Beware of Greeks bearing bonds

| 29-01-2018 | Lionel Pavey |

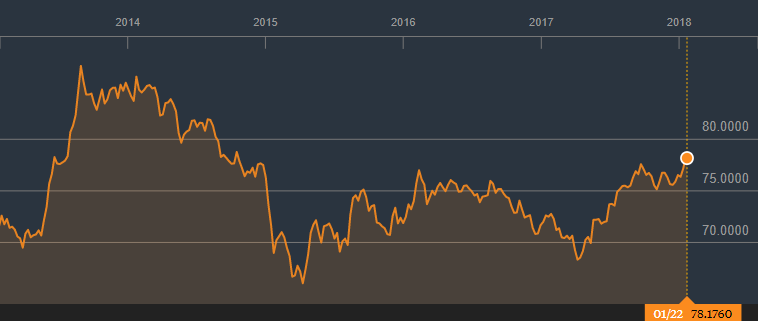

Over the last year there have been impressive price gains in Greek Government bonds leading to equally impressive falls in yields. Greek 2-year bonds are now yielding 1.35% – down from around 7% at the start of 2017. Similarly, 10-year bonds are now yielding 3.66% – a significant fall since the start of 2017. In fact, the yield on Greek 2-year bonds is now lower than in USA where the current yield is 2.09%. Last week S&P upgraded Greece’s long term credit rating to ‘B’ from ‘B-‘. It would appear that Greece is doing everything right. Right?

Over the last year there have been impressive price gains in Greek Government bonds leading to equally impressive falls in yields. Greek 2-year bonds are now yielding 1.35% – down from around 7% at the start of 2017. Similarly, 10-year bonds are now yielding 3.66% – a significant fall since the start of 2017. In fact, the yield on Greek 2-year bonds is now lower than in USA where the current yield is 2.09%. Last week S&P upgraded Greece’s long term credit rating to ‘B’ from ‘B-‘. It would appear that Greece is doing everything right. Right?

Well, looking at it from another perspective it is clear that Greece is not in such a strong shape compared to the USA. Unemployment in USA is 4.1% – Greece is about 5 times higher at 20.6%. Clearly there must be another reason for lower yields in Greece. Athens hopes to issue new bonds in 2018 with tenors of 3, 7 and 10 years. The answer would appear to be the very low to negative yields on German debt. The yield on German 2-year bonds -0.57% and on 10-years 0.63%. As investors search for any positive yield they have been attracted to the Euro countries on the periphery – Greece, Spain etc.

The ECB have regularly said that they think inflation will remain below their target for the foreseeable future. This has encouraged investors to seek out alternative countries that are offering a positive yield. There is almost a 2% yield pick up on Greek paper over Germany. This has proven to be attractive even though Greek debt-to-GDP ratio stands at 190%.

However, EU creditors hold around 80% of existing Greek debt. As they are wary of Greece reverting to the problems seen a few years ago, issuing new bonds could be difficult. With all the promises made in the past to ensure bail-outs for Greece, the rest of the EU will be extra cautious and vigilant – leading to no easing of the current reforms and restrictions that the EU has put in place.

It would seem, therefore, that the market is temporarily out of synch. The market is being distorted by the fact that there is an appreciable yield pick up in EUR (so no FX risk) when looking at Greek bonds versus German bonds. There appears to be no other logical explanation as to why Greek yields are significantly lower than those in USA.

If bond markets turn sour this year, which would you rather hold – Greek or American paper?

Cash Management and Treasury Specialist

The BEPS (base erosion and profit shifting) initiative is an OECD initiative, approved by the G20, to identify over a period to December 2015, ways of providing more standardised tax rules globally. Phases two and three involve implementation and monitoring (together with some remaining standard setting and clarification). BEPS is a term used to describe tax planning strategies that rely on mismatches and gaps that exist between the tax rules of different jurisdictions, to minimise the corporation tax that is payable overall, by either making tax profits “disappear” or shift profits to low tax operations where there is little or no genuine activity. In general BEPS strategies are not illegal; rather they take advantage of different tax rules operating in different jurisdictions, which may not be suited to the current global and digital business environment.

The BEPS (base erosion and profit shifting) initiative is an OECD initiative, approved by the G20, to identify over a period to December 2015, ways of providing more standardised tax rules globally. Phases two and three involve implementation and monitoring (together with some remaining standard setting and clarification). BEPS is a term used to describe tax planning strategies that rely on mismatches and gaps that exist between the tax rules of different jurisdictions, to minimise the corporation tax that is payable overall, by either making tax profits “disappear” or shift profits to low tax operations where there is little or no genuine activity. In general BEPS strategies are not illegal; rather they take advantage of different tax rules operating in different jurisdictions, which may not be suited to the current global and digital business environment. Payments is increasingly seen as an area that is ripe for disruption, having the potential to enhance payment processing. To overcome the current structural weaknesses in the payments area including low speed, high expenses, financial institutions are increasingly adopting the idea of blockchain or distributed ledger technology (DLT). This in order to offer (near) instant cross-border payments at lower costs, higher security and more reliability. Up till recently most of these trials have been non-interoperable stand-alone solutions. But that may change!

Payments is increasingly seen as an area that is ripe for disruption, having the potential to enhance payment processing. To overcome the current structural weaknesses in the payments area including low speed, high expenses, financial institutions are increasingly adopting the idea of blockchain or distributed ledger technology (DLT). This in order to offer (near) instant cross-border payments at lower costs, higher security and more reliability. Up till recently most of these trials have been non-interoperable stand-alone solutions. But that may change!

Despite interest rate being very low for the last few years, general consensus is that rates will eventually rise – rates will become more normal. Rates are being held down by the actions of central banks with their quantitative easing. As QE is scaled backed and stopped this should allow rates to rise from their current low levels. The big question is – how high will rates rise? The Euro is not yet 20 years old and that means that whilst there is a lot of data, it does not require looking through 50 or 60 years of data to try and find the norm.

Despite interest rate being very low for the last few years, general consensus is that rates will eventually rise – rates will become more normal. Rates are being held down by the actions of central banks with their quantitative easing. As QE is scaled backed and stopped this should allow rates to rise from their current low levels. The big question is – how high will rates rise? The Euro is not yet 20 years old and that means that whilst there is a lot of data, it does not require looking through 50 or 60 years of data to try and find the norm.

In the last year both the ECB in regard of EURIBOR and the FCA in London in regard of LIBOR have come to the same conclusion – the fixing of interest rate indices can not carry on in their present form. The current benchmarks are tainted by allegations of fraud and malpractice. Furthermore, the way that the rates are determined are also criticized – no actual transactions take place at the fixing price when the fix is made daily. But the big problem is that these fixings are intrinsically linked to financial contracts with values measured in 100 of trillions of EUR, USD, GBP etc.

In the last year both the ECB in regard of EURIBOR and the FCA in London in regard of LIBOR have come to the same conclusion – the fixing of interest rate indices can not carry on in their present form. The current benchmarks are tainted by allegations of fraud and malpractice. Furthermore, the way that the rates are determined are also criticized – no actual transactions take place at the fixing price when the fix is made daily. But the big problem is that these fixings are intrinsically linked to financial contracts with values measured in 100 of trillions of EUR, USD, GBP etc. On the 13th January 2018, PSD2 came into force. In previous articles we have discussed the meaning of this legislation. To recap – it is a directive to regulate the payment market and payment service providers, whilst also opening the market to non-banks. This should lead to a uniformity in products, technical standards and infrastructure. PSD2 will allow customers of banks to voluntarily use third party providers to process and initiate their financial transactions.

On the 13th January 2018, PSD2 came into force. In previous articles we have discussed the meaning of this legislation. To recap – it is a directive to regulate the payment market and payment service providers, whilst also opening the market to non-banks. This should lead to a uniformity in products, technical standards and infrastructure. PSD2 will allow customers of banks to voluntarily use third party providers to process and initiate their financial transactions. Have you ever heard the dogma that people only use 10% of their brain capacity? Fortunately, this statement is a

Have you ever heard the dogma that people only use 10% of their brain capacity? Fortunately, this statement is a