Bitcoin – regulation and acceptance

| 06-12-2017 | Lionel Pavey |

As the price of Bitcoin reaches ever higher – more than $11,000 at the moment – Governments are starting to look at what regulation needs to be put into place. Bitcoin has gained a reputation as the currency of choice for tax evaders and drug traders due to its anonymity. It is a market with little or no regulation and, obviously, Governments are looking at lost revenue. Yesterday the UK Treasury stated the current anti-money regulations needs to be updated to encompass all virtual currencies.

It has been reported that criminals and terrorists have used virtual currencies to purchase illegal commodities via dark webs – ensuring complete anonymity. The proposal from the UK Treasury would mean that traders would be registered. At present, there are almost 100 ATM machines for Bitcoin transactions in the UK – with more than 70 in London. Cash can be entered into the machines and converted into Bitcoins. One transaction involved a customer paying in GBP 14,000 in cash.

For Governments, regulation would mean that the Treasury would be able to identify the owner of the money and investigate the source of the funds. Tax evasion would therefore be reduced. Naturally there are genuine investors who want to buy Bitcoin, but this can already be done via an electronic exchange.

To increase acceptance as a genuine alternative currency there needs to be a growth in financial products related to virtual currencies. Yesterday, the CBOE (Chicago Board Options Exchange) announced that it will start trading Bitcoin futures this coming Monday. Initial margins for trading will be 30 per cent and price limits will be put in place.

However, there are still many hurdles before complete acceptance can occur. It is still not a recognized currency – the retail outlets that accept payment in Bitcoin is still very small. In America, only 3 of the top 500 online retailers accept Bitcoin. Whilst the price of Bitcoin has surged in 2017, this very large price increase is having a negative effect on acceptance by retailers. As the currency has increased in value so much, there appears to be a reluctance among owners of Bitcoin to use Bitcoin to transact. It has become easier to speculate on its value than to trade for goods. This is a serious problem for a virtual currency to gain worldwide acceptance.

Another area of concern regards the transaction time. Confirmation of a transaction can take up to 20 minutes – if you ordered a coffee, then it would be cold before you could drink it!

Virtual currencies are certainly something that should be considered for the future, but until they are backed and trusted by the Government and residents of a country, they will only have a small niche marketplace.

Cash Management and Treasury Specialist

In the financial industry an option is an instrument, based on financial derivatives, that enable the buyer of the option to obtain the right, but not the obligation, to buy or sell an underlying product/asset at an agreed price on or before a certain date in the future. As simple descriptions go, this requires a lot of understanding about different subjects. It is the intention of this article to clearly explain all the terms mentioned above.

In the financial industry an option is an instrument, based on financial derivatives, that enable the buyer of the option to obtain the right, but not the obligation, to buy or sell an underlying product/asset at an agreed price on or before a certain date in the future. As simple descriptions go, this requires a lot of understanding about different subjects. It is the intention of this article to clearly explain all the terms mentioned above. Lionel Pavey – Cash Management and Treasury Specialist

Lionel Pavey – Cash Management and Treasury Specialist In May this year, fintech start-up R3 raised $107 million from a consortium of the world’s top banks. The New York-based blockchain company that works in collaboration with more than 90 banks and other financial organizations world-wide, plans to use the money to invest in further developing the Corda platform (see my blog: Corda: distributed ledger ….. not blockchain! April 6, 2016) as well as “encouraging entrepreneurs to start building on the platform though training videos and hackathons”.

In May this year, fintech start-up R3 raised $107 million from a consortium of the world’s top banks. The New York-based blockchain company that works in collaboration with more than 90 banks and other financial organizations world-wide, plans to use the money to invest in further developing the Corda platform (see my blog: Corda: distributed ledger ….. not blockchain! April 6, 2016) as well as “encouraging entrepreneurs to start building on the platform though training videos and hackathons”.

Op donderdagavond 14 december 2017 vindt er een Extra Voorlichtingsavond plaats voor de Postgraduate opleiding Treasury Management & Corporate Finance, aan de Vrije Universiteit Amsterdam. Dit is de laatste kans voor geïnteresseerden in de opleiding die het programma in het Nederlands willen volgen.

Op donderdagavond 14 december 2017 vindt er een Extra Voorlichtingsavond plaats voor de Postgraduate opleiding Treasury Management & Corporate Finance, aan de Vrije Universiteit Amsterdam. Dit is de laatste kans voor geïnteresseerden in de opleiding die het programma in het Nederlands willen volgen.

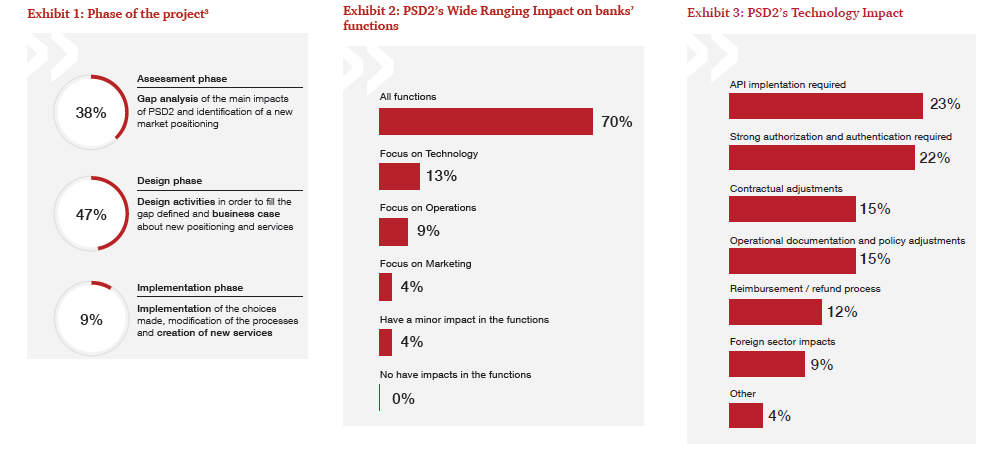

In 2018, when PSD2 comes into force, banks will lose their monopoly on payment services and customer’s account details. Bank customers will be able to use third-party providers (TPP) to administer their payments. When a customer agrees on using the services of a TPP, then their bank has to give access to TPPs to their accounts. TPPs are then able to build and offer services that compete with the existing bank services. During the summer 2017, I published a Summer Update on PSD2. Since then, a lot of things have moved, and hence I found it the right moment to provide an update to you on some developments on PSD2, in this area.

In 2018, when PSD2 comes into force, banks will lose their monopoly on payment services and customer’s account details. Bank customers will be able to use third-party providers (TPP) to administer their payments. When a customer agrees on using the services of a TPP, then their bank has to give access to TPPs to their accounts. TPPs are then able to build and offer services that compete with the existing bank services. During the summer 2017, I published a Summer Update on PSD2. Since then, a lot of things have moved, and hence I found it the right moment to provide an update to you on some developments on PSD2, in this area.

François de Witte – Founder & Senior Consultant at

François de Witte – Founder & Senior Consultant at

The DACT (Dutch association of Corporate Treasurers) will be holding their annual Treasury Fair in Noordwijk at the Hotel van Orange on 23rd and 24th November 2017 – the most important annual treasury event in the Netherlands. Discover treasury best practices, learn about the latest trends and exchange experiences. It will contain 9 practical workshops spread out throughout the day on topics including, among others, trade finance, supply chain finance, liquidity forecasting, cyber security and the Blockchain. There are more than 50 exhibitors present at the Trade Fair including Treasury Intelligence Solutions GmbH- a partner of treasuryXL.

The DACT (Dutch association of Corporate Treasurers) will be holding their annual Treasury Fair in Noordwijk at the Hotel van Orange on 23rd and 24th November 2017 – the most important annual treasury event in the Netherlands. Discover treasury best practices, learn about the latest trends and exchange experiences. It will contain 9 practical workshops spread out throughout the day on topics including, among others, trade finance, supply chain finance, liquidity forecasting, cyber security and the Blockchain. There are more than 50 exhibitors present at the Trade Fair including Treasury Intelligence Solutions GmbH- a partner of treasuryXL.