Debt Compliance – can you make the grade?

| 01-12-2017 | Paul Stheeman |

We welcome a new expert – Paul Stheeman, who immediately brings us an interesting topic that has not been covered in much detail up to now. It goes to show that there are many facets in the role of treasurer and we can constantly find new subjects that have not been approached. Thank you, Paul.

We welcome a new expert – Paul Stheeman, who immediately brings us an interesting topic that has not been covered in much detail up to now. It goes to show that there are many facets in the role of treasurer and we can constantly find new subjects that have not been approached. Thank you, Paul.

Depending on the financing method chosen, your company is likely to have debt or some kind of financial obligations to third parties. This can be in the form of loans, bilateral or syndicated, or in the form of a bond issue. In each case, the underlying agreement has to be well-documented and could be very extensive with several hundred pages of legal language which, for a non-lawyer, may be very difficult to understand.

In that documentation there will be clauses stating what the debtor is allowed and not allowed to do. Another important part of the agreement will be around financial covenants. These are usually ratios which the debtor has to regularly fulfil. It is commonly the responsibility of the Treasurer to ensure that the terms of the agreements are adhered to and to report the status of the covenants to the lenders and investors. To be able to do this the Treasurer will have to work closely with the company’s lawyers, the accountants and the Controller. He furthermore has to “educate” key internal stakeholders in the requirements, so that they also are aware of any hurdles which may prohibit them in carrying out their day-to-day business. This whole process is commonly known as debt compliance.

A loan agreement will typically have between one and five financial covenants which need to be tested and reported to the lenders on a quarterly or semi-annual basis. One of many examples of financial covenants is a coverage covenant, which requires the debtor to maintain a minimum level of earnings or cash flow relative to certain expenses, e.g. interest or debt service. Typically, such numbers are prepared in the accounting department, but the Treasurer will have to ensure that these figures are prepared timely and are within the thresholds allowed in the financing agreements. If these criteria are not met, then the debtor will be in breach of the covenant(s) and technically will be in default.

Default can also arise when so-called prohibited transactions are entered into or “basket” limits are overdrawn. In many agreements the debtor is not allowed to enter into any other financial obligation. This may in practice prohibit the debtor in carrying out his normal course of business. For example, he may be required to issue a performance guarantee. This would initially not be allowed under the agreement. Lenders therefore establish baskets with a threshold amount up to which the debtor may have a bank issue a performance guarantee. Again here, it will be the Treasurer’s responsibility to ensure that all such transactions fall within allowed business or baskets.

Being in default due to a breach of a covenant or a basket could mean that the outstanding debt becomes immediately repayable in full. This is usually neither in the interest of the debtor or the lender, so that the lender can apply for a waiver. It will depend on the seriousness of the breach, but these waivers are often agreed to by the lenders. However, there will be a fee which the lender will have to pay for the waiver and this can be quite substantial.

To summarize, debt compliance is a very important part of a Treasurer’s role as the consequences of non-compliance can at best weaken the company’s position towards its lenders and at worst be disastrous as lenders call on outstanding debt to be repaid immediately.

Owner of STS – Stheeman Treasury Solutions GmbH

Op donderdagavond 14 december 2017 vindt er een Extra Voorlichtingsavond plaats voor de Postgraduate opleiding Treasury Management & Corporate Finance, aan de Vrije Universiteit Amsterdam. Dit is de laatste kans voor geïnteresseerden in de opleiding die het programma in het Nederlands willen volgen.

Op donderdagavond 14 december 2017 vindt er een Extra Voorlichtingsavond plaats voor de Postgraduate opleiding Treasury Management & Corporate Finance, aan de Vrije Universiteit Amsterdam. Dit is de laatste kans voor geïnteresseerden in de opleiding die het programma in het Nederlands willen volgen.

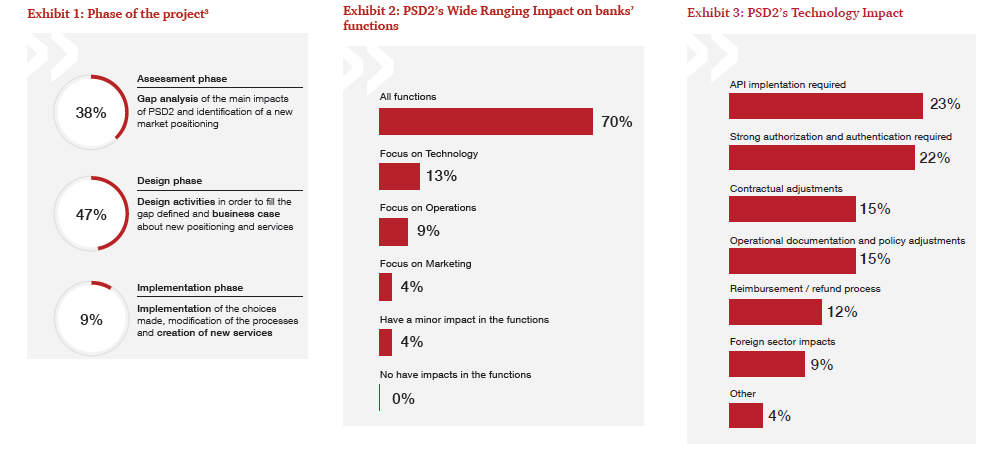

In 2018, when PSD2 comes into force, banks will lose their monopoly on payment services and customer’s account details. Bank customers will be able to use third-party providers (TPP) to administer their payments. When a customer agrees on using the services of a TPP, then their bank has to give access to TPPs to their accounts. TPPs are then able to build and offer services that compete with the existing bank services. During the summer 2017, I published a Summer Update on PSD2. Since then, a lot of things have moved, and hence I found it the right moment to provide an update to you on some developments on PSD2, in this area.

In 2018, when PSD2 comes into force, banks will lose their monopoly on payment services and customer’s account details. Bank customers will be able to use third-party providers (TPP) to administer their payments. When a customer agrees on using the services of a TPP, then their bank has to give access to TPPs to their accounts. TPPs are then able to build and offer services that compete with the existing bank services. During the summer 2017, I published a Summer Update on PSD2. Since then, a lot of things have moved, and hence I found it the right moment to provide an update to you on some developments on PSD2, in this area.

François de Witte – Founder & Senior Consultant at

François de Witte – Founder & Senior Consultant at

The DACT (Dutch association of Corporate Treasurers) will be holding their annual Treasury Fair in Noordwijk at the Hotel van Orange on 23rd and 24th November 2017 – the most important annual treasury event in the Netherlands. Discover treasury best practices, learn about the latest trends and exchange experiences. It will contain 9 practical workshops spread out throughout the day on topics including, among others, trade finance, supply chain finance, liquidity forecasting, cyber security and the Blockchain. There are more than 50 exhibitors present at the Trade Fair including Treasury Intelligence Solutions GmbH- a partner of treasuryXL.

The DACT (Dutch association of Corporate Treasurers) will be holding their annual Treasury Fair in Noordwijk at the Hotel van Orange on 23rd and 24th November 2017 – the most important annual treasury event in the Netherlands. Discover treasury best practices, learn about the latest trends and exchange experiences. It will contain 9 practical workshops spread out throughout the day on topics including, among others, trade finance, supply chain finance, liquidity forecasting, cyber security and the Blockchain. There are more than 50 exhibitors present at the Trade Fair including Treasury Intelligence Solutions GmbH- a partner of treasuryXL.

The DACT (Dutch association of Corporate Treasurers) will be holding their annual Treasury Fair in Noordwijk at the Hotel van Orange on 23rd and 24th November 2017 – the most important annual treasury event in the Netherlands. Discover treasury best practices, learn about the latest trends and exchange experiences. It will contain 9 practical workshops spread out throughout the day on topics including, among others, trade finance, supply chain finance, liquidity forecasting, cyber security and the Blockchain. There are more than 50 exhibitors present at the Trade Fair including Treasury Services- a partner of treasuryXL.

The DACT (Dutch association of Corporate Treasurers) will be holding their annual Treasury Fair in Noordwijk at the Hotel van Orange on 23rd and 24th November 2017 – the most important annual treasury event in the Netherlands. Discover treasury best practices, learn about the latest trends and exchange experiences. It will contain 9 practical workshops spread out throughout the day on topics including, among others, trade finance, supply chain finance, liquidity forecasting, cyber security and the Blockchain. There are more than 50 exhibitors present at the Trade Fair including Treasury Services- a partner of treasuryXL. The DACT (Dutch association of Corporate Treasurers) will be holding their annual Treasury Fair in Noordwijk at the Hotel van Orange on 23rd and 24th November 2017 – the most important annual treasury event in the Netherlands. Discover treasury best practices, learn about the latest trends and exchange experiences. It will contain 9 practical workshops throughout the day on topics including, trade finance, supply chain finance, liquidity forecasting, cyber security and the Blockchain. There are more than 50 exhibitors present at the Trade Fair including Cashforce – a partner of treasuryXL, who are also presenting a Workshop.

The DACT (Dutch association of Corporate Treasurers) will be holding their annual Treasury Fair in Noordwijk at the Hotel van Orange on 23rd and 24th November 2017 – the most important annual treasury event in the Netherlands. Discover treasury best practices, learn about the latest trends and exchange experiences. It will contain 9 practical workshops throughout the day on topics including, trade finance, supply chain finance, liquidity forecasting, cyber security and the Blockchain. There are more than 50 exhibitors present at the Trade Fair including Cashforce – a partner of treasuryXL, who are also presenting a Workshop. The DACT (Dutch association of Corporate Treasurers) will be holding their annual Treasury Fair in Noordwijk at the Hotel van Orange on 23rd and 24th November 2017 – the most important annual treasury event in the Netherlands. Discover treasury best practices, learn about the latest trends and exchange experiences. It will contain 9 practical workshops spread out throughout the day on topics including, among others, trade finance, supply chain finance, liquidity forecasting, cyber security and the Blockchain. There are more than 50 exhibitors present at the Trade Fair including Tipco Treasury & Technology GmbH- a partner of treasuryXL.

The DACT (Dutch association of Corporate Treasurers) will be holding their annual Treasury Fair in Noordwijk at the Hotel van Orange on 23rd and 24th November 2017 – the most important annual treasury event in the Netherlands. Discover treasury best practices, learn about the latest trends and exchange experiences. It will contain 9 practical workshops spread out throughout the day on topics including, among others, trade finance, supply chain finance, liquidity forecasting, cyber security and the Blockchain. There are more than 50 exhibitors present at the Trade Fair including Tipco Treasury & Technology GmbH- a partner of treasuryXL.