Option Tales : Cheap Options part IIII

| 07-06-2016 | Rob Söentken |

Today in the closing part of Rob Söentken’s Option Tales: When buying options it is tempting to see if the premium expenses can be minimized. A number of solutions are possible, which I’ve discussed in four articles. You can read about choosing the average rate option (ARO) and the conditional premium option in my previous article. In this closing part I will discuss the Reverse Knock Out (RKO) option.

Reverse Knock Out (RKO) option

One of the most common options used as alternative to a vanilla option is the Reverse Knock out option. It is a vanilla option which ceases to exist after the underlying reference rate has traded through a certain level, the ‘trigger’ or ‘KnockOut’. This trigger event determination can be either

- only at maturity (‘European’ trigger monitoring),

- during the entire tenor (‘American’ trigger monitoring),

- during on or more parts of the tenor (‘window’ trigger monitoring), or

- on specific moments during the tenor (‘Parisian’ trigger monitoring)

The term ‘Reverse’ means that the option has been ITM before the trigger was hit. Just when the option was starting to make money it ceases to exist after the market touches the trigger. Unlike a vanilla option the value of an RKO is capped by a potential trigger event. Therefor RKOs are a usually a lot cheaper than vanilla options which have unlimited value potential.

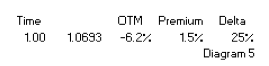

In diagram 6 an example is given of a 12-months USD call option costing 1.5%. Alternatively, one could consider buying an RKO option with same tenor and strike, with a European Knock Out trigger at 12.4% OTM. This costs 0.9%. There is only 8% chance the market is below the trigger at maturity. (The Delta of a vanilla option is 8%, which is also the chance of being below the strike at maturity). Therefor there is only 8% chance that the RKO expires worthless. Which could be a dramatic result for a hedge, especially considering the USD has appreciated by more than 12.4%, making the actual hedging cost showing a big loss. For a premium saving of only 0.6%.

So, to minimize premium expenses when buying options there are seven solutions to think about:

1. Choose Out of The Money strike (OTM)

2. Choose Shorter Tenor

3. Choose Longer Tenor

4. Compound Option

5. Average Rate Option (ARO)

6. Conditional Premium Option

7. Reverse Knock Out option (RKO)

Ex-derivatives trader