| 7-4-2017 | Carlo de Meijer |

Blockchain technology has long been viewed as a threat to CSDs (Central Securities Depositories) and their role as intermediaries for securities transactions. Blockchain and distributed ledger technology may make the role of many intermediaries in the post trade market infrastructure obsolete. In one of my blogs (Blockchain and the securities industry: future eco-system) I was one of those who think that players such as custodians, CCPs, CSDs and others would disappear when blockchain would be used in a massive way.

“It however is not expected that there will be a complete disintermediation of service providers. While the role of custodians would greatly disappear and those of clearinghouses and CSDs will drastically change in a blockchain environment, the rest of the value chain in the securities industry may remain largely intact. The functions associated with tracking, reconciling, and auditing enormous amounts of data are not going to be disintermediated away. They have to continue to exist, but just need to be done more efficiently, at lower cost and with fewer errors”- Carlo R.W. de Meijer

But these players are going in the contra-attack. 15 CSDs from developing and emerging markets, including Strate and NSD, have agreed to form a consortium to explore blockchain and DLT technology in a post-trading environment. The partners say that“financial market infrastructures need to embrace the technology and identify opportunities that will add value to their current clients”.

Let’s look what they are all doing.

CSDs aim to build distributed ledger for mobilising scarce collateral (January 2017)

A coalition of four central securities depositories are collaborating with Deutsche Börse on an initiative to use blockchain technology to ease cross-border mobilisation of security collateral. The members of the so-called “Liquidity Alliance” include The Canadian Depository for Securities Limited (CDS), Clearstream (Luxembourg), Strate (South Africa) and VPS (Norway). Via this initiative they want to overcome existing hurdles when moving collateral across various jurisdictions, making the transfer faster and more efficient. The Alliance’s ‘LA Ledger’ will initially be implemented as a prototype based on the Hyperledger Fabric. Validation by regulatory authorities and market participants will start in the second quarter of 2017.

DTCC taps blockchain to rebuild its platform (January 2017)

The Depository Trust & Clearing Corporation (DTCC), a US post-trade provider, has announced plans to use blockchain technology in 2017 to rebuild its platform. It aims to create a credit derivatives post-trade lifecycle solution built using a distributed ledger platform. Blockchain can simplify the process by automatically maintaining a shared electronic record of the security which is visible to all relevant parties. This new DTCC’s platform – Trade Information Ware house – will keep track of the security throughout the lifecycle of the associated bond.

IBM, Axoni, and R3 CEV, two technology startups have been selected to work on the project which is set to kick-off in January 2017. DTCC expects the new blockchain-enabled Trade Information Warehouse to go live in early 2018. Furthermore, the project has been developed with input from market participants and infrastructure providers including Barclays, Citigroup, Credit Suisse Group, Deutsche Bank, JPMorgan Chase, UBS Group, Wells Fargo, IHS Markit and Intercontinental Exchange, DTCC said.

SWIFT creates blockchain application to simplify cross-border payments (January 2017)

SWIFT has begun building a blockchain application to simplify cross-border payments. The global platform is integrating open-source blockchain technology with its own products to build a proof-of-concept that might “one day” replace the so-called “nostro” accounts its members keep filled with cash all over the world – just in case they need it. A successful test of distributed ledger technology (DLT) could enable banks to optimize their liquidity globally and SWIFT to reduce the costs of reconciliation between independent databases maintained by the inter-bank platform’s members, reduce operational costs and free up liquidity for other investments.

Euroclear pencils in 2017 for bullion on blockchain roll out (December 2016)

Euroclear, the securities market depository, is set for a 2017 go-live for the application of blockchain technology in the London bullion market after completing its first pilot trades. Over 600 OTC test bullion trades were settled on the Euroclear Bankchain platform over the course of a two-week pilot. A number of leading market participants in the London bullion market – all part of the Euroclear Market Advisory Group – were involved in the test run, including Scotiabank, Société Générale, Citi, MKS PAMP Group and INTL FCStone. The Euroclear Bankchain Market Advisory Group set up in June this year now includes 17 participants working with Euroclear and blockchain platform provider Paxos in the roll-out of the new service. Another market simulation will run early this year in preparation for a production launch later in 2017.

Euroclear report: “CSDs matter in blockchain settlement system” (December 2016)

A new report by Euroclear has looked at the regulatory and legal aspects of the use of blockchain technology in post-trade settlement in a European context. The report, Blockchain Settlement: Regulation, Innovation, and Application, with support from Slaughter and May, found that central securities depositories (CSDs) would play an important role in a blockchain-based settlement system. It added that as ‘custodians of the code,’ CSDs could exercise oversight of, and take responsibility for, the operation of the relevant blockchain protocol and any associated smart contracts. CSDs will continue to perform an important role as trusted, centralised FMIs, providing gatekeeping services and oversight of the relevant blockchain. While the Euroclear report states that CSDs are trusted central entities that facilitate the settlement process, it is believed that the distributed ledger technology system would be a natural evolution of this facilitation role.

SWIFT deploys PoC for bond trading based on blockchain (November 2016)

SWIFT has unveiled a proof-of-concept for managing the entire lifecycle of a bond trade based on blockchain technology. SWIFT, that has been targeted in the press as “a legacy incumbent that will be doomed by DLT”, is determined not to be left behind “in the wake of the revolution that is unfolding in the finance world” with the adoption of blockchain or Distributed Ledger Technology (DLT). SWIFT believes “it can leverage its unique set of capabilities to deliver a distinctive DLT platform offer for the community.”

At the beginning of 2016 SWIFT and Accenture released a paper investigating how blockchain technology could be used in financial services. As a technology assessment, SWIFT and Accenture identified gaps between existing DLT solutions and industry requirements.

SA Strate to launch block chain based e-proxy voting in 2017 (October 2016)

Strate, South Africa’s central securities depository (CSD), plans to launch an e-proxy voting system based on blockchain technology in 2017. The body, responsible for clearing and settling all transactions that take place on the Johannesburg Stock Exchange (JSE), has partnered with Russia’s National Settlement Depository (NSD) to develop and test systems aimed at simplifying shareholder voting. Both CSDs plan to launch the e-proxy voting system in 2017, as such they are looking to partner with an international service provider whose product is around 70% to 80% complete. In South Africa, the planned e-proxy voting system will be rolled out on a client-by-client basis, with an eventual goal to have the entire market take up the system.

The decision to partner with NSD, taken at the Sibos Conference in Geneva last year, is rooted in the fact that both CSDs have conducted independent proof of concept studies and are at a similar stage in understanding and developing an appropriate voting solution. The NSD was also one of the first financial organisations in the world to announce the development of a blockchain-based prototype for e-proxy voting. Strate and NSD will share information regarding standards, regulations and DLT technologies; explore mutually beneficial ideas; and look to make savings through the sharing of technology and development costs. They are claiming that several other CSDs have expressed interest in joining them.

Innovation in CSD space session at SIBOS: “ a slow burn for CSDs” (September2016)

During the “Innovation in CSD space: What about distributed ledger technology?” session at SIBOS, some panellists argued that the technology would “hail the end of CSDs” while others said there would be no revolution, just a “natural evolution” of what exists.

The message from the CSDs was that they are “open to innovation with blockchain, but will test it out in safe places first”.

WFE Survey “Financial market infrastructures piling into blockchain” (August 2016)

More than 84% of trading venues and clearing counterparties (CCPs) surveyed by the World Federation of Exchanges (WFE) are either investigating or actively pursuing the applicability of distributed ledger technologies in financial markets.

WFE says that the poll of 24 members indicates that firms are at different stages of evolution in their DLT initiatives, with one having already deployed a DLT-based application, some at proof-of-concept, and others on the spectrum of evaluation, design, and proof-of-technology. Clearing and settlement provided the most obvious use case for respondents, but with regulatory, legal and technical risks an issue there was little consensus on a viable time frame for live production.

Strate, global CSDs to collaborate on blockchain use (August 2016)

Strate, the South African body responsible for settling transactions concluded on the Johannesburg Stock Exchange, met with 20 other central securities depositories (CSDs) in Switzerland in September to discuss how blockchain technology can be used across global financial markets. Aim is to form a group of CSDs to share information and knowledge. The group of CSDs would try to determine an ideal model for putting clearing settlements and the transaction of shares on to a blockchain. And as opposed to each going and developing their own technology, the group could potentially get a vendor to develop something for all of them or develop something their selves and share it and share in the costs.

Euroclear explores use of blockchain in London gold markets (June 2016)

Euroclear is exploring the potential of using blockchain technology to create a next generation settlement service for the London gold market. The clearing is working with blockchain infrastructure firm itBit and market participants to evaluate the use of distributed ledgers to remove the risks and reduce the capital charges related to the settlement of unallocated gold. Euroclear will thereby use ItBits’ Bankchain product, a private network of trusted participants that clears, tracks and settles trades in close to real-time, opening the prospects of providing true delivery-versus-payment in the bullion market.

Rise testing post-trade blockchain tech with banks, custodians and CSDs (May 2016)

RISE Financial Technologies (RISE), a provider of distributed ledger technology for both post-trade settlement and securities safekeeping, has become the first technology firm to launch the second generation of blockchain for the post-trade sector. RISE is testing its solutions with a number of leading financial institutions including banks, custodians, and CSDs.

The core attributes of RISE’s technology are de-centralised ledger qualities and permissioned transparency, which gives access to different types of information depending on who you are. These qualities are applied to ensure any ‘single point of failure’ inherent in many technology systems is removed and guarantees data integrity. So investors have sight and control over their assets but not those of other participants; issuers have a view but no control into final beneficiaries; financial institutions (ledger operators/validators) have access to client information; and regulators have a complete view of the information in their jurisdiction in real-time but no direct control over the assets.

Carlo de Meijer

Economist en Researcher

More articles about blockchain from Carlo de Meijer:

[separator type=”” size=”” icon=””]

De meeste artikelen op treasuryXL zijn uiteraard treasury-gerelateerd en onze experts schrijven over de meest uiteenlopende onderwerpen. Toen wij expert Kasja Reinders vroegen om eens een onderwerp te kiezen dat relevant voor treasurers maar niet onmiddellijk vak-specifiek is, kwam zij met ‘Communicatie en transparantie’. Verrassend en toch – treasurers kunnen niet zonder.

De meeste artikelen op treasuryXL zijn uiteraard treasury-gerelateerd en onze experts schrijven over de meest uiteenlopende onderwerpen. Toen wij expert Kasja Reinders vroegen om eens een onderwerp te kiezen dat relevant voor treasurers maar niet onmiddellijk vak-specifiek is, kwam zij met ‘Communicatie en transparantie’. Verrassend en toch – treasurers kunnen niet zonder. Kasja Reinders – Treasury/Cash Manager

Kasja Reinders – Treasury/Cash Manager

One of my friends who works in human capital development and is a psychologist, explained me once how we can increase our creative output. One of the elements he mentioned was mixing up the way information comes to you and how you digest it. For example, if you are used to create business plans sitting behind your desk and writing, a multi-person brainstorm session might tap into your undiscovered creative potential. And the other way around: if you are talker/listener, try writing for a change.

One of my friends who works in human capital development and is a psychologist, explained me once how we can increase our creative output. One of the elements he mentioned was mixing up the way information comes to you and how you digest it. For example, if you are used to create business plans sitting behind your desk and writing, a multi-person brainstorm session might tap into your undiscovered creative potential. And the other way around: if you are talker/listener, try writing for a change.

Annette Gillhart – Community Manager treasuryXL

Annette Gillhart – Community Manager treasuryXL In 2014 publiceerde expert Mark van de Griendt een artikel over de voordelen (en nadelen) van SEPA en IBAN, die toen werden ingevoerd en Electronic Bank Account Management. Intussen zijn SEPA en IBAN al bekende fenomenen, maar Electronic Bank Account Management is alleen maar complexer geworden, zeker in het tijdperk van Fintech. Reden genoeg om nog een keer terug te kijken op wat Mark toen zei. Intussen zijn processen veranderd en zijn er nieuwe uitdagingen bijgekomen. Maar wij denken dat wat hij schrijft nog steeds actueel is…

In 2014 publiceerde expert Mark van de Griendt een artikel over de voordelen (en nadelen) van SEPA en IBAN, die toen werden ingevoerd en Electronic Bank Account Management. Intussen zijn SEPA en IBAN al bekende fenomenen, maar Electronic Bank Account Management is alleen maar complexer geworden, zeker in het tijdperk van Fintech. Reden genoeg om nog een keer terug te kijken op wat Mark toen zei. Intussen zijn processen veranderd en zijn er nieuwe uitdagingen bijgekomen. Maar wij denken dat wat hij schrijft nog steeds actueel is… Mark van de Griendt – Cash Management Expert at

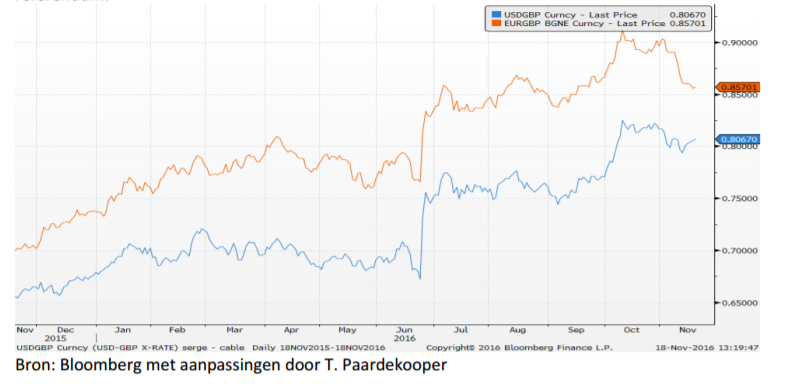

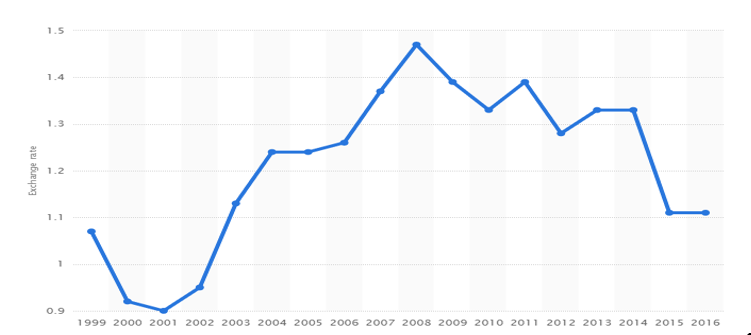

Mark van de Griendt – Cash Management Expert at  In a perfect world, one currency is the ultimate dream for every Treasurer. The introduction of the Euro has been a major leap forward in that direction. However, current anti-euro sentiments boosted by populist movements all over Europe, seriously threaten to hamper this unique and visionary European accomplishment. This article focusses on what impact the introduction of the Euro had for the corporate treasurers and what will happen if the Euro gets skipped.

In a perfect world, one currency is the ultimate dream for every Treasurer. The introduction of the Euro has been a major leap forward in that direction. However, current anti-euro sentiments boosted by populist movements all over Europe, seriously threaten to hamper this unique and visionary European accomplishment. This article focusses on what impact the introduction of the Euro had for the corporate treasurers and what will happen if the Euro gets skipped.

Working Capital is the term for the operating liquidity of a company that can be used and is needed to continue the day to day business. To calculate the working capital you have to deduct the current liabilities from the current assets. By managing your account receivables, accounts payables and inventory you can fluctuate your cash position and optimize your working capital so that the cash “trapped” in the company can be lowered to a minimum while you are still able to meet your payment agreements.

Working Capital is the term for the operating liquidity of a company that can be used and is needed to continue the day to day business. To calculate the working capital you have to deduct the current liabilities from the current assets. By managing your account receivables, accounts payables and inventory you can fluctuate your cash position and optimize your working capital so that the cash “trapped” in the company can be lowered to a minimum while you are still able to meet your payment agreements.