| 21-07-2021 | treasuryXL | Nomentia |

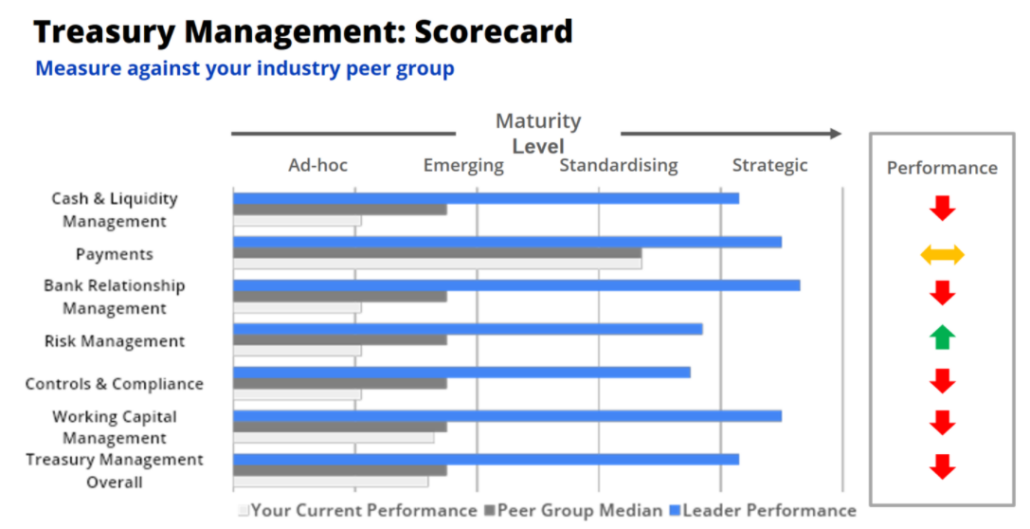

Many Corporate Treasury functions are aware of the importance of utilizing technology to deliver improved efficiency and control in their treasury operations. This is being driven by the increasing pace of regulatory change, continuously evolving business models, volatile economic conditions, and fast-growing technological developments. Also, treasurers are recognizing the benefits of a strategically focused ‘smart treasury’ – one that utilizes the latest technology to be more integrated, automated, and optimized; adding value to the business.

However, as the treasury technology landscape continues to evolve at a rapid pace, many organizations find it difficult to successfully adopt this technology, either because their entry point is not clear or because they had previously made the leap and are now struggling to keep pace with the evolution. There are a multitude of options and considerations for those looking for the right solutions, which are important to understand before deciding on what is right for an organization.

We have outlined below some key insights and considerations when selecting suitable technology solutions.

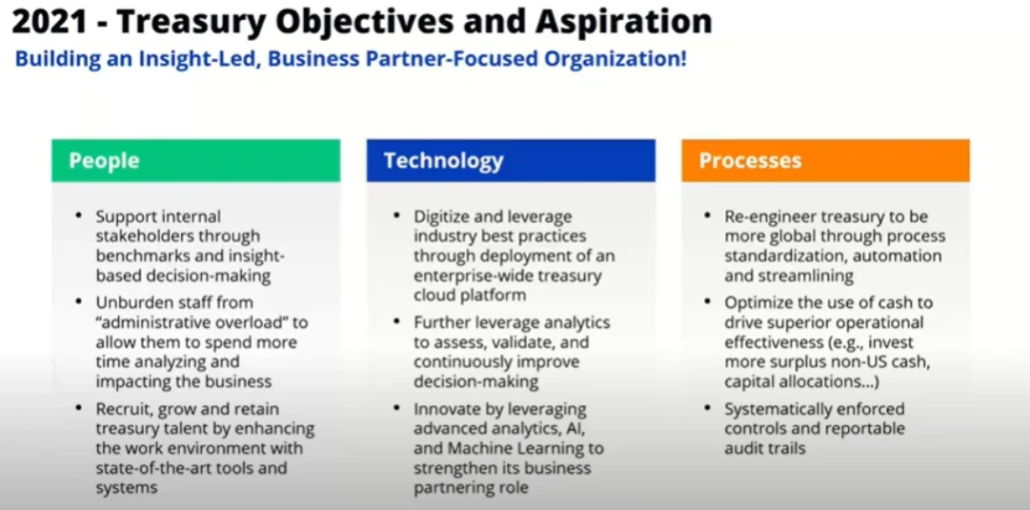

Develop a treasury technology roadmap

Your roadmap should consider essential functional requirements that must be satisfied immediately – current hot topics include improved cash visibility, robust and accurate cash forecasting, a more efficient payments and receivables process, and fraud prevention. All of these areas are ‘must-haves’ for many organizations, so the first building block for the roadmap is finding a solution that can satisfy them.

However, alongside considering your immediate needs in your roadmap it is also important to plan for the future. To do this, you must look at the internal and external drivers of change for your business and how the treasury will need to support that.

An example of an internal driver could be where accelerated geographical growth is expected, and therefore treasury will be required to rapidly connect with new banks, set up new accounts, and adopt new currencies. This comes with challenges around dealing with country-specific requirements for payment formats and new types of bank connectivity, so your chosen technology solutions should be capable of adopting these easily.

Similarly, for external drivers you can look at the current markets you operate in and identify any expected developments in payments and banking initiatives. Current examples of external drivers for those operating in the Nordics and Europe include the P27 Nordic payments initiative or PSD2 electronic payments services regulations. Once again, your technology solutions should be chosen to ensure you are able to keep pace with these changes.

Self-hosted versus SaaS solution

We find that a number of treasuries have had historic on-premise solutions which have not always kept up to date with the developments in functionality and the market. As a result, treasurers have had to establish a number of in-house workarounds which are costly and complex to maintain.

To improve upon this, most technology companies now provide a solution that is delivered as software-as-a-service (SaaS), a deployment method that comes with several benefits.

SaaS solutions are hosted in the ‘cloud’ and hence there is no need for the organization to manage technical matters such as maintaining appropriate servers, backups, etc. Because the solution is managed in the cloud by the vendor, there is no longer a need for users to manually upgrade their solutions and perform the associated regression testing – upgrades are tested and deployed by the vendor on a regular basis, ensuring all organizations using the solution are using the latest version containing the latest functionality. Over the past years, we have seen an increasing number of solutions being offered as a SaaS solution and can see this as a trend that will continue to dominate in the future. You should also consider your organization’s overall IT strategy as it is critical to ensure you are aligned with this.

All-in-one versus best of breed

Over the years we have seen significant shifts in the treasury technology market with innovative and specialized Fintech solutions driving advancements in the market. These applications are often focused on specific areas of functionality rather than covering the broad set of requirements a treasury function may have. They are often meant to be complemented by other platforms to form a suite of treasury applications that cover all requirements.

Hence, the key consideration for an organization is whether to opt for an ‘all-in-one’ TMS or to deploy a stable of ‘best of breed’ solutions. An all-in-one TMS comes with clear benefits such as a single platform to handle all treasury transactions/processes and fewer interfaces to monitor and maintain.

However, for some organizations the all-in-one TMS comes at a significant initial and ongoing cost commitment when their requirements aren’t as broad compared to the functionality on offer. Although many of the vendors of all-in-one TMSs allow organizations to choose which modules of the platform they utilize for a reduced license fee, it is often not the case that if you are only using 50% of the functionality you will be paying 50% of the price. A much more palatable solution comes in the form of best-of-breed solutions, which deliver a more flexible technology landscape utilizing specialized systems that may address the many unique requirements of a treasury function, at a lower cost than the all-in-one TMS. Previously the use of multiple platforms was not favorable due to difficulties that could be faced such as technical integration and reporting. However, the rising use of digital APIs has improved the way systems interface with each other. Also, data-warehouses coupled with BI solutions has enabled reporting based on data sourced from a variety of platforms.

Typically, when implementing a new system you will sign a license agreement for a minimum 5-year term, so it is important to ensure you have considered the suitability of the technology partner(s) and the functionality to support you in your digitalization over many years. During the selection process, it is important to perform an analysis of partners and vendors focused on their experience, innovation roadmap, development track-record, reliability, and support model. These are attributes that will demonstrate to you that the vendor is able to support your business not only now but also in the future, as your operations and the demands placed upon the treasury function change as your business grows and evolves.

Final comments

One size does not fit all treasury functions, as each organization’s treasury remit and activities will drive the appropriate solution or solutions.