate extend.

where N is the notional of the contract, R is the fixed rate, r is the published -IBOR fixing rate and d is the decimalized day count fraction over which the value start and end dates of the -IBOR rate extend.

Onderstaand een kort verslag van ons Treasury year-end meetup-event van eind 2017.

Onderstaand een kort verslag van ons Treasury year-end meetup-event van eind 2017.