| 19-4-2017 | François de Witte |

In the past, a bank mandate for a company was a fairly simple affair. There were panels of signatories (paper-based) and payments were controlled by the banks based upon the DOA (delegation of authority).

However there remained a lot of risks:

- Many individuals at different levels could engage the firm with purchase orders. This implies that the control should be at that level, rather than the payment authorization.

- Dealing mandates were not used frequently for financial market operations. The business was done based upon a personal relationship and many transactions were initiated verbally.

- There was no overall database of who could engage the company, nor a check if these persons were still working in the company.

Over time, dealing mandates have become more common. The concept of limits, which was already in use for payments, was also introduced for the financial market operation. Corporates used the bank to police these different limits, essentially expecting banks to verify each signature against the mandate and to check limits for each dealer.

With the growing complexity of the business, and the increased use of electronic banking channels, for several corporates, the management of the bank mandates is now a real challenge. If you have a complex business with a very large number of accounts, it is very difficult to have an overview of who has the power to sign transactions, what is the delegation of authorities and which is the link with the legal database of the company.

In addition, most of the banks have their own set of documents and the bank account management communication with the banks is still largely paper-based.

In order to streamline these processes, SWIFT developed some years ago its e-BAM initiative, aiming at streamlining these processes. Also vendors have started to bring new solutions in the market.

The current article aims to make a status on the question and to highlight some opportunities to rationalize the process.

Main pain points and requirement of the corporates

When discussing with corporates, I usually identify the following pain points in the management of the bank mandates:

- No linkage between the DOA (delegation of authority) and the BAM (Bank Account Management)

- Lack of consistency between legal and finance databases: linked to the organization updates, restructurings, people turnover, etc.

- Internal Control issues:

- Safety and operational risks (access rights, lost or forgotten accounts)

- Management & control: rules of compliance & segregation of powers

- A lack of audit trails, logging control and traceability

- No global oversight : Multiple data sources: decentralization and update issues

- No automation, resulting in daily time-consuming, manual tasks (turnover, reorganizational changes, dormant/ inactive accounts…) both often non-auditable and non-compliant

- Lack of standardized and transparent processes scattered across the corporation, especially regarding bank accounts, signatures, authorizations and/or limits

- Signatory information in e-Banking tools often differing from internal data of the corporate, e.g. after an employee has left the company

- Exchange of information via fax, mail or courier

- Costly archiving, printing and posting to internal systems (ERP, TMS, electronic banking interface, etc.)

- Compliance issues linked to the lack of segregation of duties : this can possible lead to audit points

- Multiple stakeholders and systems (ERP, TMS, electronic banking, …)

- Heavy compliance requirements such as the KYC

- Operational and fraud risks

Typically, the main requirements of corporates are to:

- Have at the central treasury department the visibility and control over all the bank accounts maintained globally, including the authorizations, limits and signatories per bank account

- Be able to effectively store bank account related information and documentation, as well as centrally managing the processes on the lifecycle of this information in one central database

- Be able to use a standardized and transparent workflow for bank account management (opening and closing, access rights monitoring, authorization and limit setting, etc.)

- Have an automated system that corporates can use for electronic opening, closing and maintenance of bank accounts, including generation of audit reports

- Build one central repository with digitized electronic documentation (a single version of truth), with auto-generation of documents and correspondence

- Keep an audit trail on who had ad every moment mandate over the bank accounts

- Be able to quickly revoke mandates of persons who are no longer in their position, or who left the company

- Have the banks accepting an increased use of an electronic exchange of bank account management information

Initiatives taken by SWIFT

Some years ago, SWIFT launched the e-BAM initiative. eBAM is based on the exchange of ISO 20022 XML messages, developed by SWIFT, which mainly cover the processes of opening, closing and changing bank accounts and mandates.

The SWIFT eBAM message formats provide both the standardized format, necessary to communicate account management information between companies and their banks. SWIFT eBAM messaging consists of specifically designed XML based file formats that allow companies and banks to conduct five common bank account management conversations. These types of conversation allow you to perform virtually all bank account management tasks electronically as outlined below:

Source: SWIFT Presentation on E-BAM

The key advantages and acknowledged benefits in adopting an eBAM solution are:

- Complete overview, control and management of all bank relationships, including bank accounts and their legally binding documents

- Compliance fulfillment through automated approval workflows for requests to open, close and change bank accounts and the respective mandates

- Secure processes for exchanging messages with banking partners, including a complete audit trail

- Complete integration with existing back-office infrastructures: ERP, TMS, HR, etc.

- Improved efficiency and cost reduction through automating manual processes and monitoring their performance

- Easy access to real-time information for strategically supporting all involved departments

There is a recognition in the market, especially with large corporations of the necessity for eBAM. Standards have evolved, solution provider came up with solutions and mono-bank platforms are being developed. But still, the standards need to be perfected. In addition, whilst several banks have developed e-BAM in their own platform, only very few banks have developed a fully-fledged e-BAM multibank solution.

BNP Paribas came up with solutions in this area and more recently Société Générale. The lack of adoption by other banks of this multi-bank solution is an obstacle for the further adoption of e-BAM.

How to start such a project:

Streamlining the bank account management is a complex project, requiring a number of steps:

- First one needs to convince internal stakeholders that account management responsibility should be migrated to a single department, such as treasury

- The next step is to put in place the BAM : inventory of all the bank accounts and mandates

- I recommend to also examine your bank database and to consider a clean-up of your bank accounts. It is likely that quite a number of bank accounts are hardly used, and that it would be more cost efficient to close them.

- It is essential to ensure the link between your legal administration (delegation of authority) and your bank mandates.

- Ensure to have a central a repository for account information, which is integrated with all your systems, including treasury management systems (TMS); bank systems; enterprise resource planning (ERP) and accounting systems, the legal and HR database, etc.

- In order to be successful, one should also improve the transparency and efficiency, by harmonizing and streamlining processes, and by ensuring that they are fully digitalized.

- Some banks already embedded eBAM in their electronic banking application. You can already start to use it, but be aware that each bank will have its own systems.

- It is important include in the project the implementation of the group internal controls and the reduction of the operational risks

- One should also examine possible restrictions for e-BAM in the local legislation of the affiliates.

- I recommend to standardize as much as possible the documentation with the different banks. Try to impose whenever possible your own documentation.

For smaller corporates, standardizes process and an Excel database can be a good solution. However for more complex organizations, managing over 100 bank accounts with over 5 to 10 banks, there can be a business case to combine the streamlining of the processes with a specialized solution, e.g. a web based “Software as a Service” (SaaS) BAM solution to automate and streamline internal processes and to digitize them. This includes a centralized document management internally and externally, towards the banks, as well as a central repository and shared directories for document storing, spread across the enterprise. This also encompasses the automation of the correspondence to the banks and the auditors. I also recommend to have a link with the legal database of the company.

There are a number of solutions in the market, such as middleware providers (e.g. TIS and PowertoPay), the offering of TMS providers and the Visual Sign solution of Equity. According to my information, Equity is the only European vendor providing an integrated link with the legal database, ensuring a close link with the Delegation of Authority, which is the source of the bank mandate.

When working on such a project, do not underestimate time needed to gather & validate information. It is a complex project which needs to be phased. Split & prioritize the different phases of the project, and keep it simple!

Conclusion

The management of bank mandates is a complex process, which in many companies is still managed manually with paper-based processes, without a central database. There is a real opportunity to automate and to digitize these processes in one central repository.

SWIFT launched some years ago e-BAM, an interesting initiative to standardize and automate these processes, including the customer to bank communication. However the adoption of e-BAM is a slow process and only very few banks are offering through multi-bank solutions.

There exist solutions in the market to develop standardized automated processes. If you have the require critical mass, it can be useful to consider them. Be aware that this is a complex exercise, as you need to ensure that the system is connected to your applications, including the legal database. But in the end, it is worth the exercise.

François de Witte

Founder & Senior Consultant at FDW Consult

More articles from this author:

Working capital management : Some practical advice on the optimization of the order to cash cycle

PSD 2: A lot of opportunities but also big challenges (Part I)

PSD 2: The implementation of PSD2: A lot of opportunities but also big challenges (Part II)

Treasury : Proposed “to do” list for 2017

In the article ‘payment threat trends’ on FinExtra.com you can read that the European Payments Council provides an insight into the latest developments on threats affecting payments, including cybercrime. You can also download the document, which is divided in two sections. One analyses threats including denial of service attacks, social engineering and phishing, malware, mobile related attacks, card related fraud, botnets, etc… Another section aims to include early warnings on threats related to emerging technologies which could lead to potential fraud, including cloud services and big data, internet of things and virtual currencies.

In the article ‘payment threat trends’ on FinExtra.com you can read that the European Payments Council provides an insight into the latest developments on threats affecting payments, including cybercrime. You can also download the document, which is divided in two sections. One analyses threats including denial of service attacks, social engineering and phishing, malware, mobile related attacks, card related fraud, botnets, etc… Another section aims to include early warnings on threats related to emerging technologies which could lead to potential fraud, including cloud services and big data, internet of things and virtual currencies.

Our expert Carlo de Meijer is our blockchain specialist and publishes his articles on a regular basis. We present his latest article about blockchain and supply chain finance in a shorter version.

Our expert Carlo de Meijer is our blockchain specialist and publishes his articles on a regular basis. We present his latest article about blockchain and supply chain finance in a shorter version.

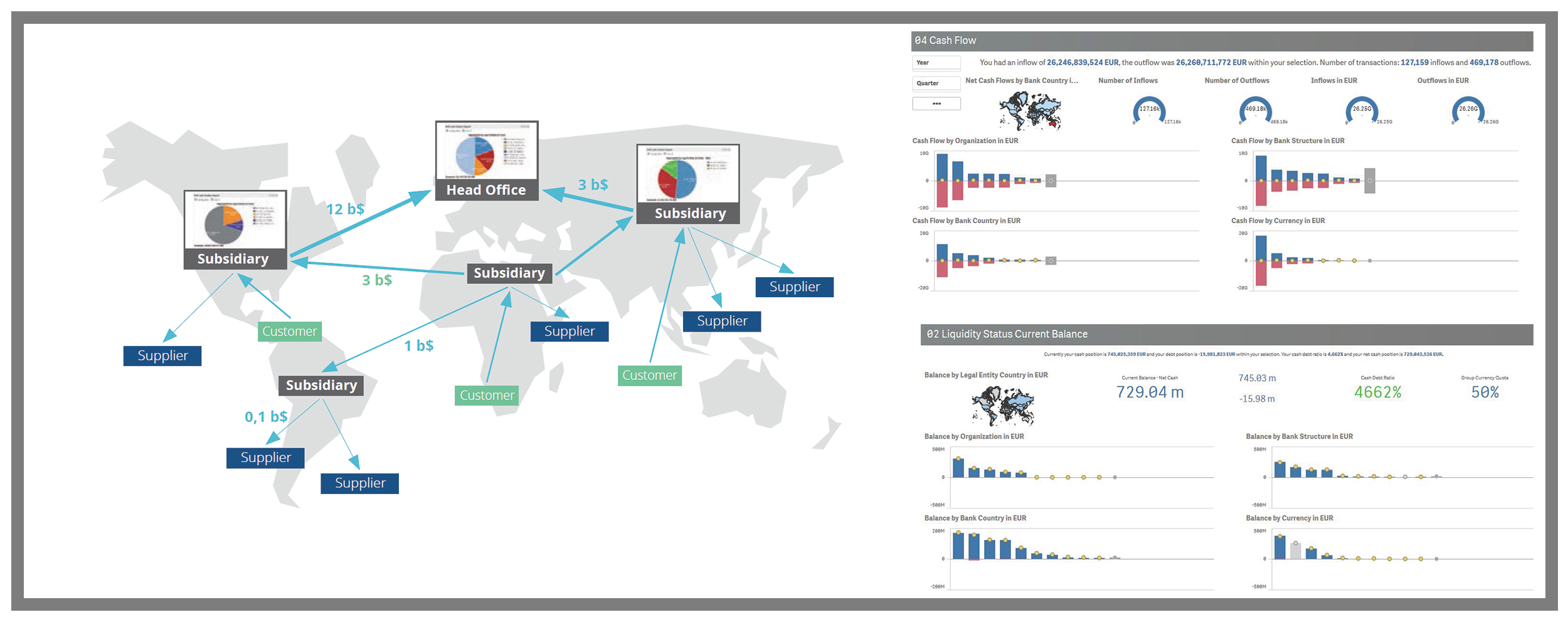

How do strategic professionals decide on the best path to success for their company? The key is in transparency and real-time reporting. If it comes to the responsibility of the treasurer or financial professional this means deciding about company-wide cash flow and liquidity levels, bank, customer and supplier relations and working capital.

How do strategic professionals decide on the best path to success for their company? The key is in transparency and real-time reporting. If it comes to the responsibility of the treasurer or financial professional this means deciding about company-wide cash flow and liquidity levels, bank, customer and supplier relations and working capital.

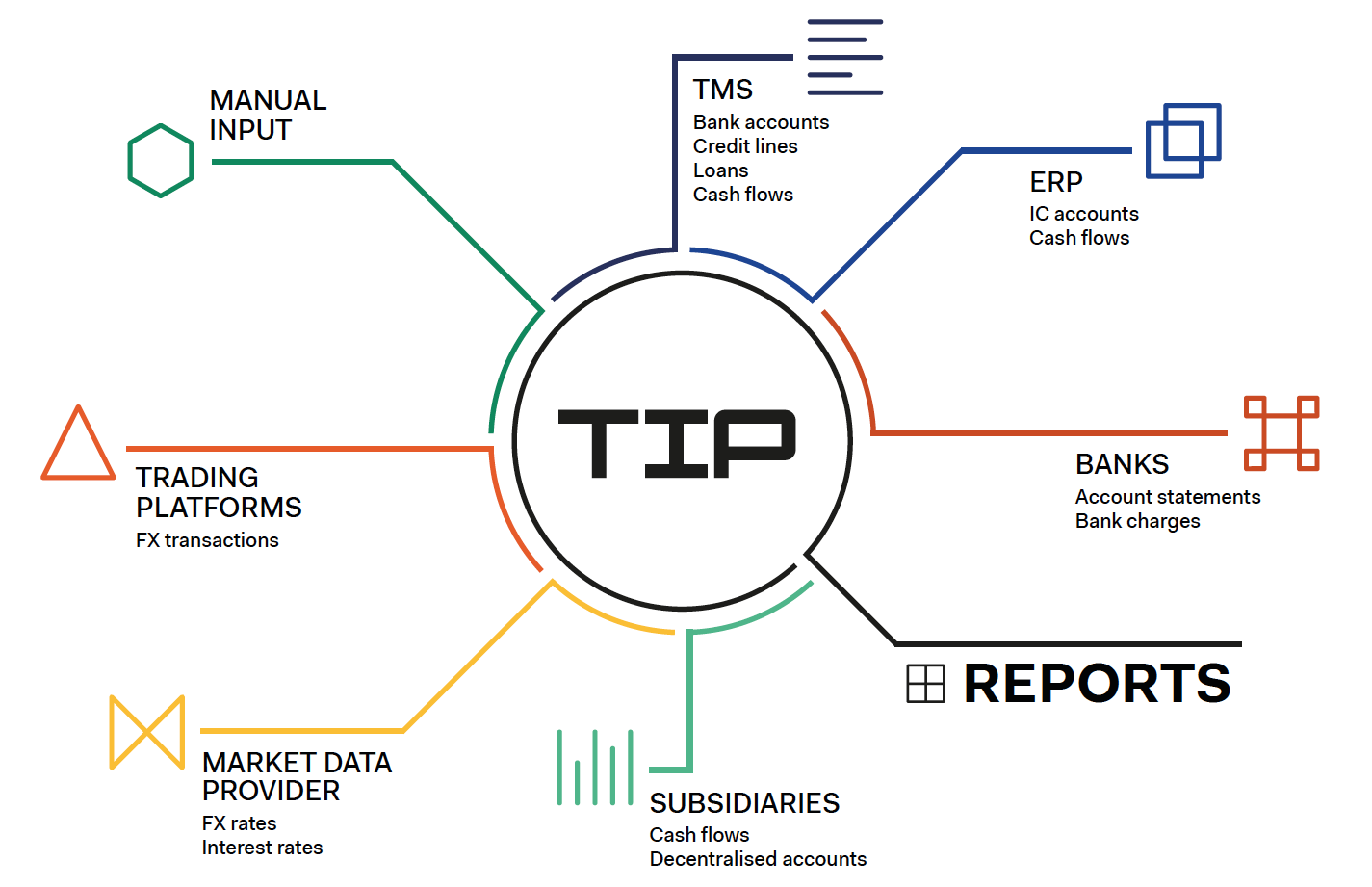

Hubert Rappold from TIPCO Treasury & Technology, puts the case for a treasury information platform (TIP), which acts as an information hub for the treasury department and reduces companies’ reliance on “Excel-based monstrosities” that are doomed to fail.

Hubert Rappold from TIPCO Treasury & Technology, puts the case for a treasury information platform (TIP), which acts as an information hub for the treasury department and reduces companies’ reliance on “Excel-based monstrosities” that are doomed to fail.

Hubert Rappold – CEO at

Hubert Rappold – CEO at

In 2014 publiceerde expert Mark van de Griendt een artikel over de voordelen (en nadelen) van SEPA en IBAN, die toen werden ingevoerd en Electronic Bank Account Management. Intussen zijn SEPA en IBAN al bekende fenomenen, maar Electronic Bank Account Management is alleen maar complexer geworden, zeker in het tijdperk van Fintech. Reden genoeg om nog een keer terug te kijken op wat Mark toen zei. Intussen zijn processen veranderd en zijn er nieuwe uitdagingen bijgekomen. Maar wij denken dat wat hij schrijft nog steeds actueel is…

In 2014 publiceerde expert Mark van de Griendt een artikel over de voordelen (en nadelen) van SEPA en IBAN, die toen werden ingevoerd en Electronic Bank Account Management. Intussen zijn SEPA en IBAN al bekende fenomenen, maar Electronic Bank Account Management is alleen maar complexer geworden, zeker in het tijdperk van Fintech. Reden genoeg om nog een keer terug te kijken op wat Mark toen zei. Intussen zijn processen veranderd en zijn er nieuwe uitdagingen bijgekomen. Maar wij denken dat wat hij schrijft nog steeds actueel is… Mark van de Griendt – Cash Management Expert at

Mark van de Griendt – Cash Management Expert at

In July 2016 our expert Pieter de Kiewit wrote an

In July 2016 our expert Pieter de Kiewit wrote an