What should treasurers do first to control against increases in interest rates?

What do treasurers think?

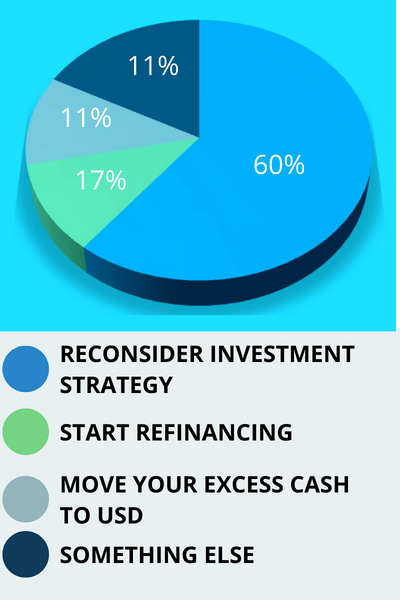

In last month’s poll, we discussed the impact of the recent interest rate increases on treasury. The poll received 35 votes, the results can be found in the image below.

We clearly notice that the majority of the treasurers are of the opinion that the first thing to do to control sharp interest increases is to reconsider the investment strategy of excess cash. We asked a number of treasury experts to explain why they voted for the other options than for a reconsideration of the investment strategy.

Views of treasuryXL experts

Niki van Zanten

Niki voted for the option to move excess cash to USD.

“Place excess cash in USD requires a holistic approach, the right time and knowledge, but if applied correctly, will manage your cash like a pro”

Treasurers want to manage certain risks, and often there is a silo approach. Liquidity risk is managed with loans and deposits, Interest risk (and returns) are managed with products such as interest rate swaps and FX is managed with FX spot, forwards and swaps. Once the incoming data (think bank balances, forecasts, markets rates) is structured, the data becomes information and is sufficient to act as treasurer with clear objectives (these are often defined in the above silos).

The next step would be to validate whether the approach meets the objectives. So, far nothing to worry about….until the market exhibits unexpected behavior. For example, a disconnect between FX swap points and underlying interest rate differentials (Jan 2015 USDCHF as a reference), or perhaps a need to optimize interest rates. In this case (and when provided time and knowledge is available), a holistic approach to FX, interest rates and cash can provide the opportunity to place excess cash in a higher-yielding currency without adding FX risk to your portfolio.

In short, it may make sense to place excess cash in USD if it does not shift FX risk or if this shift is managed by FX swaps and the pricing between swaps and deposits is compared. Again, this requires a holistic approach, the right time and knowledge, but if applied correctly, will manage your cash like a pro.

Some considerations may be to look at the efficiency of FX swaps versus deposits, as FX swaps tend to be more efficient, automation of solutions, and tracking and identifying market behavior.

Jeremy Tumber

Jeremy voted for the option to choose something else.

“Analyze how your company is exposed to the economic cycle ”

First, analyze how your company is exposed to the economic cycle – a study I saw in the early 2000s showed that the best position for airlines was to be 100% floatig, because their business was effectively in lockstep with the business cycle.

In theory, when an entity is part of an industry that is closely aligned with the economic cycle, it has a natural hedge for its interest rate exposure, in that it can afford to pay higher interest rates when the economy is booming, and get some relief from lower interest rates when the economy is slowing. The study I’m referring to involved a major German airline; at the time, the airline’s funding was 80% fixed, and their comments at the time were not very favorable to switching to such a large floating exposure. Fast forward 15 years, or so, and I checked their Financials. They were 85% floating at the time, so they had clearly stepped into the results of the study.

The biggest risk for them would be an extended period of Stagflation, so I hope they do well in the current circumstances!

Vincenzo Masile

Vincenzo voted for the option to move excess cash to USD.

“My view here is that a treasurer should take a conservative approach”

Macro themes continue to drive financial markets. One does not have to look much further than the inverted US yield curve or the collapse in copper to understand that investors continue to re-price global growth prospects lower.

This is possibly because: (a) European activity is more exposed to the Russian energy supply shock and b) the U.S. economy has entered this global tightening cycle with more momentum and a positive output gap.

Inverted yield curves are typically bad news for pro-growth currencies (commodity exporters + Europe & Asia ex-Japan) and typically good news for the dollar, the Japanese yen, and the Swiss franc. This environment looks set to continue over the summer months as the Fed continues its tightening policy.

Recall that the German Bundesbank estimated that the Germany economy could take a 5% GDP hit if gas is rationed. It now appears that we are now not far from such a scenario. The pressure on European growth has caused the Eurostoxx benchmark equity index to fall 22% year-to-date, versus -20% for the S&P 500. The question will be how much more the ECB can tighten before the growth valves come down.

My view here is that a treasurer should take a conservative approach and assume that there are no large loans to be repaid to the banks, existing cash in excess should be moved to USD or to CHF or to JPY at least until the end of this year.

Sooner or later, Ukraine and Russia war will come to an end, so the cycle will reverse and EUR will become more attractive for investors and for treasurers.