Will the ECB taper off its Quantitative Easing programme?

| 23-10-2017 | Lionel Pavey |

On the 26th October the ECB will have their next meeting. One of the main topics will be regarding the current QE programme and a possible announcement over its extension into 2018. Currently the ECB has, after 2 ½ years of QE, purchased more than EUR 2 trillion of mainly Government bonds. At present their monthly purchases amount to roughly EUR 60 billion per month.

A poll organized by Reuters would seem to indicate that the monthly programme would be tapered down to EUR 30-50 billion per month and possibly last for another 6 to 12 months from the start of 2018. Inflation is expected to be around 1.5 per cent till at least the start of 2019 – below the ECB target of just below 2 per cent.

However, under the current rules that govern the QE progamme the upper limit on outstanding purchases is around EUR 2.5 trillion. Taking the existing monthly purchases through to the end of 2017, implies starting 2018 with a balance of at least EUR 2.2 trillion – leaving just EUR 300 billion of headroom for future purchases. If it cut monthly purchases in half, the scheme could be extend to the end of the 3rd quarter in 2018, but no further.

Can the ECB continue QE longer than expected?

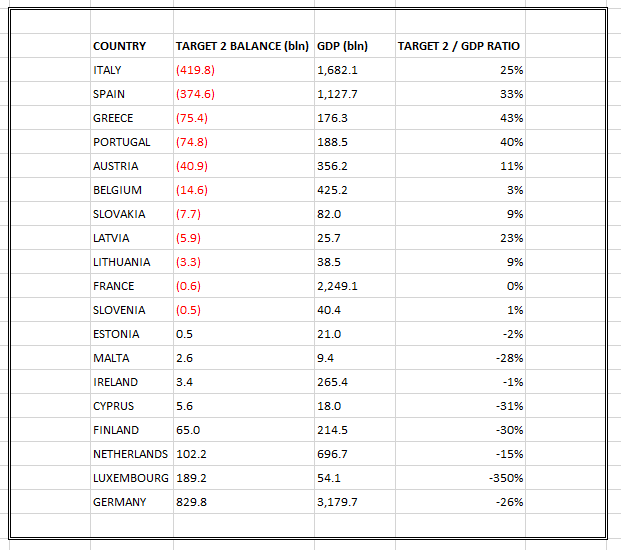

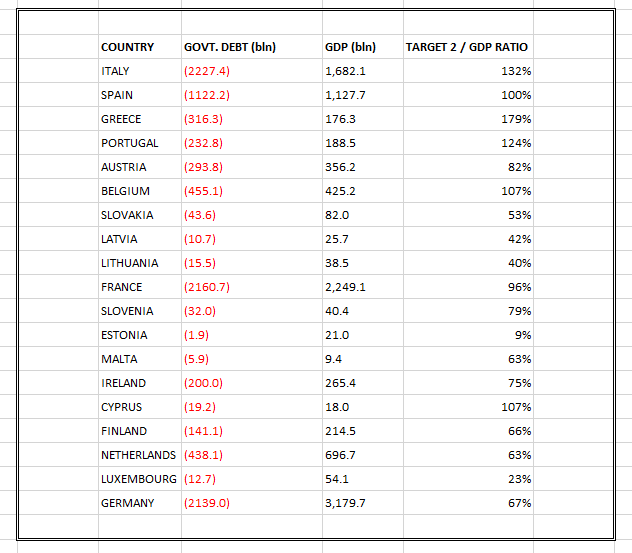

The constraints imposed on QE mainly relate to the purchase of Government bonds – maximum 33 per cent of each countries outstanding debt and maximum 25 per cent of any bond issue. The provisions written into the Maastricht Treaty clearly state that the ECB may not finance member states. QE also purchases non-bank bonds (covered bonds, corporate bonds and asset backed securities) which are subject to different criteria – maximum of 70 per cent of any bond issue.

At present, the ECB only holds about 13 per cent of the eligible bonds leaving a large headroom for future possible purchases.

It is conceivable that the ECB could reduce its purchase of Government bonds and simultaneously increase its purchase of corporate bonds, thereby maintaining liquidity to its QE programme. The major drawback is that it would reduce the amount of freely tradable corporate bonds in circulation and have an effect on their price.

What does this mean for interest rates?

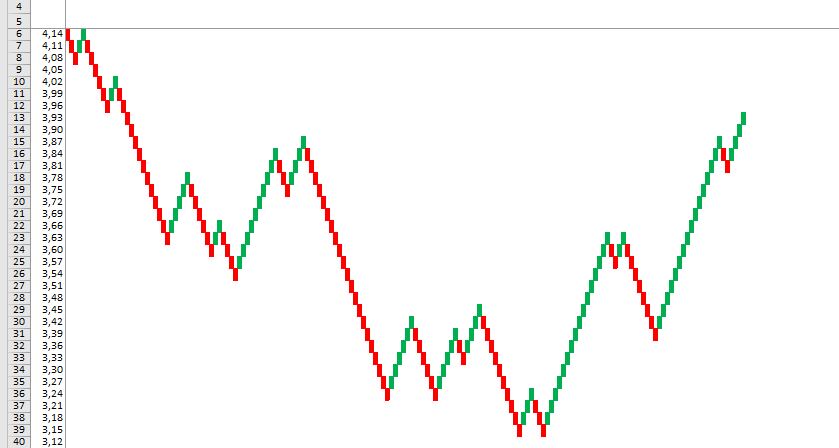

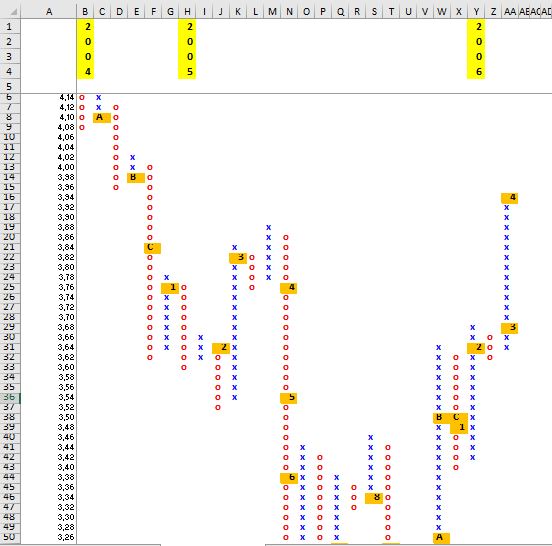

As long term debt instruments use Government bond yields as the basis for calculating their yield, when the ECB stops buying Government bonds, the yields on all other debt instruments will increase. At the moment the benchmark (German 10 year Government bonds) yield around 0.4 per cent per annum and the 10 year Interest Rate Swap yields around 0.9 per cent per annum. In 2014 (the year before QE started) German yields averaged 1.25 per cent even though they were in a downward trend the whole year. Assuming the yield spread between Government bonds and Interest Rate Swaps (IRS) remained constant, this implies 10 year IRS moving to at least 1.75 per cent. This would still be below the long term average since the inception of the EURO in 1999 that stands around 3.35 per cent, but a significant increase from the current level of 0.9 per cent.

What happens when the next crisis arrives?

The ECB is not the only central bank to use a form of QE. The Fed, Bank of England and Bank of Japan all have their own versions. When these countries also taper out their QE, naturally there will be a corresponding rise in interest rates. However, if a new financial crisis was suddenly to happen (not unthinkable at the moment) all 3 of these central banks can reapply QE to stimulate their economies. An additional increase to their balance sheets can be accommodated.

Unfortunately for the ECB the very criteria that now applies would make it impossible to restart QE. The ECB could not just increase its balance sheet – current criteria and regulation make that impossible. Any attempt to change the rules would be met by objections from national governments within the EU and legal action. The Bundesbank were very vocal in their objections to the implementation of QE in 2015 – those protests will not have softened by now.

This shows the constraints prevalent upon the EURO – monetary policy is the only tool that the ECB has at its disposal. One policy can not be used to fix all the problems present with the economies of all member states.

Cash Management and Treasury Specialist

Brexit is a fact, no news here. Discussions about how this Brexit is going to look like are an ongoing topic in the newspapers. Hard Brexit or soft Brexit – what does it actually mean for the UK and the European Union? What are the consequences of a hard Brexit compared to those of a soft Brexit to all of us? It implies there are 2 paths that can be followed – actually there are 3.

Brexit is a fact, no news here. Discussions about how this Brexit is going to look like are an ongoing topic in the newspapers. Hard Brexit or soft Brexit – what does it actually mean for the UK and the European Union? What are the consequences of a hard Brexit compared to those of a soft Brexit to all of us? It implies there are 2 paths that can be followed – actually there are 3.

In the

In the