Long term or short term debt – your choices

|18-5-2017 | François de Witte |

You might visit this site, being a treasury professional with years of experience in the field. However you could also be a student or a businessman wanting to know more details on the subject, or a reader in general, eager to learn something new. The ‘Treasury for non-treasurers’ series is for readers who want to understand what treasury is all about. Today our expert François de Witte will explain de difference between long term and short term debt.

You might visit this site, being a treasury professional with years of experience in the field. However you could also be a student or a businessman wanting to know more details on the subject, or a reader in general, eager to learn something new. The ‘Treasury for non-treasurers’ series is for readers who want to understand what treasury is all about. Today our expert François de Witte will explain de difference between long term and short term debt.

One of the main tasks of the treasurer is to ensure that the company has the required funds to operate. The treasurer will usually contact the banks for this funding. They can also extend long term loans (LT) or short term loans (ST).

Raising short term debt has several advantages, because it is more flexible, there is a lower cost due to the lower margin (smaller risk profile than long term debt) and usually lower interest, funds can be raised quickly and usually, you can repay your debt without penalty.

However, there are some drawbacks. The required repayment comes quicker than for LT loans, there can be potential difficulties in renewing short term loans, and it will be more difficult to combine ST debt with a fixed rate interest.

For this reason, many corporates take up long term loans. It helps them to improve the financial structure (better liquidity ratio). During the term of the credit facility, there is no renewal risk, and long term loans can be taken up with fixed or floating interest. Many banks will see long term loans as a prerequisite to finance fixed assets and investments.

In that case, the corporate will have to accept a higher price on these loans, a longer set up time and a possible prepayment penalty in case there is a fixed interest rate during the long-term loan.

Financing policy

The classic financing policy aims to match the maturity of the financing with the maturity of the assets. Under this policy, long term assets will be financed by long term loan, and short term assets by short term loans. An area of concern are the working capital needs. Are these to be considered as long term assets as short term assets? Usually the uncompressible part of the working capital need is considered as a long-term asset, whilst the fluctuating part (including the seasonal requirement) is considered as short term asset.

Some companies use a more aggressive financing policy and chosse short term financing to finance all the working capital needs, which can be risky. Others are more conservative and use long term loans to finance also the fluctuating part of the working capital needs.

Bank Financing versus bonds or Commercial Paper financing

Usually midcorporates and smaller corporates will use bank financing, also for the long-term financing, because it is easier to be set up. There is no need to have a complex prospectus or to ask for an external rating and there are less disclosure and reporting requirements. In addition, there is more flexibility in the repayment schedule, and it will be easier to negotiate a floating rate.

However larger corporates, those with an external rating or a large name recognition, will also consider bond or Commercial Paper financing. The bond financing will allow for longer term maturities, and the possibility to lock in the interest rate for longer periods. Bonds and commercial papers enable a diversification of funding sources, and can be traded in the market. In addition, there is no obligation provide side business to the lenders.

Bond financing

The world’s bond market can be divided into two broad groups:

- The domestic bond market (issued in a country by resident issuers)

- The international bond market (issued in a country or in the international markets by non-resident issuers). These also include the Eurobonds

Different bonds

The most common bonds are the straight bonds. In this case, the issuer issues securities for a fixed term with an annual or semi-annual interest payment at a fixed rate.

Example: Issuer A issues on 10/6/2017 EUR 100 Million debt at 6 % for 7 years. In this case, the bondholders are entitled to receive an annual interest rate of 6 % (also called the coupon) on the 10th June of each year from 2018 until 2024, and the full reimbursement of the loan on 10/6/2024.

We also see quite frequently the issuance of Floating Rate Notes. This is a medium term or long term bond with a coupon based upon a floating rate based on a benchmark rate (e.g. Euribor or Libor) plus a “spread” based upon amongst others the credit quality of the issuer.

Zero-coupon bonds that do not foresee for periodic interest payments, but for the full reimbursement of the capital and interest at the final maturity of the bond.

Convertible bonds can be exchanged later or with another instrument, mostly shares. The coupon is usually lower because of the option granted to the bondholder.

Public bonds are bonds issued by a bank syndicate through a public offering with prospectus. These bonds are focusing both on the retail and on the professional investors. They also must comply with the specific requirements for the prospectus, which sometimes needs to be submitted beforehand to the competent authorities for approval.

A private placement (or non-public offering) is a bond issue through a private offering, mostly to a small number of chosen investors. Private placements have less heavy constraints in term of prospectus.

Since 2000, the global bond markets size has nearly tripled in size. Today it is worth more than $100 trillion

(Source: Bloomberg, June 2016).

François de Witte – Founder & Senior Consultant at FDW Consult & Flex Treasurer

François de Witte – Founder & Senior Consultant at FDW Consult & Flex Treasurer

[button url=”https://www.treasuryxl.com/community/experts/francois-de-witte/” text=”View expert profile” size=”small” type=”primary” icon=”” external=”1″]

[separator type=”” size=”” icon=””]

More articles of this author:

Treasury for non-treasurers: Short term loans from a treasury perspective

Working capital management: Some practical advice on the optimization of the order to cash cycle

Management of bank mandates – EBAM – A lot of challenges

[separator type=”” size=”” icon=””]

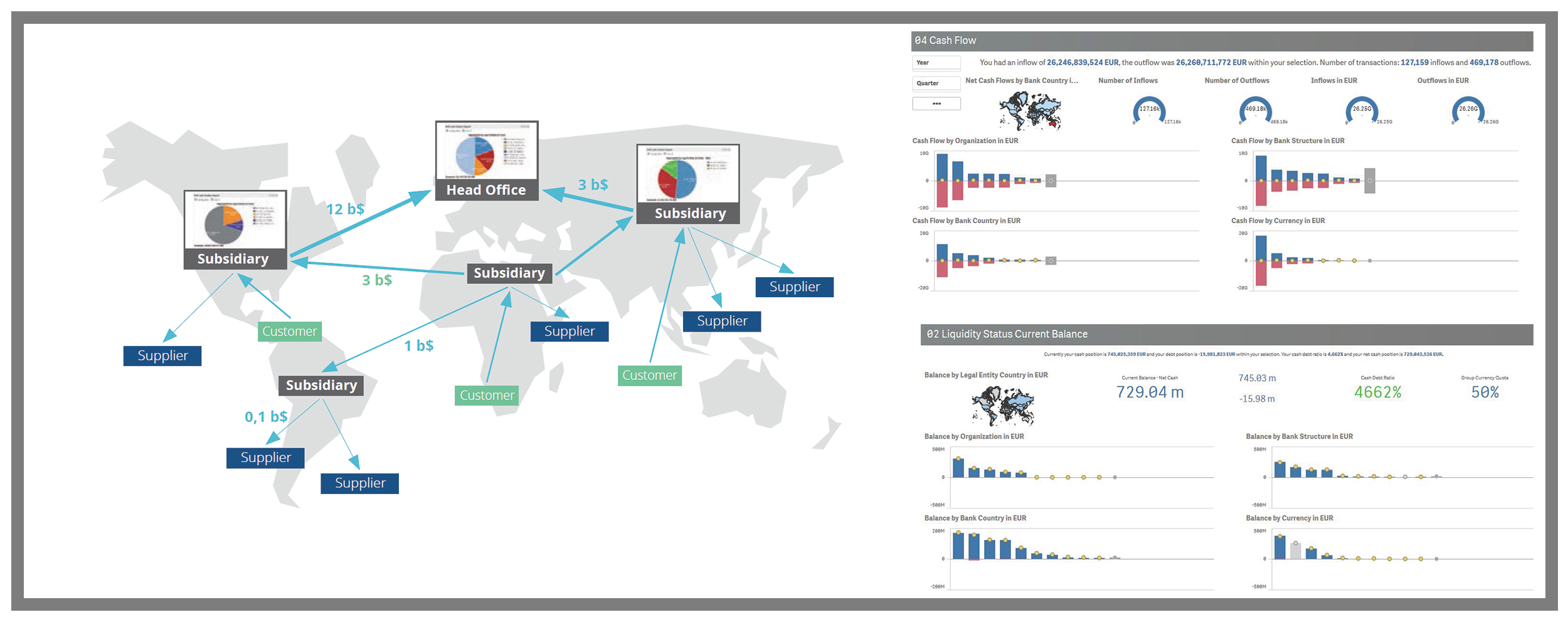

How do strategic professionals decide on the best path to success for their company? The key is in transparency and real-time reporting. If it comes to the responsibility of the treasurer or financial professional this means deciding about company-wide cash flow and liquidity levels, bank, customer and supplier relations and working capital.

How do strategic professionals decide on the best path to success for their company? The key is in transparency and real-time reporting. If it comes to the responsibility of the treasurer or financial professional this means deciding about company-wide cash flow and liquidity levels, bank, customer and supplier relations and working capital.

There are lots of discussions concerning risk, but let us start by trying to define what we mean by risk. In today’s article I will focus on liquidity risk. Many companies have very significant credit needs and this needs to be formally addressed with a credit analysis procedure in place. In my former articles I dealt with

There are lots of discussions concerning risk, but let us start by trying to define what we mean by risk. In today’s article I will focus on liquidity risk. Many companies have very significant credit needs and this needs to be formally addressed with a credit analysis procedure in place. In my former articles I dealt with

With globalisation and an increasingly complex business environment, having an efficient and centralised payment system is vital to any multinational’s success. Recognising this, we at HSBC are proud to have successfully connected to Treasury Intelligence Solutions (TIS) in Asia for automated payment and bank statement processing.

With globalisation and an increasingly complex business environment, having an efficient and centralised payment system is vital to any multinational’s success. Recognising this, we at HSBC are proud to have successfully connected to Treasury Intelligence Solutions (TIS) in Asia for automated payment and bank statement processing.

Prior to the sale of an SME, the shareholder/director is often advised to make early steps to prepare for a business transfer. This would increase the value at the moment of the sale, thus resulting in higher proceeds from this sale. At this point, many questions arise, like ‘what should be done?’, ‘how does this work?’ and ‘what are expected results?’. The lack of clear answers is a major cause for not making right choices and taking adequate steps in practice. Which leads to disappointing outcomes at the time of sale. Timely preparation for a business transfer is supported by four major pillars: working capital management, investment policy, cost effectiveness and business rigidity. My third book, titled “Werken aan Waardestuwers? Over waarde en klinkende munt!” (in Dutch) is about this topic.

Prior to the sale of an SME, the shareholder/director is often advised to make early steps to prepare for a business transfer. This would increase the value at the moment of the sale, thus resulting in higher proceeds from this sale. At this point, many questions arise, like ‘what should be done?’, ‘how does this work?’ and ‘what are expected results?’. The lack of clear answers is a major cause for not making right choices and taking adequate steps in practice. Which leads to disappointing outcomes at the time of sale. Timely preparation for a business transfer is supported by four major pillars: working capital management, investment policy, cost effectiveness and business rigidity. My third book, titled “Werken aan Waardestuwers? Over waarde en klinkende munt!” (in Dutch) is about this topic.

Op

Op