Q&A with German Karaivanov | GTreasury Report

22-12-2022 | treasuryXL | GTreasury | LinkedIn |

GTreasury has compiled a market report in conjunction with PNC in order to provide actionable insights for mid-to-large companies with multinational operations and small treasury teams. The report finds that CFOs and Treasurers remain optimistic, and focus on reducing inefficiencies and streamlining operations.

What will be the road ahead for CFOs and Treasurers? treasuryXL wanted to know more and held a Q&A with GTreasury’s VP of Product Management: German Karaivanov. Read below for German’s takeaways and thoughts on the report.

Q&A with German Karaivanov

At a high level, what are the three biggest takeaways corporate treasurers should glean from this report?

The new Pressure Points, Payments & Plans for Automation: The Road Ahead for CFOs and Treasurers survey report—conducted by Topline Strategy and commissioned by GTreasury and PNC Bank—finds corporate treasurers and CFOs are acutely focusing on three transformation goals right now. The first focus is fueling growth: treasurers and CFOs are eager to reduce costs wherever they can, but still need to be able to spur growth by improving risk management practices and getting more granular (and predictive) with their cash visibility, among other initiatives on this front.

Deploying more modernized treasury technology was also reported as essential to navigating market uncertainty—opening the door to more data-backed opportunities that can directly tie into business goals.

Also among the top-line takeaways: treasurers and CFOs are clearly ready to enter a new phase of automation for treasury functions (and across their organization’s broader financial groups). While early automation efforts had more of an ERP focus, respondents signaled that they are increasingly prepared to adopt more mature automation into their systems and apply it strategically to meet modern treasury and finance needs.

What were the demographics of the survey?

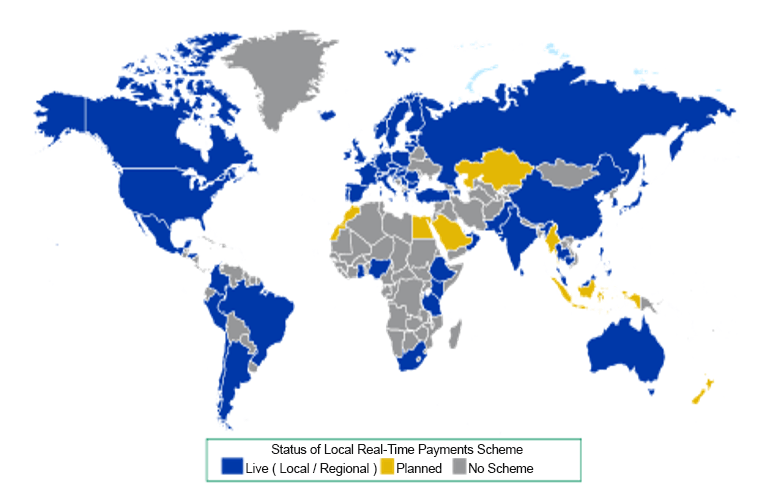

The report surveyed 93 finance executives and corporate treasurers from more than 20 industries. Participants represented large and mid-sized enterprises in both the United States and abroad. We purposely wanted to ensure a cross-section sample that wasn’t over-pinned to any one geography or industry.

CFOs and treasurers seemed to have differing opinions in a few areas covered in the report. Was this surprising?

CFOs and treasurers are on the same page in that they’re both pressing to make treasury practices more automated, more accurate, and more efficient. But CFOs in the survey show a clear preference for prioritizing cost efficiency. Corporate treasurers, on the other hand, tend to champion improved treasury functions and operational efficiency—and that proved especially so when it comes to achieving real-time insight into cash positions. There was a clear divide here, but I don’t think it was all that surprising. More CFOs need to understand that they can have it both ways. Adding more treasury functionality, integrations, and automation will make treasury operations more efficient, both with treasury technology budgeting and with the bandwidth it frees up for treasury teams to focus on the most urgent and critical business-growth initiatives.

But even for their differences, both CFOs and treasurers do plan to leverage new banking and treasury systems to achieve their goals. Strategic technology implementations that offer process modernization and automation will reduce costs by eliminating inefficiencies and provide treasurers with optimal tooling—checking boxes for CFOs and treasurers alike.

Technology modernization is certainly a theme of the survey. In what areas do treasurers and CFOs seem especially excited about transformation?

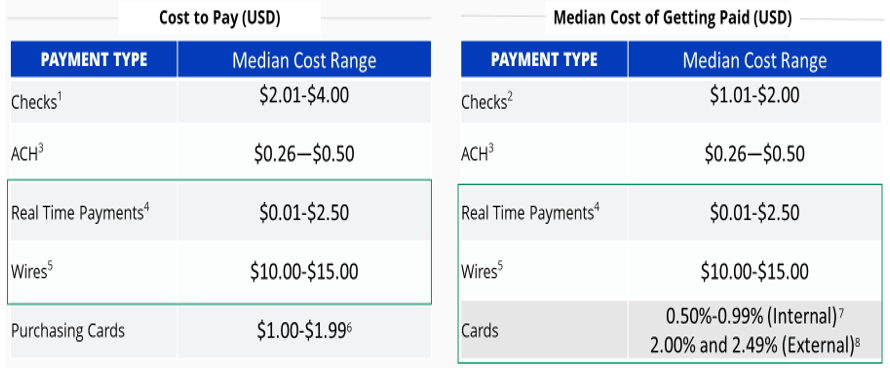

82% of survey respondents reported payment automation as a very or extremely important focus area for their planned software projects. It was clearly the highest automation priority. CFOs and treasurers view payment automation as delivering higher staff productivity, process efficiencies, improved cash visibility, enhanced fraud protection, compliance assurance, and modernized processes aligned with the demands of the digital economy. It seems clear that payment automation will come a long way in 2023. Other high-priority focuses for software modernization projects included accounts receivable, billing, and financial planning and analysis.

I found the results around digital transformation concerning: more than half of survey respondents said they didn’t yet have a formalized digital transformation plan even though there was a clear (and increasing) interest in making technology investments. Organizations either sticking with outdated, legacy systems are increasingly at risk as their competition advances. There’s also the internal experience: it’s easier for CFOs to hire and retain top treasury talent if their organization is using technology that makes treasurers’ jobs smoother and more efficient.

But when it comes to digital transformation, there is good news. Given the current volatile market, organizations that start their digital transformation now will likely be able to realize the benefits of their initiatives particularly quickly.

The report was conducted by a third-party, but backed by GTreasury and PNC Bank—one of the biggest banks in the United States. What is GTreasury’s relationship with PNC Bank?

GTreasury’s partnership with PNC Bank is a strategic alliance, one that enables us to bring a range of cash and FX risk management products to the market as part of PNC’s extensive digital channels and services.

Thank you for reading!