Why Is Bank Independency Important?

|12-7-2017 | Mark van de Griendt | PowertoPay/Unified Post | Sponsored content |

As financial technologies develop, bank independency is something more and more companies adopt. Bank independency not only means that financial streams are dealt with online and require less manual interventions (straight through processing). Mainly not having to rely on the services provided by the bank where the account is held is also an important one when talking about bank independency. A couple of things mentioned below emphasise the importance of being, or becoming, bank independent.

As financial technologies develop, bank independency is something more and more companies adopt. Bank independency not only means that financial streams are dealt with online and require less manual interventions (straight through processing). Mainly not having to rely on the services provided by the bank where the account is held is also an important one when talking about bank independency. A couple of things mentioned below emphasise the importance of being, or becoming, bank independent.

The changing landscape

Since the economic crisis, the banking landscape has become a more dynamic environment. Besides banks going bankrupt we have also seen banks that have withdrawn themselves in certain geographical or business areas. This gave CFO’s in the corporate sector headaches for having to find another bank and to ‘move’ its business. A good example of a (sudden) change of the financial landscape is the Brexit. Not knowing what the Brexit will bring in this perspective, one thing we do know is that the changing banking landscape is here to stay.

Where using bank-independent tools, products or instruments doesn’t solve the problem of finding another bank, it does take away having to start up a time-consuming project changing the applications used in the various financial processes. Bank independency will become more and more common as the banking landscape continues to change.

Formats & Interfaces

Another good reason to use bank independent solutions is not to find yourself in a so called lock-in situation when looking at file-formats and interfaces. Where local formats or proprietary interfaces may have their benefits, formats and interfaces will be subject to change or even may be replaced by the bank offering the service. Recently a bank had decided to phase out a proprietary reporting format. Although this was done with an alternative reporting format and customers had a reasonable period to migrate, many of them were confronted with major changes in their business applications from which many of them being legacy systems.

Again in this case using a bank independent solution will not prevent you from change but a good bank independent solution or tool will offer the flexibility to deal with this type of change outside the corporate IT domain. Still a project but one with less impact on the organisation. When using fully bank independent instruments (for example MT101) the number of changes are limited to a bare minimum and in case of compliance will always be dealt with by the vendor as part of its service.

Cost Savings

Last but not least a bank independent will save costs. Of course there is an investment consideration with regards to a bank independent solution but when looking at the business case the benefits of not having to manage changes due to compliancy or technological developments will in most cases create a break-even point somewhere in year 2.

Recent customer case-studies even showed a significant decrease in costs in year 1 simply by not having to change its output from their applications creating payment instructions when expanding their business to other regions using new local banks. By itself not a bad investment, even when leaving the non-qualified benefits of bank independency aside.

Mark van de Griendt – Cash Management Expert at PowertoPay

Mark van de Griendt – Cash Management Expert at PowertoPay

[button url=”https://www.treasuryxl.com/community/experts/mark-van-de-griendt/” text=”View expert profile” size=”small” type=”primary” icon=”” external=”1″]

[separator type=”” size=”” icon=””]

Please also read: 7 reasons why you should do e-invoicing too.

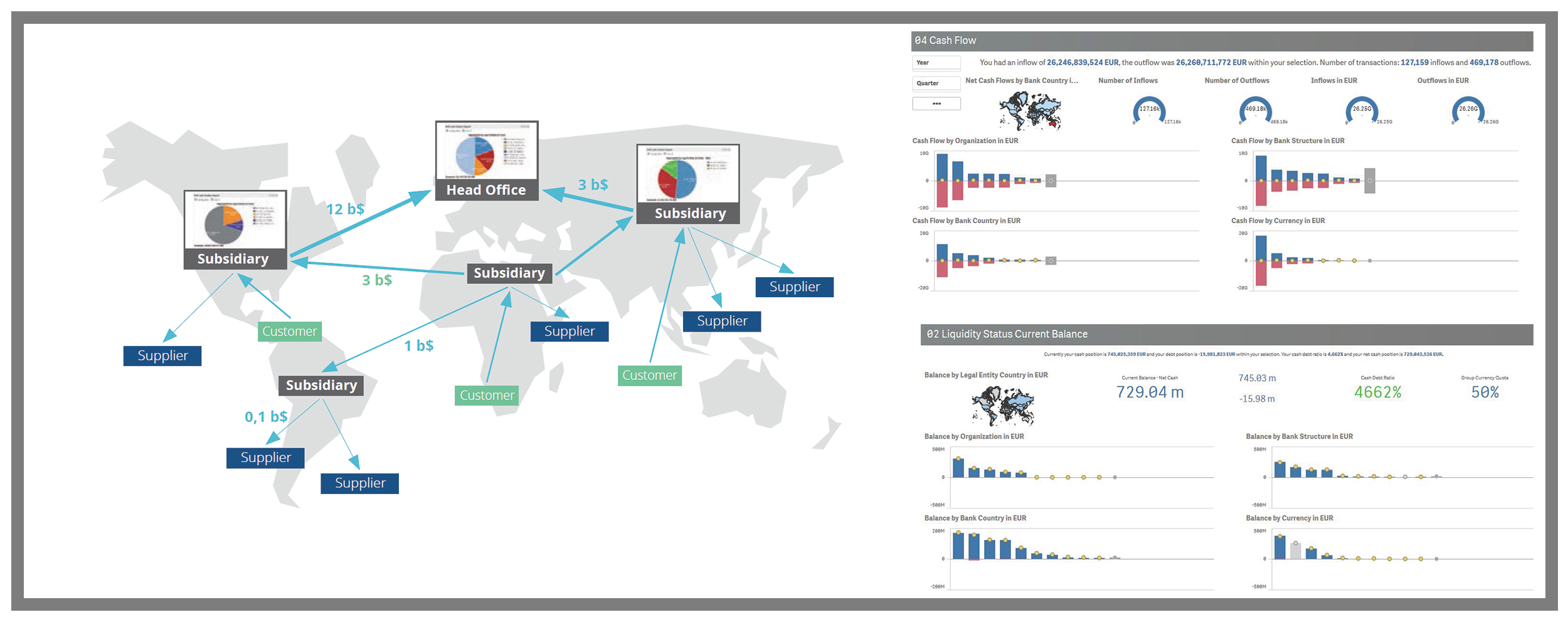

From now on, Faber-Castell will be organising its cash flow forecasting, accounts and derivatives with TIP. Regardless of where in the world, TIP allows the many subsidiaries of the multi-national to forecast and plan without major time inputs. Data capturing is decentralised while data analysis is centralised.

From now on, Faber-Castell will be organising its cash flow forecasting, accounts and derivatives with TIP. Regardless of where in the world, TIP allows the many subsidiaries of the multi-national to forecast and plan without major time inputs. Data capturing is decentralised while data analysis is centralised. Hubert Rappold – CEO at

Hubert Rappold – CEO at  E-invoicing is more than just a PDF that you send via e-mail. It’s a fully-automated process that enables receivers to get the invoice directly into their financial system. In this blog our expert Mark van de Griendt van Power toPay/Unified Post has summed up some of the key benefits for senders and receivers of electronic invoices.

E-invoicing is more than just a PDF that you send via e-mail. It’s a fully-automated process that enables receivers to get the invoice directly into their financial system. In this blog our expert Mark van de Griendt van Power toPay/Unified Post has summed up some of the key benefits for senders and receivers of electronic invoices.

In their first session

In their first session

Proferus

Proferus Cashforce Cash forecasting 2.0

Cashforce Cash forecasting 2.0 The main task of a treasurer is linked to cash management and short term funding and investments. This is the common practice in the Dutch corporate market, but this is by far not the right view on treasurer’s tasks and responsibilities. In the UK and USA the treasury function is more based on a position close to the CFO, being responsible for the corporate financial strategy and being an advisor for the financial framework of a company. A treasurer is more than a operational position in the company.

The main task of a treasurer is linked to cash management and short term funding and investments. This is the common practice in the Dutch corporate market, but this is by far not the right view on treasurer’s tasks and responsibilities. In the UK and USA the treasury function is more based on a position close to the CFO, being responsible for the corporate financial strategy and being an advisor for the financial framework of a company. A treasurer is more than a operational position in the company.

How do strategic professionals decide on the best path to success for their company? The key is in transparency and real-time reporting. If it comes to the responsibility of the treasurer or financial professional this means deciding about company-wide cash flow and liquidity levels, bank, customer and supplier relations and working capital.

How do strategic professionals decide on the best path to success for their company? The key is in transparency and real-time reporting. If it comes to the responsibility of the treasurer or financial professional this means deciding about company-wide cash flow and liquidity levels, bank, customer and supplier relations and working capital.