Treasurers Get Strategic About Hedging Programs as Interest Rates Keep Rising

02-08-2022 | treasuryXL | GTreasury | LinkedIn |

02-08-2022 | treasuryXL | GTreasury | LinkedIn |

01-08-2022 | treasuryXL | VU Amsterdam | LinkedIn |

(online) August 17 at 10.00 am CET, you are invited to join this expert session

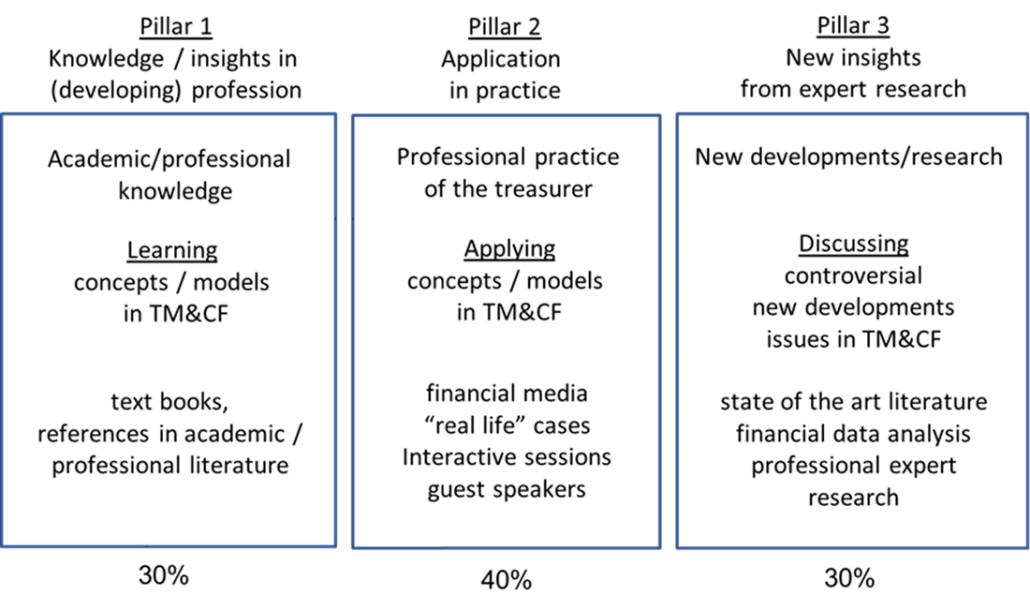

Since 1998, the School of Business and Economics of the VU University offers the Post Graduate programme: Treasury Management & Corporate Finance. The programme focuses on professionals with an academic background in economics and/or finance and at least five years’ work experience in the financial sector. The philosophy of the programme is to develop ‘Treasury Academic Professionals’, able to analyze complex treasury management & corporate finance issues independently or in multidisciplinary teams and solve and report on them. The programme differs from other programmes/courses in the field of treasury management & corporate finance through the emphasis on developing graduates as ‘Treasury Academic Professionals’ and less emphasis on knowledge accumulating, readily available in the market.

To become a ‘Treasury Academic Professional’, graduates need an overview of the standard knowledge in the broad range of topics covered by Treasury Management and Corporate Finance and need a deep understanding of Treasury Management and Corporate Finance concepts as well in order to judge applicability, create new concepts or rapidly adjust to new concepts. This requires intellectual flexibility, obtained by regular acquisition of new (academic and professional) knowledge and being able to formulate and present on a regular basis your ‘Own Opinion’ on issues in the treasury discipline.

Therefore the programme organizes frequent discussions & debates in class and in the professional network. As a result, the Treasury academic professionals are able to think beyond the standard professional practice and judge and foster new development, act as true expert professionals by executing Treasury Management & Corporate Finance with a broad perspective on the corporate board level. And most and for all: Being able to enjoy the profession!

Below please find our 3 pillar approach to becoming a Treasury academic professional:

Join the live session with Pieter de Kiewit, owner of Treasurer Search.

Strategic treasury career planning and the role of education

For a long time treasury has not been a conscious career choice for most practitioners. Nowadays an increasing number of professionals, including aspiring treasurers, think about and plan their professional goals. They think about drivers, companies, job types and also education.

In an interactive webinar Pieter de Kiewit will discuss the most relevant topics in strategic treasury career planning with a strong focus on the role of education in this. His career in international recruitment spans over 25 years. For almost 15 years his only focus is on recruitment in corporate treasury. Pieter is Member of the Management Board (curatorium) of the post-graduate programme Executive Treasury & Corporate Finance of the Vrije Universiteit Amsterdam.

01-08-2022 | treasuryXL | Kantox | LinkedIn |

When managing FX risk, CFOs could learn a lot from the world of asset management, where a revolution —led by indexing— has led to huge gains for investors. But how can you apply this to your business’s FX risk strategy? Watch below the video, or read the article!

Over the last couple of decades, the world of asset management —an industry with $100 trillion under management— has been turned upside down by a quite unexpected revolution: indexing. Instead of relying on managers’ capacity to time the markets, these firms have automated the selection of assets by quietly replicating stock indexes.

The answer is: yes, they can! Let us see why and how they can accomplish that feat.

Having embraced indexing early on, two leading firms have assets under management north of $15 trillion. What’s more, they have achieved such a spectacular result with fees that are only a fraction of the fees charged by those who embrace speculation. They have saved, and they are still saving, hundreds of billions in costs to investors.

Similar changes may be afoot in the business world. The term ‘exposure under management’, now used by CFOs and treasurers, comes from the expression ‘assets under management’. More importantly, CFOs are eschewing speculation — just like their cousins in asset management.

When managing currency risk in the one-trillion-a-day forward currency market, CFOs are using more and more digitised, automated solutions.

Once in a while, a lack of currency hedging or even speculating on an FX market move can yield a positive outcome for CFOs. But luck will run out at some point. Sooner or later, blindfolded by overconfidence, ‘speculative’ risk managers flounder in their vain attempt to time currency markets — with disastrous consequences for themselves and their companies.

Like stock prices and the price of other financial assets, exchange rates are not predictable. They follow ‘a random walk’ in which the forecast is set equal to today’s exchange rate (the spot rate). Accordingly, investors —and risk managers— should embrace markets rather than trying to beat them.

This is the thrust of the analogy between the asset management revolution and the coming revolution in FX risk management, an event that will ultimately enhance the strategic role of CFOs.

Let us go beyond the surface and take a closer look at the key tools and processes used by the most successful companies in asset management. These processes provide a useful template for understanding how CFOs will use Currency Management Automation solutions to manage FX.

We can single out at least five main lines of action:

28-07-2022 | treasuryXL | TIS | LinkedIn |

This blog gives you insights into the state of the treasury function in 2022 and a short list of recommended action items for better management of modern-day treasury operations

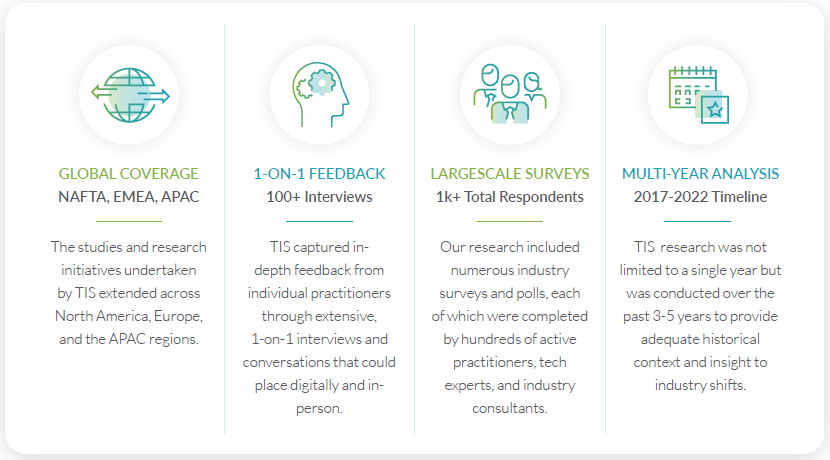

The insights highlighted in this article are based on a comprehensive set of studies conducted by TIS and our affiliates between Q1 2017 – Q2 2022. During this period, TIS held one-on-one interviews with hundreds of treasury experts and also released a suite of digital surveys that gathered feedback from thousands of financial practitioners regarding technology, staffing, and general operations.

Over the course of our research, TIS partnered closely with a niche team of industry experts, thought leaders, and consultants to interpret the findings. Historical treasury data was also obtained from the Association of Financial Professionals (AFP) and the consulting firm Strategic Treasurer to provide context regarding the evolution of treasury technologies and practices over time. Together, the expertise of our consortium and the extensive feedback collected from industry practitioners has provided us with unparalleled insights into the state of the treasury function in 2022.

While this article serves to highlight the summary findings and recommended action items from our studies, readers that would like more data and information are encouraged to download our full whitepaper for extended coverage.

The below surveys, polls, and interviews represent the full suite of research that TIS relied upon to complete our study. Links to the associated research conducted by our affiliates are provided as applicable.

This section provides a brief overview of the key points obtained through our research. For more information on any point of interest, please refer to the full whitepaper.

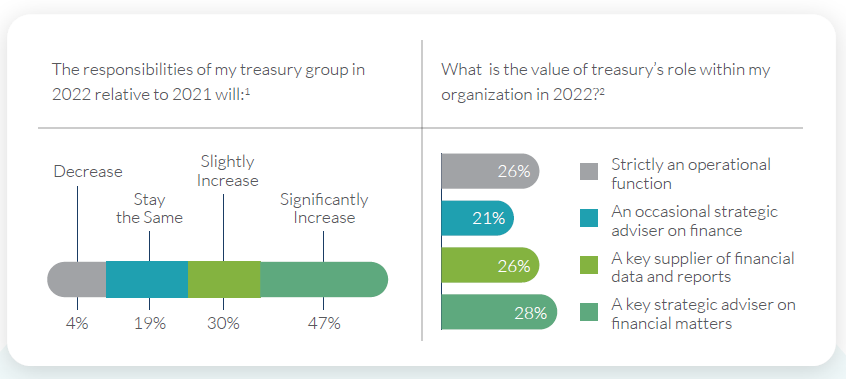

1. Treasury’s Responsibility List is Constantly Growing: The treasury function has never been more critical to the success of an organization, and this is being recognized internally by key stakeholders. However, treasury practitioners are now being handed additional responsibilities as executives and other departments realize the value they can provide, and nearly 80% of U.S. treasury teams saw their “net” list of responsibilities increase in 2022 vs 2021.

2. Stakeholders View Treasury as Equally Strategic & Operational: Over 50% of financial practitioners believe the treasury function holds key strategic value, which represents a significant shift from the traditional viewpoint of treasury being mostly an operational function. This shifting perspective is shared widely amongst internal stakeholders like accounting and AP. Today, treasury’s strategic influence is impacting areas like technology adoption, working capital management, bank connectivity, payment processing, and financial reporting.

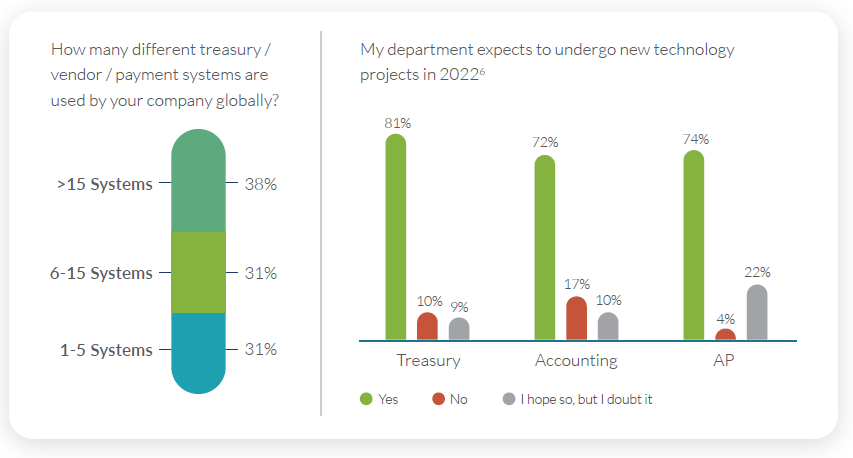

3. A Saturated Technology Market is Confusing for Treasury: The growing importance of the treasury function and widespread digitalization of global financial operations has resulted in an abundance of Fintech and bank-led software products entering the market. While this has helped foster innovation, data also shows that many treasurers have become confused by the breadth of categories and service offerings in the market, which has led to greater indecision and headache during RFPs and implementations.

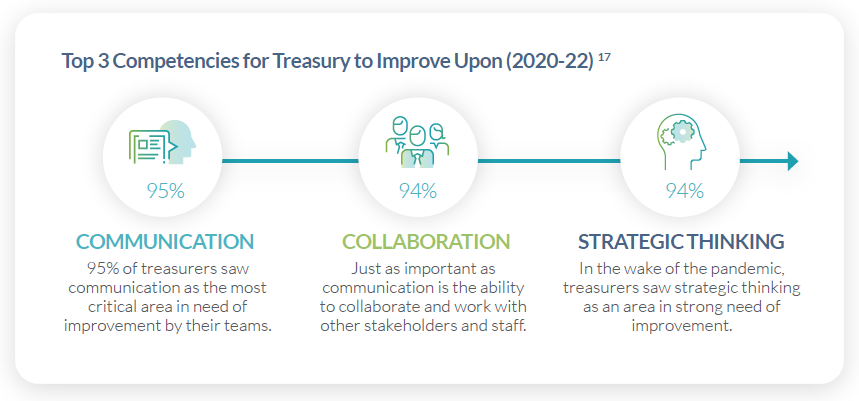

4. The Line Between “Treasury Expert” and “Tech Expert” is Blurring: As the treasury function continues shifting away from paper-based and manual workflows to digitally automated processes and software tools, treasury personnel are finding that their technological proficiency has a significant impact on their ability to perform their core financial responsibilities. This is leading many practitioners to seek out technology-based learning courses in tandem with their more traditional financial education.

5. Fraud & Security Concerns Remain a Critical Issue: In today’s remote and digitally-operated business landscape, tech-savvy criminals are presented with even more opportunities for infiltrating a company’s systems and processes. This is leading to a noted increase in fraudulent attempts across a variety of areas, and treasury teams are continuing to invest heavily in both technology and training to protect themselves.

6. Successful Treasury Teams Collaborate with Other Stakeholders: Research found that many of the most successful treasury teams are proactively working cross-collaboratively with other internal stakeholders and departments like accounting, AP, and IT to accomplish their objectives. These teams are also frequently partnering with external consultants, solution vendors, and bank personnel to ensure alignment and cohesion across all their various systems and operational workflows.

Based on the findings from our research and interviews, TIS experts have compiled a short list of recommended action items that treasury teams should consider as they seek to better manage their operations in 2022 and beyond. They are as follows:

1. Embrace the Opportunity to Provide Greater Strategic Input: As CFOs and other departments increasingly rely on treasury for reliable data and insights, practitioners should embrace the opportunity to expand their strategic influence internally. In the long run, this ability to provide value in new ways across the organization will benefit treasury when it comes to securing new budget and staffing approvals. However, in order to provide the most visibility and control over their operations without overloading their small teams, treasury must become highly adept at leveraging technology to eliminate manual workflows and repetitive tasks.

2. Becoming Proficient with Technology Should be Non-Negotiable: As technology continues to play a massive role in treasury, it’s crucial for practitioners to familiarize themselves with the core tenets of the modern technology landscape. This does not mean simply researching new buzzwords, but instead seeking to understand the unique differentiators that separate various bank and fintech product offerings in the market. Treasury should also not hesitate to seek out the help of specialized consultants or technology experts for help. Ultimately, treasury’s ability to effectively identify the solutions and capabilities that best fit their company’s needs will save significant time, money, and headache during implementations and migrations.

3. Managing Security for Remote Workforces Requires Extra Care: Given the continued prominence of fraud attacks within the treasury and finance environment, there is no room for error when it comes to protecting a company’s systems, workflows, and personnel. To secure their funds and assets, treasurers must implement multifaceted security controls and protocols that extend beyond the “frontlines” and include executives, administrators, and other “back-office” staff. Combining education and awareness with multiple layers of technology is the only way to gain the upper hand against a new era of tech-savvy criminal.

4. Building Strong Relationships with Other Stakeholders is Crucial: Today, most of the financial systems and workflows that exist within a business are closely intertwined. This means that treasury operations have a significant impact on other departments, and vice versa. Given the extent to which treasury workflows are integrated with those of other stakeholders, it’s vital for treasury to communicate and collaborate effectively with these groups. To ensure total alignment and cohesion, treasurers must be proactive in establishing solid relationships with internal IT, accounting, and AP departments as well as external banking and solution vendors.

5. Ongoing Education is Vital for Staying Ahead of the Curve: Treasury and finance teams have made it clear they are intent on furthering their education and professional skillsets. This professional development is not limited to any one area but encompasses a broad array of topics across both technology and finance. In a digital world, many practitioners are relying on remote seminars and webinars, but in-person events and training are still on the list for many teams as well. Moving forward, it’s highly recommended that practitioners who are serious about their careers undergo regular education and training so that they can stay abreast of new industry developments and innovations.

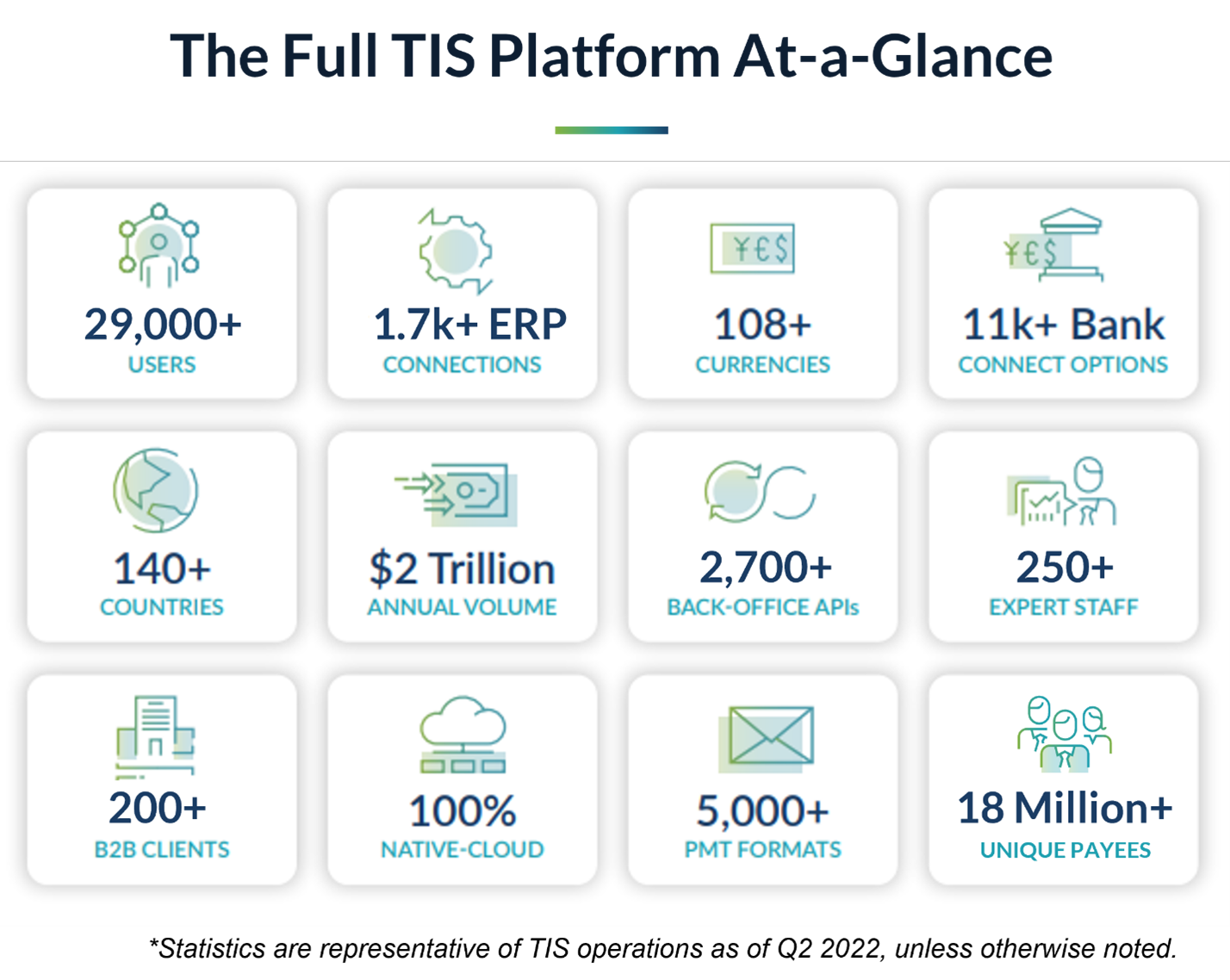

The TIS team hopes that the findings highlighted in our research are helpful for teams currently evaluating their own treasury structure, technologies, and workflows. For businesses that view these insights and find themselves in need for enhanced payments, cash management, and banking functionality, we would strongly urge you to consider the solution and services provided by TIS.

Today, TIS is streamlining treasury automation through a cloud-based platform that is uniquely designed to help global organizations optimize global payments and liquidity. In essence, the TIS solution is a multi-channel and multi-bank connectivity ecosystem that streamlines the processing of a company’s payments across all their global entities and systems.

Sitting above an enterprise’s technology stack and connecting with all its back-office, banking, and 3rd party solutions, TIS effectively breaks down department and geographic silos to allow 360-degree payments visibility and control. To date, the more than 200 organizations that have integrated TIS with their global ERPs, TMSs, and banking landscape have achieved near-real-time transparency into their payments and liquidity. This has benefited a broad variety of internal stakeholders and has also enabled them to access information through their platform of choice. Data is available either through dashboards or direct downloads but can also be delivered back to the originating systems.

As part of our client-centric service model, we fully commit our own resources to your implementation and manage the configuration of all required system functionalities, back-office integrations, and bank connections on your behalf. Beginning with project kick-off and lasting through testing and go-live, TIS’ all-inclusive approach to customer support means you never have to rely on internal resources to maintain our solution or integrate it with your existing technology stack.

This systematically controlled payments workflow is managed by TIS for both inbound balance information and outbound payments, and data can be delivered from any back-office system via APIs, direct plug-ins, or agents for transmission to banks and 3rd parties. No matter where you operate from, TIS provides global connectivity and provides the real-time data, control, and workflows needed for treasury to automate and control their end-to-end payments and liquidity processes.

For more information, visit our website or request a demo with one of our experts.

treasuryXL is the community platform for everyone with a treasury question or answer! Today, we discuss a question that treasuryXL expert Vasu Reddy often hears within his treasury network. The question relates to challenges for Treasury in Emerging Markets that most corporates continue to experience.

27-07-2022 | treasuryXL | Vasu Reddy | LinkedIn |

“This is a common question I receive. It is related to emerging market challenges for treasury that most corporates still experience. Examples of these emerging markets include Brazil, Russia, India, China and South Africa (BRICS)

My idea is to proactively submit an application in advance. This application should indicate the nature and scope of the transaction, the benefits to the company, and the impact on the country (including currency and cash implications). Furthermore, it should include the reasons for not sourcing locally, the basis for the costing, and supporting documents such as supplier agreements, shipping documents, etc.

If it is a recurring remittance, such as royalties or monthly Global service charges, then a special dispensation should be applied for (renewed annually) to avoid individual applications resulting in increased costs, efforts and delays.

The best approach is to work closely with your authorized dealer, who is your main partner bank and who has strong links with the Central Bank, has automated systems and is fully aware of regulatory changes. ”

Vasu Reddy

Do you also have a question for one of the treasuryXL experts? Feel free to leave your question on our treasuryXL Panel. The panel members are willing to answer your question, free of charge, with no commitment.

26-07-2022 | treasuryXL | marcus evans | LinkedIn |

We are proud to announce our media partnership with marcus evans group for the 25th Edition Capital Management for Banking Institutions conference taking place in London on 26-28 of September, 2022.

London, United Kingdom

26 – 28 September 2022

In recent years, the Basel IV capital regulations and amendments have put banks under large amounts of pressure to place the right measures, controls and models to understand these regulations’ impact on capital. With capital positions weakening, banks were forced to change their focus from capital optimisation to resource deployment, something which delayed Basel IV implementation. Additionally regulations such as the FRTB ad SA-CCR, impacting market and counterparty credit risk had a huge impact on the risk and capital management side. Moreover new regulations related to climate risk and stress testing being introduced recently by the Bank of England and the European Central Bank, meant that banks had to step up their capital related efforts in this area. In the face of new and ongoing regulatory pressures and market conditions banks need to be able to adapt and optimise their capital management practices.

With this in mind, the marcus evans 25th edition Capital Management for Banking Institutions conference held between 26-28 September, 2022 in London, UK will provide practical guidance on how to optimise capital management for banking institutions, with in-depth sessions on ensuring effective compliance with regulations such as the FRTB and SA-CCR, adapting to climate risk, enhancing capital planning, and meeting macroeconomic challenges. These hands-on sessions will be delivered by best-in-class practitioners who are uniquely equipped to pass on their expertise in this field. This guidance will enable banks to rise to the challenge of the new regulatory and macroeconomic conditions, and further develop their capital management and risk frameworks.

Attending This Premier marcus evans Conference Will Enable You To:

Best Practices and Case Studies from:

Special discounts available to Treasury XL subscribers! For more information please contact Ria Kiayia, Digital Media and PR Marketing Executive at [email protected] or visit: https://bit.ly/3M2gpQ0

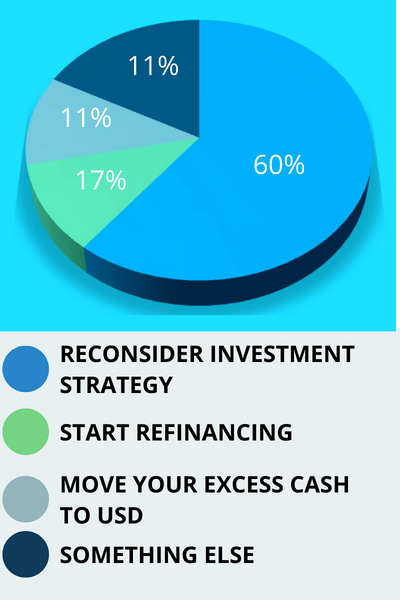

In last month’s poll, we discussed the impact of the recent interest rate increases on treasury. The poll received 35 votes, the results can be found in the image below.

We clearly notice that the majority of the treasurers are of the opinion that the first thing to do to control sharp interest increases is to reconsider the investment strategy of excess cash. We asked a number of treasury experts to explain why they voted for the other options than for a reconsideration of the investment strategy.

Niki voted for the option to move excess cash to USD.

“Place excess cash in USD requires a holistic approach, the right time and knowledge, but if applied correctly, will manage your cash like a pro”

Treasurers want to manage certain risks, and often there is a silo approach. Liquidity risk is managed with loans and deposits, Interest risk (and returns) are managed with products such as interest rate swaps and FX is managed with FX spot, forwards and swaps. Once the incoming data (think bank balances, forecasts, markets rates) is structured, the data becomes information and is sufficient to act as treasurer with clear objectives (these are often defined in the above silos).

The next step would be to validate whether the approach meets the objectives. So, far nothing to worry about….until the market exhibits unexpected behavior. For example, a disconnect between FX swap points and underlying interest rate differentials (Jan 2015 USDCHF as a reference), or perhaps a need to optimize interest rates. In this case (and when provided time and knowledge is available), a holistic approach to FX, interest rates and cash can provide the opportunity to place excess cash in a higher-yielding currency without adding FX risk to your portfolio.

In short, it may make sense to place excess cash in USD if it does not shift FX risk or if this shift is managed by FX swaps and the pricing between swaps and deposits is compared. Again, this requires a holistic approach, the right time and knowledge, but if applied correctly, will manage your cash like a pro.

Some considerations may be to look at the efficiency of FX swaps versus deposits, as FX swaps tend to be more efficient, automation of solutions, and tracking and identifying market behavior.

Jeremy voted for the option to choose something else.

“Analyze how your company is exposed to the economic cycle ”

First, analyze how your company is exposed to the economic cycle – a study I saw in the early 2000s showed that the best position for airlines was to be 100% floatig, because their business was effectively in lockstep with the business cycle.

In theory, when an entity is part of an industry that is closely aligned with the economic cycle, it has a natural hedge for its interest rate exposure, in that it can afford to pay higher interest rates when the economy is booming, and get some relief from lower interest rates when the economy is slowing. The study I’m referring to involved a major German airline; at the time, the airline’s funding was 80% fixed, and their comments at the time were not very favorable to switching to such a large floating exposure. Fast forward 15 years, or so, and I checked their Financials. They were 85% floating at the time, so they had clearly stepped into the results of the study.

The biggest risk for them would be an extended period of Stagflation, so I hope they do well in the current circumstances!

Vincenzo voted for the option to move excess cash to USD.

“My view here is that a treasurer should take a conservative approach”

Macro themes continue to drive financial markets. One does not have to look much further than the inverted US yield curve or the collapse in copper to understand that investors continue to re-price global growth prospects lower.

This is possibly because: (a) European activity is more exposed to the Russian energy supply shock and b) the U.S. economy has entered this global tightening cycle with more momentum and a positive output gap.

Inverted yield curves are typically bad news for pro-growth currencies (commodity exporters + Europe & Asia ex-Japan) and typically good news for the dollar, the Japanese yen, and the Swiss franc. This environment looks set to continue over the summer months as the Fed continues its tightening policy.

Recall that the German Bundesbank estimated that the Germany economy could take a 5% GDP hit if gas is rationed. It now appears that we are now not far from such a scenario. The pressure on European growth has caused the Eurostoxx benchmark equity index to fall 22% year-to-date, versus -20% for the S&P 500. The question will be how much more the ECB can tighten before the growth valves come down.

My view here is that a treasurer should take a conservative approach and assume that there are no large loans to be repaid to the banks, existing cash in excess should be moved to USD or to CHF or to JPY at least until the end of this year.

Sooner or later, Ukraine and Russia war will come to an end, so the cycle will reverse and EUR will become more attractive for investors and for treasurers.

21-07-2022 | treasuryXL | GTreasury | LinkedIn |

20-07-2022 | treasuryXL | The Working Capital Forum | LinkedIn |

On 1st December 2022, Working Capital Forum Europe brings together leaders in treasury, procurement, and payments to share ideas and techniques for better working capital management across supply chains.

That’s never been so important as in these times of rising interest rates, inflation, and supply chain shocks, when managing working capital is everyone’s concern.

From supply chain finance to accurate cash forecasting, solutions for every component of working capital management will be discussed on stage, demonstrated in our information area, and examined in our workshops at the world’s largest specialist working capital and supply chain finance event.

We’re delighted to return to Amsterdam for this one-day live event, with main stage keynote sessions, panel debates, and breakout workshops and demos.

If you’re interested in optimising working capital in your organisation, you need to join us in Amsterdam for the most productive day you’ve had in years.

Visit the Working Capital Forum: https://www.workingcapitalforum.com/

Join our events here: https://www.workingcapitalforum.com/events

Enter the Working Capital and Supply Chain Finance 2022 Awards here: https://www.workingcapitalforum.com/awards.html