Bitcoin – hype or reality?

| 08-01-2018 | Lionel Pavey |

Having spent my working life in international finance, I have patiently listened to all the news about the Bitcoin over the last few years. During 2017 whilst the Bitcoin was on a spectacular price rise, my interest was awakened in this new phenomenon – is this the future? I attended seminars, read articles, learnt the difference between the Bitcoin and the Blockchain, searched and investigated via the web, and tried to form an opinion. These are my findings:

Having spent my working life in international finance, I have patiently listened to all the news about the Bitcoin over the last few years. During 2017 whilst the Bitcoin was on a spectacular price rise, my interest was awakened in this new phenomenon – is this the future? I attended seminars, read articles, learnt the difference between the Bitcoin and the Blockchain, searched and investigated via the web, and tried to form an opinion. These are my findings:

Here is a technology that has recently been created – started in 2009 – that has caused a huge debate and led to passionate arguments on its merits or demerits. Those in the know understand its concept – the rest are baffled by its very existence. At essence it is a digital currency – there are no coins or notes in existence. It is decentralized – there are no governments controlling it. If you own it, your identity is anonymous to others – transactions take place via encryption keys. The supply is limited – protocol dictates that a maximum of 21 million Bitcoins can be produced. At the end of 2017 there were 16,774,500 coins in circulation – roughly 80% of the maximum allowed. So, the supply is clearly limited, but they have no real intrinsic value – they do not represent a claim on an asset.

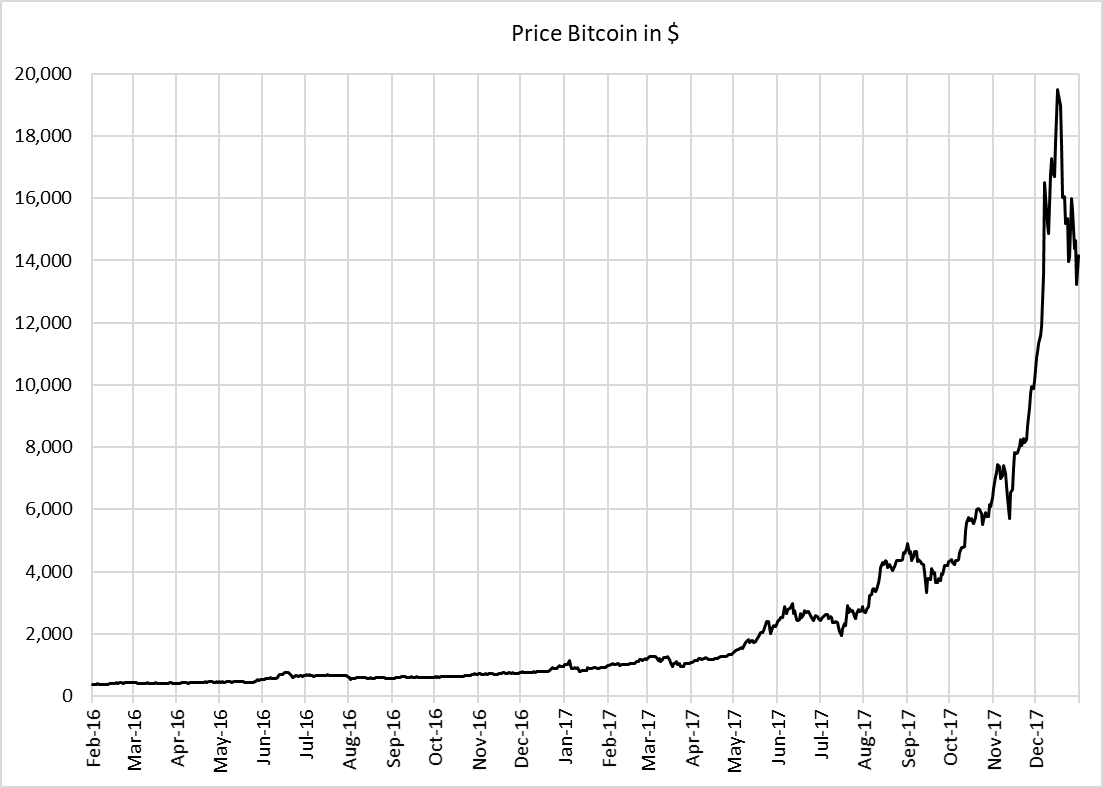

My main area of interest has been on the price – the rise in 2017 of more than 1,400% is astounding. I decided to collate some information and have a chart showing Bitcoins price of the last 2 years.

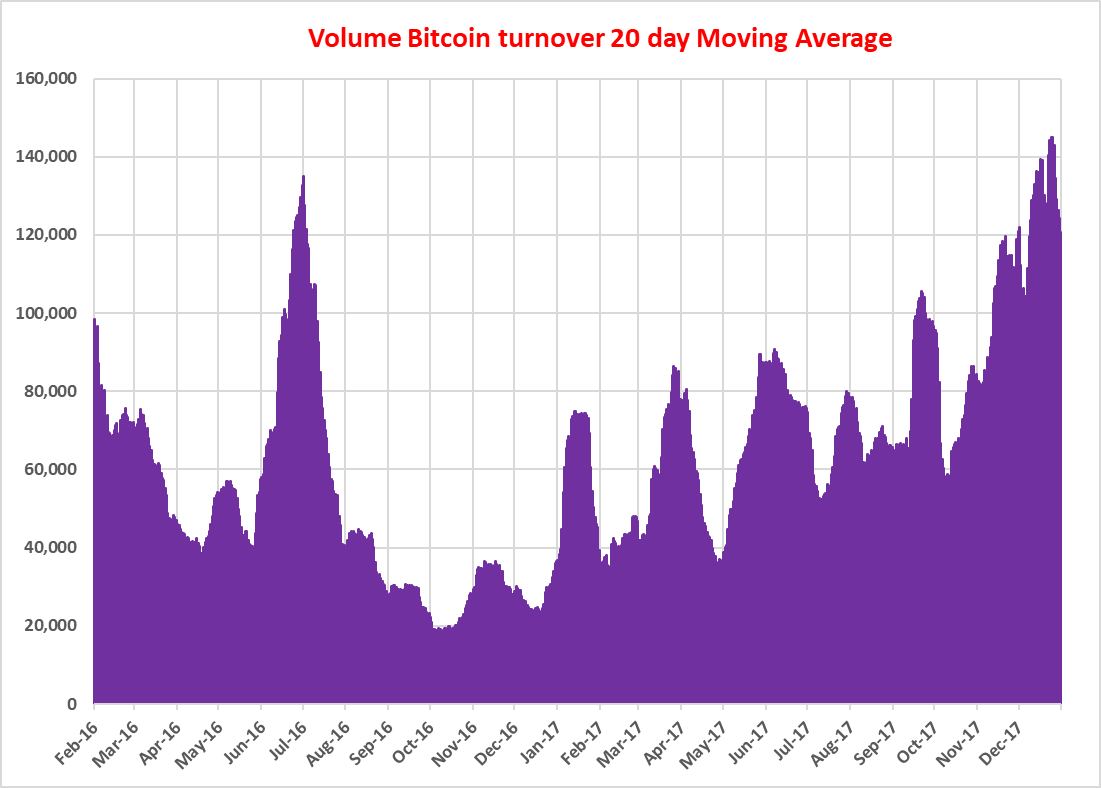

Such a stellar performance should mean that the trade volume has increased dramatically.

Such a stellar performance should mean that the trade volume has increased dramatically.

Well……. here is another chart

The daily volume in September 2017 when the price was about $4,000 was the same as the start of February 2016 when the price was about $400. I had to create this chart as all the data I could find related to the $ value of turnover – which was phenomenal – and not the actual number of Bitcoins traded. Normally, when an asset sees a huge increase in price, this goes together with a corresponding increase in turnover. Clearly this has not happened with Bitcoin – why?

The daily volume in September 2017 when the price was about $4,000 was the same as the start of February 2016 when the price was about $400. I had to create this chart as all the data I could find related to the $ value of turnover – which was phenomenal – and not the actual number of Bitcoins traded. Normally, when an asset sees a huge increase in price, this goes together with a corresponding increase in turnover. Clearly this has not happened with Bitcoin – why?

There appears to be a “strategy” of buying Bitcoin to hoard them. There does not appear to be a sizeable free float of Bitcoin. If there is more demand than supply, then obviously the price will increase dramatically. Bitcoin is touted as an alternative currency, yet the advocates do not seem to want to spread it around with everybody else. It is a currency that is not used to settle transactions – this makes it difficult to consider Bitcoin becoming a recognized mechanism for payments. One of the criteria of money is that it is a “medium of exchange” – yet again Bitcoin, which appears to be hoarded, does not meet the criteria.

How can a cryptocurrency replace a conventional fiat currency if it is not freely tradeable? Furthermore, if you hold Bitcoin and want to take your profit, then this will be realized in a fiat currency. As Bitcoin is generally quoted and traded in $, this means receiving your profit in an antiquated currency that your cryptocurrency wishes to replace – ironic?

The underlying technology – Blockchain – is here to stay. As to whether Bitcoin is here to stay – if people hoard Bitcoin, it will exist. What the value of Bitcoin should be – whatever someone is prepared to pay for it. Will it replace fiat currency – maybe one day, but not in its present Bitcoin form.

Cash Management and Treasury Specialist