31-08-2020 | Lex van Teeffelen | treasuryXL

Due to the corona crisis, loan volume shrank by 37% for corporate loans with crowdfunding platforms. Unique, because since the foundation of crowdfunding platforms there has only been growth. The first half of 2020 was so bad that a number of platforms made use of the NOW scheme. Yet there is also good news. A number of platforms are growing rapidly. Five platforms have also been admitted to the SME Corona Guarantee Scheme. What are the main developments? And where are the largest platforms?

(Blog in Dutch)

Het goede nieuws

Het gaat een aantal platforms voor de wind. NLInvesteert neemt de koppositie over als marktleider in het eerste halfjaar 2020. Onderscheidend door de sterke risicobeoordeling en de lage default. Maar ook SameninGeld voor particulier vastgoedfinanciering en LenderSpender voor consumentenleningen groeien door.

Eindelijk toegang tot overheidsgaranties

Na veel lobbywerk in Den Haag is de kogel door de kerk. Ook crowdfundingplatforms kunnen overbruggingskredieten met staatsgaranties aanbieden. Het gaat om BMKB-Corona regeling tot 1,5 miljoen euro met een aflosvrije periode tot 18 maanden en een maximale looptijd van 4 jaar. Een aantal platforms heeft concessies moeten doen. Naast de crowd dienen ook professionele/grote investeerders mee te doen. De website van het RVO is wat traag met alle partijen te vermelden, maar de volgende crowdfundingplatforms zijn geaccrediteerd: Geldvoorelkaar, VoordeGroei, OneplanetCrowd, Coöperatie NLInvesteert en October. Vreemd genoeg krijgen ook de flitskredietverstrekkers Swishfund en Yeaz toegang tot de staatsgarantie. Die trekken ondernemers qua kosten en rente het vel over de neus. En dat met staatsgarantie!

NOW-aanvragen

Het Europees opererende platform October van Franse origine, is de grootste aanvrager van de platforms in de eerste NOW-ronde met 151K. Maar ook marktleider 2019 Geldvoorelkaar voelde de pijn en ontving 136K. De derde grootste aanvrager was DuurzaamInvesteren (Crowdinvesting BV) met een toegekend bedrag van 83K. Deze partij heeft onder meer de Triodos Bank als aandeelhouder. Flitskredietverstrekker Swishfund spant echter de kroon met 313K.

Het is natuurlijk toegestaan, maar het staat niet chic. Deze platforms behoren bepaald niet tot de kleintjes. Dat kleinere non-profit platforms als VoordeKunst en Kentau de NOW aanvragen, is meer vanzelfsprekend.

DuurzaamInvesteren krijgt navolging

Bij DuurzaamInvesteren gaat het al een tijd niet goed. Niet alleen scoort dit platform hoog op het aantal ondeugdelijkheden, ook blijft het volume achter bij de concurrenten sinds begin 2019. Een doorn in het oog is dat DuurzaamInvesteren proposities van de eigen aandeelhouders YardEnergie en Greenchoice plaatst. Hoe kan het platform daarbij objectiviteit garanderen? Helaas volgt aandeelhouder Lambert Kassing van KapitaalopMaat dit slechte voorbeeld op met deze propositie. Ook KapitaalopMaat kent weinig transacties met daarbij ook een hoge (loss giving) default. De aandeelhouder is tevens actief voor de Stichting Zekerheden KapitaalopMaat. Wederom ongewenste verstrengeling van belangen. Belanghebbenden kunnen melding doen bij de AFM.

Vastgoedtransacties zonder heldere risicobeoordeling

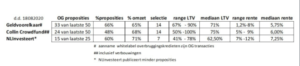

Waar de platforms voorheen vooral werkkapitaal verschaften, groeit nu de objectfinanciering – meer specifiek de vastgoedfinanciering – snel. Bijgaand ziet u een indicatief overzicht van de Onroerend Goed (OG) proposities van de drie grootste platforms (2020 YTD) op 18 augustus 2020 om 00.00 uur.

Tweederde of meer van de verstrekte leningen (in volume) is nu vastgoedfinanciering. Hoewel Geldvoorelkaar de meeste proposities post (66%), wordt zij in volume voorbijgestreefd door Collin Crowdfund en NLInvesteert. Dat investeerders wat te kiezen hebben blijkt uit de ranges in Loan To Value (LTV) en de geboden rentes. Op het eerste gezicht lijkt NLInvesteert het betere risico/rendement aan te bieden. Let wel, het aantal waarnemingen is beperkt. De proposities binnen en tussen de platforms wijken sterk van elkaar af. In een enkel geval wordt niet eens onderpand gevestigd, soms een tweede hypotheek (= lastig uitwinbaar), veelal een eerste hypotheek met (te) hoge LTV.

Er ontbreken veel indicatoren om OG proposties op waarde te kunnen schatten: de beoordeling van de locatie, de courantheid en verhandelbaarheid van het pand, de staat van onderhoud (binnen- en buitenkant), de kosten van achterstallig onderhoud of bouwkundige gebreken. Taxatierapporten worden niet bijgevoegd.

Investeren in vastgoed met eerste hypotheek is niet risicoloos. In een crisis komen meer bedrijfspanden leeg te staan. Daarmee daalt de waarde. Geen huurder, betekent sowieso een zeer lage waarde. Excecutieverkoop levert een fractie van de getaxeerde waarde op. Wachten op de juiste koper meer, maar gaat gepaard met doorlopende kosten. Bij particuliere woningen is dat risico minder groot. Maar in ontvolkte en sterk vergrijzende regio’s zeker aanwezig. Meer dan 65% LTV bij courante bedrijfspanden en 80% LTV bij particulier vastgoed voor investeringsdoeleinden is onverstandig. Vooral Geldvoorelkaar en Collin Crowdfund overschrijden die grenzen regelmatig. Geen van de drie platforms hanteert overigens expliciete pricingscriteria voor vastgoedproposities. Andere beoordelingscriteria zijn nodig.

Investeren in de reële economie of meedeinen met speculanten?

Naarmate er meer gehandeld wordt in particulier onroerend goed, zullen de platfoms meebewegen. Daar waar nieuwe panden en projecten worden gerealiseerd via aan-, ombouw en nieuwbouw, zie ik toegevoegde waarde. Daar waar ondernemers hun kosten gelijk kunnen houden met verwerving van het bedrijfspand niet. Investeren in stenen is – zeker nu – slecht voor de liquiditeit van een onderneming. Cash is King in crisistijd.

Maar wat is de toevoegde waarde van opkoop van particuliere panden? Die worden gesplitst of voor drie tot vijf personen ingericht. Huurprijzen worden flink verhoogd, stedelijke omgevingen worden onbetaalbaar voor starters en mensen met lage en midden inkomens. In plaats van honderden euro’s, stijgen de huren naar duizenden euro’s. Niet alleen het snel groeiende platform SameninGeld specialiseert zich hierin. Ook de grote platforms doen mee.

Economen in 17e eeuw noemden grond- en huizenbezitters de steriele klasse, omdat zij niet herinvesteren in directe economie en productiviteit. Adam Smith – schrijver van The Wealth of Nations – noemt hen zelfs parasieten, omdat zij “love to reap, where they never sowed”. Ook Nobelprijs winnaar Joseph Stiglitz, waarschuwt voor de ontwrichtende werking van de toenemende ongelijkheid en de accumulatie van kapitaal en bezit. En u kent vast de econoom Thomas Pikkety, die pleit voor het zwaar belasten van bezittingen en het licht belasten van arbeid?

Kleur bekennen

Met het verstrekken van overbruggingskredieten BMKB-C kunnen platforms hun rol herpakken. Banken laten steken vallen en beperken zich graag tot financieringen van 1 miljoen euro en meer.

Ik ben benieuwd waar de grotere crowdfundplatforms nu voor staan. Blijft het bij het oppikken van de restjes die de banken achterlaten? Zoals het er nu naar uitziet, lijken de grootste platforms veel op elkaar. Tijd voor fusies? Er mag wel wat meer kleur in het landschap komen*. Waar zit de toegevoegde waarde? Wat is hun Why en aan welke maatschappelijke doelstellingen dragen deze grotere platforms meetbaar bij?

Professor Entrepreneurial Finance and Firm Acquisition

Identify the skills you possess and/or need to develop to build deeper mutually beneficial relationships within and across departmental lines.

Identify the skills you possess and/or need to develop to build deeper mutually beneficial relationships within and across departmental lines.