Discussion LinkedIn poll | The Dollar-Euro exchange rate reached parity for the first time in two decades

We analyze the results of the most recent treasuryXL poll on today’s corporate treasury concerns in this third edition of the newsletter. We’ll show you how treasurers voted to express their opinions on a current issue, and a few treasury experts will explain their positions.

Is the trend in the dollar-euro exchange rate something to worry about for treasurers?

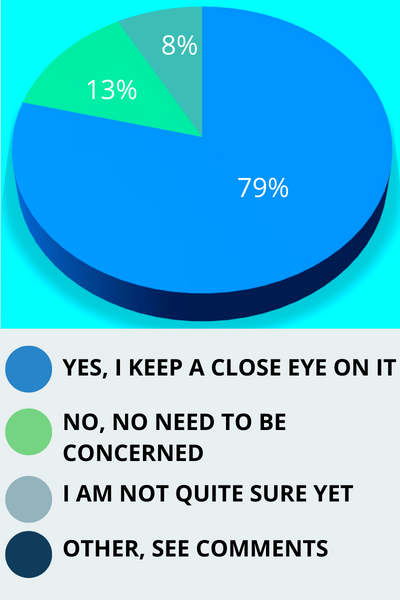

We talked about whether treasurers should be concerned about the present trend in the Dollar-Euro exchange rate in last month’s poll. 38 people participated in the poll, and the results are shown in the image below. Thank you to everyone who voted.

What do treasurers think?

The results indicate quite clearly that the Corporate Treasurer is, of course, very much aware of the current trend. The exchange rate remains volatile, as the euro has even currently fallen to a new two-decade low. A number of treasuryXL experts have expressed their views regarding the current trend and how it may or may not affect treasury activities.

Views of treasuryXL experts

Patrick Kunz

Patrick voted for the option to keep a close eye on the current trend

“The main reason for keeping an eye on it is so a treasurer can estimate what the impact of a falling Euro or stronger USD will be on the company’s financials.”

Keeping an eye on the Euro-Dollar rate is not necessarily to know what the current rate is. The main reason for keeping an eye on it is so a treasurer can estimate what the impact of a falling Euro or stronger USD will be on the company’s financials. Both in the field of FX hedging (not all companies hedge 100% of their exposure but have a rolling hedging policy) and higher hedge costs (forward points have increased due to larger interest rate differences with the US).

But also the sensitivity of the exchange rate on profits and sales is important. For example, if you sell in USD, you suddenly earn more in EUR and you probably sell more. On the other hand, if you buy in USD, it becomes more expensive while your EUR price is fixed. Is it perhaps cheaper to buy elsewhere? What is the impact on the cost price and total demand and turnover of the product? Do the prices need to be adjusted? All questions that the treasurer does not have to answer but that he can signal to his colleagues (CFO, Procurement, Sales etc.).

Harry Mills

Harry voted for the option to keep a close eye on the current trend

“Currency risk aside, treasurers have other headaches to contend with when currencies exhibit high volatility and/or experience a large directional shift (trend) in value.”

The euro’s descent from above $1.20 in mid-2021 to below parity with the dollar has been well covered in the financial media, and the impact on European importers is obvious: higher import costs, squeezed margins, and pressure on business performance. Currency risk aside, treasurers have other headaches to contend with when currencies exhibit high volatility and/or experience a large directional shift (trend) in value. Let me name a small sample of potential areas for attention

Hedge Maintenance and Funding Requirements

Managing the currency hedging position, in line with policy, requires maintenance – trading in derivatives such as forward contracts and options, which presents its own challenges when exchange rates change over time. Additionally, FX swaps are used to balance cash positions and manage liquidity: it’s typical for swaps to be deployed to rollover the settlement on a hedging trade, or to bring forward a delivery. A lower EUR/USD spot rate compared to the hedged rate could incur a funding requirement if the position is out of the money when rolling-over or extending (i.e., for a euro-buyer / dollar-seller).

Treasurers as internal Consultants

Treasurers will need to work with the risk team and other stakeholders to manage internal expectations and provide guidance into the business. Preparing commentary, analysis, and forecasts using proprietary research and that of appropriate external sources, such as banking and consulting partners, is a critical area in which treasurers can demonstrate additional value. Business leaders will be aware of the EUR/USD parity story from headlines, but taking advice and information from trusted internal resources could be invaluable.

Collateral and Margin Calls

For European importers, selling the euro to buy the dollar, a move below parity will likely mean their hedging position is in the money, but of course, future hedging trades may well be at less favourable rates. For those firms selling the dollar to buy the euro however, they may find that they are losing headroom on their trading lines and could face margin calls as the sustained fall in the euro erodes their position value. Regular stress-testing of position valuations should give ample forewarning of any calls for additional collateral, and frequent communication with liquidity providers should provide the opportunity to discuss trading terms and spreads, which are liable to be adjusted in times of high volatility.

Currency Options

EUR/USD volatility has risen to multiyear highs, meaning that option premiums are higher. Treasurers will need to manage the impact of higher hedging costs and ensure an appropriate balance of cost-efficiency and hedge effectiveness is achieved. Another way EUR/USD breaking below parity could be a concern for treasurers is regarding option payoffs, and especially for path-dependent trades such as knock in or knock out options. Exotic options and multi-leg “structured” products can return a vastly different outcome in the event of a large shift in the underlying spot rate. Care should be paid to model various scenarios for the impact on the hedging and liquidity position, and to offer guidance on the appropriateness of such transactions.

Paul Stheeman

Paul voted for the option that there is no need to be concerned

“The recent movements in the EUR/USD may seem extreme at first glance, but historically they have in no way gone outside of trends or ranges we have seen before.”

I think treasurers should not be over-worried about the current movement in EUR/USD exchange rate. Let me explain to you why.

Every company should have a sound FX policy. This policy should take into account the possibility of increased market volatility. Some companies believe that their balance sheet is strong enough to deal with fluctuations in exchange rates and therefore will not hedge much, if at all. Others will want to manage their risk by using futures contracts or options. These instruments allow CFOs and Treasurers to hedge at a comfortable level. The only ones who may have sleepless nights are those who have not implemented a coherent hedging policy. But under normal circumstances, any Treasurer will ensure that such a policy is in place and implemented.

Moreover, European importers are concerned about the strength of the USD and the weakness of the EUR. But the current volatility in the market is by no means extreme. Over the past seven years, we have seen prices move between 1.25 and 1.00. In the seven-year period between 2008 and 2015, we saw rates between almost 1.60 and 1.10 . In that period, the euro has fallen twice as much as it has in the past seven years. Or look at the volatility over a shorter period, during the financial crisis between 2008 and 2010, when we saw rates move dramatically in both directions over much shorter periods. The recent movements in the EUR/USD may seem extreme at first glance, but historically they have in no way gone outside of trends or ranges we have seen before.