Making the most of Open Banking for corporates

20-04-2022 | Cobase | treasuryXL | LinkedIn |

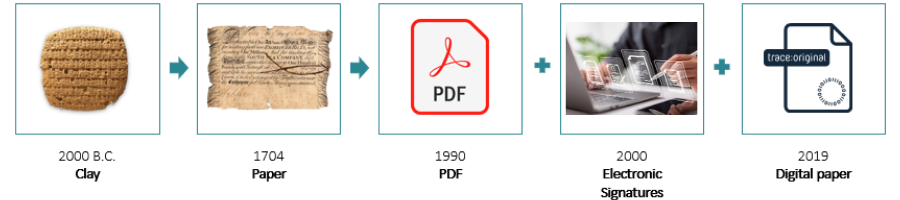

Open Banking has come a long way in just a few years. Many banks around the world now offer APIs for account reporting or payment initiation, and several banks also offer other products and services via APIs.

So far, most banks have invested in APIs for consumer banking because they believe they can achieve a competitive advantage, or because they must comply with regulations such as PSD2.

When we look at use cases for corporate banking, the maturity level of APIs offered by banks is still rather low and it is expected that most banks will take a few years to get to the minimum level required for corporate customers.

Corporates typically want to connect their accounting software, ERP system or other software with their banks and using APIs for this can bring a variety of benefits for corporates. But these customers have different needs to consumers and therefore have some specific requirements.

Benefits include:

- Availability of balance and transaction information in real-time to enable more accurate and timely decision-making

- Payment execution in real-time, enabling more optimized cash management

- Fast connectivity to new banks, especially for corporates who work via partners that already have implemented connectivity with specific banks via their APIs

However, while banks may be keen to encourage corporates to use APIs they are not a panacea for all bank connectivity challenges.

For example, current APIs often require the use of a bank-specific hardware token or mobile app, which is prohibitive for those clients that wish to work with a number of banking partners. Additionally, APIs delivered by banks often assume that a human is initiating the session whereas corporates may be looking for an automated connection from their systems.

There is also limited standardisation, which means that integrating and maintaining these APIs may require a degree of specialisation that would not be available to most corporates.

When a corporate uses a bank connectivity provider, ERP or TMS provider or other provider that has already integrated the bank’s API it is relatively easy to connect with the bank, especially compared to traditional interfaces such as SFTP or SWIFT.

On the other hand, if the corporate has to integrate the API itself, it will become clear that the technical aspect of that process can be rather time consuming because each bank offers its own API and there is no industry standard yet.

So making the most of Open Banking will involve answering questions such as:

- Which products or services do we need from our banks?

- Which APIs and/or other interfaces do we need from our banks for those products/services?

- Can my banks offer the required products or services via APIs?

- Can these APIs be used for corporate banking processes, meaning can I connect my corporate systems directly and schedule automated interfacing with my banks?

- Do we integrate the APIs ourselves or will we need a solution partner to do that?

When it comes to future connectivity, corporates also need to consider whether their provider will be able to move to Open Banking APIs once banks make them available and is able to provide APIs to the corporate’s ERP environment.

It would be unwise to select a provider only to encounter implementation issues as soon as these new opportunities become available. Determining whether providers can facilitate such a move involves checking on their ability to handle external APIs (from banks, for instance) and whether they have the right licences and capabilities to connect via APIs to the corporate’s systems once they are ready.

We will explore issues relating to cash management optimisation projects and identifying the right bank connectivity partner for your company in the remaining blogs in this series.

A reality check on Open Banking

To know more about the benefits of new developments in bank connectivity for treasury and cash management you can download our white paper. It offers insights into how corporate treasurers and cash managers can avoid pitfalls.