Gebrek aan voortgang in Voortgangsrapportage Rentederivaten MKB

| 13-12-2017 | Simon Knappstein |

De voortgangsrapportage van AFM die op 8 december 2017 gepubliceerd werd, bevat vooral oud nieuws. Er is verdere vertraging en zelfs de nieuwe door de banken afgegeven planningen zijn onzeker. Wat dat betreft had de AFM het passender “gebrek-aan-voortgangsrapportage” kunnen noemen. Het beeld wat blijft hangen na het lezen van deze rapportage is dat de AFM er zich bij neerlegt dat het nog wel eens erg lang kan gaan duren voordat dit dossier afgerond is.

De voortgangsrapportage van AFM die op 8 december 2017 gepubliceerd werd, bevat vooral oud nieuws. Er is verdere vertraging en zelfs de nieuwe door de banken afgegeven planningen zijn onzeker. Wat dat betreft had de AFM het passender “gebrek-aan-voortgangsrapportage” kunnen noemen. Het beeld wat blijft hangen na het lezen van deze rapportage is dat de AFM er zich bij neerlegt dat het nog wel eens erg lang kan gaan duren voordat dit dossier afgerond is.

De AFM noemt als reden voor de vertraging “Problemen met automatisering en data. De kwaliteit van de historische data van banken is niet in alle gevallen voldoende om efficiënt de compensatie op grond van het UHK te kunnen berekenen en controleren. Verder geldt dat de rentederivatendossiers van klanten zeer verschillend zijn en vaak bijzonder complex en dat heeft gevolgen gehad voor (de praktische uitwerking van) het UHK. Mede door deze knelpunten blijkt de uitvoering van het UHK in de praktijk complexer dan de banken, de externe dossierbeoordelaars en de AFM hadden voorzien. Dit betekent ook dat de door banken afgegeven planningen onzeker zijn.” Verder staat er: “Zo zijn bijvoorbeeld de derivaten- en lening-systemen veelal niet structureel gekoppeld en is een handmatig proces ingezet om de derivaten aan de juiste leningen te koppelen.” Dat die systemen niet gekoppeld zijn mag geen verrassing zijn voor de banken. Dus waarom dat op dit moment als oorzaak genoemd wordt mag eerder als verrassing gekwalificeerd worden.

De vraag die dit oproept is waarom de banken überhaupt hebben geprobeerd de oplossing te automatiseren. Mijn beste gok is dat er in een eerder stadium ingeschat is dat op de bulk van de dossiers slechts alleen stap 3 (de coulance-uitkering) van toepassing zou zijn. Het zal dan een dure misrekening zijn geweest als blijkt dat het leeuwendeel van de dossiers toch een handmatige benadering vereist. In dat geval is er een hoop geld en tijd verloren gegaan wat niet meer goed gemaakt gaat worden.

In de huidige planning, die dus onzeker is, zijn er 2 banken die verwachten eind 2017 alle aanbodbrieven te zullen hebben verstuurd, 1 bank die rekent met medio 2018 en 3 die mikken op eind 2018. Het zou nog inzichtelijker zijn als daarbij ook vermeld stond om hoeveel klanten het dan gaat per bank.

Een volgende rapportage van de AFM wordt in de zomer van 2018 verwacht. Zoals het er nu uitziet zou het al heel mooi zijn als de einddatum dan niet weer vooruitgeschoven wordt.

De AFM zegt ook in de komende periode kritisch toezicht te blijven houden op zowel de banken als de externe dossierbeoordelaars.

Owner of FX Prospect

Lees ook: Uniform herstelkader rentederivaten mkb

The markets and the ECB feel that the economy is doing very well. It can be compared to Goldilocks – not too hot and not too cold. Is it possible that the Eurozone could be entering a period of continued growth with little or no immediate prospect for rising inflation? A quick scan of the relevant markets would appear to suggest that it is possible. Let us examine where the markets are now.

The markets and the ECB feel that the economy is doing very well. It can be compared to Goldilocks – not too hot and not too cold. Is it possible that the Eurozone could be entering a period of continued growth with little or no immediate prospect for rising inflation? A quick scan of the relevant markets would appear to suggest that it is possible. Let us examine where the markets are now.

In the financial industry an option is an instrument, based on financial derivatives, that enable the buyer of the option to obtain the right, but not the obligation, to buy or sell an underlying product/asset at an agreed price on or before a certain date in the future. As simple descriptions go, this requires a lot of understanding about different subjects. It is the intention of this article to clearly explain all the terms mentioned above.

In the financial industry an option is an instrument, based on financial derivatives, that enable the buyer of the option to obtain the right, but not the obligation, to buy or sell an underlying product/asset at an agreed price on or before a certain date in the future. As simple descriptions go, this requires a lot of understanding about different subjects. It is the intention of this article to clearly explain all the terms mentioned above. Lionel Pavey – Cash Management and Treasury Specialist

Lionel Pavey – Cash Management and Treasury Specialist In May this year, fintech start-up R3 raised $107 million from a consortium of the world’s top banks. The New York-based blockchain company that works in collaboration with more than 90 banks and other financial organizations world-wide, plans to use the money to invest in further developing the Corda platform (see my blog: Corda: distributed ledger ….. not blockchain! April 6, 2016) as well as “encouraging entrepreneurs to start building on the platform though training videos and hackathons”.

In May this year, fintech start-up R3 raised $107 million from a consortium of the world’s top banks. The New York-based blockchain company that works in collaboration with more than 90 banks and other financial organizations world-wide, plans to use the money to invest in further developing the Corda platform (see my blog: Corda: distributed ledger ….. not blockchain! April 6, 2016) as well as “encouraging entrepreneurs to start building on the platform though training videos and hackathons”.

Op donderdagavond 14 december 2017 vindt er een Extra Voorlichtingsavond plaats voor de Postgraduate opleiding Treasury Management & Corporate Finance, aan de Vrije Universiteit Amsterdam. Dit is de laatste kans voor geïnteresseerden in de opleiding die het programma in het Nederlands willen volgen.

Op donderdagavond 14 december 2017 vindt er een Extra Voorlichtingsavond plaats voor de Postgraduate opleiding Treasury Management & Corporate Finance, aan de Vrije Universiteit Amsterdam. Dit is de laatste kans voor geïnteresseerden in de opleiding die het programma in het Nederlands willen volgen.

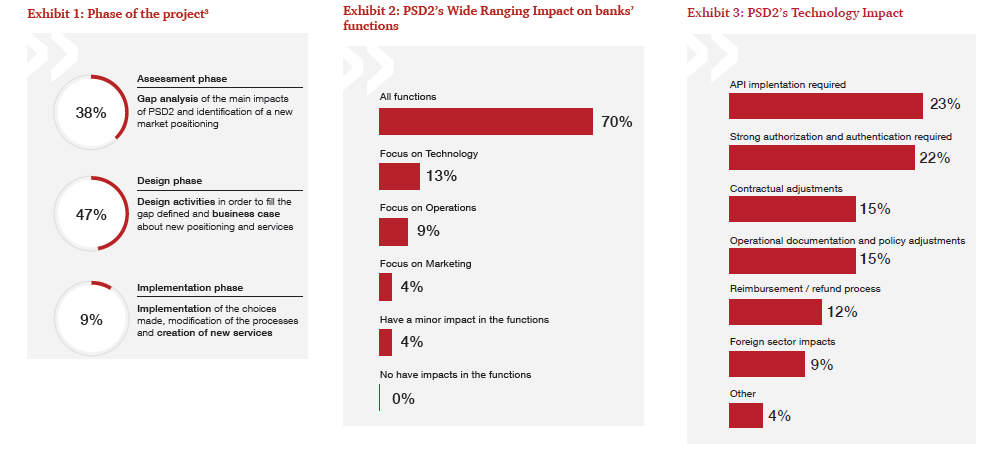

In 2018, when PSD2 comes into force, banks will lose their monopoly on payment services and customer’s account details. Bank customers will be able to use third-party providers (TPP) to administer their payments. When a customer agrees on using the services of a TPP, then their bank has to give access to TPPs to their accounts. TPPs are then able to build and offer services that compete with the existing bank services. During the summer 2017, I published a Summer Update on PSD2. Since then, a lot of things have moved, and hence I found it the right moment to provide an update to you on some developments on PSD2, in this area.

In 2018, when PSD2 comes into force, banks will lose their monopoly on payment services and customer’s account details. Bank customers will be able to use third-party providers (TPP) to administer their payments. When a customer agrees on using the services of a TPP, then their bank has to give access to TPPs to their accounts. TPPs are then able to build and offer services that compete with the existing bank services. During the summer 2017, I published a Summer Update on PSD2. Since then, a lot of things have moved, and hence I found it the right moment to provide an update to you on some developments on PSD2, in this area.

François de Witte – Founder & Senior Consultant at

François de Witte – Founder & Senior Consultant at