Recap #3: Round Table “Digital currencies for a digital future?” | Toekomst Betalingsverkeer

20-10-2021 | François de Witte | treasuryXL | LinkedIn

Here is my third and final recap where I will highlight the round table topic: Digital currencies for a digital future?

1. Introduction

On September 9, 2021, the event “Toekomst Betalingsverkeer” has taken place in Amsterdam. Amongst others, following topics were covered:

- The Fintech evolution of banking.

- Platform strategies & developments big tech.

- Customer experience strategies.

- Open banking.

- Instant payments.

I hosted two round table sessions on “Payment Challenges in a Post-Covid” World and we made a deep dive on the following 3 topics:

- Instant Payments – the new “normal”?

- Request to Pay: the bridge between customer convenience and reconciliation?

- Digital currencies for a digital future?

Click on the above links to read my previous articles where I discussed the first two topics.

2. Setting the Scene

Facebook’s Libra announcement in June 2019 has shaken up the finance industry, forcing regulators around the world to take a closer look at it. This has sped up analyses and projects around Central Bank Digital Currencies (CBDCs).

Moreover, the fears that the Covid-19 virus might live on banknotes and coins, fostered the development of CBCDs.

In the context of this article, CBDC is regarded as general-purpose central bank digital currency, which has 3 elements:

- It is a digital currency and therefore only exists electronically.

- Issued directly by a central bank;

- Universally accessible.

Several countries started CBCD projects: e.g., China, The Bahamas, The Marshall Islands, Sweden, the UK and the EU.

For the digital Euro: According to the ECB, this will take 2 more years from now to establish its characteristics (See announcement ECB) .

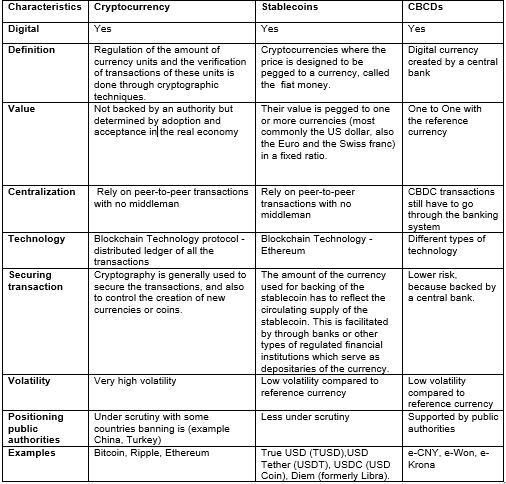

3. Positioning of CBCDs versus the cryptocurrencies and the stablecoins

In the table below, you will find the positioning.

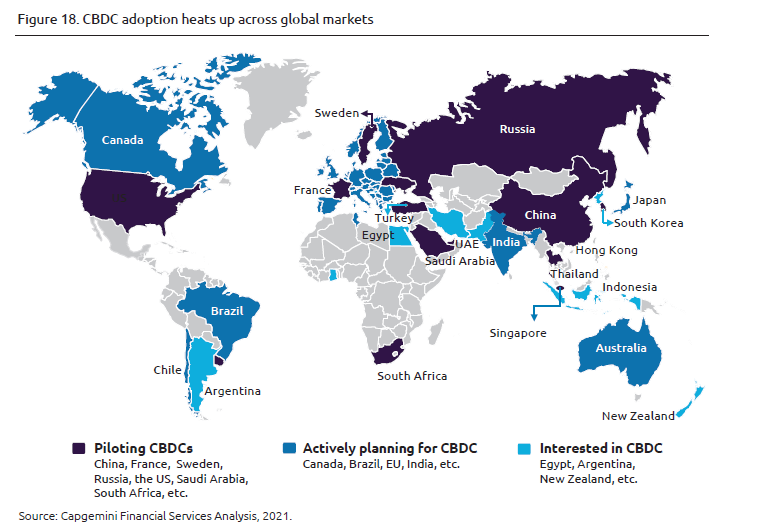

4. Current Status of the CBCDs

Below you can find an overview of CBDC adoption across global markets.

5. CBCDs: Benefits and Challenges

CBCDs offer several benefits such as:

- Playing a role in retaining public money for general use. The increasing adoption of user-friendly digital money reduces the demand for cash, currently the only public form of money.

- Acting as a backup for the critical infrastructure in the payment system, as physical cash currently has a function as backup during failures in non-cash payment. CBDC could serve as a parallel backup and its role could gradually become more prominent.

- Considering the preferences of the public, related to privacy and the use of data. Some citizens and businesses value privacy when paying, as is the case with cash. Central banks could restrict the use of data generated by CBDC transactions to just that information required for public duties such as compliance with anti-money laundering legislation.

- Facilitating financial inclusion: especially in countries whereinto everybody has access to a bank account with a commercial bank.

- Enable new monetary policies: If central banks now want to pump money into the economy, the CBCDs are a new channel to get money directly into the economy.

- Providing Financial security: There is less need for fractional banking and your bank can hardly fall over. This makes the deposit guarantee scheme virtually superfluous.

- Capitalizing on « Trust », as it is supported by a central bank, whereas a stablecoin is merely capitalizing on technology and is not supported by a « Trusted » Party.

However, there are also some challenges such as:

- Ensuring that the infrastructure for CBDC is sufficiently segregated from the current infrastructure to prevent both from becoming disrupted.

- Time to market. The ECB is now starting to investigate what a digital euro might look like. This investigation phase will start in October 2021 and last for about two years. Other countries like Sweden and China seem to have a quicker time to market.

- The risk that some central banks focus resources on other topics like instant payment and open banking models, rather than digital currencies.

- A potential negative impact on the potential of commercial banks to cross-sell profitable products if customers were to switch to CBDC entirely. Banks use the payment account as an anchor to offer and grant higher-margin products such as mortgages and personal loans. Customers switching to CBDC entirely could put pressure on their profitability. The ECB took this into account by putting a maximum amount on CBCD accounts per citizen.

Thank you for reading!

To see all my previous blogs, click here.

François de Witte