What does experience in Treasury get you?

10-06-2020 | Niki van Zanten

In the wonderful world of Treasury there is an easy and digestible answer for most things, but to cover the full context requires general elaboration. In other words, there are always main points but fine-tuning is equally important and the devil is in the details.

Keeping this in mind, let’s get right into attempting to answer the headline question of this blog and unravel what experience can mean for you in financial risk management with the following points

- The answer before the analysis

- The right analysis and additional validation

- Speed when needed and a reserved approach

- An actual opinion

- Leadership in crisis

- Holistic approach to Finance and ability to see what’s really going on

The answer before the analysis

At school you have the smart kids who have the answer for tough questions (lets say for conversation sake a math equation which looks like this 3(1-2x)=-9, where question is what x is*) and get there by taking the necessary steps** to come to the correct answer. This is what you are taught and it leads to the desired result. Then, there is a second group who shout out the right answer immediately but skipped all the steps involved. The teacher will disapprove of this behavior as it’s not how you are taught to handle a mathematical problem. Also not all kids can be taught to handle problems this way. If experience were to be molded into these group of kids, it would perhaps be one who can answer the question immediately and then explain this steps in retrospect. In financial markets this combination is very valuable as going for the process can be cumbersome and hard to explain, unless you see what will happen at the beginning.

The right analysis and the right questions

Imagine you walk into a wine shop and ask for a bottle of wine to combine with a mouth watering turbot with lobster Bearnaise sauce. The wine shop owner recommends a Montrachet**, asking no further question. You ask him, why this wine? He answers the following; because it is a thick buttery wine thus perfectly combining with the richness of Bearnaise. Also this happens to be an excellent year from an equally exceptional producer. You end up buying the bottle to return home and taste a thirteen in a dozen overpriced bottle of wine which does reasonable well with the food but has no element of surprise or the fascination one might expect.

A few question from the wine shop owner like, what kind of wine do you appreciate a lot and what do you like about it or how much is your budget would help you on the way. The best question from your side is potential, did you ever try it? If it turns out he didn’t try it and is still trying to sell it to you he has a close resemblance to a very typical sales person in the financial sector. In other words, experience enables people to ask the right question as well as create a value and advice instead of value add for the selling party only.

Speed when needed or a reserved approach

Typically, it is assumed that decision making in financial markets and Risk management requires speed. In most cases, this is correct, providing you understand of the exposure for which your are hedging as well as the derivative you are using. Put in a simple example, when hedging a 5 year INR loan, experience will tell you to do some extra due diligence on the accuracy of the underlying exposure for the simple reason that the consequences can be significant if things go wrong. Immediately, you will also realize a 5 year tenor on INR is either not liquid or the credit component is priced in at a hefty charge replacing your FX risk with an interest risk on the roll over. If you do not execute with speed, you could be exposed to the spot risk; if you execute to fast, you might hedge something not required or with a derivative which doesn’t do the job as intended. A seasoned advisor will be the best of both worlds.

An actual opinion

Experience creates a backbone as well as a level of comfort to believe what you are saying. Consequently, this boils down to the question; Why is someone trying to sell something to me? Because you need it or because they need you to make their PL? This goes into the discussion on whether an advisor has an intrinsic or extrinsic motivation. In my view, experience is not a guarantee on where motivation comes from, but it had a lot more time to positively develop. You will hear what you are better of hearing than what you want to hear. On top of that, the advise will be more holistic as it takes a while to get all the bits and pieces of treasury together, let alone how it fits across departments in a company.

Leadership in crisis

Argentina 2018. Hefty devaluation on the currency as well as very steep and volatile interest rates combined with liquidity issues, not to forget the social and economic disaster hitting many citizens. Situations like this, attract senior management attention like Winnie the Pooh spotting a jar of honey. One might be inclined to leave the ”when to hedge or not” decision to senior management or have endless meetings discussing business mitigation. Each crisis has different triggers as well as solutions. A seasoned crisis manager does add direct value in not only identifying root cause of what’s going on, whether financial instruments actually provide relief or are a black hole of money and in putting together the right and moreover realistic guidance for the business. I am aware of the fact that people do not like hearing bad news, but not listening to it usually brings problems back on steroids.

Holistic approach

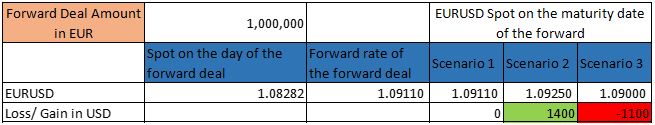

This is a tough one. Most people will agree, the big picture is the best one to follow, but its very common across corporates to religiously hedge PL exposures. Even in cases where there are conflicts, like the cash flow at company level being different sign than the PL FX exposure, often a bogus hedge is implemented. A holistic approach and good target setting, helps you pick the strategy with the overall best results and experience.

Conclusion

These are just a few considerations on why experience can provide added value in (FX) risk management beyond the well know assumption that it provides a way to do more in less time and is a great way to also transfer knowledge down to the younger workforce.

Hope this gives some food for thought and many fruitful discussions.

* multiply by 3 giving 3-6X=—9 and then deducting 3 on each side reducing equation to -6X=-12 revealing the answer.

** Montrachet is one of the words most sought after white wines. Also happy to discuss wine but that’s a different beast and business proposition.

FX specialist