| 8-5-2017 | Carlo de Meijer |

Now also The Netherlands (I am a Dutchman!) has its broad-based collaborative blockchain initiative. At the end of last month (30 March 2017), there was the official kick-off of the National Blockchain Coalition (“Nationale Blockchain Coalitie” in official Dutch language) (NBC) at the premises of the Ministry of Economic Affairs in The Hague. The National Blockchain Coalition is a collaboration of more than 20 organisations, governmental institutions and knowledge centres. At the same event the action agenda was handed over to The Dutch Economics Minister Henk Kamp on behalf of the partners of the NBC.

Now also The Netherlands (I am a Dutchman!) has its broad-based collaborative blockchain initiative. At the end of last month (30 March 2017), there was the official kick-off of the National Blockchain Coalition (“Nationale Blockchain Coalitie” in official Dutch language) (NBC) at the premises of the Ministry of Economic Affairs in The Hague. The National Blockchain Coalition is a collaboration of more than 20 organisations, governmental institutions and knowledge centres. At the same event the action agenda was handed over to The Dutch Economics Minister Henk Kamp on behalf of the partners of the NBC.

National Blockchain Coalition: raison d’être

The creation of the Coalition is an initiative of Team ICT, last year set up by the Ministry of Economic Affairs and is one of the action points in the “Digital Agenda” of the Dutch Government to accelerate the digitalisation of the economy.

The partners in the Coalition are convinced there is increasing need for corporates and government bodies to realise synergies between existing blockchain initiatives, facilitate them and bundle and share the knowledge already gained. Al these initiatives are being brought into the Coalition. But they also agreed that there is a need to create coherence between policy, regulation, supervision, maintenance and execution.

Main goal of the Coalition is to establish the preconditions needed for trusted and reliable blockchain applications. The collaboration aims, by means of collective initiatives, cooperation and knowledge sharing, to enable the Netherlands become front runner in the field of applying blockchain technology.

Some quotes (originally in Dutch!)

“The Blockchain Coalition stands for innovation and an open network approach. Cooperating on difficult issues that no one can solve on its own”. Minister Kamp

“Developing and introduction of blockchain ask for a coordinated approach of challenges by parties form various sectors. If The Netherlands in this pioneer stadium takes the chances there are, we could become a frontrunner in the blockchain area in the world”. René Penning de Vries, Team ICT

“We as employers organisation are extremely positive about this initiative and its timing. If we (in the Netherlands) collectively shoulder this project, I am firmly convinced that we will be frontrunner worldwide on blockchain.” VNO-NCW chairman Hans de Boer

“Most important lesson is that you cannot pick up this (blockchain) theme alone. Most value will be created if you bring more parties together and unites. That is also one of the main reasons to get to work with blockchain via a consortium”. Mariken Tannemaat, Chief Innovation Officer Nationale Nederlanden

Partners

This joint initiative has 23 founding partners and 8 sustaining organisations. Because the application of blockchain technology is expected to have a big impact on the financial sector, as well as logistics and energy sector, these are the best represented sectors in the Coalition.

From the financial services side banks like ABN AMRO, ING en Volksbank and insurer Nationale Nederlanden participate.

Other partner organisations are: Havenbedrijf Rotterdam, Enexis, Alliander, de Koninklijke Notariële Beroepsorganisatie, Brightlands, CWI, Inspectie Leefomgeving en Transport (ILT), de KvK, RDW, Rijksdienst voor Identiteitsgegevens, ECP | Platform voor de InformatieSamenleving.

From the government side participating bodies are: Ministeries van Economische Zaken, Infrastructuur en Milieu, Veiligheid and Justitie en Binnenlandse Zaken en Koninkrijksrelaties.

From the knowledge centre side: TU Delft, Universiteit van Tilburg, Radboud Universiteit, Centrum Wiskunde & Informatica, NWO and TNO.

Supportive organisations include: AFM, Betaalvereniging Nederland, De Nederlandsche Bank, de NVB, DutchChain, SIVI, StartupDelta en Verbond van Verzekeraars.

Action Agenda

The action agenda is a joint initiative of the above mentioned organisations. In this action plan it is described which steps the Coalition is going to take in the coming period to realise the various goals. The agenda contains three lines of action to boost blockchain expertise and operational readiness in The Netherlands.

The partners of the National Blockchain Coalitie will primarily focus on the development of digital identities, with which persons, objects and legal persons in the blockchain can perform transactions as part of a blockchain. Working on these identification processes requires the focus on both interoperability (APIs) and standardisation.

”Goal is to create stronger identities for persons, so that repetitive verification is not needed. This is one of the preconditions needed to let blockchain function well”. Program manager Ad Kroft.

Besides that the Coalition will also work on solutions in the field of legislation and acceptation. It is thereby their intention to work on the right conditions under which blockchain can be used.

Also arrangements have been made regarding education, knowledge sharing and strengthen skills. The third line of action is realisation of the Human Capital Agenda to improve the level of knowledge and skills on blockchain, both at an information-technical as well as on social-scientific, economical, legal, ethical and business themes.

Positives

Blockchain has the potential to make business processes more efficient and reliable. The Coalition partners foresee great possibilities within the country for improvement of service delivery, better control of production processes, cost savings, reduction of fraud and reduced cyber risk.The Coalition also foresees positive effects on the autonomy of citizens, transparency of transactions, cybersecurity and reduction of administrative burden.

“Blockchain plays an important role in the further strengthening of trust in the world of digital transactions. This technology brings positive effects for the efficiency of organisations that are active in the financial sector.” Arjan van Os, Head Innovation Centre

No Poldermodel

Collaboration, certainly when talking about blockchain is a necessity. To discuss the rules of the game, agree on common issues etc. But the participating partners in this Coalition should prevent that the final results are weakened compromises (for the sake off!!). The partners in the Coalition should keep in mind that in this field a Polder model to keep everybody satisfied is not the way!!!! Because that will leave the Netherlands behind, not in front. Besides, the benefits of blockchain can only be reaped at the maximum in an international context. And not isolated. This asks for international cooperation.

Carlo de Meijer

Economist and researcher

Proferus

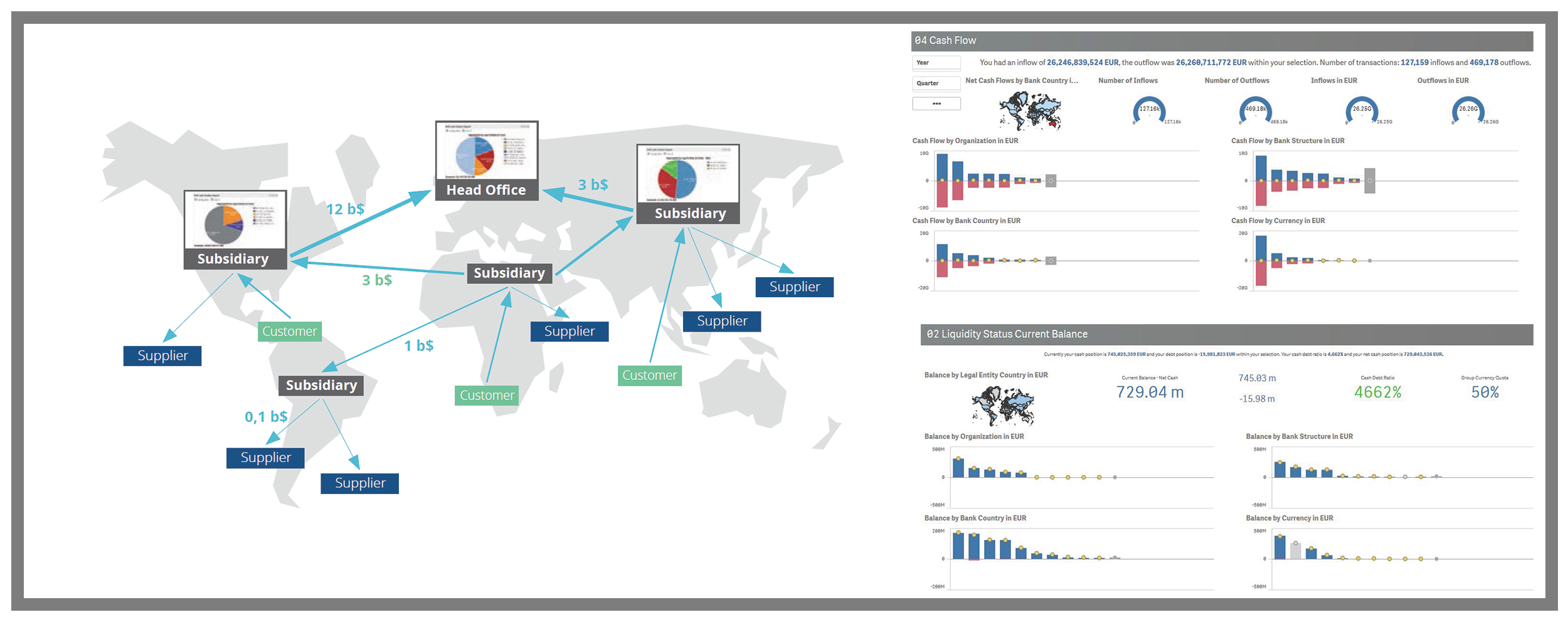

Proferus Cashforce Cash forecasting 2.0

Cashforce Cash forecasting 2.0

How do strategic professionals decide on the best path to success for their company? The key is in transparency and real-time reporting. If it comes to the responsibility of the treasurer or financial professional this means deciding about company-wide cash flow and liquidity levels, bank, customer and supplier relations and working capital.

How do strategic professionals decide on the best path to success for their company? The key is in transparency and real-time reporting. If it comes to the responsibility of the treasurer or financial professional this means deciding about company-wide cash flow and liquidity levels, bank, customer and supplier relations and working capital.

Now also The Netherlands (I am a Dutchman!) has its broad-based collaborative blockchain initiative. At the end of last month (30 March 2017), there was the official kick-off of the National Blockchain Coalition (“Nationale Blockchain Coalitie” in official Dutch language) (NBC) at the premises of the Ministry of Economic Affairs in The Hague. The National Blockchain Coalition is a collaboration of more than 20 organisations, governmental institutions and knowledge centres. At the same event the action agenda was handed over to The Dutch Economics Minister Henk Kamp on behalf of the partners of the NBC.

Now also The Netherlands (I am a Dutchman!) has its broad-based collaborative blockchain initiative. At the end of last month (30 March 2017), there was the official kick-off of the National Blockchain Coalition (“Nationale Blockchain Coalitie” in official Dutch language) (NBC) at the premises of the Ministry of Economic Affairs in The Hague. The National Blockchain Coalition is a collaboration of more than 20 organisations, governmental institutions and knowledge centres. At the same event the action agenda was handed over to The Dutch Economics Minister Henk Kamp on behalf of the partners of the NBC.

One of my friends who works in human capital development and is a psychologist, explained me once how we can increase our creative output. One of the elements he mentioned was mixing up the way information comes to you and how you digest it. For example, if you are used to create business plans sitting behind your desk and writing, a multi-person brainstorm session might tap into your undiscovered creative potential. And the other way around: if you are talker/listener, try writing for a change.

One of my friends who works in human capital development and is a psychologist, explained me once how we can increase our creative output. One of the elements he mentioned was mixing up the way information comes to you and how you digest it. For example, if you are used to create business plans sitting behind your desk and writing, a multi-person brainstorm session might tap into your undiscovered creative potential. And the other way around: if you are talker/listener, try writing for a change.

Once more the Financial Systems exhibition will open its doors on May 18th in Nieuwegein, The Netherlands. As the years before it will be the most outstanding event where finance and IT meet each other. treasuryXL will promote the event on a regular basis and we will be present at the event with our own booth.

Once more the Financial Systems exhibition will open its doors on May 18th in Nieuwegein, The Netherlands. As the years before it will be the most outstanding event where finance and IT meet each other. treasuryXL will promote the event on a regular basis and we will be present at the event with our own booth.