Blank Sheet Treasury

08-03-2021 | Jesper Nielsen-Terp | treasuryXL |

In uncertain times like the financial crisis in 2009 and the Covid-19 pandemic in 2020, the old phrase “Cash is King” always pops up. By the end of day the Treasurer and the Treasury Department once again sit in the middle of the fire. Although it is the Board of Directors who is overall responsible for the financial strategic target settings, which is influenced by the CEO or the CFO, tasks and responsibilities flow from the top management and end up at the Treasurer’s desk.

To be prepared for the fireplace, I believe that it is crucial for the Treasurer or the Finance Department employees carrying out treasury activities, that a clear strategy is implemented and outlined. Not only a strategy for how the policies and guidelines are carried out but a strong mandate from Top management and maybe all the way from the Board of Directors. A mandate carved in stone, so no one can be in doubt when something hits the fan.

“Do not ask what the company can do for you, but ask…”

There are a couple of questions that all back office functions need to ask themselves on a regular basis. The answer to the questions should dictate the activities that are undertaken on any given day. First, they should ask, “Is this activity going to increase the company’s revenue?”. If the answer is no, they should move on to question number two, “Is this activity going to reduce the company’s cost base?”. Once again, if the answer is no, then they should move on to question number three, “Will this activity delight the customer?”. If the answers to all three of these questions are no, then we need to examine the activity to understand why we are conducting it.

The Blank Sheet Treasury

In order to understand why the recommendations that follow are applicable, we must decide what it is that we as a Treasury Department are trying to accomplish and why. There are certain practices in Treasury across the world that should drive our behavior. In examining these practices, one potential structure emerges; the Blank Sheet Treasury. This way we are starting with our objectives and future state in mind instead of our current state.

In my opinion, the future state should equal the Treasurer to be prepared and know how to handle future potential crises, whether it is a business-related financial crisis or a worldwide pandemic.

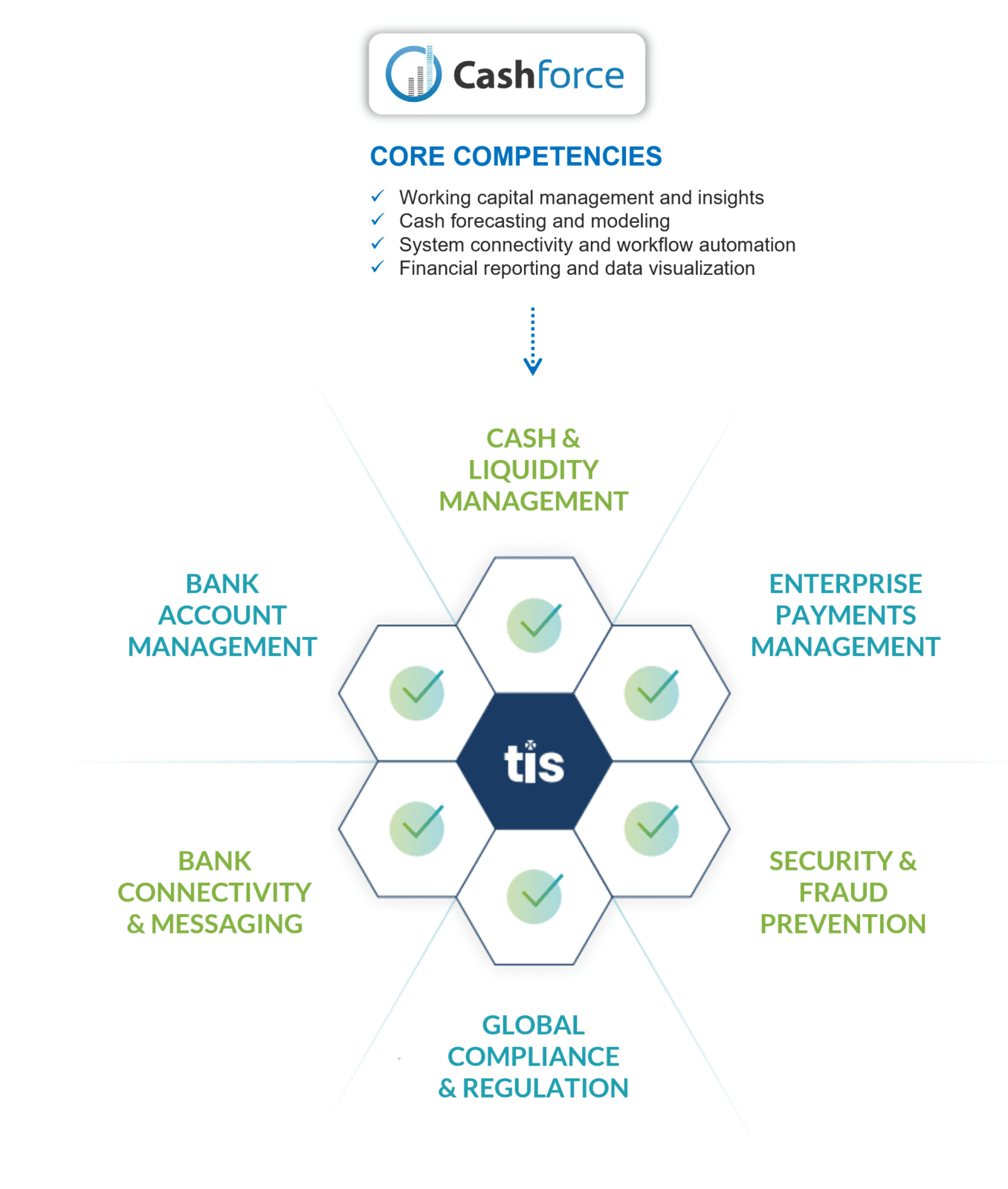

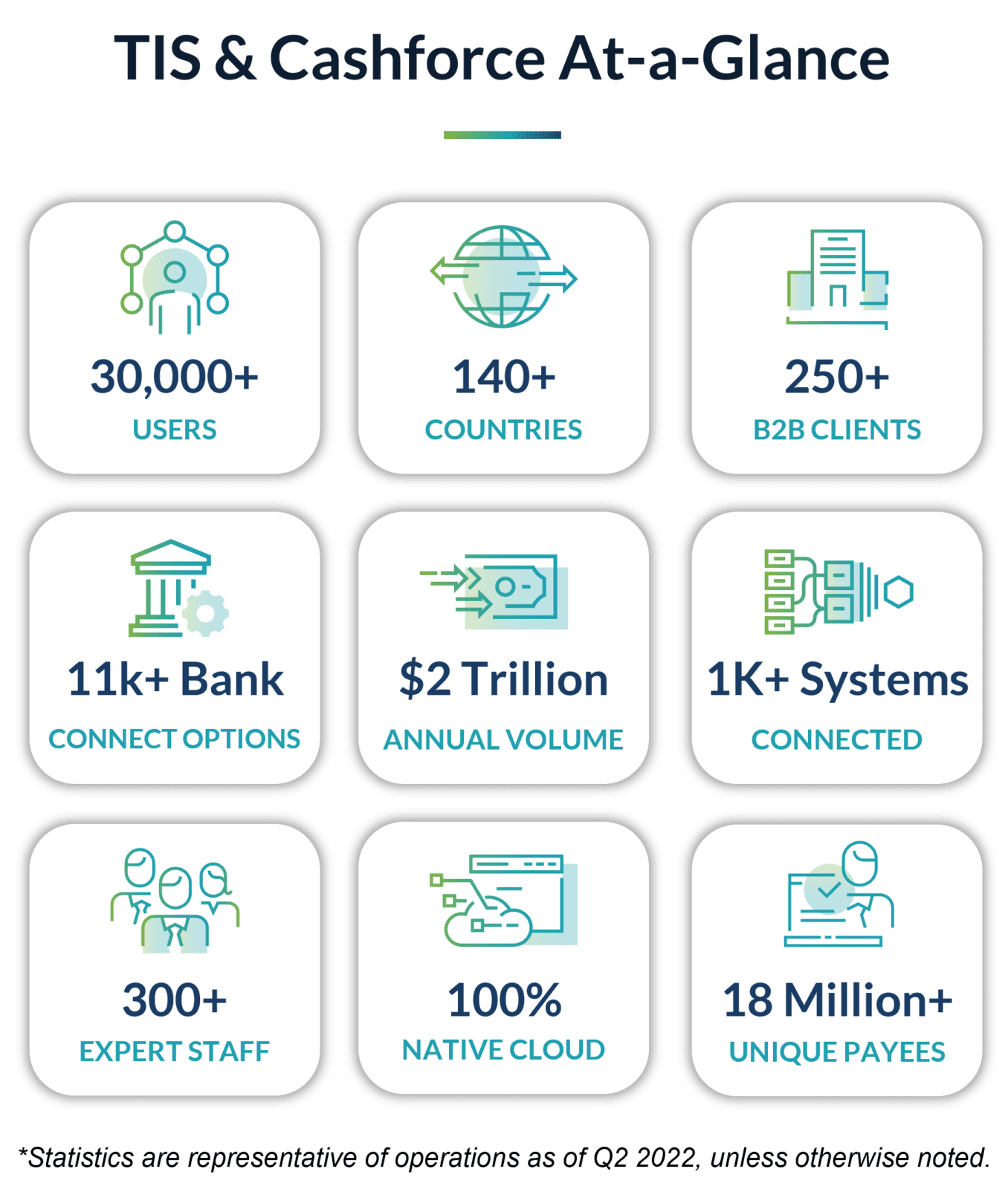

Coming back to the phrase “Cash is King”, when in the middle of a crisis, everything else than access to cash or cash visibility should be a next-day issue for the Treasurer. Stating this should give an idea of why I believe the Blank Sheet Treasury always should start within the area of Cash/Liquidity Management, which of course can come in many different flavours.

The initial process

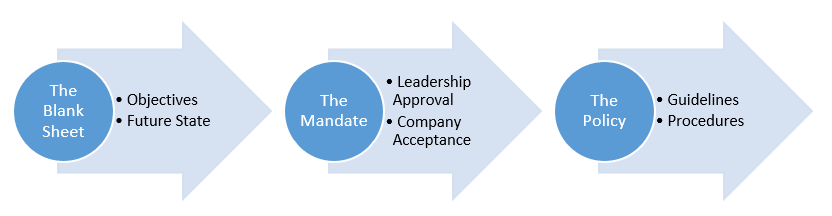

Coming back to the statements about having a focus on the future state and the mandates to get there, the initial process visualized below is a tool that the Treasurer needs in his/her toolbox. Maybe not the most innovative tool, but most likely one of the most important tools, if not the most important, when shaping, re-shaping and driving treasury.

The process map works like a Lego building instruction, where there actually is a possibility to skip or change the order, but when doing it, the result will not be what we were aiming for, or even worse than what our surroundings (stakeholders) thought we were aiming for. So if the order somehow is changed or some parts are skipped, it will be similar to an “unfinished” Lego construction. It will in some cases be functional, but there will always be some spare and important “bricks” left on the table. In the Lego context, some left bricks might not make a difference or at least not a huge difference, but in a corporate context the repairment will have a critical impact on time, costs and loss confidence from stakeholders.

The foundation for everything else

Before moving to the discussion on the Leadership mandate and afterwards on daily-life guidelines for the Treasury Department, let’s first make sure that a part of the objectives and future state is the idea that everything is to be accomplished (now or in a few years). Not only will it be a guidance for the “how, when and why”, but also because top management, that give access to the budget, want visibility and take decisions based on valid information.

As the majority of Treasurers and their departments have Cash/Liquidity Management as one of their key deliveries and as the Cash/Liquidity Management highly impacts other workflows in the Treasury Department, it is somehow the foundation for everything else and therefore a good place to start.

This figure is of course not a golden rulebook, and for some Treasury Departments priorities can come in another order. But when talking to Treasurers about their priorities and building or re-shaping their setup, the figure outlines to a great extend how they see the structures and how they want to manage the process of reaching the end line.

Best Practise and Future Workflows

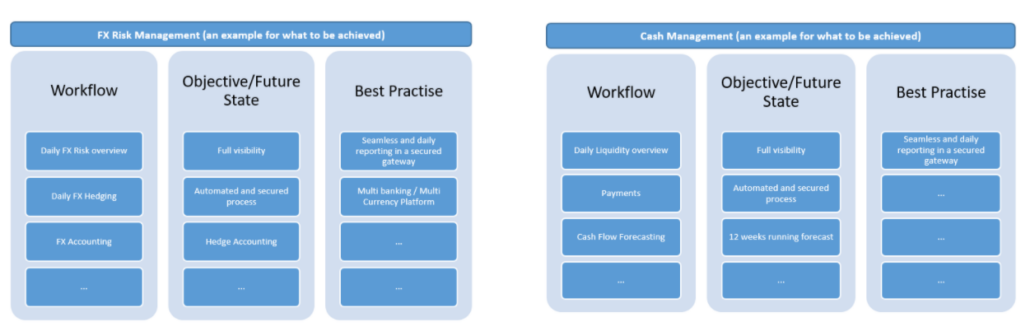

Each of the circles has some underlying characteristics and is decomposed into a number of workflows. Here, the objectives for the future state and best practise will come into play.

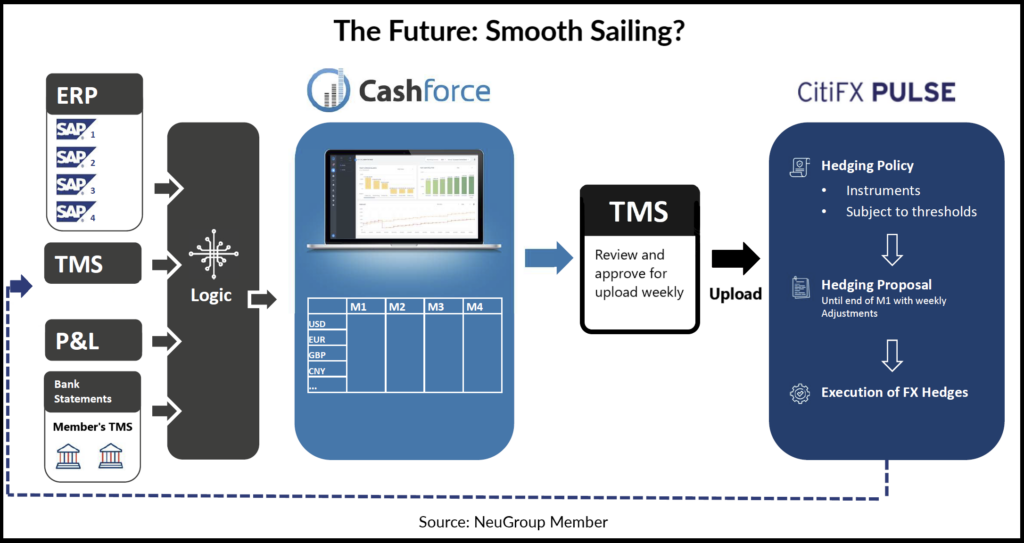

In this recommendation, Cash Management is identified as the foundation for other workflows. Next to that, when looking into job descriptions and talking to Treasurers about their key objectives, FX Risk Management is identified to be high on the agenda. Therefore, the following graphs will assist the visualizing and guidance of Cash and FX Risk Management.

The Best Practise box has to be filled out by the company (the Treasury Department), based on their needs and very much linked to the Objective/Future State. The question asked here is; ‘’Does the Company actually know what is the best practise in each of the work flows or could there actually be multiple solutions for the Best Practise?’’

The answer for both questions will for the majority of companies be that the Treasury Department has some thoughts and ideas for what they see as Best Practise for their setup, but at the same time they will recognize that a solution for the future state and the Best Practise for this, can come in different varieties – it is not a One Size Fits All. When agreed on the Best Practise for the future state, it will then be time to start visualizing the future workflows, which will give some thoughts and ideas for what actually has to be build, changed and implemented.

One of the pitfalls to avoid here is to not look too much into what worked in the past and in addition avoid looking at single workflows (in this example Cash and FX Risk Management).

As a normal part of being a human being, there can be a significant probability to start applying what worked well in the past, because the Treasurer might have some experience or preferences from similar projects. Thus, there will be a tendency of implementing same workflows and systems used in the past, even though they do not fit into the entire puzzle.

The entire puzzle

Likewise in our own life, the CFO wants to see the full picture and understand the full picture, before opening up the purse and increasing capital expenditure. With this in mind and the objective of getting a budget, do not only look into the short term and easy reachable targets, but think big and lay out the entire puzzle. Still continue to grab the low hanging fruits though, because they are to be grabbed in order to keep momentum.

What is the entire puzzle and how can it be shown in a simple, but informative structure, so no one will be in doubt of the individual workflows on the journey of reaching the objectives and creating a best-in-class treasury setup.

To assist on laying out the entire puzzle, all workflows will be identified and structured by its “Value” and “Importance”. Therefore, the below chart can be the guidance for where to start as well as be used in the dialogue with the CFO and other stakeholders. Once again it is important to state that the chart is not a golden rule book, but an inspiration for how to make progress on the journey.

The red box will obviously be the initial most wins and the focus areas. Even though most wins have been identified, the entire puzzle is still unfinished, because it is actually laying like a puzzle.

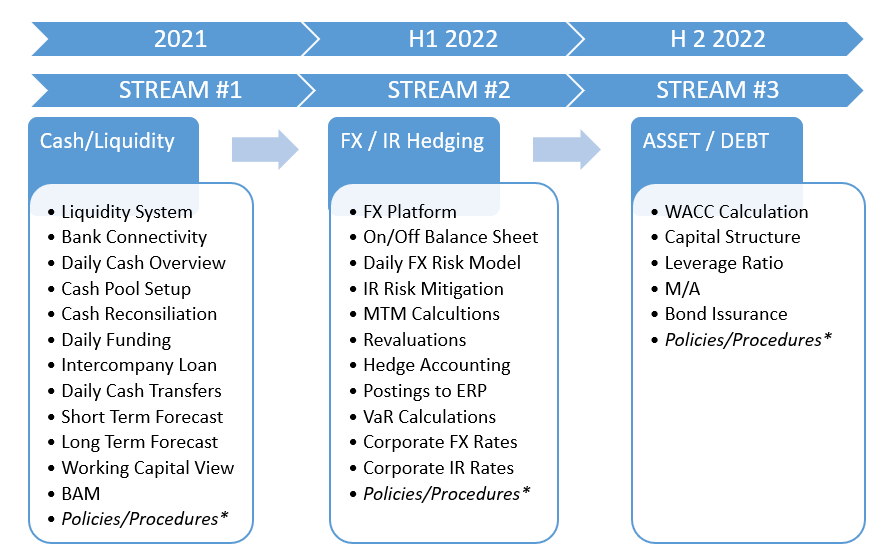

The box has been unpacked and the puzzle pieces has been sorted. The next step for the Treasury Department will be to make the final move and bring their game plan. A game plan divided into a number of streams showing the how, when and why.

*Policies/Procedures are in the initial phase not a part of the Blank Sheet Treasury, but is stated above in each of the streams as it is something which need to be in place when start implementing.

Using streams and a given timeline for each of the streams as well as combining the different areas and the workflow process identified, the Treasurer now has made a construction manual for how to implement a best practise setup for the future state.

When utilizing some or maybe all of the recommendations and figures in this article, it will be possible for the Treasury Department to start taking the dialogue with the CFO and potential other stakeholders, who need to be involved in the process. Because when being able to identify the how, when and why, and showing the entire process and the needs, the CFO can see the entire picture. A picture which can be used when moving into the next section, where mandates will be given to the Treasurer and a budget needs to be allocated.

Additional considerations

When using a Blank Sheet Treasury setup, the probability of succeeding is higher if no planning has been made. Moreover, the Treasurer needs to consider whether or not the right resources are in place when moving into the building, crafting or re-shaping the phases. When talking about resources, it will both be human resources and resources in terms of systems.

In terms of human resources it can be internal resources, such as treasury and/or IT people, or external resources, such as treasury consultants. Speaking about consultants, it might be worth considering. Even though it comes with a cost, advantages are gained in times and knowledge.

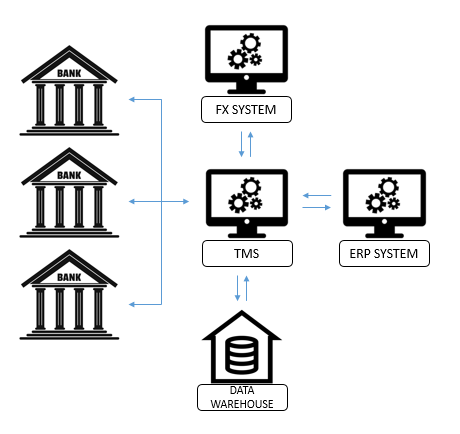

On the system side, the Treasurer will have to decide whether or not he/she can bring his/her plan to live with the existing system landscape, and if not, the process will have to be added with a suggestion to make changes to the current system landscape.

Thank you for reading and looking forward to your thoughts.

Treasury & Risk Management Expert