| 24-3-2017 | Carlo de Meijer |

One of the obstacles for massive adoption of blockchain technology is the lack of clarity from regulators. Regulators world-wide have long time taken a wait-and-see attitude towards blockchain and distributed ledger technology (DLT) (see my Blog “Blockchain and Regulation: do no stiffle …. April 4, 2016). But that is changing. Regulators across the globe have turned their attention and are now considering how existing regulations may (or may not!) accommodate the development of new distributed ledger technologies. This growing interest shows that it is becoming all the more serious for regulators in the securities industry that blockchain is coming to reality and that this asks for a more closer look a this technology.

Since the start of 2017 a number of regulatory organisations including ESMA (EU), FINRA (US) and IOSCO (Global) have launched reports asking for answers to meet the various challenges of blockchain or distributed ledger technology in the securities industry.

“Regulators prepare to address perceived weaknesses or potential risks relating to blockchains in their regulatory frameworks, and be ready to voice any concerns to, or discuss potential DLT benefits with the relevant authorities”.

What have regulators been doing up till now

To keep pace with the developments in the DLT space some regulators have already established dedicated Fintech offices, contact points and hubs. Others launched regulatory sandbox frameworks that enable innovators to experiment with Fintech solutions for financial services (see my Blog, “Blockchain: playing in the Sandbox September 7, 2016”). And there are regulators that have set up labs and accelerator programs to explore how new technologies including DLT can help them better achieve their regulatory objectives.

To give some examples:

- Regulators, such as the US Commodity Futures Trading Commission (CFTC) and the US Securities Exchange Commission (SEC), have attempted to incorporate DLT innovations into existing legal and regulatory frameworks. Also, the French Parliament last June approved a law that lets some securities vouchers be issued and exchanged on a DLT.

- Others, such as the UK Financial Conduct Authority (FCA), the Swiss Financial Market Supervisory Authority (FINMA), and the Monetary Authority of Singapore (MAS), have created regulatory sandboxes for companies utilizing innovative technologies.

But, as FINRA, ESMA and IOSCO all note in their recent reports, integrating novel DLT products into existing regulatory regimes may prove challenging as DLT continues to develop.

FINRA Report

Early January this year, the US Financial Industry Regulatory Authority (FINRA) published a report titled “Distributed Ledger Technology Implications for the Securities Industry. The FINRA report provides, while structured as only a “request for comments”, an overview of DLT, highlights applications and gives a detailed review of how blockchain technology may impact existing securities regulations affecting dealers and marketplaces.

The report thereby gives a clear picture of the many regulatory considerations for broker dealers that (it says) “market participants may want to consider and regulators will want to have worked out before such infant technologies can be allowed to leave their sandboxes.

US regulatory considerations include issues such as governance, operational structure, network security and regulatory considerations, customer data privacy, trade and order reporting requirements, supervision and surveillance, fees and commissions, customer confirmations and account statements and business continuity planning.

This report is intended to be an “initial contribution to an ongoing dialogue with market participants” about the use of DLT in the securities industry. Accordingly, FINRA is requesting comments from all interested parties regarding all of the areas covered by this paper.

“FINRA welcomes an open dialogue with market participants to help proactively identify and address any potential risks or hurdles in order to tap into the full potential of DLT, while maintaining the core principles of investor protection and market integrity”. FINRA Report

- More questions than answers!

The FINRA report doesn’t provide specific guidance for many questions, but it does represent something of a practical checklist of issues that will need to be addressed by regulated securities businesses considering implementing DLT networks more broadly.

To give an idea of the many questions raised:

How would the governance structure be determined? Who would be responsible for the business continuity plan, addressing conflicts of interest? How would errors or omissions on the blockchain be rectified? What type of access will be provided to regulators? In the event of fraud, who covers the cost? How will regulated entities deal with DLT transactions? Who is the custodian? Does the DLT network itself affect the market risk or liquidity of the digital asset? How is access to the data controlled? Which entities are playing what roles. Would dealers become clearing agencies? How is customer information updated for changes? How is the process supervised and tested? And many, many more!!

- Possible implications for existing US regulation

Many FINRA rules, as well as some rules implemented by other regulators, such as the Securities and Exchange Commission (SEC), that FINRA is responsible for examining or enforcing with respect to broker-dealers, are potentially implicated by various DLT applications.

For example, a DLT application that seeks to alter clearing arrangements or serve as a source of recordkeeping by broker-dealers may implicate FINRA’s rules related to carrying agreements and books and records requirements. The use of DLT may also have implications for trade and order reporting requirements to the extent it seeks to alter the equity or debt trading process.

Other FINRA rules such as those related to financial condition, verification of assets, anti-money laundering, know-your-customer, supervision and surveillance, fees and commissions, payment to unregistered persons, customer confirmations, materiality impact on business operations, and business continuity plans, also may to be impacted depending on the nature of the DLT application.

The head of the US Commodity Futures Trading Commission Christopher (CFTC) Giancarlo recently said that US fintech policy should take a “do no harm” approach. He added that US regulators should coordinate to “avoid stifling innovation”.

ESMA Report

Early February 2017, the European Securities and Markets Authority (ESMA) published a report regarding distributed ledger technology (DLT). In this report named ”The Distributed Ledger Technology Applied to Securities Markets” ESMA summarizes its position on DLT, with a note that it will continue to monitor this “dynamic” technology and consider whether a regulatory response may become a necessity. It sets out ESMA’s views on DLT, its potential applications, benefits, risks and how it maps to existing EU regulation.

ESMA concluded that regulatory action is premature at this stage, but may not be in the longer term. The report anticipates that early applications of DLT will focus on optimising processes under the current market structure, particularly less automated processes in low volume market segments.

ESMA “has not identified any major impediments in the current European Union regulatory framework that would need to be addressed in the short term to allow for the first applications of DLT to securities markets to emerge in a scenario where DLT would be used to optimise processes within the current market structure”.

Longer term, and based on industry responses to the discussion paper, ESMA in its report notes the potential of the technology to support clearing and settlement activities. Potential risks outlined in the report include cyber-attacks, fraudulent activity, operational risk if errors are disseminated, fair competition issues, and market volatility.

Also ESMA “appreciates that broader legal issues, such as securities ownership, company law, insolvency law or competition/antitrust law may have an impact on the deployment of DLT”.

IOSCO Report

The “IOSCO Research Report on Financial Technology”, also published in February this year by the International Organization of Securities Commissions (IOSCO), highlights the increasingly important intersection between financial technology (Fintech) and securities market regulation. It describes a variety of innovative business models and emerging technologies that are transforming the securities industry including the application of the blockchain technology and shared ledgers.

The IOSCO report analyses both the opportunities and risks that these new technologies present to investors, securities markets and their regulators. Though the risks differ depending on the technology, certain risks are recurring across the Fintech sector, such as those arising from unlicensed cross-border activity, programing errors in the algorithms that underlie automation, breaches in cyber security, and the failure of investors to understand financial products and services. Another risk is the failure of financial firms to “know-the-client” for reasons of anti-money laundering and fraud control.

“Financial technology regulators may need to develop “highly automated” surveillance and hire technology experts if they want to closely monitor risks posed by blockchain and other distributed ledger technologies” IOSCO Report

And there is the cross-border challenge. While tech firms operate globally, regulation is conducted largely within national or sub-national borders. The local nature of regulation may create challenges regarding cross-border supervision and enforcement, whereas regulatory inconsistency across jurisdictions increases the potential for regulatory arbitrage.

“The global nature of Fintech therefore creates challenges that regulators should address through international cooperation and the exchange of information”,according to the report.

DLT and blockchain Regulation: not today!

Regulation of blockchain and distributed ledger technology in the securities industry is not to be expected short term. There are still more questions than answers. Before regulators will be able to address the various issues raised, they must better understand their impact. And that takes time. It is in the securities industry’s interest that they remain in an ongoing dialogue with regulators to get the best of both worlds.

Carlo de Meijer

Economist and researcher

More articles about blockchain from Carlo de Meijer:

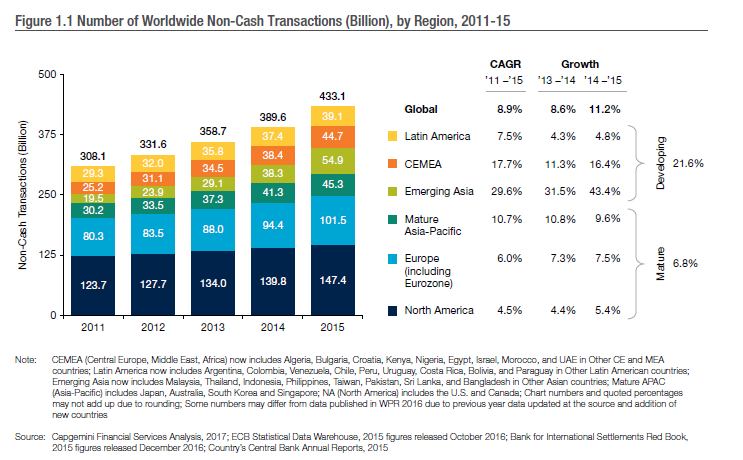

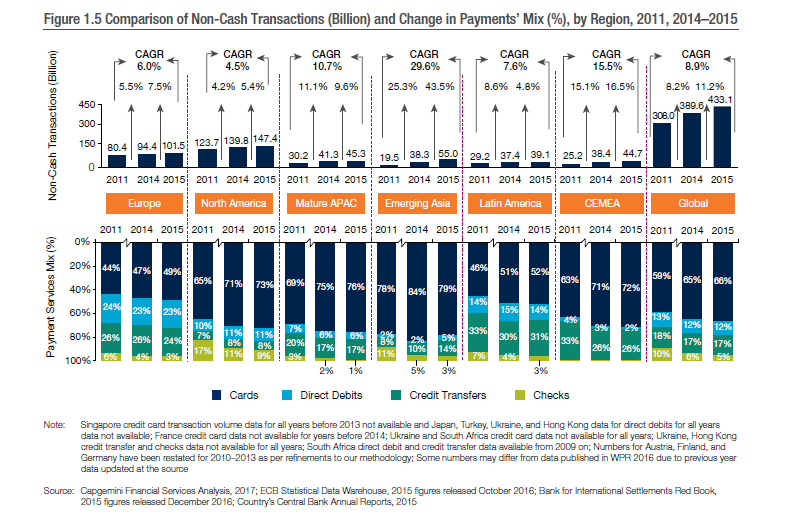

Each year, during the summer, Cap Gemini publishes with BNP Paribas the World Payments Report, aiming at providing a preview of the global payments landscape. In the following I present you a short summary with what I consider the main findings. If you want to access the full report please click on this link.

Each year, during the summer, Cap Gemini publishes with BNP Paribas the World Payments Report, aiming at providing a preview of the global payments landscape. In the following I present you a short summary with what I consider the main findings. If you want to access the full report please click on this link.

François de Witte – Founder & Senior Consultant at FDW Consult

François de Witte – Founder & Senior Consultant at FDW Consult

The Paypers

The Paypers Annette Gillhart – Community manager treasuryXL

Annette Gillhart – Community manager treasuryXL Early 2017, I published a post about PSD2, a lot of opportunities, but also big challenges. Now half a year later, I would like to update you on some developments in this area. PSD2 still needs to be transposed in the national legal system of all the member countries, and according to my knowledge several countries, including Belgium, have not yet released the draft laws. This creates quite some uncertainty in the market, as there will be several country-specific specifications. Hence one can expect that Fintech’s and other TPPs might already have started their certification application in countries that already enacted PSD2 in their local legislation.

Early 2017, I published a post about PSD2, a lot of opportunities, but also big challenges. Now half a year later, I would like to update you on some developments in this area. PSD2 still needs to be transposed in the national legal system of all the member countries, and according to my knowledge several countries, including Belgium, have not yet released the draft laws. This creates quite some uncertainty in the market, as there will be several country-specific specifications. Hence one can expect that Fintech’s and other TPPs might already have started their certification application in countries that already enacted PSD2 in their local legislation. For almost 25 years,

For almost 25 years,

On 18/5/2017, I attended a seminar covering the topic “From Fintech to Regtech… from potentially disruptive to leaner compliance opportunities” organized by The Finance Club of Brussels, the Free University of Brussels (ULB), the Solvay Finance Society and Thomson Reuters.

On 18/5/2017, I attended a seminar covering the topic “From Fintech to Regtech… from potentially disruptive to leaner compliance opportunities” organized by The Finance Club of Brussels, the Free University of Brussels (ULB), the Solvay Finance Society and Thomson Reuters.

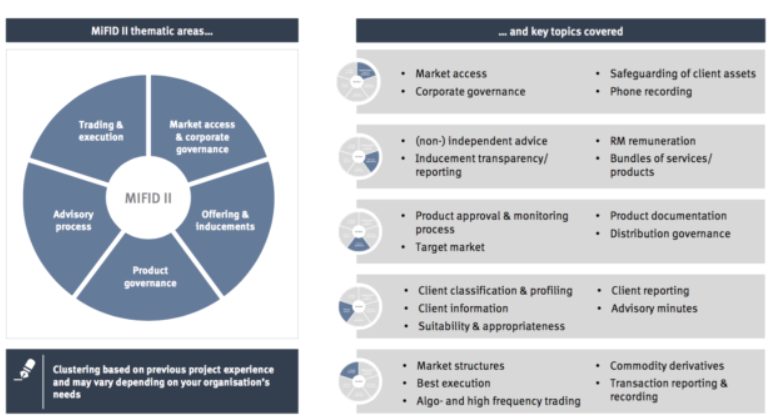

MIFID II – you read about it frequently. And there are more abbreviations: you will also find MIFIR and MIFID I. As a banker you will know what we are talking about. As a treasurer or financial professional you are supposed to understand what MIFID II will bring you. We think it is time to zoom in on this subject and present a short summary.

MIFID II – you read about it frequently. And there are more abbreviations: you will also find MIFIR and MIFID I. As a banker you will know what we are talking about. As a treasurer or financial professional you are supposed to understand what MIFID II will bring you. We think it is time to zoom in on this subject and present a short summary.