College Tour International Cash Management 2019

| 04-11-2019 | treasuryXL | Vrije Universiteit

The treasurer’s professional environment is changing rapidly. Alongside the classic management of capital flows, treasurers are confronted with ever-increasing legislation. In addition, fintechs and cryptocurrency offer solutions which compete with traditional banking services. The International Cash Management module of the RT programme covers these topics extensively, clustered in several units. The Cash Management Fundamentals unit includes working capital management, liquidity forecasting and liquidity management. In addition, the structure of international banking is covered in detail. The role of correspondent banking, the principles of international payments and the main payment systems are examined in depth. In this context, the module also deals with the information technology which businesses require to create the interface with banking payment systems. Naturally, this covers the latest technological developments, including blockchain. The module also expands on netting and cash pooling techniques, the relationship with financial institutions and the organisation of an international treasury department. An overview of the legal and fiscal aspects is also included. Case studies are used to supplement the extensive practical knowledge provided.

The treasurer’s professional environment is changing rapidly. Alongside the classic management of capital flows, treasurers are confronted with ever-increasing legislation. In addition, fintechs and cryptocurrency offer solutions which compete with traditional banking services. The International Cash Management module of the RT programme covers these topics extensively, clustered in several units. The Cash Management Fundamentals unit includes working capital management, liquidity forecasting and liquidity management. In addition, the structure of international banking is covered in detail. The role of correspondent banking, the principles of international payments and the main payment systems are examined in depth. In this context, the module also deals with the information technology which businesses require to create the interface with banking payment systems. Naturally, this covers the latest technological developments, including blockchain. The module also expands on netting and cash pooling techniques, the relationship with financial institutions and the organisation of an international treasury department. An overview of the legal and fiscal aspects is also included. Case studies are used to supplement the extensive practical knowledge provided.

Course Content

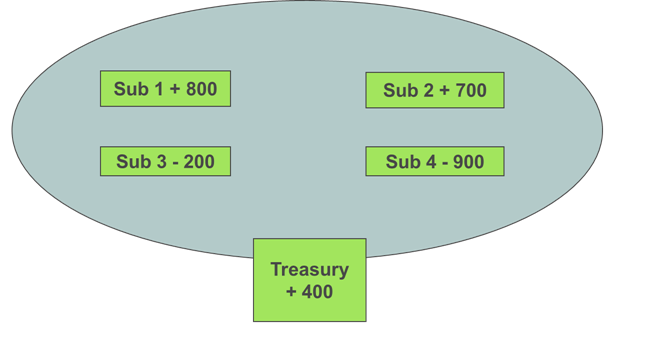

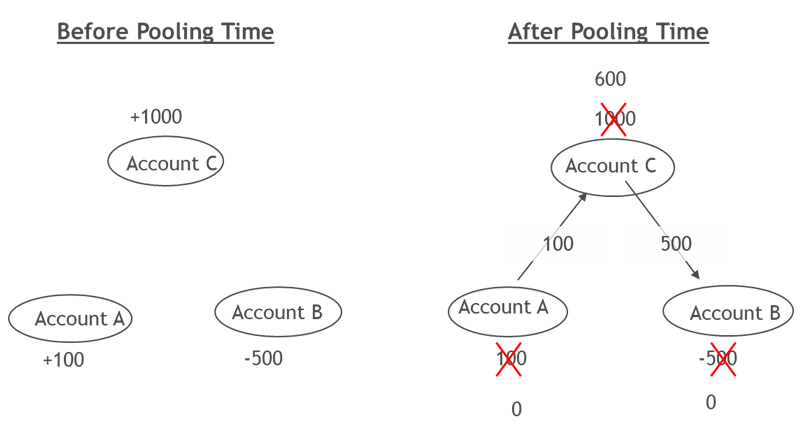

- Management Account Structures: pooling Techniques, cash pooling, netting, tax and accounting impact

- Working Capital Management: cash conversion cycle, working capital management, short term finance

- Trade & Commodity Finance: identifying trade risks, trade instruments, trade finance solutions

- Payment Services: payment instruments, collection instruments, clearing, bank connectivity

- Relevant regulatory environment: Basel III, PSD2, bank relationship management

- Cash flow forecasting methods

- Treasury Management Systems: overview, treasury functions and evolution, selection of a treasury management system, implementation

- Fintech: Payment innovations, Blockchain, Crypto currency

Course features

Primarily, the course gives an overview of this treasury

discipline, focussed on everyday practice and the latest

developments in this area. Sessions are interactive and

delivered by lecturers active in this field. There is an

opportunity to put knowledge sharing into practice with

the help of a game and case studies.

Exam/exemption

There will be an end-of-module examination. Participants

passing the examination will receive a certificate. This

certificate counts towards an exemption when enrolling

for the post-doctorate Treasury Management & Corporate

Finance programme; course language – English.

Coordination and lecturers

Professor Wilko Bolt (DNB) and Professor Herbert Rijken

(VU) will be the key lecturers for this module. Other lecturers will

include Rolf Michon and Nanno van der Werff.

Sybrand de Groes is responsible for the coordination of

this module. Maximum number of participants: 25

Admission requirements

The course is at Bachelor level. It is assumed that you

have work experience in the field of cash management.

Tuition fees & registration

The tuition fees are € 3,950. If there are enough places,

non-DACT members may also participate. The tuition

fees for non-members are € 4,750.

Send an email to [email protected] if you wish to register.

Location

VU Universiteit, Hoofdgebouw, Agora Zalen Complex,

De Boelelaan 1105, Amsterdam.

Course schedule

The course includes 8 double lectures (2 x 2 hours) each

week on Thursdays, starting Thursday 14 November 2019,

ending on Thursday 16 January 2019 (note: the lecture

planned on Thursday November 14, 2019 will be organized

in De Leeuwenhorst in Noordwijkerhout where the DACT

Treasury Fair will be held). Lectures are from 15:30 –

17:30 hours and 18:15 – 20:15 hours, including a meal.

The examination date is on Thursday 23 January 2020.

It is a question that many companies have been asking themselves for the past few years. Innovative, dedicated technologies may be very exciting, but the question remains: Are they worth the investment?

It is a question that many companies have been asking themselves for the past few years. Innovative, dedicated technologies may be very exciting, but the question remains: Are they worth the investment?

There are also other forms of cash concentration:

There are also other forms of cash concentration: