21-11-2022 | treasuryXL | Kurt Smith | LinkedIn |

Meet our newest expert for the treasuryXL community, Kurt Smith.

Kurt is a Director of Marengo Capital, a corporate advisory company specialising in treasury, financial markets, corporate finance and private equity. Marengo Capital has a track record of, and passion for, creating and managing for long term enterprise value by aligning corporate strategy, finance and risk.

Kurt is also the Vice President and Technical Director of the Australian Corporate Treasury Association, a member of the Australian Payments Network Stakeholder Advisory Council, and a member of FX Markets Asia Advisory Board. His career includes senior positions across fund management, bank derivative trading, Fintech, private equity and corporate treasury. He has a Ph.D in Finance and is a graduate of the University of Cambridge.

Kurt is an engaging and compelling public speaker with substantial experience in presenting, being a panellist and master of ceremonies, for intimate and large audiences in Australia, Asia, Europe, and the United States. He is well known for providing unique insights into new and well-worn issues, balancing contrarian thinking with informed judgment, and communicating highly technical issues to non-technical audiences.

We asked Kurt 9 questions, let’s go!

INTERVIEW

1. How did your treasury journey start?

I started in financial markets, firstly as a portfolio manager with a macro fund, and secondly as an FX option trader and Head of Derivative Trading for a commercial bank. While I enjoyed the excitement, spontaneity, and commercial pressure of each day, I wanted something more fulfilling.

I became a Director in two FinTech companies commercialising option valuation and risk management technologies, one for the interbank exotic option market and the other for retail investors. Sourcing capital for product development was a constant challenge but also very rewarding. By this stage I was hooked on corporate treasury. Treasury allowed me to direct my passion for financial markets to create, operate and scale businesses by funding growth and making them financially sustainable.

I then moved to a $10B+ corporate to run their treasury, corporate finance and insurance businesses. My main responsibility was developing and implementing capital management and financial risk management strategies to ensure that the company target credit rating was achieved, while obtaining funding, allocating capital to investments, and hedging market exposures to reduce earnings volatility.

I am now a Director of Marengo Capital which specialises in creating and managing for value in corporate treasury and corporate finance. I am still involved in FinTech as the Group CFO of a cash flow securitization company; and I am also the Vice President and Technical Director of the Australian Corporate Treasury Association, which is engaging with and improving the treasury community in Australia.

2. What do you like about working in Treasury?

I like that the success of the company is in your hands. The company can formulate exciting corporate strategies and business plans, but those strategies and plans will not be delivered unless capital is sourced, structured and allocated properly, and financial risks are hedged to provide corporate resilience to business cycle downturns and adverse economic conditions.

When you think about it, it is a massive responsibility. However, I prefer to think of it as a fantastic opportunity to make an impactful contribution.

3. What is your Treasury Expertise and what expertise gives you a boost of energy?

My specialist expertise is in creating and managing for long term enterprise value. Increasing value is critical to increasing the capital funding capacity of the company and delivering into the main goals of Executives and the Board. Most treasurers consider treasury a cost centre and do not have ambition to add value. To me, that makes treasury a tax on the business, an overhead to be recovered by everyone else. I believe that there are a large number of ways that treasury can add substantial value, by increasing cash flow not just forecasting it, managing the capital structure to reduce the cost of capital, and evaluating the allocation of capital to investments to ensure value accretive and efficient returns.

While I get a kick out of applying commercial acumen to improve businesses, I really get a kick out of convincing others to do the same, from decision-makers to operational teams. I get very enthusiastic – but I truly believe that value is the key to financial sustainability, which is necessary for companies to do more of what they want to do.

4. What has been your best experience in your treasury career until today?

I built a very high-functioning treasury and got team members to work on several projects simultaneously in small multi-disciplinary teams. Team leadership was based on expertise not the hierarchy, and it not only provided all team members with rapidly growing CVs to support their careers, it also provided opportunities for, and the most satisfying discovery of, junior employees with real talent fast tracking into leadership succession planning. This way of working was new to all of us, and we created a lot of value and had a lot of fun doing it!

5. What has been your biggest challenge in treasury?

I worked for a capital-intensive company that had rapidly growing capital expenditure to be funded predominantly by debt, during an expected aggressive interest rate tightening cycle. The rates market had already factored five sequential monetary policy tightenings into the yield curve, such that fixed rates for term debt were very high. Our analysis showed that in most foreseeable scenarios floating rates would outperform fixed rates, even during sharp tightening cycles. We went with the maximum allocation to floating rates, and over the next five years interest rates decreased markedly, and we used those decreases to gradually re-weight floating rate exposure back to their neutral weight.

This was a real risk management lesson for me, that is applicable now. One has to take emotion out decisions, especially fear, do the analysis and trust your instincts. Worked for us!

6. What’s the most important lesson that you’ve learned as a treasurer?

Communication is crucial, especially verbal communication.

Executives, Boards and operational teams do not understand treasury and corporate finance. Treasurers need to be able to communicate complex technical information in a persuasive and compelling way to non-technical audiences. For example, I prepared a 35-page capital management strategy working paper that I turned into a six-page Board paper, and my presentation to the Board was a single diagram on one slide. If they were not convinced in the first few minutes, all that work would have been wasted. Communication is key, and I believe it is a defining characteristic between the best and the rest.

7. How have you seen the role of Corporate Treasury evolve over the years?

Corporate treasury was formerly a satellite of the business that was involved at the end of the value-chain, to be engaged only when funding of spend and hedging of exposures was required. As a result, treasury did not influence decisions, it just implemented them.

Good corporate treasuries today are deeply integrated with, and embedded into the DNA of, their businesses; and, as a result, are involved at the beginning of the value-chain where they can influence outcomes. This is a much more interesting space to play in.

8. What developments do you expect in corporate treasury in the near and further future?

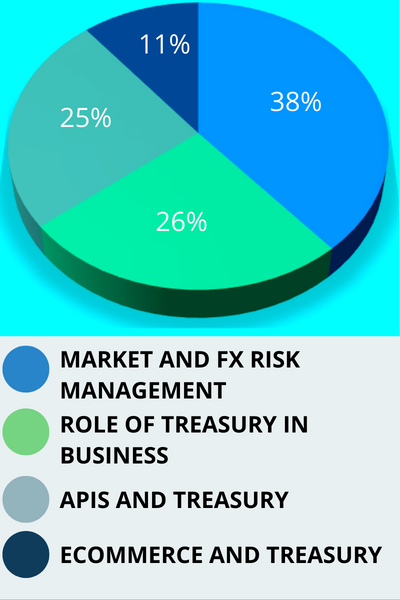

Everyone is focusing on using technology, digitalisation and data rich environments to reduce operational risk, release resources and gain insights. This is understandable given the change in the technology landscape and eco-system.

However, I believe that we will have to focus increasingly on our human resources as we re-examine whether the treasury operating model, governance architecture, people, processes and systems are fit-for-purpose not only now, but for the future. Are our selection processes biased towards technocrats with limited ability to engage and communicate? Do we hire and / or cultivate businesspeople with commercial acumen? Do we encourage out-of-the-box innovation or do we effectively enforce the status quo through a relentless drive for efficiency? I see treasury as a business within a business, and that it should be run as such.

9. Is there anything that you would like to share with our treasury followers that they must know from you?

As a community of treasury professionals we all have a responsibility to improve the standard of the profession, and to contribute to the recognition of the profession as a profession! In this regard, treasuryXL is doing a fantastic job of bringing us all together and giving us opportunities to share, learn, explore and discuss treasury. Let’s make sure that we contribute more than we take out, so that we add value overall.

Want to connect with Kurt? Click here

Thanks for reading!

Kendra Keydeniers

Director Community & Partners, treasuryXL