19-10-2022 | Philip Costa Hibberd | treasuryXL | LinkedIn |

We sent our expert Philip Costa Hibberd to the SIBOS conference to discover and explore the World’s Premier Financial Services event.

Last week, the SIBOS conference took place in Amsterdam. Sibos 2022 brought together more than 10,000 participants in Amsterdam and online, as this event returned in-person for the first time in three years.

Philip is delighted to share his experience with you. Happy reading!

What is Sibos?

The Sibos conference is an annual event organized by Swift that brings together leaders in the payments, banking, and financial technology industries. The conference provides a forum for attendees to discuss the latest trends and developments in the industry, but – as it turns out – it is mostly used as a venue where bankers meet other bankers with the occasional FinTech thrown in the mix.

During the 4 days of the 2022 edition, I learnt that little focus is given to the needs of the corporate treasurer. Throughout the conference, a few interesting recurring themes emerged nonetheless, which I’ll describe in the paragraphs that follow.

Purpose of the financial industry

Queen Maxima – acting as the “United Nations Secretary-General’s Special Advocate for Inclusive Finance for Development” – kicked off the opening plenary by speaking about the importance of financial inclusion and access to banking services for all.

The first priority is to make sure we do no harm […] but we have a chance today of moving beyond doing no harm to actually doing good. So, beyond transaction volume and customer acquisition can we create the rails for transformative change to help users become more financially healthy?

Sadly the answer I heard from the bankers speaking on stage during the sessions that followed was not promising. “Maximising shareholder value” was still the dominating mantra… which – as experience teaches us – has seldom led the banking industry to “doing no harm”, let alone “doing good” in the past.

Banks vs FinTechs

A bit more hope for the industry “doing good” came from the voice of FinTechs on stage. As it turns out, a mantra based on “innovation and disruption” makes it easier to attract scarce resources (such as talent) and ironically deliver shareholder value as a consequence.

It was interesting to observe the evolution of the Bank-FinTech relationship. The change in how banks perceive FinTechs today compared to a few years ago was remarkable. Once seen as a threat, FinTechs are today considered an ally by banks.

When asked “Are FinTechs Friend or Foe?”, bankers gave answers as:

“Partnership with FinTechs is our main strategy”.

“Partnership with FinTechs is crucial. They bring agility and they are a matter of survival for us”.

It was hardly a surprise then to learn on day 2 of the conference about BNP Paribas’ acquisition of Kantox, a leading fintech for automation of currency risk management. The relationship between banks and FinTechs will probably only get warmer and tighter from here… but only time will tell if that is good news for us.

Regulation-driven innovation

Besides FinTechs, another often cited source of innovation for banks was “the regulator”.

Singapore was the most cited example of successful regulator-driven innovation. Its central bank has been encouraging innovation in the financial sector with generous grants to adopt and develop digital solutions, AI technology, cybersecurity capabilities, etc. On top of that, it has developed an exceptionally accommodating regulatory framework. It has for example introduced a “regulatory sandbox” for FinTechs and banks to test their products and services in a live environment without them having to be concerned with compliance hurdles (at least for the delicate initial phases of innovation).

There are hopes that Singapore’s success will be taken as an example by other regulators across the globe, but the most basic expectation from the industry is for regulators to at least set guidelines to improve standardization across the market. As nicely put by Victor Penna, there is still a lot of work to be done:

“Can you imagine if I sent an email from Singapore to Belgium and they couldn’t process it? That is exactly what is happening today with payments. This has to change.”

One last often cited trend where regulators are expected to play a dominant role in innovations, are Central bank digital currencies – CBDC in short.

CBDC (Central bank digital currency)

CBDCs are digital currencies issued by central banks. Typically central banks have two kinds of liabilities:

- Cash: takes a physical form and is available to the general public

- Central bank deposits: which take a digital form but with limited access

CBDCs are a third form of liability that complements cash and central bank deposits: they take a digital form and are directly available to the general public.

More than 100 central banks are estimated to be working on their own projects. They are important in the context of innovating the financial sector because they have the potential to provide greater efficiency and transparency in financial transactions. Additionally, CBDCs could help to reduce the cost of financial services and increase access to financial services for underserved populations.

There is still little consensus today on what exactly the impact will be, not least because of the fragmentation of all the initiatives. For example, when it comes to the digital Euro project, the impact on corporate treasury payments is expected to be limited. The project is still in the validation phase, but the assumption is that even if/when the project were to move into the realization phase (decision expected in September 2023) usage will be limited by design with the introduction of low limits to the maximum balances which could be held (exact limits need to be defined, but think of a few thousand euros max).

Realtime banking and 24/7/365

Banks have invested a lot in the technological backbone needed to support open banking and instant payment requirements across the world and seem to be puzzled by the modest adoption. The ambition is to move away from batches, cut-off times, and end-of-day statements in favour of instant payments 24/7 and provide information-on-demand via APIs.

From a treasury perspective, this brings some challenges. Moving to APIs can be hard, especially if you have a fragmented ERP/TMS/Banking landscape. But the biggest challenge is probably the way that we organize our work and our processes. As jokingly put by Eddy Jacqmotte group treasurer at Borealis:

“Instant Treasury is nice: but I don’t like the idea of instant treasury on Saturday and Sunday”.

AI and (big) data

The ever-decreasing cost of storage and processing information, combined with the ever-increasing flow and value of user data has transformed the “AI” and “(big) data” brothers from geeky kids in the corner to rockstars in the centre stage.

Besides the obvious use cases such as fraud detection, sanction screening, reconciliation, payment repair, etc. the new trend is to use AI to generate new tailored content and to feed it to users to measure their interest in a specific topic and nudge their behaviour. Instead of asking you directly if you are interested in a mortgage, the algorithm might casually inform you about the price per square meter of properties in the neighbourhood where you go for coffee every weekend. If you interact with the prompt, the algorithm will take notice and will keep on feeding you with “property-related” information, until you find yourself asking for a mortgage…or showing interest in something else that the bank can do for you.

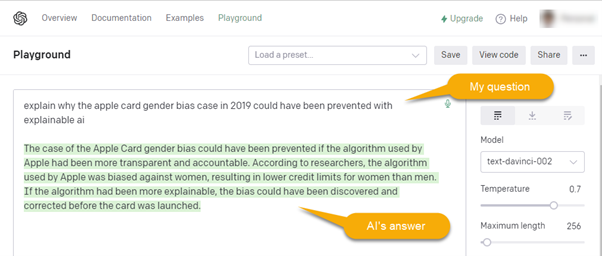

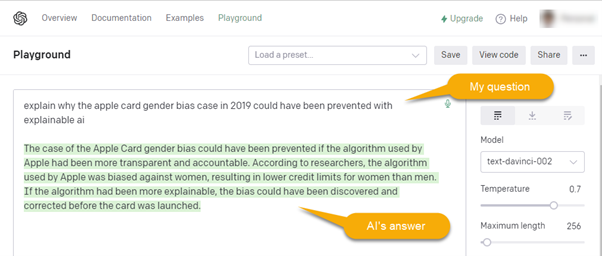

Sounds sketchy? It might be, that’s why another trend in this area has been making its way to the foreground: Explainable AI.

Explainable AI is a form of AI that can provide understandable explanations for its predictions and decisions. This is important especially in the financial industry because it can help to build trust with customers and regulators and avoid (or at least make explicit and controllable) unwelcome biases.

For example, the Apple Card / Goldman Sachs scandal in 2019 could have been prevented if the algorithm used by Apple had been more transparent and accountable. According to researchers, the algorithm used by Apple was biased against women, resulting in lower credit limits for women than men. If the algorithm had been more explainable, the bias could have been discovered and corrected before the card was launched.

In essence: AI is powerful, but transparency is key. On that note, I have a confession to make: the previous paragraph was written by an AI and not by me…

Thanks for reading!

Philip Costa Hibberd