https://treasuryxl.com/wp-content/uploads/2025/04/GTreasury-BLOGS-featured-10.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-06-18 07:00:192025-06-13 06:58:175 Silent Killers of Cash Flow Forecasting Accuracy and How to Eliminate Them

https://treasuryxl.com/wp-content/uploads/2025/04/GTreasury-BLOGS-featured-10.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-06-18 07:00:192025-06-13 06:58:175 Silent Killers of Cash Flow Forecasting Accuracy and How to Eliminate ThemAs a corporate treasurer, it is crucial to have a deep understanding of your organization’s cash position at all times. In today’s dynamic business environment, cash forecasting has become an essential tool for treasury management. By predicting future cash flows, treasurers can make informed decisions to ensure that their organization has adequate liquidity to meet its financial obligations.

What is Cash Forecasting?

Cash forecasting is the process of predicting future cash flows based on historical data and expected changes in the organization’s financial activities. A cash forecast provides treasurers with valuable insights into their organization’s future cash position, enabling them to make informed decisions on how to allocate cash resources.

Benefits of Cash Forecasting

Cash forecasting provides several benefits for corporate treasurers, including:

- Improved Cash Management: By providing visibility into future cash flows, treasurers can manage their organization’s cash position more effectively, ensuring that they have the necessary liquidity to meet their financial obligations.

- Enhanced Financial Planning: Cash forecasting allows treasurers to identify potential cash shortfalls or surpluses and take proactive steps to manage their organization’s cash position accordingly.

- Better Decision Making: With accurate cash forecasts, treasurers can make informed decisions on cash management strategies, such as investing surplus cash or securing additional funding to cover cash shortfalls.

Cash Forecasting Strategies

Several cash forecasting strategies can be used by corporate treasurers to predict future cash flows, including:

- Bottom-up forecasting: This approach involves aggregating data from individual business units to create an organization-wide cash forecast.

- Top-down forecasting: This approach involves starting with the organization’s overall financial goals and then breaking them down into cash flow projections.

- Hybrid forecasting: This approach combines both top-down and bottom-up forecasting methods to provide a more accurate cash forecast.

Cash Flow Forecast Formula

The cash flow forecast formula is a simple yet powerful tool that can be used to create a cash flow forecast. It involves estimating cash inflows and outflows over a given period, such as a month or a quarter. The formula is as follows:

Cash inflows – Cash outflows = Net cash flow

How to Create a Cash Flow Forecast

To create a cash flow forecast, treasurers can follow these steps:

- Collect historical data on cash inflows and outflows, such as sales receipts, accounts payable, and accounts receivable.

- Estimate future cash inflows and outflows based on expected changes in the organization’s financial activities.

- Use a cash forecasting model or software to aggregate and analyze the data, generating a cash forecast for a given period.

Cash Forecasting Software

Cash forecasting software options are available in the market, providing treasurers with valuable tools to manage their organization’s cash position. Cash forecasting software can automate the forecasting process, improve accuracy, and provide real-time visibility into the organization’s cash position. Partners of treasuryXL provide excellent Cash Forecasting Software.

Conclusion

Cash forecasting is an essential tool for corporate treasurers, enabling them to manage their organization’s cash position more effectively. By providing visibility into future cash flows, treasurers can make informed decisions on cash management strategies, improving financial planning and decision-making. With the help of cash forecasting models, formulas, and software, treasurers can generate accurate cash forecasts and ensure that their organization has the necessary liquidity to meet its financial obligations.

Click and Scroll! Here are more articles that you might like…

https://treasuryxl.com/wp-content/uploads/2025/04/GTreasury-BLOGS-featured-10.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-06-18 07:00:192025-06-13 06:58:175 Silent Killers of Cash Flow Forecasting Accuracy and How to Eliminate Them

https://treasuryxl.com/wp-content/uploads/2025/04/GTreasury-BLOGS-featured-10.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-06-18 07:00:192025-06-13 06:58:175 Silent Killers of Cash Flow Forecasting Accuracy and How to Eliminate Them https://treasuryxl.com/wp-content/uploads/2025/05/GTreasury-BLOGS-featured-12.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-05-27 07:00:212025-05-27 08:54:00Cash Forecasting Accuracy Measurement

https://treasuryxl.com/wp-content/uploads/2025/05/GTreasury-BLOGS-featured-12.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-05-27 07:00:212025-05-27 08:54:00Cash Forecasting Accuracy Measurement https://treasuryxl.com/wp-content/uploads/2025/01/Nomentia-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-05-20 07:00:332025-05-19 14:03:02Sanctions screening compliance excuses, debunked

https://treasuryxl.com/wp-content/uploads/2025/01/Nomentia-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-05-20 07:00:332025-05-19 14:03:02Sanctions screening compliance excuses, debunked https://treasuryxl.com/wp-content/uploads/2025/05/Francois-Template_BLOGS-Expert-featured-7.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-05-15 07:00:252025-05-06 14:23:53Treasury Management and Credit Collections

https://treasuryxl.com/wp-content/uploads/2025/05/Francois-Template_BLOGS-Expert-featured-7.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-05-15 07:00:252025-05-06 14:23:53Treasury Management and Credit Collections https://treasuryxl.com/wp-content/uploads/2025/01/Nomentia-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-04-24 07:00:162025-04-22 14:39:41Best liquidity management strategies for multinational enterprises

https://treasuryxl.com/wp-content/uploads/2025/01/Nomentia-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-04-24 07:00:162025-04-22 14:39:41Best liquidity management strategies for multinational enterprises https://treasuryxl.com/wp-content/uploads/2024/07/Template_BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-04-22 07:00:292025-04-18 14:19:09Managing Corporate Treasury with Spreadsheets

https://treasuryxl.com/wp-content/uploads/2024/07/Template_BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-04-22 07:00:292025-04-18 14:19:09Managing Corporate Treasury with Spreadsheets https://treasuryxl.com/wp-content/uploads/2025/04/Francois-Template_BLOGS-Expert-featured-6.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-04-17 07:00:042025-04-16 16:56:09Strategic Treasury & Cash Management 2.0 Masterclass

https://treasuryxl.com/wp-content/uploads/2025/04/Francois-Template_BLOGS-Expert-featured-6.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-04-17 07:00:042025-04-16 16:56:09Strategic Treasury & Cash Management 2.0 Masterclass https://treasuryxl.com/wp-content/uploads/2025/04/Nomentia-BLOGS-featured-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-04-15 11:45:382025-04-15 11:45:38Nomentia Unveils AI Cash Flow Forecasting for Accurate & Predictive Insights

https://treasuryxl.com/wp-content/uploads/2025/04/Nomentia-BLOGS-featured-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-04-15 11:45:382025-04-15 11:45:38Nomentia Unveils AI Cash Flow Forecasting for Accurate & Predictive Insights https://treasuryxl.com/wp-content/uploads/2025/01/Nomentia-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-04-07 07:00:542025-04-03 11:16:22Cash pools and in-house bank – Everything you need to know

https://treasuryxl.com/wp-content/uploads/2025/01/Nomentia-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-04-07 07:00:542025-04-03 11:16:22Cash pools and in-house bank – Everything you need to know https://treasuryxl.com/wp-content/uploads/2025/01/Nomentia-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-03-26 07:00:562025-03-25 21:48:49Why Excel fails at cash flow forecasting?

https://treasuryxl.com/wp-content/uploads/2025/01/Nomentia-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-03-26 07:00:562025-03-25 21:48:49Why Excel fails at cash flow forecasting? https://treasuryxl.com/wp-content/uploads/2025/03/Live-Session-AB-1-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-03-20 07:00:532025-03-31 16:39:22Recap & Recording: Self-Service Treasury: Excel, APIs, AI, and Other Practical Tools

https://treasuryxl.com/wp-content/uploads/2025/03/Live-Session-AB-1-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-03-20 07:00:532025-03-31 16:39:22Recap & Recording: Self-Service Treasury: Excel, APIs, AI, and Other Practical Tools https://treasuryxl.com/wp-content/uploads/2025/03/Embat-BLOGS-featured-4.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-03-19 08:00:102025-04-24 17:19:05Building a Smarter Treasury: The Embat Story

https://treasuryxl.com/wp-content/uploads/2025/03/Embat-BLOGS-featured-4.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-03-19 08:00:102025-04-24 17:19:05Building a Smarter Treasury: The Embat Story https://treasuryxl.com/wp-content/uploads/2024/07/Template_BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-03-04 07:00:302025-02-28 11:17:57Corporate Treasury’s relationship with their IT department

https://treasuryxl.com/wp-content/uploads/2024/07/Template_BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-03-04 07:00:302025-02-28 11:17:57Corporate Treasury’s relationship with their IT department https://treasuryxl.com/wp-content/uploads/2025/02/Embat-BLOGS-featured-3.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-02-25 10:31:452025-02-25 10:33:31Embat acquires Necto, strengthening its leadership in global corporate banking connectivity through APIs

https://treasuryxl.com/wp-content/uploads/2025/02/Embat-BLOGS-featured-3.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-02-25 10:31:452025-02-25 10:33:31Embat acquires Necto, strengthening its leadership in global corporate banking connectivity through APIs https://treasuryxl.com/wp-content/uploads/2024/07/Template_BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-02-20 07:00:502025-02-19 16:37:44Managing KYC & AML in Corporate Treasury

https://treasuryxl.com/wp-content/uploads/2024/07/Template_BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-02-20 07:00:502025-02-19 16:37:44Managing KYC & AML in Corporate Treasury https://treasuryxl.com/wp-content/uploads/2024/10/Embat-BLOGS-featured-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-02-11 07:00:212025-02-07 09:30:24Direct and Indirect Cash Forecasting: Advantages and Disadvantages

https://treasuryxl.com/wp-content/uploads/2024/10/Embat-BLOGS-featured-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-02-11 07:00:212025-02-07 09:30:24Direct and Indirect Cash Forecasting: Advantages and Disadvantages https://treasuryxl.com/wp-content/uploads/2024/07/Template_BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-02-05 07:00:002025-02-04 10:13:37Measuring Corporate Treasury Performance

https://treasuryxl.com/wp-content/uploads/2024/07/Template_BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-02-05 07:00:002025-02-04 10:13:37Measuring Corporate Treasury Performance https://treasuryxl.com/wp-content/uploads/2025/01/Blog-Kyriba-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-01-27 08:00:062025-01-24 13:51:37Cash Forecasting: Your Blueprint for Liquidity Performance

https://treasuryxl.com/wp-content/uploads/2025/01/Blog-Kyriba-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-01-27 08:00:062025-01-24 13:51:37Cash Forecasting: Your Blueprint for Liquidity Performance https://treasuryxl.com/wp-content/uploads/2024/07/Template_BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-01-16 07:00:332025-01-14 16:38:00Future-proofing Global Treasury Teams

https://treasuryxl.com/wp-content/uploads/2024/07/Template_BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-01-16 07:00:332025-01-14 16:38:00Future-proofing Global Treasury Teams https://treasuryxl.com/wp-content/uploads/2024/12/FIS-BLOGS-featured-4.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-01-08 07:00:412025-01-07 10:39:33Unlocking Value: How TMS Delivers Measurable ROI for Corporate Treasury

https://treasuryxl.com/wp-content/uploads/2024/12/FIS-BLOGS-featured-4.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-01-08 07:00:412025-01-07 10:39:33Unlocking Value: How TMS Delivers Measurable ROI for Corporate Treasury https://treasuryxl.com/wp-content/uploads/2024/10/Embat-BLOGS-featured-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-12-09 07:00:232024-12-01 20:05:54The role of the CFO in the company’s overall strategy

https://treasuryxl.com/wp-content/uploads/2024/10/Embat-BLOGS-featured-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-12-09 07:00:232024-12-01 20:05:54The role of the CFO in the company’s overall strategy https://treasuryxl.com/wp-content/uploads/2024/07/Template_BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-12-04 07:00:372024-12-16 12:00:55Corporate Treasury: Funding Working Capital

https://treasuryxl.com/wp-content/uploads/2024/07/Template_BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-12-04 07:00:372024-12-16 12:00:55Corporate Treasury: Funding Working Capital https://treasuryxl.com/wp-content/uploads/2024/10/Embat-BLOGS-featured-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-11-21 07:00:232024-10-31 15:22:41AI in treasury: cash forecasting and payment predictions

https://treasuryxl.com/wp-content/uploads/2024/10/Embat-BLOGS-featured-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-11-21 07:00:232024-10-31 15:22:41AI in treasury: cash forecasting and payment predictions https://treasuryxl.com/wp-content/uploads/2024/07/Template_BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-11-20 07:00:122024-11-18 12:06:18The influence of Corporate Treasury on Working Capital

https://treasuryxl.com/wp-content/uploads/2024/07/Template_BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-11-20 07:00:122024-11-18 12:06:18The influence of Corporate Treasury on Working Capital https://treasuryxl.com/wp-content/uploads/2024/04/Kopie-van-Copy-of-Kopie-van-Template_BLOGS-featured.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-10-30 07:00:432024-10-28 13:49:41Plans & Experiences with AI in Cash Forecasting

https://treasuryxl.com/wp-content/uploads/2024/04/Kopie-van-Copy-of-Kopie-van-Template_BLOGS-featured.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-10-30 07:00:432024-10-28 13:49:41Plans & Experiences with AI in Cash Forecasting https://treasuryxl.com/wp-content/uploads/2024/09/TIS-BLOGS-featured-6.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-10-08 07:00:452024-09-30 16:56:23Unlock the Full Potential of Your TMS

https://treasuryxl.com/wp-content/uploads/2024/09/TIS-BLOGS-featured-6.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-10-08 07:00:452024-09-30 16:56:23Unlock the Full Potential of Your TMS https://treasuryxl.com/wp-content/uploads/2024/09/Wout-Template_BLOGS-Expert-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-09-05 07:00:362025-04-24 17:16:18Growing Interest in Cashflow Management Software

https://treasuryxl.com/wp-content/uploads/2024/09/Wout-Template_BLOGS-Expert-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-09-05 07:00:362025-04-24 17:16:18Growing Interest in Cashflow Management Software https://treasuryxl.com/wp-content/uploads/2024/08/Kopie-van-Kopie-van-Kopie-van-TIS-BLOGS-featured-4.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-08-06 07:00:502024-08-08 12:51:04TIS Summer Magazine

https://treasuryxl.com/wp-content/uploads/2024/08/Kopie-van-Kopie-van-Kopie-van-TIS-BLOGS-featured-4.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-08-06 07:00:502024-08-08 12:51:04TIS Summer Magazine https://treasuryxl.com/wp-content/uploads/2024/07/GPS-featured.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-07-25 10:00:332024-07-24 14:13:26Choosing the Right Financial Strategy: Intercompany Netting VS. In-House Banking

https://treasuryxl.com/wp-content/uploads/2024/07/GPS-featured.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-07-25 10:00:332024-07-24 14:13:26Choosing the Right Financial Strategy: Intercompany Netting VS. In-House Banking https://treasuryxl.com/wp-content/uploads/2024/07/TIS-BLOGS-featured-5.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-07-22 07:00:462024-07-18 13:54:18TIS Sizzlin’ Summer Webinar Series

https://treasuryxl.com/wp-content/uploads/2024/07/TIS-BLOGS-featured-5.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-07-22 07:00:462024-07-18 13:54:18TIS Sizzlin’ Summer Webinar Series https://treasuryxl.com/wp-content/uploads/2024/05/TIS-BLOGS-featured-4.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-06-03 07:00:392024-05-29 10:44:07Podcast | Bas rebel explores best practices for new treasury technology projects & Implementations

https://treasuryxl.com/wp-content/uploads/2024/05/TIS-BLOGS-featured-4.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-06-03 07:00:392024-05-29 10:44:07Podcast | Bas rebel explores best practices for new treasury technology projects & Implementations https://treasuryxl.com/wp-content/uploads/2024/05/TIS-BLOGS-featured-3.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-05-23 07:00:102024-05-15 10:10:57Whitepaper | The Complex World of Corporate Payments & How TIS Helps Simplify It

https://treasuryxl.com/wp-content/uploads/2024/05/TIS-BLOGS-featured-3.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-05-23 07:00:102024-05-15 10:10:57Whitepaper | The Complex World of Corporate Payments & How TIS Helps Simplify It https://treasuryxl.com/wp-content/uploads/2024/04/TIS-BLOGS-featured-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-04-25 10:00:542024-04-22 09:51:28TIS Spring Magazine

https://treasuryxl.com/wp-content/uploads/2024/04/TIS-BLOGS-featured-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-04-25 10:00:542024-04-22 09:51:28TIS Spring Magazine https://treasuryxl.com/wp-content/uploads/2024/02/Kopie-van-Kopie-van-TIS-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-04-04 07:00:352024-10-08 09:58:35Four Things Every CFO Should Know About Treasury

https://treasuryxl.com/wp-content/uploads/2024/02/Kopie-van-Kopie-van-TIS-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-04-04 07:00:352024-10-08 09:58:35Four Things Every CFO Should Know About Treasury https://treasuryxl.com/wp-content/uploads/2024/03/Copy-of-Kopie-van-Kopie-van-Kopie-van-TIS-BLOGS-featured.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-03-27 09:32:552024-03-27 09:32:55TIS has Signed a Binding Agreement with Marlin Equity Partners to Secure a Majority Growth Investment

https://treasuryxl.com/wp-content/uploads/2024/03/Copy-of-Kopie-van-Kopie-van-Kopie-van-TIS-BLOGS-featured.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-03-27 09:32:552024-03-27 09:32:55TIS has Signed a Binding Agreement with Marlin Equity Partners to Secure a Majority Growth Investment https://treasuryxl.com/wp-content/uploads/2024/03/Grain-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-03-20 07:00:232024-07-03 11:11:45Mastering Cross-Currency Transactions Understanding FX Risks and Strategies

https://treasuryxl.com/wp-content/uploads/2024/03/Grain-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-03-20 07:00:232024-07-03 11:11:45Mastering Cross-Currency Transactions Understanding FX Risks and Strategies https://treasuryxl.com/wp-content/uploads/2024/03/Kopie-van-Kopie-van-Kopie-van-TIS-BLOGS-featured-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-03-19 09:53:192024-03-21 13:50:17A Guide to the Emergence of Instant Payments Globally & How to Navigate Them

https://treasuryxl.com/wp-content/uploads/2024/03/Kopie-van-Kopie-van-Kopie-van-TIS-BLOGS-featured-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-03-19 09:53:192024-03-21 13:50:17A Guide to the Emergence of Instant Payments Globally & How to Navigate Them https://treasuryxl.com/wp-content/uploads/2024/02/Kopie-van-Kopie-van-Kopie-van-TIS-BLOGS-featured.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-03-14 07:00:142024-03-12 13:34:59TIS Magazine | The Winter Issue

https://treasuryxl.com/wp-content/uploads/2024/02/Kopie-van-Kopie-van-Kopie-van-TIS-BLOGS-featured.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-03-14 07:00:142024-03-12 13:34:59TIS Magazine | The Winter Issue https://treasuryxl.com/wp-content/uploads/2024/02/Kopie-van-TIS-BLOGS-featured.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-02-12 07:00:362024-02-06 16:47:31TIS Podcast with Sugandha Singhal | Analyzing the Intracacies of Effective Treasury Management in 2024

https://treasuryxl.com/wp-content/uploads/2024/02/Kopie-van-TIS-BLOGS-featured.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-02-12 07:00:362024-02-06 16:47:31TIS Podcast with Sugandha Singhal | Analyzing the Intracacies of Effective Treasury Management in 2024 https://treasuryxl.com/wp-content/uploads/2024/01/TIS-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-01-31 07:00:072024-01-31 09:46:205 Ways Treasury Can Save Money & Boost Profits in 2024

https://treasuryxl.com/wp-content/uploads/2024/01/TIS-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-01-31 07:00:072024-01-31 09:46:205 Ways Treasury Can Save Money & Boost Profits in 2024 https://treasuryxl.com/wp-content/uploads/2023/12/CORPORATE-TREASURY-IN-100-WORDS_200x200-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-01-16 07:00:412024-01-16 16:51:30In 100 Words | How should Treasury approach A/R Cash Forecasting?

https://treasuryxl.com/wp-content/uploads/2023/12/CORPORATE-TREASURY-IN-100-WORDS_200x200-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-01-16 07:00:412024-01-16 16:51:30In 100 Words | How should Treasury approach A/R Cash Forecasting? https://treasuryxl.com/wp-content/uploads/2023/12/TIS-100-days-3e-200.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-01-03 07:00:582023-12-22 14:29:44Guide to Navigating a Treasurers 1st 100 Days in a New Job

https://treasuryxl.com/wp-content/uploads/2023/12/TIS-100-days-3e-200.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-01-03 07:00:582023-12-22 14:29:44Guide to Navigating a Treasurers 1st 100 Days in a New Job https://treasuryxl.com/wp-content/uploads/2023/12/tis-magazine-fall-200.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2023-12-04 07:00:572023-12-01 08:51:43TIS Magazine | The Fall Issue

https://treasuryxl.com/wp-content/uploads/2023/12/tis-magazine-fall-200.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2023-12-04 07:00:572023-12-01 08:51:43TIS Magazine | The Fall Issue https://treasuryxl.com/wp-content/uploads/2023/11/TIS-10-questions-200.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2023-11-20 07:00:472023-11-10 11:11:0610 Common Questions & Answers About the TIS Cash Forecasting Solution

https://treasuryxl.com/wp-content/uploads/2023/11/TIS-10-questions-200.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2023-11-20 07:00:472023-11-10 11:11:0610 Common Questions & Answers About the TIS Cash Forecasting Solution https://treasuryxl.com/wp-content/uploads/2023/09/tis-200-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

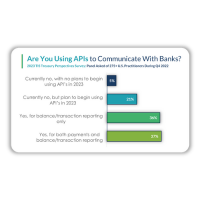

treasuryXL2023-09-27 07:00:212023-09-22 09:29:41Seven Key Findings from the 2023-2024 Treasury Technology Survey

https://treasuryxl.com/wp-content/uploads/2023/09/tis-200-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2023-09-27 07:00:212023-09-22 09:29:41Seven Key Findings from the 2023-2024 Treasury Technology Survey https://treasuryxl.com/wp-content/uploads/2023/08/TIS-Magazine-Summer-Issue-2023.png

800

800

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2023-08-29 07:00:462023-08-28 09:22:31Exploring the World of Treasury & Finance: Introducing the Debut Issue of the TIS Magazine

https://treasuryxl.com/wp-content/uploads/2023/08/TIS-Magazine-Summer-Issue-2023.png

800

800

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2023-08-29 07:00:462023-08-28 09:22:31Exploring the World of Treasury & Finance: Introducing the Debut Issue of the TIS Magazine https://treasuryxl.com/wp-content/uploads/2023/07/grain-interview-200-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2023-07-27 07:00:482023-07-27 08:37:42Why Cross-Currency Management Matters: The Top 3 Risks for Businesses that Ignore It

https://treasuryxl.com/wp-content/uploads/2023/07/grain-interview-200-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2023-07-27 07:00:482023-07-27 08:37:42Why Cross-Currency Management Matters: The Top 3 Risks for Businesses that Ignore It https://treasuryxl.com/wp-content/uploads/2023/07/TIS-APIs-200.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2023-07-20 07:00:562023-07-17 17:01:04APIs as a Game Changer for the Office of the CFO: Expectations vs Reality

https://treasuryxl.com/wp-content/uploads/2023/07/TIS-APIs-200.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2023-07-20 07:00:562023-07-17 17:01:04APIs as a Game Changer for the Office of the CFO: Expectations vs Reality https://treasuryxl.com/wp-content/uploads/2023/07/Kopie-van-poll-results-10.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2023-07-05 16:51:362023-07-12 09:23:37How far ahead do Treasurers forecast?

https://treasuryxl.com/wp-content/uploads/2023/07/Kopie-van-poll-results-10.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2023-07-05 16:51:362023-07-12 09:23:37How far ahead do Treasurers forecast? https://treasuryxl.com/wp-content/uploads/2023/06/TIS-200-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2023-07-03 07:00:092023-06-28 09:33:38Reviewing Best Practices for Treasury’s Cash Flow Forecasts

https://treasuryxl.com/wp-content/uploads/2023/06/TIS-200-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2023-07-03 07:00:092023-06-28 09:33:38Reviewing Best Practices for Treasury’s Cash Flow Forecasts https://treasuryxl.com/wp-content/uploads/2023/06/TIS-awards-200.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2023-06-28 13:45:042023-06-28 13:49:24TIS Clients Unilever, Siemens Gamesa, and TeamViewer Win Five Treasury Technology Awards in H1 2023

https://treasuryxl.com/wp-content/uploads/2023/06/TIS-awards-200.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2023-06-28 13:45:042023-06-28 13:49:24TIS Clients Unilever, Siemens Gamesa, and TeamViewer Win Five Treasury Technology Awards in H1 2023 https://treasuryxl.com/wp-content/uploads/2022/07/gtreasury-200-21e.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2022-07-21 07:00:172023-06-28 09:38:55Zeroing in on 4 Specific Ways Treasurers’ Can Improve Cash Forecasting

https://treasuryxl.com/wp-content/uploads/2022/07/gtreasury-200-21e.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2022-07-21 07:00:172023-06-28 09:38:55Zeroing in on 4 Specific Ways Treasurers’ Can Improve Cash Forecasting https://treasuryxl.com/wp-content/uploads/2022/05/Een-titel-toevoegen-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2022-06-01 07:00:122023-06-28 09:39:06Recording Live Discussion Session | More reliable cash forecasting in a fraction of the time

https://treasuryxl.com/wp-content/uploads/2022/05/Een-titel-toevoegen-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2022-06-01 07:00:122023-06-28 09:39:06Recording Live Discussion Session | More reliable cash forecasting in a fraction of the time https://treasuryxl.com/wp-content/uploads/2022/05/kyriba-200-19e.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2022-05-19 07:00:492023-06-28 09:39:49The Role of APIs in Strategic Cash Forecasting

https://treasuryxl.com/wp-content/uploads/2022/05/kyriba-200-19e.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2022-05-19 07:00:492023-06-28 09:39:49The Role of APIs in Strategic Cash Forecasting https://treasuryxl.com/wp-content/uploads/2022/04/TreasuryXL_Apr28-200x200-1.jpg

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2022-04-27 07:00:482023-06-28 09:39:27Reminder Live Discussion Session | More reliable cash forecasting in a fraction of the time

https://treasuryxl.com/wp-content/uploads/2022/04/TreasuryXL_Apr28-200x200-1.jpg

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2022-04-27 07:00:482023-06-28 09:39:27Reminder Live Discussion Session | More reliable cash forecasting in a fraction of the time https://treasuryxl.com/wp-content/uploads/2022/04/cashforce-200-14e-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2022-04-14 07:00:522023-06-28 09:39:33The Treasury Dragons vs Cash Forecasting | Best-of-breed Cashforce

https://treasuryxl.com/wp-content/uploads/2022/04/cashforce-200-14e-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2022-04-14 07:00:522023-06-28 09:39:33The Treasury Dragons vs Cash Forecasting | Best-of-breed Cashforce https://treasuryxl.com/wp-content/uploads/2022/04/TreasuryXL_Apr28-200x200-1.jpg

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2022-04-13 15:52:582023-06-28 09:39:38Live Discussion Session | More reliable cash forecasting in a fraction of the time

https://treasuryxl.com/wp-content/uploads/2022/04/TreasuryXL_Apr28-200x200-1.jpg

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2022-04-13 15:52:582023-06-28 09:39:38Live Discussion Session | More reliable cash forecasting in a fraction of the timeCash Management topics

Search

Newsletter & eBook

Subscribe to our free weekly newsletter and receive your 41 pages ‘easy-to-read’ eBook, What is Treasury?

The latest treasuryXL articles

Great news! treasuryXL’s live session recordings are now available on Spotify

Go to

Partner Program

Contact us

treasuryXL

Kaldenkerkerweg 22

5913 AE Venlo

The Netherlands

Email: info @[email protected]

Telephone & WhatsApp: +31 6 2732 8942

Subscribe

Newsletter & eBook

Subscribe to our free weekly newsletter and receive your 41 pages ‘easy-to-read’ eBook, What is Treasury?