Recap #2: Round Table “The bridge between customer convenience and reconciliation” | Toekomst Betalingsverkeer

04-10-2021 | François de Witte | treasuryXL |

Here is my second recap where I will highlight the round table topic: Request to Pay: the bridge between customer convenience and reconciliation?

1. Introduction

On September 9, 2021, the event “Toekomst Betalingsverkeer” has taken place in Amsterdam. Amongst others, following topics were covered:

- The Fintech evolution of banking.

- Platform strategies & developments big tech.

- Customer experience strategies.

- Open banking.

- Instant payments.

I hosted two round table sessions, the other round table named “Payment Challenges in a Post-Covid World”, and you can read the recap here.

2. Setting the Scene

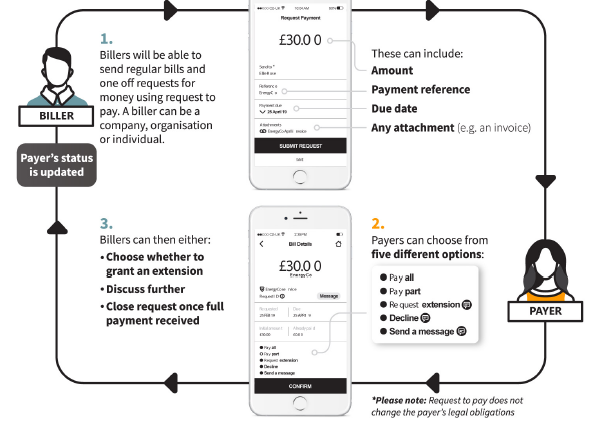

The Request to Pay (RTP) is a payment technique allowing a business or individual wishing to receive a payment, to send an electronic request for that payment to the debtor account.

The request will be received by the payer – most likely via an electronic interface such as a mobile banking app showing the requested amount and the due date. The payer will then have some choices:

- Pay in full.

- Pay part

- Ask for an extension

- Decline payment

If the payer chooses to make a payment, the payee will be notified whether the payment is in part of in full and when it has been confirmed.

The scheme is operational in the UK.

The European Payments Council has published the first version of the Single Euro Payments Area (SEPA) Request-To-Pay (SRTP) scheme rulebook, which is expected to go live during 2022.

3. Outline of the scheme

Source: IS REQUEST TO PAY THE SYSTEM FOR A WORLD OF NEW NORMS? Finextra July 2020

4. Request to Pay: Benefits and challenges

The major advantage of the scheme is the convenience: when consumers want something, they want it quickly—immediately, if possible— and they want to pay for it as simply as possible, preferably using contactless payment. And, if possible, without even leaving the couch to dig out their card or account details.

Another advantage for the payor is that keeps a full control of the payment process.

For the Merchant, there are also important advantages, such as:

- The follow up of the payment process.

- The certainty of the payment: once the payment has been done, it is final, which is not the case for direct debits, where the payor has a refund right.

- The easy reconciliation at the Merchant’s side, as the payment message in the RTP is not altered.

The challenges are to find the right and secure network to send the invoices and to channel the payments – there are already providers positioning their offer, to get the consent of the payer to receive his invoice through the RTP and to come to a standardization of the different schemes. This will be a key driver of success.

The SRTP (SEPA Request to Pay) is a good step in this direction. Following on a 3-month public consultation, the EPC expects to publish on 30/11/2021 its next rulebook (entering into effect 6 months to 12 months later – to be confirmed).

François de Witte