12-01-2023 | treasuryXL | LinkedIn |

A new year, a new edition in which we discuss the latest treasuryXL poll results. It is encouraging that once again many treasurers participated in the vote. We examined the voting patterns of treasurers and gathered the perspectives of experts Jack Gielen and Konstantin Khorev on the topic of APIs in treasury.

Source

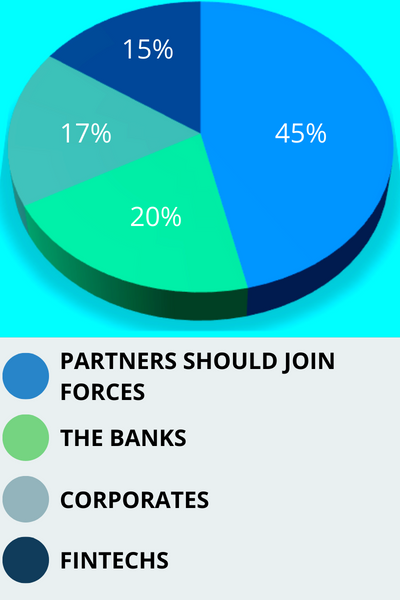

Who should “give a push” and work on APIs?

It is commonly understood that APIs are prevalent in today’s digital landscape. However, corporate treasurers can also reap benefits from API technology and its advantages. If you are unsure about the importance of APIs in Treasury or need more information, you should definitely watch the recording of the joint webinar together with Cobase on the future of APIs. It is encouraging that once again many treasurers participated in the vote. The current treasuryXL poll remains open and we encourage you to continue to have your voice heard! You can cast your vote on this link.

Question: Who should “give a push” and work on APIs?

First observation

That looks quite straightforward: partners should join forces. Do the treasuryXL experts agree, or what is their view on this?

View of treasuryXL experts

Jack Gielen (Cobase)

Jack voted for the option that partners should join forces.

“APIs and the benefits are clearly on the map but there is also an understanding that there is still work to be done before those benefits will really be realised”

It is good to see that regarding the results of this poll, the market agrees that the success of corporate APIs and OpenBanking requires cooperation and cannot be dictated by 1 party. This means Treasurers clearly understand the complexity of the playing field. At the moment, although there are many initiatives by individual parties, there is a need to create a good partnership where the whole eco-system works together

The main benefits that APIs could realise if banks and companies were to work together are:

- Better integration of banking services into customers’ own internal systems,

- Easier connection to new banks and expansion of banking services

- Better and more real-time data that can be converted into actionable information

These benefits translate into being able to use the systems the treasurer has chosen more efficiently and better, more up-to-date insight into status, exposures and required actions.

Recently, Cobase set up the webinar “The Future of APIs” in collaboration with treasuryXL to discuss this topic. I was particularly impressed by the level of knowledge Treasurers have gained over the past year which was also reflected in the questions. APIs and the benefits are clearly on the map but there is also an understanding that there is still work to be done before those benefits will really be realised. Ultimately, the priority with the end customer, the treasurer, will determine how quickly other market players act.

Konstantin Khorev

Konstantin voted for the option that partners should join forces.

“By working together, we can achieve a more efficient and effective treasury management system.”

I agree with the majority view that the implementation of APIs in the treasury field should be a collaborative effort. Banks will play a key role in implementing these changes, but it is also crucial for corporates and TMS providers to set and specify the requirements. This ensures that the solutions being implemented align with the unique needs and goals of each individual corporate, and TMS providers can develop the tools and services necessary to support these needs. By working together, we can achieve a more efficient and effective treasury management system.

Recently, my latest article on this topic was published on treasuryXL. In it, I try to make it plain that APIs are a nice and easy solution, although they come with some limitations and challenges. At the same time, I believe that the future of bank connectivity lies in API technology. What do you think?