28-06-2021 | treasuryXL | Kyriba |

”The pandemic has boosted automation in treasury departments and led to big increases in productivity. But that is only the start. The big prize is the value that treasury teams can generate with the man-hours that automation frees up”, says Bob Stark, Head of Marketing Strategy at Kyriba.

The Post-Pandemic Treasurer

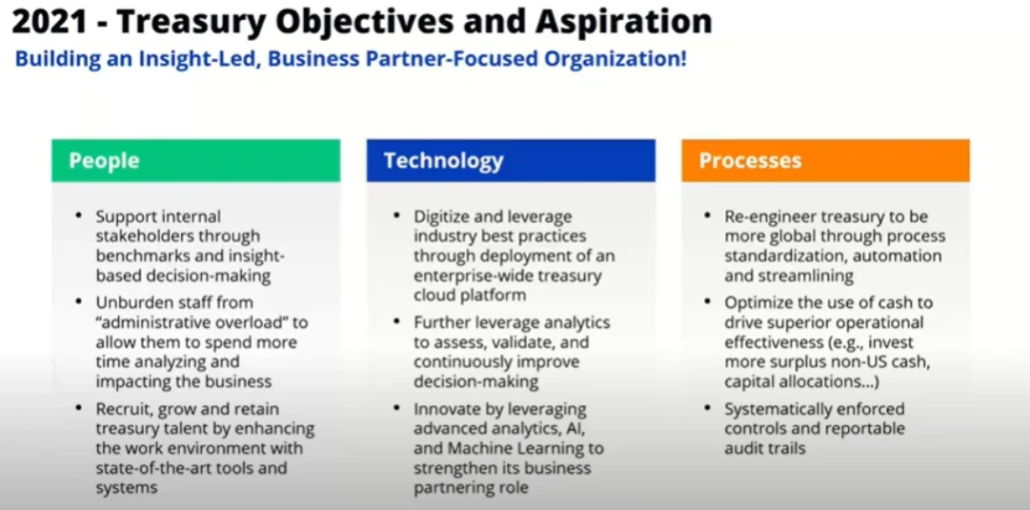

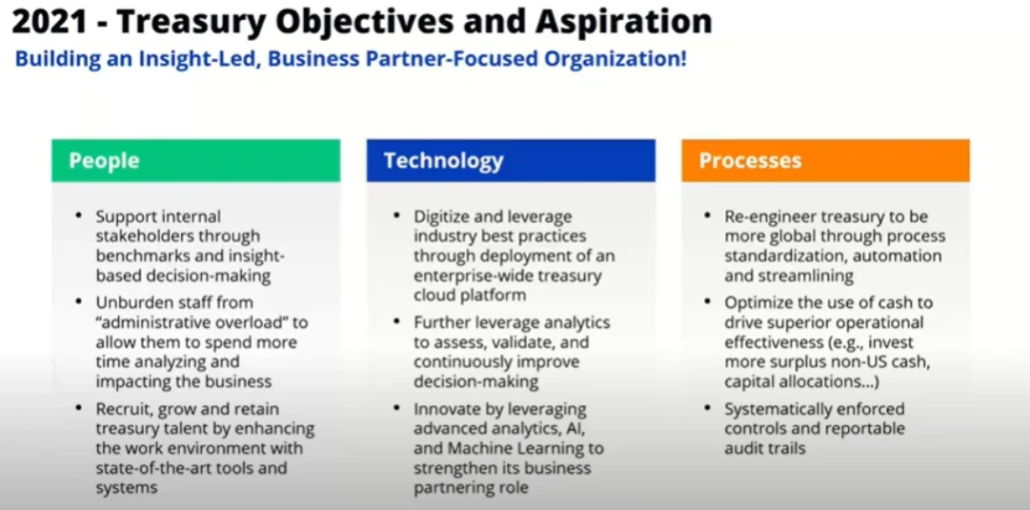

The post-pandemic world will not be a return to the previous status quo. In treasury we can look at this in three ways – people, process and technology.

In terms of people, a recent survey showed that 61% of CFOs expect their teams to be working out of the office at least a day a week in future (source: fortune.com 2020). In some ways the combination of working from home and in the office will pose its own problems, with different opportunities for fraud and mistakes. At least working from home all the time provided some consistency! Furthermore, many of the changes that treasury teams had to make suddenly last year will now become permanent.

Now let’s look at processes. Fully 78% of CFOs have changed inefficient workflows during the pandemic, and 82% intend to keep the changes that they have made in terms of automation and digitisation (source: MasterCard 2020). These changes involve the standardisation, automation and streamlining of multiple processes.

Thirdly, treasurers need to digitise and have an enterprise-wide cloud platform; to leverage analytics to assess and improve decision-making; and then to innovate through Artificial Intelligence and Machine Learning to make treasury a better business partner.

There has also been a change in the role of treasury within companies over the past 15 months. During the pandemic, treasury’s involvement in other areas of the business has increased. A treasurer’s objectives often now include more strategic aims, and the remit is likely to expand still further. In many cases this will involve increased shared responsibilities, for example reverse factoring.

Treasurers are progressing from a simple focus on productivity to making liquidity visible and then participating in strategic decisions that really add value. All of which in turn elevates the value of treasurers within their organisations.

How Treasury can add Value

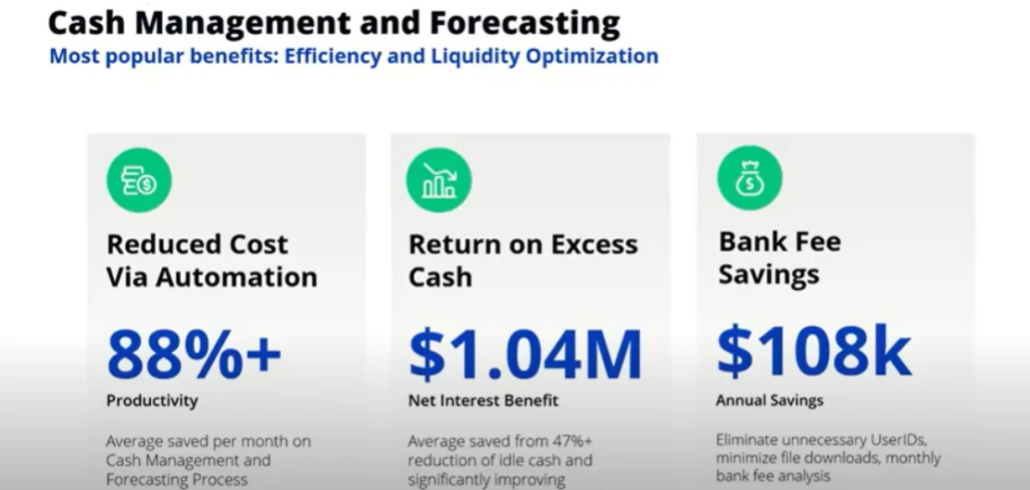

We can all agree that treasurers have the ability to add value. We regularly see our clients make significant productivity gains in terms of man-hours as they automate residual manual functions. In many cases, automating processes can save over 80% of the man-hours involved (source: Hackett Group).

But that is only part of the story. The real value comes from what the treasury team can do with all those freed-up hours. The extra time gained through improvements in productivity allows them to analyse risks (such as counterparty, liquidity and FX risk) and make better, informed decisions, based on real insight and business intelligence. Or perhaps the extra time that automation has made available can reduce the opportunity for fraud. The common aim is to leverage liquidity to drive business growth and turn treasury into a strategic business partner.

Digitisation plays a big role here, especially in areas like payments, which have remained partially manual, for example in sanctions screening. Smart contracts are also increasing, which makes for other savings.

Measuring the impact

In any such analysis it is essential to be able to measure what you are achieving. That starts with liquidity itself: how much do we have? How far forward can I forecast liquidity? How confident can I be in the accuracy of those forecasts? After all, you can only use the “excess” liquidity within your company when you are confident that you aren’t going to need it!

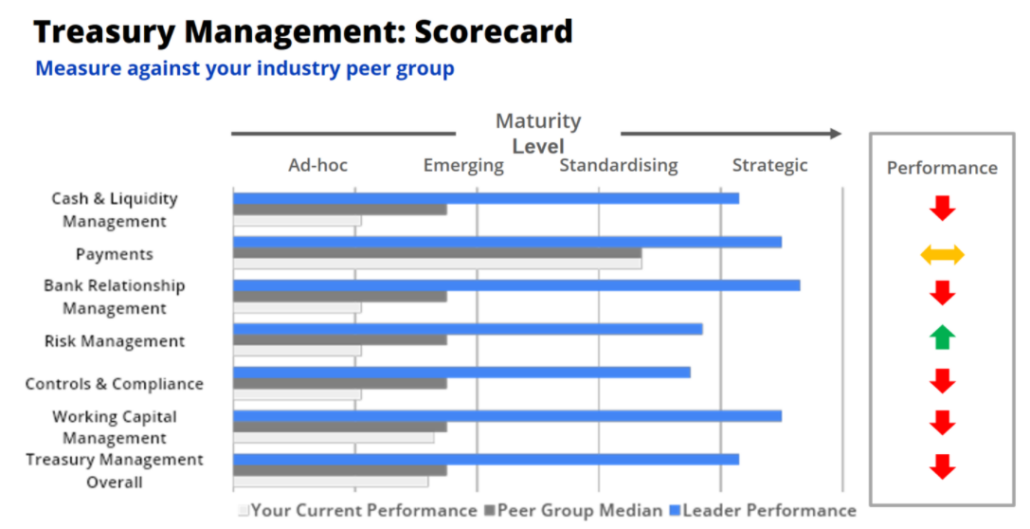

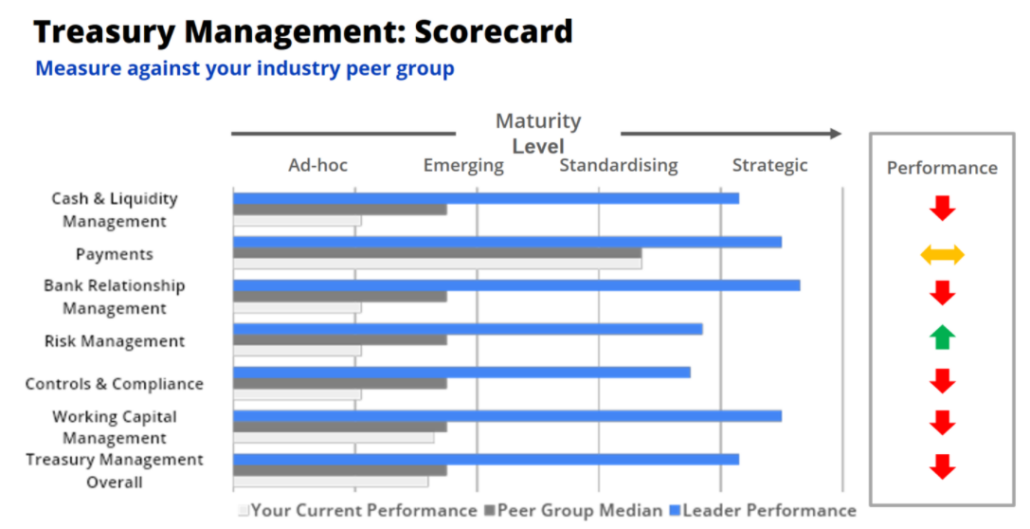

Digitisation is the way to improve the visibility of your liquidity. You can then test the accuracy of your information and decide how to use that asset. You can do this with a scorecard to measure your company against industry peers and assess your level of maturity, from Ad hoc, through Emerging and Standardising to Strategic. You can then highlight the opportunities for improvement

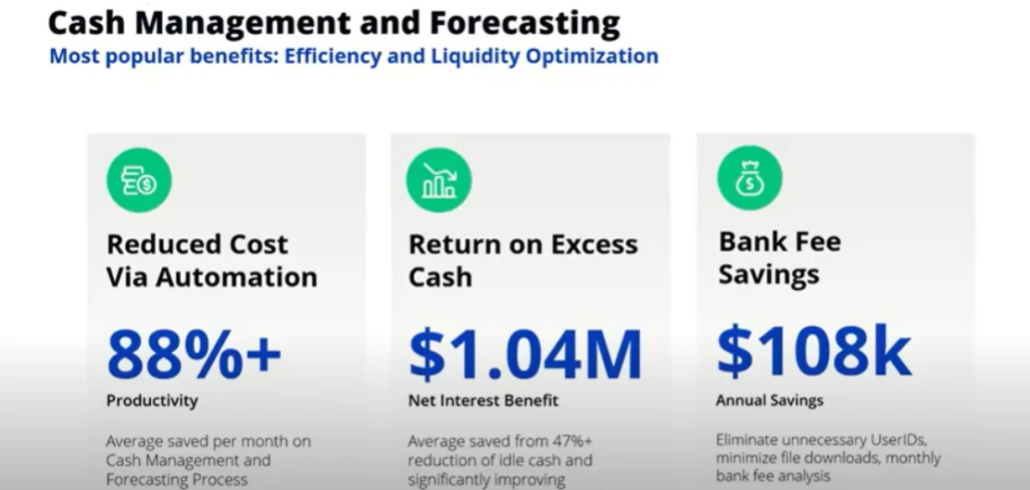

Many of our clients have done just that. For one client, an 88% improvement in cash management and forecasting – thanks to automation – saved over £1m in net interest by unlocking cash that had been lying idle. It also helped the same client to save over £100K in bank fees.

Another client reduced costs by 85% and used the newly spare man-hours to avoid £1.2m in fraud-related costs. They also accelerated ERP migration by 80%. Other savings might include generating free cashflow or protecting the business against financial loss. But all these achievements start with productivity gains that free up treasury staff to do something more valuable within their organisations.

I will leave you with three thoughts: automation and digitisation are here to stay; productivity is an opportunity, not just a saving; and if you are going to add value as a treasurer, you need to be able to measure that saving.