Recap: Round Table “Payment Challenges in a Post-Covid World” | Toekomst Betalingsverkeer

22-09-2021 | François de Witte | treasuryXL |

On September 9, 2021, the event “Toekomst Betalingsverkeer“ took place in Amsterdam.

Amongst others, the following topics were covered:

- The Fintech evolution of banking.

- Platform strategies & developments big tech.

- Customer experience strategies.

- Open banking.

- Instant payments.

I hosted two round table sessions on “Payment Challenges in a Post-Covid” World and we made a deep dive on the following 3 topics:

- Instant Payments – the new “normal”?

- Request to Pay: the bridge between customer convenience and reconciliation?

- Digital currencies for a digital future?

In the present article, I will take a deep dive on the topic “Instant Payments: The New Normal”.

Setting the Scene

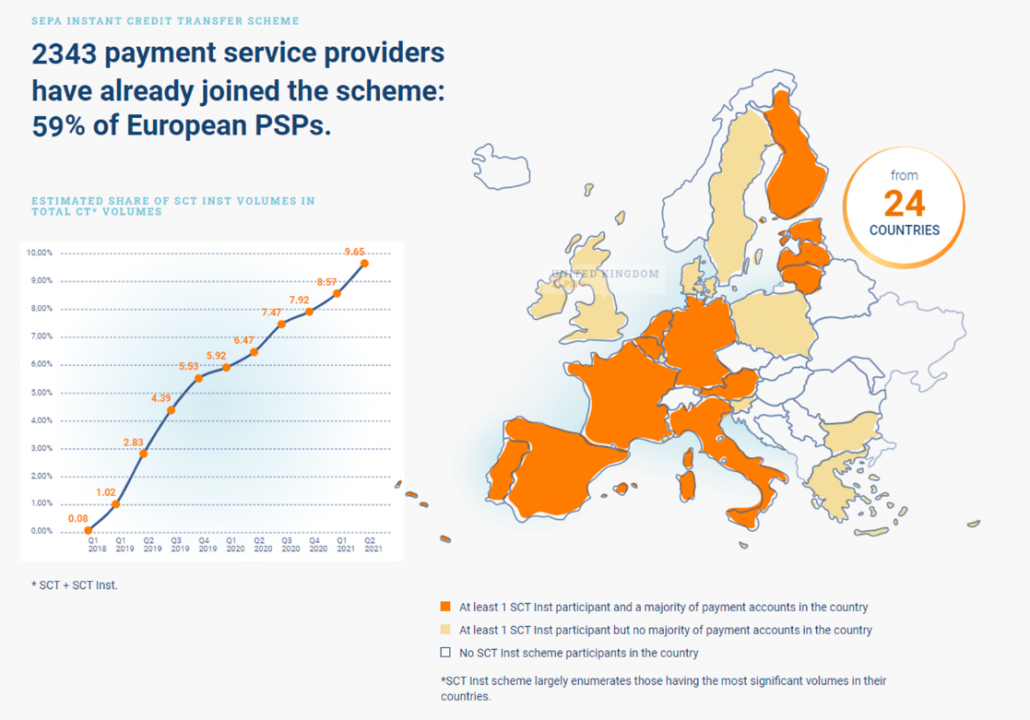

Since the creation of the SEPA Instant Credit Transfer (SCT Inst CT) Scheme in November 2017, we have observed a huge increase in the number of instant payments in Europe, as outlined in the statistics of the EPC down below:

We have also observed the same tendency in other countries outside the UE, like e.g., the UK. The Netherlands are clearly forefront runners in Europe.

Reasons for Using Instant Payments

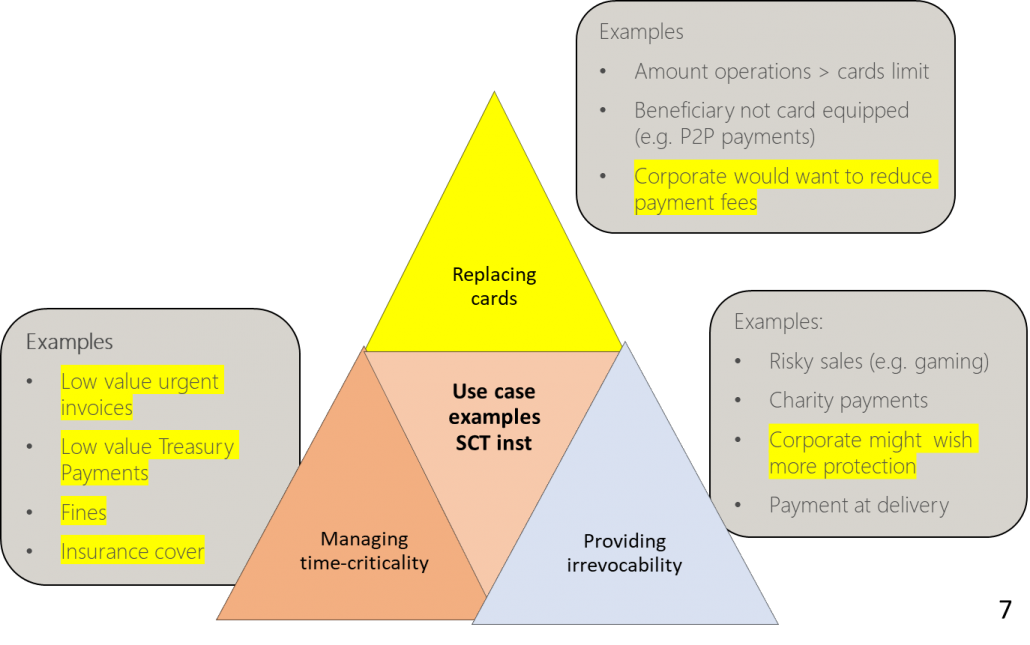

In the diagram down below, you will see an outline of the major use cases for instant payments:

We observe also that increasingly instant payments are challenging the card payments, and this happens for several reasons such as:

- Party paying the costs: whilst for the credit card and wallet payments, the costs are collected at the merchant side, for instant payments, they are charged at the payer side.

- Costs: the costs of instant payments are usually way lower than the traditional card or wallet payments, in particular for high-value transactions.

- Amount of the transaction: traditionally card payments have a limit of up to EUR 5 K, whilst for SCT Inst CT, the limit is put at EUR 100 K.

- Irrevocability: whilst in the card schemes, clients have the possibility to revoke payments, whilst instant payments are irrevocable.

However, there are still some hurdles to overcome, such as:

- Card payments are well embedded in the ecosystem and provide real ease of use. This presents good challenges for Fintechs to find smart solutions in this area.

- Card payments also make contactless payments possible

- The possibility to process batch payments, although more and more banks are able to do this.

- Pricing: in some counties, instant payments remain expensive.

European Payment Initiative

EPI is an initiative launched by 31 European banks/credit institutions and two third-party acquirers to create a unified, innovative pan-European payment solution leveraging Instant Payments SEPA Instant Credit Transfer (SCT Inst) and cards. EPI will offer both a card and a digital wallet to consumers and merchants across Europe.

This innovative solution aims to become a new standard in payments for European consumers and merchants, both for retail payments and for payments between individuals “peer-to-peer”.

The aim is to reach out to the whole of Europe. In the first half of 2022, EPI plans to launch the first EPI offerings, based on both the EPI card and the EPI digital wallet. The first set of services will be available at the same time the brand is launched at a European level. These services will be expanded in phases from 2022 until 2024. EPI plans to complete a full deployment of services in 2025 (source: https://www.aciworldwide.com/what-is-the-european-payments-initiative).

EPI does not mean the end of the domestic card schemes. It means the migration of the domestic card volumes into EPI. Maintaining these domestic card schemes doesn’t make sense. It is a transfer of domestic transactions into EPI, which ultimately could result in de-commissioning domestic card schemes. But this is a choice of each national banking community and not of EPI.

The benefits are quite clear:

- Immediate payment guarantees and high security

- Capped debit interchange—lower fees

- A standardized solution accepted across Europe—easier travel and enrolment procedures

- Parallel development with Central Bank Digital Currencies and an identity scheme—enhanced user experience

- A consolidation of use cases—increased convenience

- The compatibility of existing card services with changes to other European payments schemes, such as SCT Inst CT.

The major challenge for EPI and its stakeholders will be convincing consumers (and, by extension, merchants) to get onboard. To acquire and retain a critical mass of users, EPI must have strong user incentives. It needs a compelling business case to convince issuers to migrate from domestic or international brands and acquirers to enable acceptance, the more that right now, all these national card schemes are amortized. This also requires a migration process, breaking user habits.

Conclusion

We see an increasing importance of Instant Payment in Europe, and the EPI initiative will further foster this evolution. However, the EPI might take some time. Good cooperation and interoperability with the domestic schemes will be important to get the required critical mass.

François de Witte