https://treasuryxl.com/wp-content/uploads/2026/02/Nomentia-BLOGS-featured.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2026-02-24 07:00:562026-02-23 16:40:30Nomentia Treasury Trends Report 2026

https://treasuryxl.com/wp-content/uploads/2026/02/Nomentia-BLOGS-featured.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2026-02-24 07:00:562026-02-23 16:40:30Nomentia Treasury Trends Report 2026Cash forecasting is the practice of predicting a company’s future cash positions. For treasurers, an accurate forecast is the single most important tool for strategic decision-making. It transforms uncertainty into a clear plan, enabling proactive management of liquidity, investment, and debt.

The Strategic Impact of Forecasting Accuracy

The quality of a cash forecast directly determines financial performance. The table below shows how errors in forecasting translate into real business costs and missed opportunities.

| Forecasting Error Impact | Consequence for Treasury & the Business |

|---|---|

| Over-forecasting (Surplus) | Idle cash earns minimal or negative real returns. Missed opportunities to invest in growth or pay down expensive debt. |

| Under-forecasting (Deficit) | Requires emergency short-term borrowing at high rates. May force the delay of critical payments to suppliers, damaging relationships. |

| Unreliable Forecast | Undermines confidence in treasury from the CFO and business units. Makes long-term capital planning (e.g., M&A, capex) risky and difficult. |

A Practical Framework: The Three Time Horizons

Effective forecasting uses different techniques for different planning needs. A mature treasury function operates all three horizons simultaneously.

| Horizon | Typical Period | Primary Method | Treasury Purpose & Key Inputs |

|---|---|---|---|

| Short-Term (Operational) | 1 day to 6 weeks | Direct (Receipts & Disbursements) | Ensure daily liquidity to meet obligations. Inputs: Confirmed data—bank balances, A/P & A/R ledgers, payroll files. |

| Medium-Term (Tactical) | 1 month to 1 year | Indirect / P&L Derived | Plan for seasonal funding needs, manage credit lines, optimize working capital. Inputs: Budget-based P&L forecasts, sales pipelines, capex plans. |

| Long-Term (Strategic) | 1 year to 5+ years | Indirect / Balance Sheet | Inform major strategic decisions: dividend policy, debt issuance, M&A, long-term investments. Inputs: High-level strategic plans, market growth assumptions. |

Technology as a Force Multiplier

Manual spreadsheets are error-prone and limit analysis. Modern forecasting relies on:

-

Integration: Direct API connections between your Treasury Management System (TMS), ERP, bank portals, and business systems automate data collection.

-

Automation: Rules engines automatically categorize cash flows and flag anomalies.

-

Analytics: Advanced systems use machine learning to identify patterns in historical data, improve prediction models, and run scenario simulations (e.g., “What if a major customer pays 30 days late?” or “What if raw material costs spike?”).

Implementing a Best-Practice Process

-

Define Ownership: Treasury should own the process, but inputs must come from finance, sales, procurement, and business units.

-

Start Simple: Begin with a focused, 13-week short-term forecast for your main currency. Prove value before expanding complexity.

-

Standardize & Automate: Create a single data template for all business units. Use technology to pull data automatically.

-

Review Religiously: Hold weekly meetings to compare forecast vs. actuals, understand variances, and update the rolling forecast.

-

Communicate Value: Share forecast insights with leadership—not just numbers, but actionable recommendations on debt, investment, and risk.

In essence, cash forecasting is not an accounting exercise; it is the central planning function of a proactive treasury. A disciplined, technology-enabled process provides the clarity needed to secure funding, optimize returns, and support the company’s strategic ambitions with confidence.

Trusted partners to support you further

Click and Scroll! Here are more articles that you might like…

https://treasuryxl.com/wp-content/uploads/2026/02/Nomentia-BLOGS-featured.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2026-02-24 07:00:562026-02-23 16:40:30Nomentia Treasury Trends Report 2026

https://treasuryxl.com/wp-content/uploads/2026/02/Nomentia-BLOGS-featured.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2026-02-24 07:00:562026-02-23 16:40:30Nomentia Treasury Trends Report 2026 https://treasuryxl.com/wp-content/uploads/2025/08/Nomentia-BLOGS-featured-3.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2026-02-18 07:00:082026-02-19 10:35:54Benchmark your treasury: Insights from Nomentia Treasury Trends Report

https://treasuryxl.com/wp-content/uploads/2025/08/Nomentia-BLOGS-featured-3.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2026-02-18 07:00:082026-02-19 10:35:54Benchmark your treasury: Insights from Nomentia Treasury Trends Report https://treasuryxl.com/wp-content/uploads/2026/02/RR-Session-GTreasury.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2026-02-11 07:00:182026-02-11 15:18:46Recap & Recording: Master Cash Forecasting: Gain Confidence, Clarity & Control

https://treasuryxl.com/wp-content/uploads/2026/02/RR-Session-GTreasury.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2026-02-11 07:00:182026-02-11 15:18:46Recap & Recording: Master Cash Forecasting: Gain Confidence, Clarity & Control https://treasuryxl.com/wp-content/uploads/2025/05/Francois-Template_BLOGS-Expert-featured-7.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2026-01-27 07:00:082026-01-26 15:02:23International Treasury Management and Corporate Finance – Advanced

https://treasuryxl.com/wp-content/uploads/2025/05/Francois-Template_BLOGS-Expert-featured-7.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2026-01-27 07:00:082026-01-26 15:02:23International Treasury Management and Corporate Finance – Advanced https://treasuryxl.com/wp-content/uploads/2025/08/Nomentia-BLOGS-featured-3.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2026-01-20 07:00:082026-02-19 09:11:06Future of Forecasting: Smart, connected & strategic?

https://treasuryxl.com/wp-content/uploads/2025/08/Nomentia-BLOGS-featured-3.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2026-01-20 07:00:082026-02-19 09:11:06Future of Forecasting: Smart, connected & strategic? https://treasuryxl.com/wp-content/uploads/2025/01/Nomentia-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-12-04 11:28:302025-12-04 11:29:18Is AI a risk in payments?

https://treasuryxl.com/wp-content/uploads/2025/01/Nomentia-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-12-04 11:28:302025-12-04 11:29:18Is AI a risk in payments? https://treasuryxl.com/wp-content/uploads/2025/05/Francois-Template_BLOGS-Expert-featured-7.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-11-24 08:30:272025-11-24 08:32:52Roundtable on Alternative Methods of Funding

https://treasuryxl.com/wp-content/uploads/2025/05/Francois-Template_BLOGS-Expert-featured-7.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-11-24 08:30:272025-11-24 08:32:52Roundtable on Alternative Methods of Funding https://treasuryxl.com/wp-content/uploads/2025/11/Copy-of-Live-Session-Nomentia.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-11-14 14:11:432026-02-19 10:40:40Live Session: Corporate Treasury in 2026 (and beyond): A Vision for the Future – and What’s Holding Us Back

https://treasuryxl.com/wp-content/uploads/2025/11/Copy-of-Live-Session-Nomentia.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-11-14 14:11:432026-02-19 10:40:40Live Session: Corporate Treasury in 2026 (and beyond): A Vision for the Future – and What’s Holding Us Back https://treasuryxl.com/wp-content/uploads/2025/01/Nomentia-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-11-06 07:00:162025-11-05 16:51:22How treasury teams master multi-bank connectivity

https://treasuryxl.com/wp-content/uploads/2025/01/Nomentia-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-11-06 07:00:162025-11-05 16:51:22How treasury teams master multi-bank connectivity https://treasuryxl.com/wp-content/uploads/2025/01/Nomentia-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-10-27 07:00:392025-11-05 16:41:05The key to cash flow visibility across multiple banks

https://treasuryxl.com/wp-content/uploads/2025/01/Nomentia-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-10-27 07:00:392025-11-05 16:41:05The key to cash flow visibility across multiple banks https://treasuryxl.com/wp-content/uploads/2025/10/Live-Session-Aviva-Investors-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-10-16 07:00:052025-10-15 13:58:44Recap & Recording: From Outlook to Action: Turning Market Signals into Cash Decisions

https://treasuryxl.com/wp-content/uploads/2025/10/Live-Session-Aviva-Investors-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-10-16 07:00:052025-10-15 13:58:44Recap & Recording: From Outlook to Action: Turning Market Signals into Cash Decisions https://treasuryxl.com/wp-content/uploads/2025/10/Live-Session-Aviva-Investors.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-10-01 09:11:112025-12-05 09:58:54Live Session: From Outlook to Action: Turning Market Signals into Cash Decisions

https://treasuryxl.com/wp-content/uploads/2025/10/Live-Session-Aviva-Investors.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-10-01 09:11:112025-12-05 09:58:54Live Session: From Outlook to Action: Turning Market Signals into Cash Decisions https://treasuryxl.com/wp-content/uploads/2025/09/Nomentia-BLOGS-featured-5.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-09-29 07:00:332025-09-26 15:08:48Nomentia and Mitigram Form Nordic Partnership to Bridge Treasury and Trade Finance

https://treasuryxl.com/wp-content/uploads/2025/09/Nomentia-BLOGS-featured-5.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-09-29 07:00:332025-09-26 15:08:48Nomentia and Mitigram Form Nordic Partnership to Bridge Treasury and Trade Finance https://treasuryxl.com/wp-content/uploads/2025/01/Nomentia-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-09-17 07:55:082025-09-17 07:55:08How to turn your controlling plan into a reliable cash flow forecast

https://treasuryxl.com/wp-content/uploads/2025/01/Nomentia-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-09-17 07:55:082025-09-17 07:55:08How to turn your controlling plan into a reliable cash flow forecast https://treasuryxl.com/wp-content/uploads/2025/09/Live-Session-Panax-8.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-09-16 07:00:432026-01-05 15:30:39Recap & Recording: Entering a New Age of Cash Management: Opportunities and Risks of AI

https://treasuryxl.com/wp-content/uploads/2025/09/Live-Session-Panax-8.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-09-16 07:00:432026-01-05 15:30:39Recap & Recording: Entering a New Age of Cash Management: Opportunities and Risks of AI https://treasuryxl.com/wp-content/uploads/2025/09/Live-Session-Panax-3.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-09-08 12:44:462026-01-05 15:30:31Live Session: Entering a New Age of Cash Management: Opportunities and Risks of AI

https://treasuryxl.com/wp-content/uploads/2025/09/Live-Session-Panax-3.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-09-08 12:44:462026-01-05 15:30:31Live Session: Entering a New Age of Cash Management: Opportunities and Risks of AI https://treasuryxl.com/wp-content/uploads/2025/09/Nomentia-BLOGS-featured-4.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-09-01 08:45:572025-09-01 08:47:32Millions of Payments, One Solution – OTTO Payments Chooses Nomentia

https://treasuryxl.com/wp-content/uploads/2025/09/Nomentia-BLOGS-featured-4.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-09-01 08:45:572025-09-01 08:47:32Millions of Payments, One Solution – OTTO Payments Chooses Nomentia https://treasuryxl.com/wp-content/uploads/2025/01/Nomentia-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-08-18 07:00:552025-08-15 13:42:35How to build a business case for a payment hub?

https://treasuryxl.com/wp-content/uploads/2025/01/Nomentia-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-08-18 07:00:552025-08-15 13:42:35How to build a business case for a payment hub? https://treasuryxl.com/wp-content/uploads/2025/08/Nomentia-BLOGS-featured-3.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-08-07 08:13:452025-08-07 08:14:33Real-time treasury: Beyond bank connections & controls

https://treasuryxl.com/wp-content/uploads/2025/08/Nomentia-BLOGS-featured-3.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-08-07 08:13:452025-08-07 08:14:33Real-time treasury: Beyond bank connections & controls https://treasuryxl.com/wp-content/uploads/2025/04/Francois-Template_BLOGS-Expert-featured-6.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-08-04 09:00:552025-08-04 14:54:32The European Payment Evolution: Regulations, Technology, and Strategic Implementation

https://treasuryxl.com/wp-content/uploads/2025/04/Francois-Template_BLOGS-Expert-featured-6.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-08-04 09:00:552025-08-04 14:54:32The European Payment Evolution: Regulations, Technology, and Strategic Implementation https://treasuryxl.com/wp-content/uploads/2025/04/GTreasury-BLOGS-featured-10.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-06-18 07:00:192025-06-13 06:58:175 Silent Killers of Cash Flow Forecasting Accuracy and How to Eliminate Them

https://treasuryxl.com/wp-content/uploads/2025/04/GTreasury-BLOGS-featured-10.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-06-18 07:00:192025-06-13 06:58:175 Silent Killers of Cash Flow Forecasting Accuracy and How to Eliminate Them https://treasuryxl.com/wp-content/uploads/2025/05/GTreasury-BLOGS-featured-12.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-05-27 07:00:212025-05-27 08:54:00Cash Forecasting Accuracy Measurement

https://treasuryxl.com/wp-content/uploads/2025/05/GTreasury-BLOGS-featured-12.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-05-27 07:00:212025-05-27 08:54:00Cash Forecasting Accuracy Measurement https://treasuryxl.com/wp-content/uploads/2025/01/Nomentia-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-05-20 07:00:332025-05-19 14:03:02Sanctions screening compliance excuses, debunked

https://treasuryxl.com/wp-content/uploads/2025/01/Nomentia-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-05-20 07:00:332025-05-19 14:03:02Sanctions screening compliance excuses, debunked https://treasuryxl.com/wp-content/uploads/2025/05/Francois-Template_BLOGS-Expert-featured-7.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-05-15 07:00:252025-05-06 14:23:53Treasury Management and Credit Collections

https://treasuryxl.com/wp-content/uploads/2025/05/Francois-Template_BLOGS-Expert-featured-7.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-05-15 07:00:252025-05-06 14:23:53Treasury Management and Credit Collections https://treasuryxl.com/wp-content/uploads/2025/01/Nomentia-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-04-24 07:00:162025-04-22 14:39:41Best liquidity management strategies for multinational enterprises

https://treasuryxl.com/wp-content/uploads/2025/01/Nomentia-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-04-24 07:00:162025-04-22 14:39:41Best liquidity management strategies for multinational enterprises https://treasuryxl.com/wp-content/uploads/2024/07/Template_BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-04-22 07:00:292025-04-18 14:19:09Managing Corporate Treasury with Spreadsheets

https://treasuryxl.com/wp-content/uploads/2024/07/Template_BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-04-22 07:00:292025-04-18 14:19:09Managing Corporate Treasury with Spreadsheets https://treasuryxl.com/wp-content/uploads/2025/04/Francois-Template_BLOGS-Expert-featured-6.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-04-17 07:00:042025-04-16 16:56:09Strategic Treasury & Cash Management 2.0 Masterclass

https://treasuryxl.com/wp-content/uploads/2025/04/Francois-Template_BLOGS-Expert-featured-6.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-04-17 07:00:042025-04-16 16:56:09Strategic Treasury & Cash Management 2.0 Masterclass https://treasuryxl.com/wp-content/uploads/2025/04/Nomentia-BLOGS-featured-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-04-15 11:45:382025-04-15 11:45:38Nomentia Unveils AI Cash Flow Forecasting for Accurate & Predictive Insights

https://treasuryxl.com/wp-content/uploads/2025/04/Nomentia-BLOGS-featured-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-04-15 11:45:382025-04-15 11:45:38Nomentia Unveils AI Cash Flow Forecasting for Accurate & Predictive Insights https://treasuryxl.com/wp-content/uploads/2025/01/Nomentia-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-04-07 07:00:542025-04-03 11:16:22Cash pools and in-house bank – Everything you need to know

https://treasuryxl.com/wp-content/uploads/2025/01/Nomentia-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-04-07 07:00:542025-04-03 11:16:22Cash pools and in-house bank – Everything you need to know https://treasuryxl.com/wp-content/uploads/2025/01/Nomentia-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-03-26 07:00:562025-03-25 21:48:49Why Excel fails at cash flow forecasting?

https://treasuryxl.com/wp-content/uploads/2025/01/Nomentia-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-03-26 07:00:562025-03-25 21:48:49Why Excel fails at cash flow forecasting? https://treasuryxl.com/wp-content/uploads/2025/03/Live-Session-AB-1-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-03-20 07:00:532025-03-31 16:39:22Recap & Recording: Self-Service Treasury: Excel, APIs, AI, and Other Practical Tools

https://treasuryxl.com/wp-content/uploads/2025/03/Live-Session-AB-1-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-03-20 07:00:532025-03-31 16:39:22Recap & Recording: Self-Service Treasury: Excel, APIs, AI, and Other Practical Tools https://treasuryxl.com/wp-content/uploads/2025/03/Embat-BLOGS-featured-4.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-03-19 08:00:102025-04-24 17:19:05Building a Smarter Treasury: The Embat Story

https://treasuryxl.com/wp-content/uploads/2025/03/Embat-BLOGS-featured-4.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-03-19 08:00:102025-04-24 17:19:05Building a Smarter Treasury: The Embat Story https://treasuryxl.com/wp-content/uploads/2024/07/Template_BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-03-04 07:00:302025-02-28 11:17:57Corporate Treasury’s relationship with their IT department

https://treasuryxl.com/wp-content/uploads/2024/07/Template_BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-03-04 07:00:302025-02-28 11:17:57Corporate Treasury’s relationship with their IT department https://treasuryxl.com/wp-content/uploads/2025/02/Embat-BLOGS-featured-3.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-02-25 10:31:452025-02-25 10:33:31Embat acquires Necto, strengthening its leadership in global corporate banking connectivity through APIs

https://treasuryxl.com/wp-content/uploads/2025/02/Embat-BLOGS-featured-3.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-02-25 10:31:452025-02-25 10:33:31Embat acquires Necto, strengthening its leadership in global corporate banking connectivity through APIs https://treasuryxl.com/wp-content/uploads/2024/07/Template_BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-02-20 07:00:502025-02-19 16:37:44Managing KYC & AML in Corporate Treasury

https://treasuryxl.com/wp-content/uploads/2024/07/Template_BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-02-20 07:00:502025-02-19 16:37:44Managing KYC & AML in Corporate Treasury https://treasuryxl.com/wp-content/uploads/2024/10/Embat-BLOGS-featured-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-02-11 07:00:212025-02-07 09:30:24Direct and Indirect Cash Forecasting: Advantages and Disadvantages

https://treasuryxl.com/wp-content/uploads/2024/10/Embat-BLOGS-featured-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-02-11 07:00:212025-02-07 09:30:24Direct and Indirect Cash Forecasting: Advantages and Disadvantages https://treasuryxl.com/wp-content/uploads/2024/07/Template_BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-02-05 07:00:002025-02-04 10:13:37Measuring Corporate Treasury Performance

https://treasuryxl.com/wp-content/uploads/2024/07/Template_BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-02-05 07:00:002025-02-04 10:13:37Measuring Corporate Treasury Performance https://treasuryxl.com/wp-content/uploads/2025/01/Blog-Kyriba-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-01-27 08:00:062025-01-24 13:51:37Cash Forecasting: Your Blueprint for Liquidity Performance

https://treasuryxl.com/wp-content/uploads/2025/01/Blog-Kyriba-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-01-27 08:00:062025-01-24 13:51:37Cash Forecasting: Your Blueprint for Liquidity Performance https://treasuryxl.com/wp-content/uploads/2024/07/Template_BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-01-16 07:00:332025-01-14 16:38:00Future-proofing Global Treasury Teams

https://treasuryxl.com/wp-content/uploads/2024/07/Template_BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-01-16 07:00:332025-01-14 16:38:00Future-proofing Global Treasury Teams https://treasuryxl.com/wp-content/uploads/2024/12/FIS-BLOGS-featured-4.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-01-08 07:00:412025-01-07 10:39:33Unlocking Value: How TMS Delivers Measurable ROI for Corporate Treasury

https://treasuryxl.com/wp-content/uploads/2024/12/FIS-BLOGS-featured-4.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2025-01-08 07:00:412025-01-07 10:39:33Unlocking Value: How TMS Delivers Measurable ROI for Corporate Treasury https://treasuryxl.com/wp-content/uploads/2024/10/Embat-BLOGS-featured-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-12-09 07:00:232024-12-01 20:05:54The role of the CFO in the company’s overall strategy

https://treasuryxl.com/wp-content/uploads/2024/10/Embat-BLOGS-featured-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-12-09 07:00:232024-12-01 20:05:54The role of the CFO in the company’s overall strategy https://treasuryxl.com/wp-content/uploads/2024/07/Template_BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-12-04 07:00:372024-12-16 12:00:55Corporate Treasury: Funding Working Capital

https://treasuryxl.com/wp-content/uploads/2024/07/Template_BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-12-04 07:00:372024-12-16 12:00:55Corporate Treasury: Funding Working Capital https://treasuryxl.com/wp-content/uploads/2024/10/Embat-BLOGS-featured-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-11-21 07:00:232024-10-31 15:22:41AI in treasury: cash forecasting and payment predictions

https://treasuryxl.com/wp-content/uploads/2024/10/Embat-BLOGS-featured-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-11-21 07:00:232024-10-31 15:22:41AI in treasury: cash forecasting and payment predictions https://treasuryxl.com/wp-content/uploads/2024/07/Template_BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-11-20 07:00:122024-11-18 12:06:18The influence of Corporate Treasury on Working Capital

https://treasuryxl.com/wp-content/uploads/2024/07/Template_BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-11-20 07:00:122024-11-18 12:06:18The influence of Corporate Treasury on Working Capital https://treasuryxl.com/wp-content/uploads/2024/04/Kopie-van-Copy-of-Kopie-van-Template_BLOGS-featured.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-10-30 07:00:432024-10-28 13:49:41Plans & Experiences with AI in Cash Forecasting

https://treasuryxl.com/wp-content/uploads/2024/04/Kopie-van-Copy-of-Kopie-van-Template_BLOGS-featured.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-10-30 07:00:432024-10-28 13:49:41Plans & Experiences with AI in Cash Forecasting https://treasuryxl.com/wp-content/uploads/2024/09/TIS-BLOGS-featured-6.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-10-08 07:00:452024-09-30 16:56:23Unlock the Full Potential of Your TMS

https://treasuryxl.com/wp-content/uploads/2024/09/TIS-BLOGS-featured-6.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-10-08 07:00:452024-09-30 16:56:23Unlock the Full Potential of Your TMS https://treasuryxl.com/wp-content/uploads/2024/09/Wout-Template_BLOGS-Expert-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-09-05 07:00:362025-04-24 17:16:18Growing Interest in Cashflow Management Software

https://treasuryxl.com/wp-content/uploads/2024/09/Wout-Template_BLOGS-Expert-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-09-05 07:00:362025-04-24 17:16:18Growing Interest in Cashflow Management Software https://treasuryxl.com/wp-content/uploads/2024/08/Kopie-van-Kopie-van-Kopie-van-TIS-BLOGS-featured-4.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-08-06 07:00:502024-08-08 12:51:04TIS Summer Magazine

https://treasuryxl.com/wp-content/uploads/2024/08/Kopie-van-Kopie-van-Kopie-van-TIS-BLOGS-featured-4.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-08-06 07:00:502024-08-08 12:51:04TIS Summer Magazine https://treasuryxl.com/wp-content/uploads/2024/07/GPS-featured.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-07-25 10:00:332024-07-24 14:13:26Choosing the Right Financial Strategy: Intercompany Netting VS. In-House Banking

https://treasuryxl.com/wp-content/uploads/2024/07/GPS-featured.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-07-25 10:00:332024-07-24 14:13:26Choosing the Right Financial Strategy: Intercompany Netting VS. In-House Banking https://treasuryxl.com/wp-content/uploads/2024/07/TIS-BLOGS-featured-5.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-07-22 07:00:462024-07-18 13:54:18TIS Sizzlin’ Summer Webinar Series

https://treasuryxl.com/wp-content/uploads/2024/07/TIS-BLOGS-featured-5.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-07-22 07:00:462024-07-18 13:54:18TIS Sizzlin’ Summer Webinar Series https://treasuryxl.com/wp-content/uploads/2024/05/TIS-BLOGS-featured-4.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-06-03 07:00:392024-05-29 10:44:07Podcast | Bas rebel explores best practices for new treasury technology projects & Implementations

https://treasuryxl.com/wp-content/uploads/2024/05/TIS-BLOGS-featured-4.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-06-03 07:00:392024-05-29 10:44:07Podcast | Bas rebel explores best practices for new treasury technology projects & Implementations https://treasuryxl.com/wp-content/uploads/2024/05/TIS-BLOGS-featured-3.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-05-23 07:00:102024-05-15 10:10:57Whitepaper | The Complex World of Corporate Payments & How TIS Helps Simplify It

https://treasuryxl.com/wp-content/uploads/2024/05/TIS-BLOGS-featured-3.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-05-23 07:00:102024-05-15 10:10:57Whitepaper | The Complex World of Corporate Payments & How TIS Helps Simplify It https://treasuryxl.com/wp-content/uploads/2024/04/TIS-BLOGS-featured-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-04-25 10:00:542024-04-22 09:51:28TIS Spring Magazine

https://treasuryxl.com/wp-content/uploads/2024/04/TIS-BLOGS-featured-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-04-25 10:00:542024-04-22 09:51:28TIS Spring Magazine https://treasuryxl.com/wp-content/uploads/2024/02/Kopie-van-Kopie-van-TIS-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-04-04 07:00:352024-10-08 09:58:35Four Things Every CFO Should Know About Treasury

https://treasuryxl.com/wp-content/uploads/2024/02/Kopie-van-Kopie-van-TIS-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-04-04 07:00:352024-10-08 09:58:35Four Things Every CFO Should Know About Treasury https://treasuryxl.com/wp-content/uploads/2024/03/Copy-of-Kopie-van-Kopie-van-Kopie-van-TIS-BLOGS-featured.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-03-27 09:32:552024-03-27 09:32:55TIS has Signed a Binding Agreement with Marlin Equity Partners to Secure a Majority Growth Investment

https://treasuryxl.com/wp-content/uploads/2024/03/Copy-of-Kopie-van-Kopie-van-Kopie-van-TIS-BLOGS-featured.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-03-27 09:32:552024-03-27 09:32:55TIS has Signed a Binding Agreement with Marlin Equity Partners to Secure a Majority Growth Investment https://treasuryxl.com/wp-content/uploads/2024/03/Grain-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-03-20 07:00:232024-07-03 11:11:45Mastering Cross-Currency Transactions Understanding FX Risks and Strategies

https://treasuryxl.com/wp-content/uploads/2024/03/Grain-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-03-20 07:00:232024-07-03 11:11:45Mastering Cross-Currency Transactions Understanding FX Risks and Strategies https://treasuryxl.com/wp-content/uploads/2024/03/Kopie-van-Kopie-van-Kopie-van-TIS-BLOGS-featured-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-03-19 09:53:192024-03-21 13:50:17A Guide to the Emergence of Instant Payments Globally & How to Navigate Them

https://treasuryxl.com/wp-content/uploads/2024/03/Kopie-van-Kopie-van-Kopie-van-TIS-BLOGS-featured-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-03-19 09:53:192024-03-21 13:50:17A Guide to the Emergence of Instant Payments Globally & How to Navigate Them https://treasuryxl.com/wp-content/uploads/2024/02/Kopie-van-Kopie-van-Kopie-van-TIS-BLOGS-featured.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-03-14 07:00:142024-03-12 13:34:59TIS Magazine | The Winter Issue

https://treasuryxl.com/wp-content/uploads/2024/02/Kopie-van-Kopie-van-Kopie-van-TIS-BLOGS-featured.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-03-14 07:00:142024-03-12 13:34:59TIS Magazine | The Winter Issue https://treasuryxl.com/wp-content/uploads/2024/02/Kopie-van-TIS-BLOGS-featured.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-02-12 07:00:362024-02-06 16:47:31TIS Podcast with Sugandha Singhal | Analyzing the Intracacies of Effective Treasury Management in 2024

https://treasuryxl.com/wp-content/uploads/2024/02/Kopie-van-TIS-BLOGS-featured.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-02-12 07:00:362024-02-06 16:47:31TIS Podcast with Sugandha Singhal | Analyzing the Intracacies of Effective Treasury Management in 2024 https://treasuryxl.com/wp-content/uploads/2024/01/TIS-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-01-31 07:00:072024-01-31 09:46:205 Ways Treasury Can Save Money & Boost Profits in 2024

https://treasuryxl.com/wp-content/uploads/2024/01/TIS-BLOGS-featured-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-01-31 07:00:072024-01-31 09:46:205 Ways Treasury Can Save Money & Boost Profits in 2024 https://treasuryxl.com/wp-content/uploads/2023/12/CORPORATE-TREASURY-IN-100-WORDS_200x200-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-01-16 07:00:412024-01-16 16:51:30In 100 Words | How should Treasury approach A/R Cash Forecasting?

https://treasuryxl.com/wp-content/uploads/2023/12/CORPORATE-TREASURY-IN-100-WORDS_200x200-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-01-16 07:00:412024-01-16 16:51:30In 100 Words | How should Treasury approach A/R Cash Forecasting? https://treasuryxl.com/wp-content/uploads/2023/12/TIS-100-days-3e-200.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-01-03 07:00:582023-12-22 14:29:44Guide to Navigating a Treasurers 1st 100 Days in a New Job

https://treasuryxl.com/wp-content/uploads/2023/12/TIS-100-days-3e-200.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2024-01-03 07:00:582023-12-22 14:29:44Guide to Navigating a Treasurers 1st 100 Days in a New Job https://treasuryxl.com/wp-content/uploads/2023/12/tis-magazine-fall-200.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2023-12-04 07:00:572023-12-01 08:51:43TIS Magazine | The Fall Issue

https://treasuryxl.com/wp-content/uploads/2023/12/tis-magazine-fall-200.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2023-12-04 07:00:572023-12-01 08:51:43TIS Magazine | The Fall Issue https://treasuryxl.com/wp-content/uploads/2023/11/TIS-10-questions-200.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2023-11-20 07:00:472023-11-10 11:11:0610 Common Questions & Answers About the TIS Cash Forecasting Solution

https://treasuryxl.com/wp-content/uploads/2023/11/TIS-10-questions-200.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2023-11-20 07:00:472023-11-10 11:11:0610 Common Questions & Answers About the TIS Cash Forecasting Solution https://treasuryxl.com/wp-content/uploads/2023/09/tis-200-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

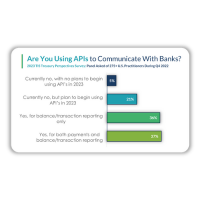

treasuryXL2023-09-27 07:00:212023-09-22 09:29:41Seven Key Findings from the 2023-2024 Treasury Technology Survey

https://treasuryxl.com/wp-content/uploads/2023/09/tis-200-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2023-09-27 07:00:212023-09-22 09:29:41Seven Key Findings from the 2023-2024 Treasury Technology Survey https://treasuryxl.com/wp-content/uploads/2023/08/TIS-Magazine-Summer-Issue-2023.png

800

800

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2023-08-29 07:00:462023-08-28 09:22:31Exploring the World of Treasury & Finance: Introducing the Debut Issue of the TIS Magazine

https://treasuryxl.com/wp-content/uploads/2023/08/TIS-Magazine-Summer-Issue-2023.png

800

800

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2023-08-29 07:00:462023-08-28 09:22:31Exploring the World of Treasury & Finance: Introducing the Debut Issue of the TIS Magazine https://treasuryxl.com/wp-content/uploads/2023/07/grain-interview-200-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2023-07-27 07:00:482023-07-27 08:37:42Why Cross-Currency Management Matters: The Top 3 Risks for Businesses that Ignore It

https://treasuryxl.com/wp-content/uploads/2023/07/grain-interview-200-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2023-07-27 07:00:482023-07-27 08:37:42Why Cross-Currency Management Matters: The Top 3 Risks for Businesses that Ignore It https://treasuryxl.com/wp-content/uploads/2023/07/TIS-APIs-200.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2023-07-20 07:00:562023-07-17 17:01:04APIs as a Game Changer for the Office of the CFO: Expectations vs Reality

https://treasuryxl.com/wp-content/uploads/2023/07/TIS-APIs-200.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2023-07-20 07:00:562023-07-17 17:01:04APIs as a Game Changer for the Office of the CFO: Expectations vs Reality https://treasuryxl.com/wp-content/uploads/2023/07/Kopie-van-poll-results-10.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2023-07-05 16:51:362023-07-12 09:23:37How far ahead do Treasurers forecast?

https://treasuryxl.com/wp-content/uploads/2023/07/Kopie-van-poll-results-10.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2023-07-05 16:51:362023-07-12 09:23:37How far ahead do Treasurers forecast? https://treasuryxl.com/wp-content/uploads/2023/06/TIS-200-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2023-07-03 07:00:092023-06-28 09:33:38Reviewing Best Practices for Treasury’s Cash Flow Forecasts

https://treasuryxl.com/wp-content/uploads/2023/06/TIS-200-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2023-07-03 07:00:092023-06-28 09:33:38Reviewing Best Practices for Treasury’s Cash Flow Forecasts https://treasuryxl.com/wp-content/uploads/2023/06/TIS-awards-200.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2023-06-28 13:45:042023-06-28 13:49:24TIS Clients Unilever, Siemens Gamesa, and TeamViewer Win Five Treasury Technology Awards in H1 2023

https://treasuryxl.com/wp-content/uploads/2023/06/TIS-awards-200.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2023-06-28 13:45:042023-06-28 13:49:24TIS Clients Unilever, Siemens Gamesa, and TeamViewer Win Five Treasury Technology Awards in H1 2023 https://treasuryxl.com/wp-content/uploads/2022/07/gtreasury-200-21e.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2022-07-21 07:00:172023-06-28 09:38:55Zeroing in on 4 Specific Ways Treasurers’ Can Improve Cash Forecasting

https://treasuryxl.com/wp-content/uploads/2022/07/gtreasury-200-21e.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2022-07-21 07:00:172023-06-28 09:38:55Zeroing in on 4 Specific Ways Treasurers’ Can Improve Cash Forecasting https://treasuryxl.com/wp-content/uploads/2022/05/Een-titel-toevoegen-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2022-06-01 07:00:122023-06-28 09:39:06Recording Live Discussion Session | More reliable cash forecasting in a fraction of the time

https://treasuryxl.com/wp-content/uploads/2022/05/Een-titel-toevoegen-2.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2022-06-01 07:00:122023-06-28 09:39:06Recording Live Discussion Session | More reliable cash forecasting in a fraction of the time https://treasuryxl.com/wp-content/uploads/2022/05/kyriba-200-19e.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2022-05-19 07:00:492023-06-28 09:39:49The Role of APIs in Strategic Cash Forecasting

https://treasuryxl.com/wp-content/uploads/2022/05/kyriba-200-19e.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2022-05-19 07:00:492023-06-28 09:39:49The Role of APIs in Strategic Cash Forecasting https://treasuryxl.com/wp-content/uploads/2022/04/TreasuryXL_Apr28-200x200-1.jpg

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2022-04-27 07:00:482023-06-28 09:39:27Reminder Live Discussion Session | More reliable cash forecasting in a fraction of the time

https://treasuryxl.com/wp-content/uploads/2022/04/TreasuryXL_Apr28-200x200-1.jpg

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2022-04-27 07:00:482023-06-28 09:39:27Reminder Live Discussion Session | More reliable cash forecasting in a fraction of the time https://treasuryxl.com/wp-content/uploads/2022/04/cashforce-200-14e-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2022-04-14 07:00:522023-06-28 09:39:33The Treasury Dragons vs Cash Forecasting | Best-of-breed Cashforce

https://treasuryxl.com/wp-content/uploads/2022/04/cashforce-200-14e-1.png

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2022-04-14 07:00:522023-06-28 09:39:33The Treasury Dragons vs Cash Forecasting | Best-of-breed Cashforce https://treasuryxl.com/wp-content/uploads/2022/04/TreasuryXL_Apr28-200x200-1.jpg

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2022-04-13 15:52:582023-06-28 09:39:38Live Discussion Session | More reliable cash forecasting in a fraction of the time

https://treasuryxl.com/wp-content/uploads/2022/04/TreasuryXL_Apr28-200x200-1.jpg

200

200

treasuryXL

https://treasuryxl.com/wp-content/uploads/2018/07/treasuryXL-logo-300x56.png

treasuryXL2022-04-13 15:52:582023-06-28 09:39:38Live Discussion Session | More reliable cash forecasting in a fraction of the timeNew: XLMatchMaker

Disclaimer: This chatbot is in beta; occasional errors might occur. It doesn’t give financial advice, but it will do its best to connect you with the right treasuryXL expert or partner.

Not displaying right? Click here to open treasuryXL MatchMaker in a full page.

Newsletter & eBook

Subscribe to our free weekly newsletter and receive your 41 pages ‘easy-to-read’ eBook, What is Treasury?

Great news! treasuryXL’s live session recordings are now available on Spotify

Go to

Partner Program

Join treasuryXL as a partner!

At treasuryXL, we help your company connect with treasury professionals and showcase your solutions and expertise through our partner network. Stand out in 2026 and schedule a meeting with us today.

Get in touch and discover the best partnership option for you.

Contact us

treasuryXL

Kaldenkerkerweg 22

5913 AE Venlo

The Netherlands

Email: [email protected]

Telephone & WhatsApp: +31 6 2732 8942

Subscribe

Newsletter & eBook

Subscribe to our free weekly newsletter and receive your 41 pages ‘easy-to-read’ eBook, What is Treasury?