20-12-2021 | treasuryXL | Kantox | LinkedIn |

How to automate the FX treatment of cancellations

It is no secret that the wave of cancellations following Covid-imposed travel restrictions has been a nightmare for travellers, airlines, hotel chains and tour operators alike. In the United States alone, cancelled domestic flights peaked at 137 thousand in April 2021. Largely due to cancellations, air traffic in Europe in 2021 was barely equivalent to 43% of the level seen before the pandemic.

Given the amount of time and resources devoted to adjusting their refunding policies, many players in the industry are still scared by the ghost of cancellations. But is that fear warranted? Not when it comes to FX management. This is because Currency Management Automation gives travel companies the tools to minimise the P&L impact of cancellations.

When it comes to FX management, the message is crystal clear: the ghost can be tamed.

Cancellations and FX exposure

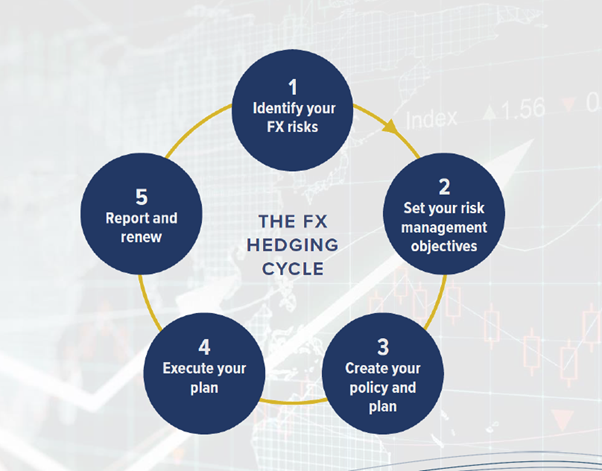

FX risk management is a process in three phases: the pre-trade, the trade and the post-trade phase. Cancellations are an important element of the pre-trade phase, when the exposure to currency risk is collected and processed. Now, the type of exposure and the way it is managed depends, crucially, on each business’ pricing dynamics (see: “The hidden secret behind the different types of FX exposure”).

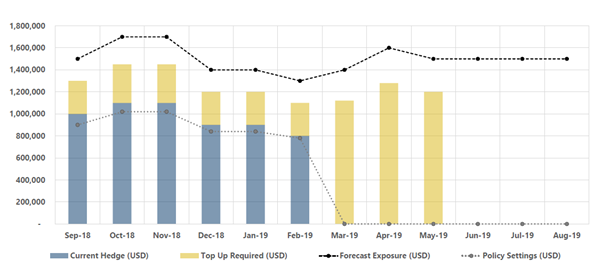

In the Travel world, dynamic prices are the norm (see: Currency Management Automation in Travel Distribution). OTAs, Bed banks, Hotel chains, DMCs and others frequently update their FX-denominated prices, and their cash flows are at risk from the moment of the bookings till settlement. For this reason, most Travel distribution firms apply micro-hedging programs that take those ‘firm commitments’ as the key FX exposure item.

This is where cancellations kick in. A cancelled FX-denominated booking diminishes the exposure to currency risk if the corresponding hedge has not been executed, or if an already executed trade is closed out at the same FX rate. Otherwise, there would be a situation of over-hedging. Manually adjusting hundreds or thousands of individual pieces of exposure to their corresponding hedges can quickly become an impossibly complicated task.

Taming the ghost in FX-related cancellations

Currency Management Automation provides treasurers with a number of tools to tame the ghost of cancellations. The first line of defence is to include —as part of business rules defined in the process of FX automation— an automatic cancellation rate. For example, if managers set an average cancellation rate of 10%, Kantox Dynamic Hedging® will hedge the remaining 90% hedge of the bookings.

As more information becomes available, this cancellation rate can be refined and adjusted by management when it so desires. While it is good practice to try and anticipate events, perfect accuracy cannot be expected in matters related to travel cancellations, especially in the current situation. This is why a second line of defence is provided by what our FX automation software takes as ‘negative entries’, a more efficient way to deal with cancellations. Let us briefly see how that works.

An entry is an individual piece of exposure. As part of the implementation phase of the software, risk managers establish a set of business rules that include —for each currency pair— the accumulated value of the entries they wish to hedge. These instructions also include a rule for setting negative entries from their own ERP, Booking Engine or Data Lake in the event of cancellations. API-transmitted negative entries automatically cancel the corresponding FX exposure.

But what happens when a negative entry is pushed after the corresponding hedge has been executed? Not much. Because travel-related FX exposure typically includes hundreds/thousands of individual transactions, new positions are constantly entered for the same currency pair and value date. The more granular the information included in these entries, the more accurate the FX hedging process, and the better the traceability of each piece of exposure.

Conclusion: speed is the name of the game

As the effects of the global pandemic still loom large, the ability to quickly process cancellations is a must for airlines, hotel chains and wholesalers in general. FX management is an integral part of this process — and it relies mostly on automated micro-hedging programs for bookings or ‘firm commitments”.

These micro-hedging programs, in turn, automatically treat cancellations as a key element of the ‘pre-trade’ phase of exposure management. If your aim is to tame the ghost of cancellations —while relieving the finance team from performing repetitive, resource-consuming and potentially risky manual tasks—, FX automation is the starting point.

The time to act is now!