| 10-4-2017 | Hans de Vries |

In a perfect world, one currency is the ultimate dream for every Treasurer. The introduction of the Euro has been a major leap forward in that direction. However, current anti-euro sentiments boosted by populist movements all over Europe, seriously threaten to hamper this unique and visionary European accomplishment. This article focusses on what impact the introduction of the Euro had for the corporate treasurers and what will happen if the Euro gets skipped.

In a perfect world, one currency is the ultimate dream for every Treasurer. The introduction of the Euro has been a major leap forward in that direction. However, current anti-euro sentiments boosted by populist movements all over Europe, seriously threaten to hamper this unique and visionary European accomplishment. This article focusses on what impact the introduction of the Euro had for the corporate treasurers and what will happen if the Euro gets skipped.

Let’s start with the beginning. One must be aware that the introduction of the Euro is the world’s largest economic policy experiment so far with heavy repercussions on the autonomy of the countries involved with regard to their monetary regimes. So naturally this expedition has met a lot of criticism ever since the beginning, the creation of the European Monetary System (EMS) on March 13,1979.

The Euro skeptics mostly feared that the wide-spread adoption of the Euro would deteriorate the economies of countries that accepted this currency and was in favor of the larger countries, like France and Germany, that now could easily manipulate the Euro’s puppet strings. Main belief was that the Euro would weaken instead of strengthen the European economy.

As from the start, Euro stronger than expected

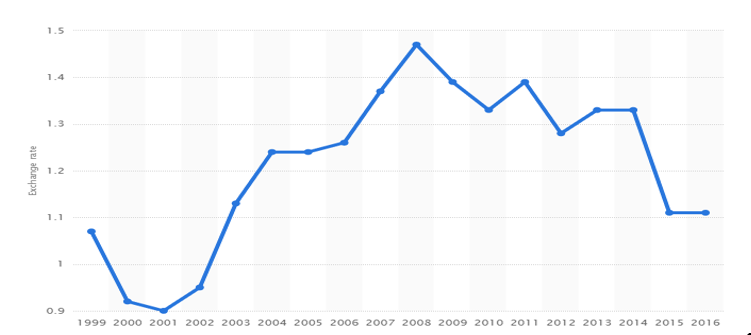

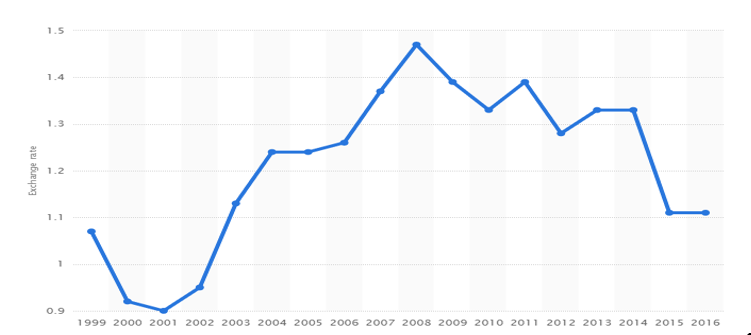

Although the Euro met quite some negative public attention, looking at more than 15 years of Euro, the track record has not been that bad at all. As the graph shows, after a relatively weak position against the USD at the beginning of this century, the Euro has held a strong position against the USD as from 2003 on, although weakening after 2014 in the aftermath of the banking and economic crisis that followed it. However, the predicted downfall of the Euro never took place. Remarkable phenomenon was that when the value of the dollar was higher, it was regarded in the media as a sign of weakness of the Euro against a “strong” Dollar and when the value of the Euro was stronger than the USD it was regarded by the analysts as a sign of weakness of the Dollar.

More important is that the introduction of the Euro as per January 1, 1999 has indeed brought the predicted transparency to the European market but also to the global market. This transparency has contributed to the substantial growth (5-40% according to Bun and Klaassens) of the internal trade flows within the EU countries due to the fact that the Euro has lowered the fixed and/or variable costs of exports. Prices can be compared across the whole Eurozone, allowing companies to choose the most price-competitive suppliers. The newly exported goods are of lower unit values than those previously exported because the Euro has made exporting them profitable, particularly for small exporters. Don’t forget that with 28 member states in 2014 Europe was the strongest economic player on global level taking care of 17,1% of the World GDP whereas the USA had a share of 15,9% and Russia 3,3%.

From a more monetary viewpoint the Euro brought price stability. Inflation in the Eurozone has been around 2-2.5% for most of the time since its creation.

A strong Euro mitigated the impact of the volatility of dollar-denominated commodity prices.This advantage was particularly visible before the beginning of the financial and economic crisis, when the oil price and the price of some other important food commodities reached unprecedented peaks. Due to the Strong Euro or weak USD, the consequences for the European market were relatively minor.

Euro leads to transparent treasury operations and substantial cost reductions

In today´s Euro environment, most Treasurers in Europe only have to deal with the USD, GBP and sometimes CHF and the Nordic Currencies. This makes live quite overseeable and has substantially enhanced their risk portfolio. The same applies for the Treasurers outside the Euro zone, who are now freed from the hassle of the past European currency palette.

Although a number of Euro critics pointed their finger at the Euro as direct cause for the Banking crisis a few years ago, it is almost impossible to imagine the consequences of the crisis in and outside Europe if every European country had been dealing with their own currencies. This would have resulted in a pandemonium of devaluations and revaluations with even more severe consequences for the values of all national and international operating companies and even more bank bankruptcies. Not to mention the impact this might have had on pension funds and other investment vehicles on short and longer terms.

From a corporate perspective, the benefits of the introduction of the Euro are therefore quite clear.

But also the consumers more and more are sharing the benefits of the common Euro market. Not only during travels abroad but also internet shopping becomes more and more international with new initiatives on the way to support payments like the Fast Payment project.

Looking at all these benefits, the current anti Euro sentiment in a number of European member states is from an economic point of view hard to understand and might pose a serious threat on the future European economic development.

Consequences of a Euro exit from a treasury and cash management perspective

Imagine getting back to the world without the Euro. This means an enormous rise of the operational costs considering:

- The daily currency shifts that influence directly the position of the corporate’s accounts receivable/ and accounts payable and therefore the short time profit/loss situation. To minimize the impact substantial investment in systems and manpower will be needed;

- The monetary developments as result of the internal economic/ political situation per country resulting in overnight currency devaluation/ revaluation and it’s inter currency reaction’s. (The recent takeover of Opel by Peugeot was merely a result of the strong decline of the GBP against the Euro which had severe consequences on the UK based Vauxhall subsidiary and shows the impact of the monetary developments on the corporate world.)

- The banking costs involved in setting up swaps/ hedges/ Long term deposits etc.

- The banking costs involved in buying and selling the various currencies;

- The impact on money transfers which will be treated as international payments again with different clearing systems, correspondent banks, local payment instruments and formats etc. resulting in delayed payments and receipts and therefore threatening the growth of the economies.

- The impact on international trade that will strongly diminish due to the lack of transparency of the international markets, the rise of costs and the loss of trust.

- Re-opening of local accounts to support local business

Banking industry as sole winner

The only party that will benefit from this skip of the Euro development is the banking industry, because of the margin to be made on currency exchange, swaps and other derivates, and the backshift to a Non-Sepa/ international payments environment with substantial higher transaction costs. Looking at the public opinion on banks in general ever since the bank crisis, it’s hard to believe that the populist movements in Europe are in favour of this development.

Take the loss or start a counter movement?

This leaves us with the question, what benefits are there to gain by consumers and businesses alike by leaving Europe and the Euro? Looking at the economic development of the Euro countries today and all the benefits the Euro has brought the corporates and consumers, there is no clue why we should not stick to the current status quo and enhance it in any possible way.

It is therefore high time to start advocating the true merits a United Europe has been gaining thanks to the pan European ideals: a unprecedented war free community already lasting for more than seventy years combined with an enormous economic and cultural development.

Hans de Vries

Treasury/ Cash Management Consultant

E-invoicing is more than just a PDF that you send via e-mail. It’s a fully-automated process that enables receivers to get the invoice directly into their financial system. In this blog our expert Mark van de Griendt van Power toPay/Unified Post has summed up some of the key benefits for senders and receivers of electronic invoices.

E-invoicing is more than just a PDF that you send via e-mail. It’s a fully-automated process that enables receivers to get the invoice directly into their financial system. In this blog our expert Mark van de Griendt van Power toPay/Unified Post has summed up some of the key benefits for senders and receivers of electronic invoices.

Mark van de Griendt – Cash Management Expert at PowertoPay

Mark van de Griendt – Cash Management Expert at PowertoPay

Proferus

Proferus Cashforce Cash forecasting 2.0

Cashforce Cash forecasting 2.0

Our expert Carlo de Meijer is our blockchain specialist and publishes his articles on a regular basis. We present his latest article about blockchain and supply chain finance in a shorter version.

Our expert Carlo de Meijer is our blockchain specialist and publishes his articles on a regular basis. We present his latest article about blockchain and supply chain finance in a shorter version.

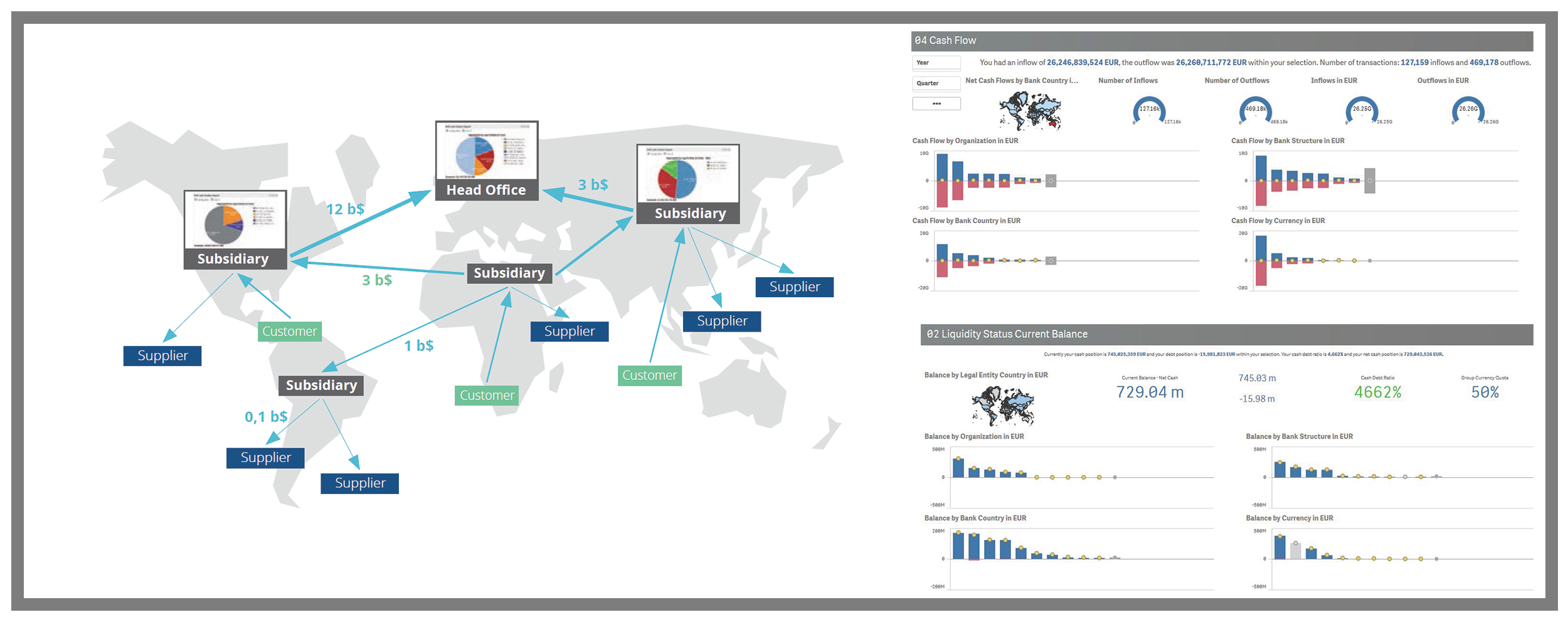

How do strategic professionals decide on the best path to success for their company? The key is in transparency and real-time reporting. If it comes to the responsibility of the treasurer or financial professional this means deciding about company-wide cash flow and liquidity levels, bank, customer and supplier relations and working capital.

How do strategic professionals decide on the best path to success for their company? The key is in transparency and real-time reporting. If it comes to the responsibility of the treasurer or financial professional this means deciding about company-wide cash flow and liquidity levels, bank, customer and supplier relations and working capital.

In a perfect world, one currency is the ultimate dream for every Treasurer. The introduction of the Euro has been a major leap forward in that direction. However, current anti-euro sentiments boosted by populist movements all over Europe, seriously threaten to hamper this unique and visionary European accomplishment. This article focusses on what impact the introduction of the Euro had for the corporate treasurers and what will happen if the Euro gets skipped.

In a perfect world, one currency is the ultimate dream for every Treasurer. The introduction of the Euro has been a major leap forward in that direction. However, current anti-euro sentiments boosted by populist movements all over Europe, seriously threaten to hamper this unique and visionary European accomplishment. This article focusses on what impact the introduction of the Euro had for the corporate treasurers and what will happen if the Euro gets skipped.

Working Capital is the term for the operating liquidity of a company that can be used and is needed to continue the day to day business. To calculate the working capital you have to deduct the current liabilities from the current assets. By managing your account receivables, accounts payables and inventory you can fluctuate your cash position and optimize your working capital so that the cash “trapped” in the company can be lowered to a minimum while you are still able to meet your payment agreements.

Working Capital is the term for the operating liquidity of a company that can be used and is needed to continue the day to day business. To calculate the working capital you have to deduct the current liabilities from the current assets. By managing your account receivables, accounts payables and inventory you can fluctuate your cash position and optimize your working capital so that the cash “trapped” in the company can be lowered to a minimum while you are still able to meet your payment agreements. Building on the ideas shared in a

Building on the ideas shared in a