Treasury and regulations: A changing environment

| 15-2-2017 | Theo Paardekoper |

Companies need to comply to their regulatory framework in their industry. For the treasury department a regulatory framework is applicable which is basically linked to the financial industry and not linked to the industry of the company. Because regulations in the financial industry are changing it is important for the treasurer to update.

Regulations

Important regulations and rulings for treasurers are EMIR, MIFID and MIFID II/MIFIR.

Other regulations that are applicable for the financial industry, like UCITS and AIFM (regulations for investments funds) and CRD rules (capital requirement directive as a result of BASEL III) do not effect the corporate treasury directly, but the side effect of these rules can have effects on pricing and product offering by financial institutions.

Anti Money Laundring regulations (MOT-melding in The Netherlands) are not only applicable for banks. Also corporates are mandatory to register these transactions at the Finance Intelligence Unit of the Dutch Tax autorities.

The regulations mentioned above are all linked to the European regulatory framework and are valid in addition to local laws, like the WfT (Wet Financieel Toezicht) in the Netherlands.

EMIR (= European Market Infrastructure Regulation)

This regulation is valid since August 2012 and was initiated after the Lehman Brothers bankrupty in 2008. The main goal of EMIR is to improve transpancy of the OTC market to create a clear overview of all the derivative positions. This was one of the main problems that became clear after the Lehman bankrupty. It was totally unclear to get a view on the derivate positions and risk of a counterparty. Emir also introduced a solid clearing member (named CCP) and Trade Repository members to register your OTC derivates. To register your positions a LEI (Legal Entity Identifier) can be obtained at the Chamber of Commerce.

EMIR is not (yet) applicable for small pensionfunds.

MIFID (= Markets In Financial Instruments Derivatives)

Main objective of MIFID is to increase competition in the investment industry and to protect consumers. The well-known 40/20/2 rule to define a professional or non-professional counterparty is one of the items to protect consumers and force financial institutions into a duty of care. One of the results is a direct view on the Market-to-Market pricing of the companies derivates and monitoring of margin call obligations.

Also the classification based on knowledge is an important item and can be part of discussion during a lawsuit.

Mifid increased the number of trades in the OTC market what caused a more fragmented view on market pricing. Financial institutions are forced to provide the 5 best quotes in the market to their clients.

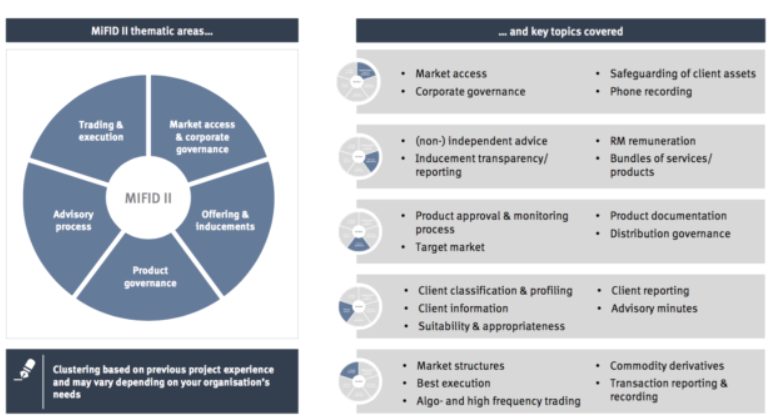

MIFID II

In January 2018 this new set of regulations is applicable. Mifid II made Mifid regulations also applicable for commodity and CO2-rights traders. Also market data suppliers must be registered to comply with MIFID II. Structured deposits (return is not interest based but linked to an other ratio link EUR/USD or oilprice) will also fall under the scope of Mifid. Change of classifications on behalf of Mifid II classifies local governmental entities as non-professionals. Health Institutions governmental education and housing associations are not clearly excluded as non-professional.

Mifid II will mainly “change the game” of manufacturers and distributors of financial services, but this regulations will give corporates more tools in case of a conflict about a trade. The negative side effect of new regulations is that pricing in the market will increase because of reduced competition as a result of higher entry barriers in the market.

Any action required for a corporate treasurer?

It is up to your bank to comply to MIFID II. So I would say “no”. The bank will inform you with new legal documentation and product information in the near future.

Independent treasury specialist

More articles of this author: