World Payments Report 2017

| 21-9-2017 | François de Witte |

Each year, during the summer, Cap Gemini publishes with BNP Paribas the World Payments Report, aiming at providing a preview of the global payments landscape. In the following I present you a short summary with what I consider the main findings. If you want to access the full report please click on this link.

Each year, during the summer, Cap Gemini publishes with BNP Paribas the World Payments Report, aiming at providing a preview of the global payments landscape. In the following I present you a short summary with what I consider the main findings. If you want to access the full report please click on this link.

Introduction

2017 is a quite exciting year, with new regulatory initiatives having a big impact on the payments industry. In the EU, the most important one being PSD2, which opens the market to new players (third party providers), and which needs to be transposed on the national legislation of the EU member states by 13/1/2018. We also have the AML Directive, which had to be transposed in the legislation of the different member states and the GDPR Directive which needs to be transposed by 6/5/2018. The report is giving attention to these new developments, in particular the ones linked to PSD2.

Main findings

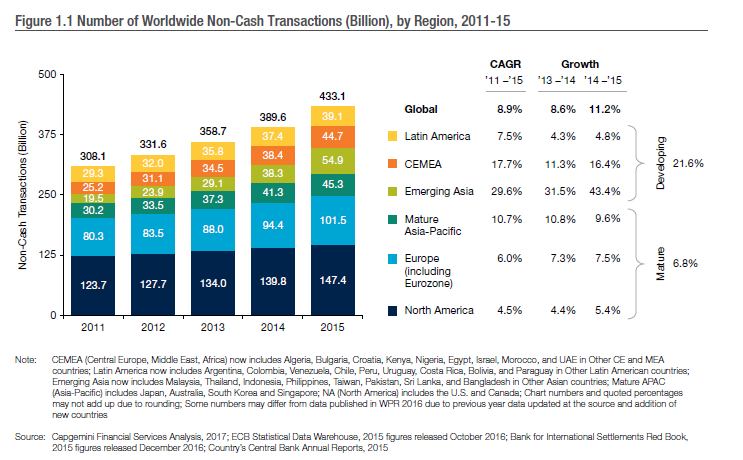

The World Payments Report reported that global non cash transaction volumes grew 11.2% during 2014-15 to reach 433.1 billion transactions, the highest growth of the past decade, and slightly above last year’s prediction. Overall global non cash transaction volumes are expected to continue to grow, due to the rising adoption of these payment instruments, the growing inclusion, the increasing financial literacy and the enhance payments infrastructure, in particular ion the developing markets.

Source: World Payments Report 2017, page 6

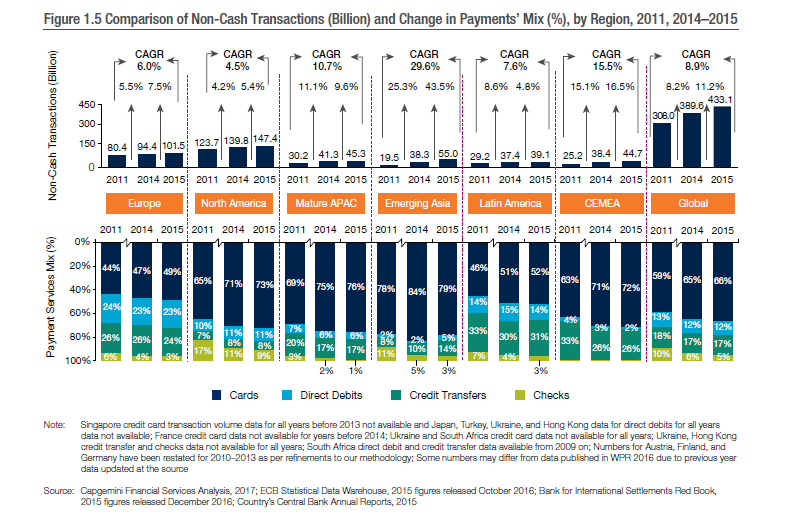

When looking at the breakdown of the non-cash transaction (see following chart), we see some interesting trends:

Source: World Payments Report 2017, page 11

Debit cards and credit transfers were the leading digital instruments in 2015, while the check usage continues to decline globally.

Despite the increased adoption of digital payments, cash continues to keep an important role, in particular for low value transactions. Key factors contributing to the persistency of cash include the anonymity associated with cash transactions, lack of a modern payments infrastructure, and limited or no access to the banking system in developing markets. However in some countries (e.g. Scandinavia), the usage of cash was reduced drastically.

When looking at Europe, during the coming years credit card transaction volumes are expected to be affected by the interchange fee cap in Europe and by the less proactive policy of banks in this respect.

Conclusion

The ongoing increase of the non-cash transactions and the reduction of the checks is encouraging. We move towards more efficient payment instruments. The next years will bring new challenging new regulatory and industry initiatives, which will have to be implemented by the banks. This will require huge investments, and in my view, some more regulatory coordination will be needed.

François de Witte – Founder & Senior Consultant at FDW Consult

François de Witte – Founder & Senior Consultant at FDW Consult

[button url=”https://www.treasuryxl.com/community/experts/francois-de-witte/” text=”View expert profile” size=”small” type=”primary” icon=”” external=”1″]

[separator type=”” size=”” icon=””]