LIVE | Deep dive session about the Philosophy of the Treasury Management & Corporate Finance programme

01-08-2022 | treasuryXL | VU Amsterdam | LinkedIn |

(online) August 17 at 10.00 am CET, you are invited to join this expert session

Since 1998, the School of Business and Economics of the VU University offers the Post Graduate programme: Treasury Management & Corporate Finance. The programme focuses on professionals with an academic background in economics and/or finance and at least five years’ work experience in the financial sector. The philosophy of the programme is to develop ‘Treasury Academic Professionals’, able to analyze complex treasury management & corporate finance issues independently or in multidisciplinary teams and solve and report on them. The programme differs from other programmes/courses in the field of treasury management & corporate finance through the emphasis on developing graduates as ‘Treasury Academic Professionals’ and less emphasis on knowledge accumulating, readily available in the market.

Become a Treasury Academic Professional

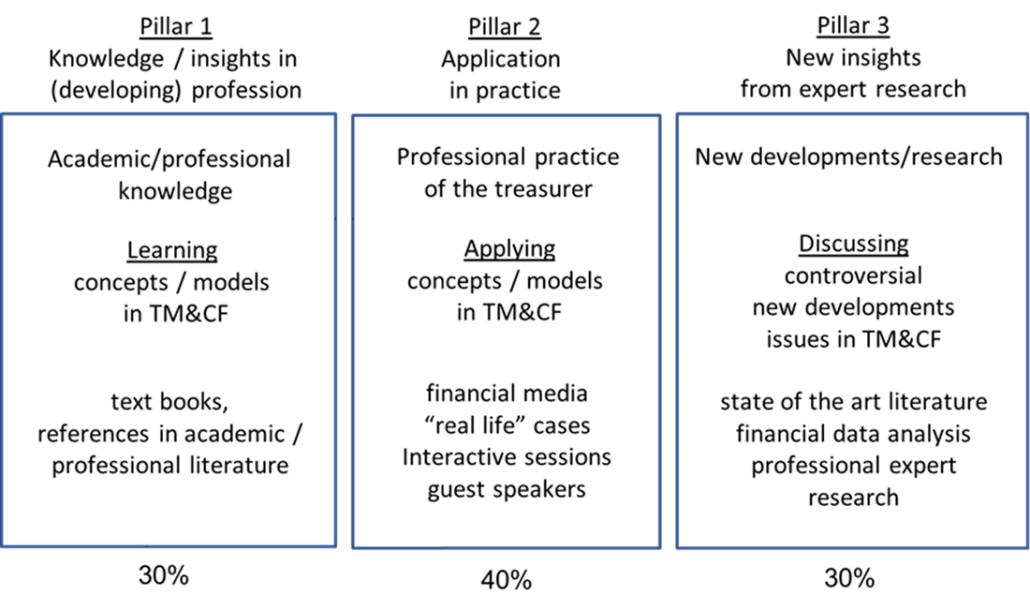

To become a ‘Treasury Academic Professional’, graduates need an overview of the standard knowledge in the broad range of topics covered by Treasury Management and Corporate Finance and need a deep understanding of Treasury Management and Corporate Finance concepts as well in order to judge applicability, create new concepts or rapidly adjust to new concepts. This requires intellectual flexibility, obtained by regular acquisition of new (academic and professional) knowledge and being able to formulate and present on a regular basis your ‘Own Opinion’ on issues in the treasury discipline.

Therefore the programme organizes frequent discussions & debates in class and in the professional network. As a result, the Treasury academic professionals are able to think beyond the standard professional practice and judge and foster new development, act as true expert professionals by executing Treasury Management & Corporate Finance with a broad perspective on the corporate board level. And most and for all: Being able to enjoy the profession!

Below please find our 3 pillar approach to becoming a Treasury academic professional:

SPEAKER INFORMATION

Mark your calendar for August 24 at 10 am CET

Join the live session with Pieter de Kiewit, owner of Treasurer Search.

Strategic treasury career planning and the role of education

For a long time treasury has not been a conscious career choice for most practitioners. Nowadays an increasing number of professionals, including aspiring treasurers, think about and plan their professional goals. They think about drivers, companies, job types and also education.

In an interactive webinar Pieter de Kiewit will discuss the most relevant topics in strategic treasury career planning with a strong focus on the role of education in this. His career in international recruitment spans over 25 years. For almost 15 years his only focus is on recruitment in corporate treasury. Pieter is Member of the Management Board (curatorium) of the post-graduate programme Executive Treasury & Corporate Finance of the Vrije Universiteit Amsterdam.

Robert Dekker is Associate Director at KPMG Netherlands. He studied Economics at the University of Groningen and did an Associate’s Degree in Risk Management at the University of Pennsylvania.

Robert Dekker is Associate Director at KPMG Netherlands. He studied Economics at the University of Groningen and did an Associate’s Degree in Risk Management at the University of Pennsylvania. Professor Herbert Rijken is Full Professor Corporate Finance at the department of Finance at VU University Amsterdam. He obtained his PhD (1993) in Physics at Eindhoven University of Technology.

Professor Herbert Rijken is Full Professor Corporate Finance at the department of Finance at VU University Amsterdam. He obtained his PhD (1993) in Physics at Eindhoven University of Technology.