The end of the Euro as we know it – when the party ends?

| 4-5-2017 | Lionel Pavey |

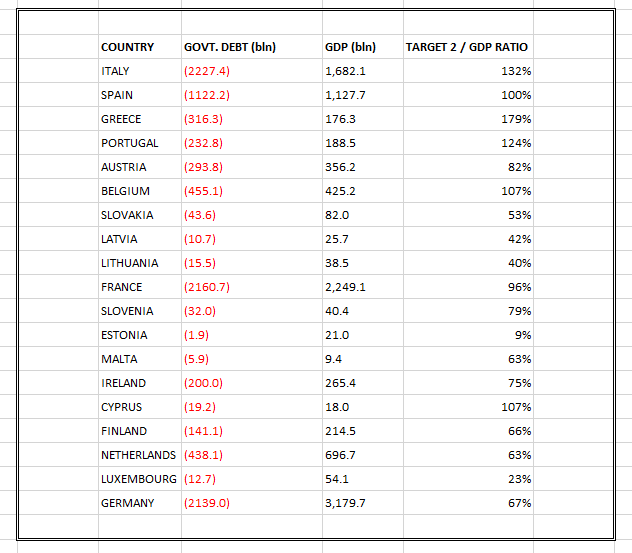

The papers are full of stories about the level of Government debt within the Eurozone (Italy has a debt to GDP ratio of more than 130%), probable new bailouts for Greece, lack of suitable bonds to purchase for Quantitive Easing, Brexit, the rise of populist rightwing politics etc. Well at least we have all the bad news out in the open – don’t we?

Target 2

A new problem has arisen that was partly accelerated by QE – namely the outstanding national balances within Target 2. This is the “Trans European Automated Real-time Settlement Express Transfer System” foe the Eurozone. The key word is “Settlement” as I shall explain.

When a financial transaction is agreed 2 actions have to happen – clearing and settlement. Clearing entails all the actions that must be undertaken up to settlement, such as delivery of bonds, securities or shares. Settlement means the exchange (transfer) of money for goods or bonds etc.

When a party in Italy buys goods from the Netherlands, they instruct their bank to debit their account and credit the account of the seller. This is a cross-border transaction. But, within the Eurozone monetary settlement does immediately take place between banks. The Italian bank will have its balance reduced at the Banca D’Italia and the Dutch bank will have its balance credited at de Nederlandsche Bank. However, the balance is not settled between the 2 central banks – a new claim is shown on their books.

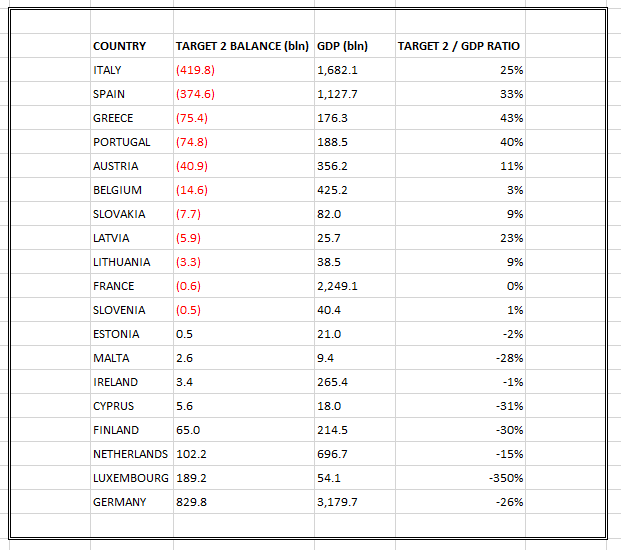

At the end of 2016, according to the Euro statistics website Italy has a negative Target 2 balance of EUR 420 billion with other countries in the Eurozone. This amount has been accumulated over the years since 1999 and now represents more than 25% of GDP. This is on top of the Italian Government debt of 130% of GDP. If a country were to leave the Eurozone they would be liable to immediately settle their Target 2 balances – something that is not realistic. Under the current agreement the other countries within the Eurozone would be liable to cover the debt. Target 2 balances do not have to be settled as countries would never default appears to be the thinking.

At the other end of the scale, Germany has an outstanding claim on other Eurozone countries of EUR 830 billion. At the moment these amounts are shown at full face value in the books – it would appear that politically, no one wants to acknowledge that the claims can not be settled in full under the current constraints within the Eurozone. If the Eurozone are 100% committed to supporting the Euro and, the balances are not going to be settled within the foreseeable future then, eventually, something will have to break.

Emperor with no clothes

Confession time – I am English (and proud of it). If I had been able to vote in last year’s referendum in the UK, then I would also have voted for Brexit. This does not make me anti-European; rather the reality of the Eurozone is very much like the fable of the Emperor with no clothes. Everyone sees it, but no one will say it. Perhaps, a solution can be found that does not mean debt forgiveness, writedowns, defaults or exits, but common sense would imply that this is wishful thinking.

When I was a young boy at Grammar School I had to learn some poetry for my English Literature exam – it included D.H. Lawrence. As a wild youth I could cope with Shakespeare, had a hard time with Chaucer, but fell in love with a poem by Lawrence entitled “A Sane Revolution”. He told us to make a revolution for fun and not in seriousness. Also I knew the poem as it was quoted by Mott the Hoople who got me through my teenage years with their music.

The creation of the Euro is a revolution in European history, but could it ever be called sane?

TARGET 2 BALANCES

Source: http://sdw.ecb.europa.eu/reports.do?node=1000004859

GOVERNMENT DEBT

Source: http://www.debtclocks.eu/select-an-eu-member-state.html

Cash Management and Treasury Specialist