Which Solution would enhance the Safety and Security of Financial Processes?

22-08-2023 | Recently we ran a poll to find out what solution treasurers thought was most important to maintain safety and security for financial processes.

22-08-2023 | Recently we ran a poll to find out what solution treasurers thought was most important to maintain safety and security for financial processes.

27-07-2023 | The results are in, so find out what is considered the key strategy!

05-07-2023 | Recently we delved into a poll to gain further understanding of how far ahead treasurers do forecast. Are you a master of short-term planning, or do you have your eye on the future? The results are in, find out how you compare with your peers and learn from Conor Deegan of CashAnaltyics what can be learned from this.

01-06-2023 | treasuryXL and Nomentia recently discussed the issue of underutilisation of useful trade finance tools by corporate treasury departments in-depth during the recent live session “Trade Finance Trends: Innovations and Disruptions”.

30-03-2023 | Recently we had a live session regarding Interim Treasury and its benefits. We were particularly interested in your opinions on the key benefits of an interim treasurer.

09-02-2023 | The year’s second edition features a discussion on the newest treasuryXL poll results, including a review of treasurer voting patterns and expert perspectives on effective currency management.

12-01-2023 | treasuryXL | LinkedIn |

A new year, a new edition in which we discuss the latest treasuryXL poll results. It is encouraging that once again many treasurers participated in the vote. We examined the voting patterns of treasurers and gathered the perspectives of experts Jack Gielen and Konstantin Khorev on the topic of APIs in treasury.

It is commonly understood that APIs are prevalent in today’s digital landscape. However, corporate treasurers can also reap benefits from API technology and its advantages. If you are unsure about the importance of APIs in Treasury or need more information, you should definitely watch the recording of the joint webinar together with Cobase on the future of APIs. It is encouraging that once again many treasurers participated in the vote. The current treasuryXL poll remains open and we encourage you to continue to have your voice heard! You can cast your vote on this link.

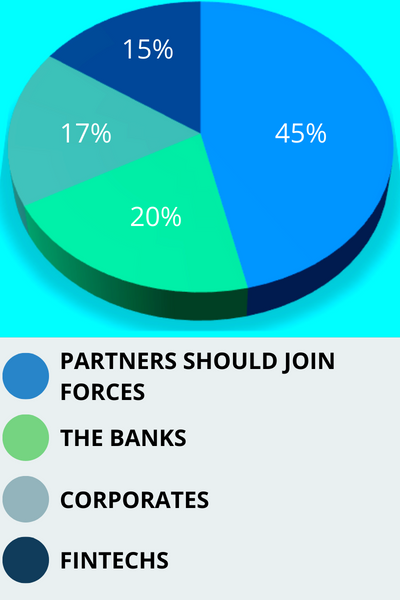

Question: Who should “give a push” and work on APIs?

That looks quite straightforward: partners should join forces. Do the treasuryXL experts agree, or what is their view on this?

Jack voted for the option that partners should join forces.

“APIs and the benefits are clearly on the map but there is also an understanding that there is still work to be done before those benefits will really be realised”

It is good to see that regarding the results of this poll, the market agrees that the success of corporate APIs and OpenBanking requires cooperation and cannot be dictated by 1 party. This means Treasurers clearly understand the complexity of the playing field. At the moment, although there are many initiatives by individual parties, there is a need to create a good partnership where the whole eco-system works together

The main benefits that APIs could realise if banks and companies were to work together are:

These benefits translate into being able to use the systems the treasurer has chosen more efficiently and better, more up-to-date insight into status, exposures and required actions.

Recently, Cobase set up the webinar “The Future of APIs” in collaboration with treasuryXL to discuss this topic. I was particularly impressed by the level of knowledge Treasurers have gained over the past year which was also reflected in the questions. APIs and the benefits are clearly on the map but there is also an understanding that there is still work to be done before those benefits will really be realised. Ultimately, the priority with the end customer, the treasurer, will determine how quickly other market players act.

Konstantin voted for the option that partners should join forces.

“By working together, we can achieve a more efficient and effective treasury management system.”

I agree with the majority view that the implementation of APIs in the treasury field should be a collaborative effort. Banks will play a key role in implementing these changes, but it is also crucial for corporates and TMS providers to set and specify the requirements. This ensures that the solutions being implemented align with the unique needs and goals of each individual corporate, and TMS providers can develop the tools and services necessary to support these needs. By working together, we can achieve a more efficient and effective treasury management system.

Recently, my latest article on this topic was published on treasuryXL. In it, I try to make it plain that APIs are a nice and easy solution, although they come with some limitations and challenges. At the same time, I believe that the future of bank connectivity lies in API technology. What do you think?

30-11-2022 | treasuryXL | LinkedIn |

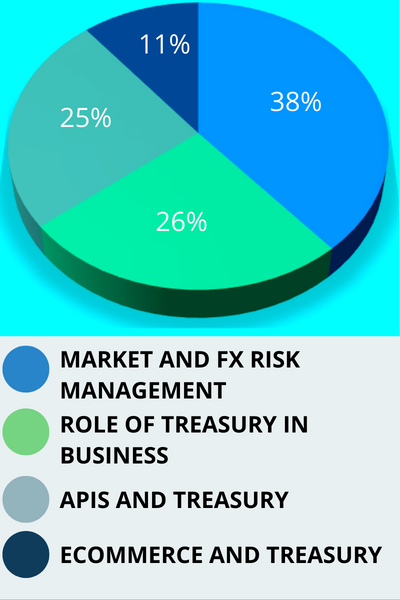

As 2023 is approaching, we explored what Treasurers are particularly looking forward to in treasury for next year. What will be the Treasury Trend of 2023? Are treasurers curious to know what is going to happen in the area of Market and FX Risk Management, or just what the developments are going to be in e-commerce related to Treasury? Or will the understanding of APIs in Treasury be the story of 2023, or the role of Treasury within companies? We sought it out!

As 2023 is approaching, we explored what treasurers are particularly looking forward to in treasury for next year. What will become the trends in treasury management next year?Are treasurers curious to know what is going to happen in the area of Market and FX Risk Management, or just what the developments are going to be in Ecommerce related to Treasury? Or will the understanding of APIs in Treasury be the story of 2023, or the role of Treasury within companies? We sought it out! This topic was also the subject of discussion during the last webinar together with Nomentia, you can find the recording here.

Question: What are you particularly interested in that will develop in 2023 in treasury?

We see that Market and FX Risk Management stands out a little, and that there is less focus on trends in e-commerce and Treasury. What do those within treasuryXL say about this, and what are they looking forward to for next year?

Huub is especially interested in the developments in APIs for Treasury for in 2023.

“My personal interest is in the focus on APIs, which is good, as APIs offer new functionalities and convenience for treasurers”

With the current political and economic turmoil, it makes sense that market risk is back on the agenda. Interest rates are rising and emerging markets are becoming riskier. My personal interest is in the focus on APIs, which is good, as APIs offer new functionalities and convenience for treasurers. However, it is a jungle because everyone promises APIs, but few deliver on them, and the few that do make them have no standards.

We also see APIs that are ‘disguised’ file connections. This makes sense, because an API means linking two applications and this can be done through authentication, security and then exchange of a file. We see this a lot with Payment Service Providers. Getting reporting files for matching purposes, for example.

The webinar the other day was interesting because Niki and I represent two different areas of treasury that are important to Patrick, a very experienced treasurer, namely market risk and technology. Together with Pieter as moderator, it was fun to hear the different perspectives and experiences!

Kim Vercoulen (Treasurer Search)

Kim is especially interested in the developments of Market and FX Risk Management for in 2023.

” Important question for the treasurer will remain what to do about this.”

I chose for Market and FX Risk Management. I think especially with inflation and higher interest rates, this is going to have an impact on the treasurer’s work within the treasury department.

This is obviously all going to play through on companies’ costs, and pressure on selling prices will also increase. Important question for the treasurer will remain what to do about this.

How this will affect the treasury market compared to the current year remains to be seen. That is what we are going to witness at Treasurer Search.

31-10-2022 | treasuryXL | LinkedIn |

The fifth edition in which we discuss the latest poll, is available for your reading. We show how treasurers voted to express their opinions on a current issue, and several of our treasury experts will talk about their perspectives.

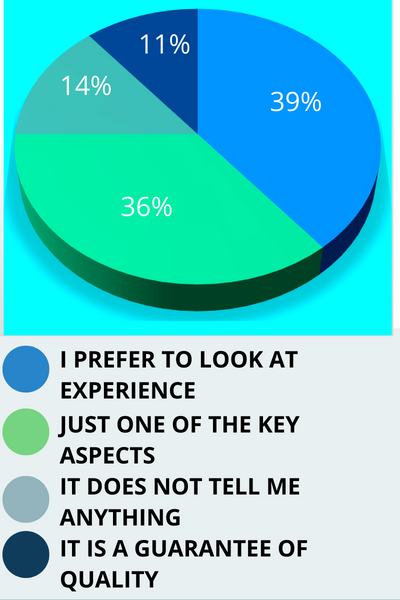

There are plenty of education and training courses in treasury, with the aim of obtaining treasury certificates. We wanted to explore how important you think this is, in the job market or for other things. There was a very good participation in the poll, resulting in a record 113 votes. Thank you everyone for actively participating, and join us in voting for the poll that is currently live and let’s try break the record votes right away!

Question: How important is it for you that someone has a well-known Treasury degree? On the job market or for other things?

We see a considerable spread of votes. A large proportion of treasurers value expertise more than a degree. On the other hand, a large proportion considers a treasury degree minimally of high importance. Some of our treasuryXL experts from different backgrounds explained their views on the subject.

Konstantin voted for the option that a treasury degree is a guarantee of quality.

” Specific, treasury-focused education certainly makes sense.”

From the perspective of a recruitment manager who has conducted a number of interviews, I find that a standard academic programme does not focus enough on the topics relevant to the treasury function.

For example, I note that too many candidates for treasury positions find it difficult to understand or don’t know FX forward pricing (relationship between interest rate differential, spot and forward pricing), or don’t understand the difference/relationship between net income and cash flows, etc.

And, of course, these are only general topics; other topics – like cash pooling or hedge accounting are just not part of the regular curriculum. Therefore, specific, treasury-focused education certainly makes sense.

Arnoud voted for the option that a treasury degree is just one of the key aspects.

” There are also elements that you can never learn from a book”

A treasury degree is a great start to a career in treasury. But after having interviewed many candidates in my life, I am also convinced that practice is also a very good learning opportunity. There are also elements that you can never learn from a book. You must have done that. But a treasury degree is a nice theoretical framework to start with.

In treasury you have to think in terms of cash flows and risks. In addition, you still need some understanding of financing, how to price it in relation to the risk that the bank runs on your company.

I don’t have a treasury degree myself, but I am completely self-made man. After 25 years in dealing rooms of banks and then 9 years as a treasury consultant, I think I have seen all facets of the profession.

François voted for the option that a treasury degree is a guarantee of quality.

” It is key to ensure that both the candidates and the current treasury staff keep their treasury knowledge updated”

Within Finance, Treasury is a fast-moving activity, which requires in addition to the soft skills a lot of technical skills and competencies. We are in the war for talent, and we experience more and more staff rotation. Hence it is key to ensure that both the candidates and the current treasury staff keep their treasury knowledge updated.

Several programs have been developed, the most well known being the ACT Certificate in Treasury Fundamentals. In the Netherlands NIVE also organizes the QCM (Qualified Cash manager) and QT (Qualified Treasurer) training. In Luxembourg, ATEL organizes with the House of Training the Certificate in International Treasury Management and Corporate Finance, with a Fundamentals version and an Advanced version.

Some treasury associations partnering with universities to provide treasury certification. In France, the AFTE has teamed up with the university of Paris Sorbonne, the university of Rennes and the University of Lille to develop a full master program in Treasury Management.

We also have in the Netherlands the Vrije Universiteit Amsterdam who organizes the postgraduate Executive Treasury Management & Corporate Finance program combining two finance disciplines which largely overlap and are inextricably connected: Treasury Management and Corporate Finance. It has now been running for more than 20 years.

Beside this we have a lot of other treasury trainings organized by organizations such as Van Groningen, Finsiders Academy, Orchard Finance, etc. However, they do not offer a certification.

In an ever more sophisticating environment, and in view of the increased regulations, it is for me key to look at certified trainings to build a solid background in a Treasury Management field. It enables to meet other talented treasurers and teachers. In addition, thanks to the certification, based upon an examination and/or end paper, you can get a additional quality label, which can be very useful in your career.

In this respect, I wish to share my personal experience in a completely different area. I am currently looking for Board Mandates and realized that there also a certification can be useful. Hence I have started the Guberna programme to become a Guberna Certified Director.

In the event that due to circumstances, you cannot follow certified trainings, you can also get a certification thanks to the Treasurer Test developed by treasuryXL.

We analyze the results of the most recent treasuryXL poll on today’s corporate treasury concerns in this third edition of the newsletter. We’ll show you how treasurers voted to express their opinions on a current issue, and a few treasury experts will explain their positions.

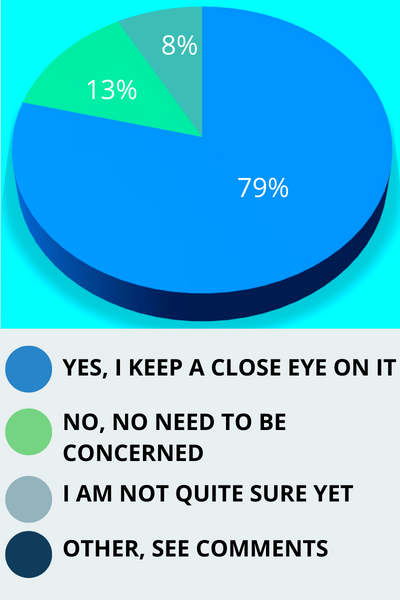

We talked about whether treasurers should be concerned about the present trend in the Dollar-Euro exchange rate in last month’s poll. 38 people participated in the poll, and the results are shown in the image below. Thank you to everyone who voted.

The results indicate quite clearly that the Corporate Treasurer is, of course, very much aware of the current trend. The exchange rate remains volatile, as the euro has even currently fallen to a new two-decade low. A number of treasuryXL experts have expressed their views regarding the current trend and how it may or may not affect treasury activities.

Patrick voted for the option to keep a close eye on the current trend

“The main reason for keeping an eye on it is so a treasurer can estimate what the impact of a falling Euro or stronger USD will be on the company’s financials.”

Keeping an eye on the Euro-Dollar rate is not necessarily to know what the current rate is. The main reason for keeping an eye on it is so a treasurer can estimate what the impact of a falling Euro or stronger USD will be on the company’s financials. Both in the field of FX hedging (not all companies hedge 100% of their exposure but have a rolling hedging policy) and higher hedge costs (forward points have increased due to larger interest rate differences with the US).

But also the sensitivity of the exchange rate on profits and sales is important. For example, if you sell in USD, you suddenly earn more in EUR and you probably sell more. On the other hand, if you buy in USD, it becomes more expensive while your EUR price is fixed. Is it perhaps cheaper to buy elsewhere? What is the impact on the cost price and total demand and turnover of the product? Do the prices need to be adjusted? All questions that the treasurer does not have to answer but that he can signal to his colleagues (CFO, Procurement, Sales etc.).

Harry voted for the option to keep a close eye on the current trend

“Currency risk aside, treasurers have other headaches to contend with when currencies exhibit high volatility and/or experience a large directional shift (trend) in value.”

The euro’s descent from above $1.20 in mid-2021 to below parity with the dollar has been well covered in the financial media, and the impact on European importers is obvious: higher import costs, squeezed margins, and pressure on business performance. Currency risk aside, treasurers have other headaches to contend with when currencies exhibit high volatility and/or experience a large directional shift (trend) in value. Let me name a small sample of potential areas for attention

Hedge Maintenance and Funding Requirements

Managing the currency hedging position, in line with policy, requires maintenance – trading in derivatives such as forward contracts and options, which presents its own challenges when exchange rates change over time. Additionally, FX swaps are used to balance cash positions and manage liquidity: it’s typical for swaps to be deployed to rollover the settlement on a hedging trade, or to bring forward a delivery. A lower EUR/USD spot rate compared to the hedged rate could incur a funding requirement if the position is out of the money when rolling-over or extending (i.e., for a euro-buyer / dollar-seller).

Treasurers as internal Consultants

Treasurers will need to work with the risk team and other stakeholders to manage internal expectations and provide guidance into the business. Preparing commentary, analysis, and forecasts using proprietary research and that of appropriate external sources, such as banking and consulting partners, is a critical area in which treasurers can demonstrate additional value. Business leaders will be aware of the EUR/USD parity story from headlines, but taking advice and information from trusted internal resources could be invaluable.

Collateral and Margin Calls

For European importers, selling the euro to buy the dollar, a move below parity will likely mean their hedging position is in the money, but of course, future hedging trades may well be at less favourable rates. For those firms selling the dollar to buy the euro however, they may find that they are losing headroom on their trading lines and could face margin calls as the sustained fall in the euro erodes their position value. Regular stress-testing of position valuations should give ample forewarning of any calls for additional collateral, and frequent communication with liquidity providers should provide the opportunity to discuss trading terms and spreads, which are liable to be adjusted in times of high volatility.

Currency Options

EUR/USD volatility has risen to multiyear highs, meaning that option premiums are higher. Treasurers will need to manage the impact of higher hedging costs and ensure an appropriate balance of cost-efficiency and hedge effectiveness is achieved. Another way EUR/USD breaking below parity could be a concern for treasurers is regarding option payoffs, and especially for path-dependent trades such as knock in or knock out options. Exotic options and multi-leg “structured” products can return a vastly different outcome in the event of a large shift in the underlying spot rate. Care should be paid to model various scenarios for the impact on the hedging and liquidity position, and to offer guidance on the appropriateness of such transactions.

Paul voted for the option that there is no need to be concerned

“The recent movements in the EUR/USD may seem extreme at first glance, but historically they have in no way gone outside of trends or ranges we have seen before.”

I think treasurers should not be over-worried about the current movement in EUR/USD exchange rate. Let me explain to you why.

Every company should have a sound FX policy. This policy should take into account the possibility of increased market volatility. Some companies believe that their balance sheet is strong enough to deal with fluctuations in exchange rates and therefore will not hedge much, if at all. Others will want to manage their risk by using futures contracts or options. These instruments allow CFOs and Treasurers to hedge at a comfortable level. The only ones who may have sleepless nights are those who have not implemented a coherent hedging policy. But under normal circumstances, any Treasurer will ensure that such a policy is in place and implemented.

Moreover, European importers are concerned about the strength of the USD and the weakness of the EUR. But the current volatility in the market is by no means extreme. Over the past seven years, we have seen prices move between 1.25 and 1.00. In the seven-year period between 2008 and 2015, we saw rates between almost 1.60 and 1.10 . In that period, the euro has fallen twice as much as it has in the past seven years. Or look at the volatility over a shorter period, during the financial crisis between 2008 and 2010, when we saw rates move dramatically in both directions over much shorter periods. The recent movements in the EUR/USD may seem extreme at first glance, but historically they have in no way gone outside of trends or ranges we have seen before.