In House Bank – Your Money Works For You Under Your Watch

24-06-2025 | Most banking and corporate treasury experts agree that inhouse bank is a concept, an organization , a function that is created in multi national businesses.

24-06-2025 | Most banking and corporate treasury experts agree that inhouse bank is a concept, an organization , a function that is created in multi national businesses.

10-06-2025 | Is banking industry going to be disrupted ? Will there be AI bank(s) or Banks enabled by AI in 2030.

14-12-2023 | How does Fintech impact the payments and corporate treasury landscape? And what are the opportunities for fintech entrepreneurs in the EU?

02-10-2023 | Can Treasury Go From Support to Strategic Function? | Kurth Smith on the Corporate Treasury 101 Podcast

23-02-2023 | treasuryXL | LinkedIn |

Download the comprehensive eBook on Treasury function, compiled by treasuryXL. This valuable resource covers a wide range of relevant topics including Treasury, Corporate Finance, Cash Management, Risk Management, and Working Capital Management.

Drawing on the expertise of Treasury professionals and their best practices, we have carefully crafted clear and concise articles that provide you with the most crucial information about the key topics in the world of Treasury.

In this eBook, we take a deep dive into each Treasury function and explore:

Whether you are new to Treasury or an experienced practitioner looking to expand your knowledge, this eBook is an essential resource that will help you stay up-to-date with the latest best practices and insights in the field.

We simply giveaway two presents for you! By signing up for our newsletter you will automatically receive the following in your inbox:

Subscribe, Join, Download and Relax.

Welcome to our community and have fun reading!

Director, Community & Partners at treasuryXL

14-02-2023 treasuryXL | Treasurer Search | LinkedIn

Join us for a thought-provoking Live Session on Interim Treasury Management, where our experts will delve into the pros and cons of this exciting market.

Unlock the Benefits of Interim Treasury Management: Discover Why it’s a Must-Have for Your Business!

Our panel of seasoned interim treasurers, including Emiel van Maris, Francois De Witte, and treasury recruiter Pieter de Kiewit, will share their valuable insights and experiences.

This webinar is designed for aspiring interim managers, potential clients, and anyone interested in learning more about this market.

Don’t miss this opportunity to gain tips and tricks from the experts in the field and engage in an open discussion.

Register now to secure your spot!

Everyone is welcome to this webinar.

🌟Moderator: Pieter de Kiewit of Treasurer Search

🌟Duration: 45 minutes

𝘉𝘺 𝘳𝘦𝘨𝘪𝘴𝘵𝘦𝘳𝘪𝘯𝘨 𝘺𝘰𝘶 𝘤𝘰𝘯𝘴𝘦𝘯𝘵 𝘵𝘰 𝘳𝘦𝘤𝘦𝘪𝘷𝘪𝘯𝘨 𝘤𝘰𝘮𝘮𝘶𝘯𝘪𝘤𝘢𝘵𝘪𝘰𝘯𝘴 𝘧𝘳𝘰𝘮 𝘵𝘳𝘦𝘢𝘴𝘶𝘳𝘺𝘟𝘓 𝘳𝘦𝘨𝘢𝘳𝘥𝘪𝘯𝘨 𝘵𝘩𝘦 𝘭𝘢𝘵𝘦𝘴𝘵 𝘵𝘳𝘦𝘢𝘴𝘶𝘳𝘺 𝘪𝘯𝘴𝘪𝘨𝘩𝘵𝘴. 𝘠𝘰𝘶 𝘮𝘢𝘺 𝘸𝘪𝘵𝘩𝘥𝘳𝘢𝘸 𝘢𝘯𝘺𝘵𝘪𝘮𝘦. 𝘗𝘭𝘦𝘢𝘴𝘦 𝘳𝘦𝘧𝘦𝘳 𝘵𝘰 𝘰𝘶𝘳 𝘗𝘳𝘪𝘷𝘢𝘤𝘺 𝘗𝘰𝘭𝘪𝘤𝘺.

We can’t wait to welcome!

Best regards,

Kendra Keydeniers

Director, Community & Partners

07-02-2023 | Eurofinance | treasuryXL | LinkedIn |

Join senior treasury peers on March 7th in London at EuroFinance’s 10th annual Effective Finance & Treasury in Africa. Understand changing developments and the unique opportunities and challenges of doing business in this dynamic region.

This year’s speaker line-up includes experienced treasurers – all active in African markets – including:

● Edward Collis, Treasurer, Save the Children

● Neiciriany Mata, Head of finance, Angola Cables

● Marta de Teresa, Group treasurer, Maxamcorp

● Chigbo Enenmo, Finance and treasury manager, Nigeria LNG

● Folake Fawibe, Integrated business service lead, Danone, Southern Africa

● Jan Beukes, Group treasurer, MultiChoice Group

They will discuss important topics including cash and FX, payments, liquidity and financing, digital transformation, share success stories and provide practical guidance on how to optimise your treasury operation for growth.

For the full agenda and to register, please visitt this link.

Quote discount code MKTG/TXL10 for an exclusive 10% discount for TreasuryXL readers.

If you have any questions, you can contact the EuroFinance team directly at [email protected].

31-01-2023 | François de Witte | treasuryXL | LinkedIn |

treasuryXL expert François de Witte will lead the upcoming advanced training on PSD2 & Open Banking, exploring its impact on finance and new challenges. Read below more

This training program prepares participants for 2 major challenges of the upcoming years in banking: PSD2 and Open Banking. This will have a major impact on the financial ecosystem and will create new challenges.

The goal of this training course is to:

12-01-2023 | treasuryXL | LinkedIn |

A new year, a new edition in which we discuss the latest treasuryXL poll results. It is encouraging that once again many treasurers participated in the vote. We examined the voting patterns of treasurers and gathered the perspectives of experts Jack Gielen and Konstantin Khorev on the topic of APIs in treasury.

It is commonly understood that APIs are prevalent in today’s digital landscape. However, corporate treasurers can also reap benefits from API technology and its advantages. If you are unsure about the importance of APIs in Treasury or need more information, you should definitely watch the recording of the joint webinar together with Cobase on the future of APIs. It is encouraging that once again many treasurers participated in the vote. The current treasuryXL poll remains open and we encourage you to continue to have your voice heard! You can cast your vote on this link.

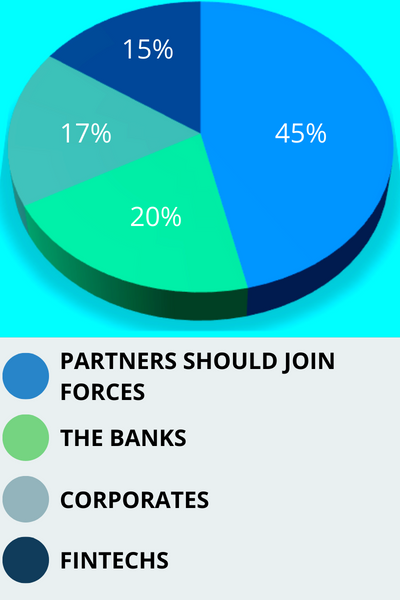

Question: Who should “give a push” and work on APIs?

That looks quite straightforward: partners should join forces. Do the treasuryXL experts agree, or what is their view on this?

Jack voted for the option that partners should join forces.

“APIs and the benefits are clearly on the map but there is also an understanding that there is still work to be done before those benefits will really be realised”

It is good to see that regarding the results of this poll, the market agrees that the success of corporate APIs and OpenBanking requires cooperation and cannot be dictated by 1 party. This means Treasurers clearly understand the complexity of the playing field. At the moment, although there are many initiatives by individual parties, there is a need to create a good partnership where the whole eco-system works together

The main benefits that APIs could realise if banks and companies were to work together are:

These benefits translate into being able to use the systems the treasurer has chosen more efficiently and better, more up-to-date insight into status, exposures and required actions.

Recently, Cobase set up the webinar “The Future of APIs” in collaboration with treasuryXL to discuss this topic. I was particularly impressed by the level of knowledge Treasurers have gained over the past year which was also reflected in the questions. APIs and the benefits are clearly on the map but there is also an understanding that there is still work to be done before those benefits will really be realised. Ultimately, the priority with the end customer, the treasurer, will determine how quickly other market players act.

Konstantin voted for the option that partners should join forces.

“By working together, we can achieve a more efficient and effective treasury management system.”

I agree with the majority view that the implementation of APIs in the treasury field should be a collaborative effort. Banks will play a key role in implementing these changes, but it is also crucial for corporates and TMS providers to set and specify the requirements. This ensures that the solutions being implemented align with the unique needs and goals of each individual corporate, and TMS providers can develop the tools and services necessary to support these needs. By working together, we can achieve a more efficient and effective treasury management system.

Recently, my latest article on this topic was published on treasuryXL. In it, I try to make it plain that APIs are a nice and easy solution, although they come with some limitations and challenges. At the same time, I believe that the future of bank connectivity lies in API technology. What do you think?

22-12-2022 | François de Witte | treasuryXL | LinkedIn | On December 1, 2022, I had the opportunity to attend in Brussels a panel discussion on “Is the EU market ready for instant payments?”. The event was organized by CEPS (1) and ECRI (2), and featured several prominent speakers.