Zeroing in on 4 Specific Ways Treasurers’ Can Improve Cash Forecasting

21-07-2022 | treasuryXL | GTreasury | LinkedIn |

21-07-2022 | treasuryXL | GTreasury | LinkedIn |

20-07-2022 | treasuryXL | The Working Capital Forum | LinkedIn |

On 1st December 2022, Working Capital Forum Europe brings together leaders in treasury, procurement, and payments to share ideas and techniques for better working capital management across supply chains.

That’s never been so important as in these times of rising interest rates, inflation, and supply chain shocks, when managing working capital is everyone’s concern.

From supply chain finance to accurate cash forecasting, solutions for every component of working capital management will be discussed on stage, demonstrated in our information area, and examined in our workshops at the world’s largest specialist working capital and supply chain finance event.

We’re delighted to return to Amsterdam for this one-day live event, with main stage keynote sessions, panel debates, and breakout workshops and demos.

If you’re interested in optimising working capital in your organisation, you need to join us in Amsterdam for the most productive day you’ve had in years.

Visit the Working Capital Forum: https://www.workingcapitalforum.com/

Join our events here: https://www.workingcapitalforum.com/events

Enter the Working Capital and Supply Chain Finance 2022 Awards here: https://www.workingcapitalforum.com/awards.html

14-07-2022 | treasuryXL | Refinitiv | LinkedIn |

A recent Refinitiv expert talk looks at the digital banking and fintech arena, unpacking the compliance challenges that dominate the sector and offering advice for a best-practice response.

12-07-2022 | treasuryXL | GTreasury | LinkedIn |

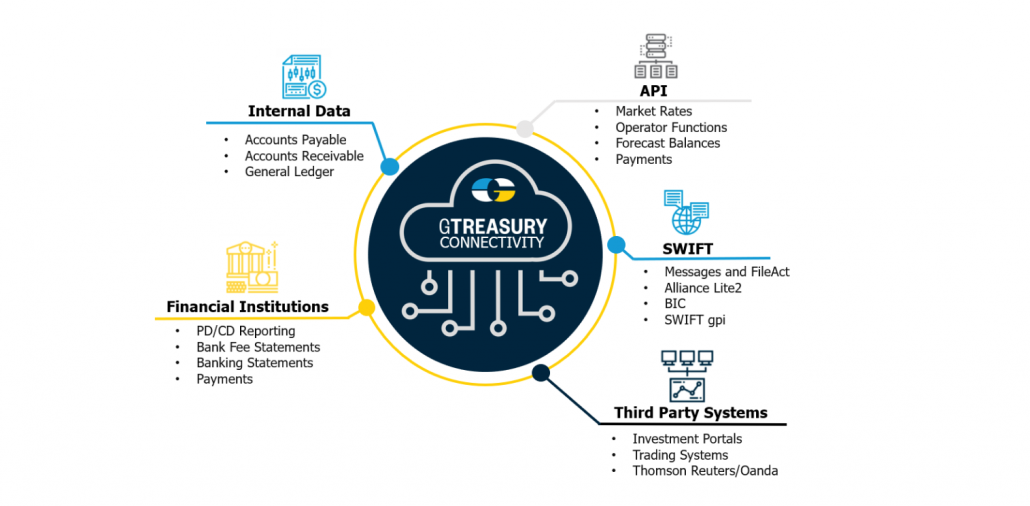

Workflow Brings in Third-Party Banking, Payments, and Financial Data

CHICAGO, Ill. – July 12, 2022 – GTreasury, a treasury and risk management platform provider, today announced the launch of ClearConnect. Featuring more than 80 API calls in a dozen key categories, ClearConnect offers the most robust connectivity suite available to treasury teams and the office of the CFO. The solution provides immediate access to the comprehensive data required for confident and actionable treasury insights, and ensures the fidelity and security of that data through purpose-built connections bolstered by GTreasury’s support.

While “API” is becoming a buzzword often associated with data connectivity solutions, the terms are not synonymous. API connections are only as powerful as the underlying workflows that support them. Activating an out-of-the-box API is not an instant panacea for an organization’s data needs. Without the right underlying workflows, APIs not attuned to a business’s specific requirements will drop or fail to capture all the data sets necessary to power effective analytics and data lakes. Given the complexity of treasury and risk management, those missing insights can result in significant consequences for treasury teams and CFOs.

ClearConnect provides both the powerful underlying workflows and the multifaceted purpose-built API-enabled connectivity to ensure that data capture is consistently done correctly and thoroughly—providing all the analytics an organization needs from a particular connection. The solution creates certainty, security, and seamless connections by integrating all data from business systems and financial institutions, and is capable of combining connection types for uniquely complete data sets and data fidelity.

Specifically, ClearConnect creates value for treasury teams and the office of the CFO by delivering:

ClearConnect’s market-leading API catalog features over 80 API calls, augmented by host-to-host connectivity wherever needed to bolster capabilities. The solution enables robust functionality across a dozen categories, including payment approval rules, payment workflows, payments and templates, balances and transactions, general ledgers, deal management, bank accounts, bank account management, legal entities, forecasts, operators, and data extracts. ClearConnect’s flexible connectivity architecture uses best-in-class API-enabled connections to ensure fidelity and continuity of customers’ most vital data. Connectivity into Swift, Fides, and others provides a single source of truth and visibility into an organization’s cash and financial risk, and delivers transparent workflows for payments, bank file monitoring, and more.

GTreasury’s always-expanding partnerships with leading global financial institutions and market data partners ensure seamless bank and ERP connectivity, domestic and international transactions, and access to market insights. As client needs change, GTreasury’s active collaborations with product partners further ensure the creation and delivery of modernized products and services, securing ClearConnect’s place as a market-leading solution always aligned with customers’ current data requirements.

From risk management capabilities powered by Moody’s Analytics and KYOS, to market data provided by Refinitiv and Fenics MD, to banking, ERP, investments, and payments partners, ClearConnect now enables customers to wield the full power of the GTreasury ecosystem even more easily and completely.

“ClearConnect doesn’t just offer a significantly greater breadth of connectivity options than anything else available, it also underwrites those capabilities with foundational workflows for data integrity and ease of use,” said Pete Srejovic, Chief Technology Officer at GTreasury. “Investing in API technology only to realize that you are dropping crucial data is a nightmare that has come true for many CFOs and treasury teams. With today’s launch of ClearConnect, we’re proud to offer not only the largest and most powerful API connectivity solution on the market, but one that customers can entrust to deliver absolute data integrity along with the comprehensive and future-proof solutions of the GTreasury ecosystem.”

About GTreasury

28-06-2022 | treasuryXL | GTreasury | LinkedIn |

With interest rates rising and remaining unpredictable, corporate treasurers need to have a hedging plan in place. For many, this can be easier said than done.

![]()

21-06-2022 | treasuryXL | GTreasury | LinkedIn |

CHICAGO, Ill. – June 21, 2022 – GTreasury, a treasury and risk management platform provider, today announced that it has named Victoria Blake as GTreasury’s Chief Product Officer, and Ashley Pater as General Manager at Hedge Trackers. Recently acquired by GTreasury, Hedge Trackers is the global leader in accounting, consulting, and software services that protect clients against financial risk.

Victoria Blake joins GTreasury with more than 20 years of experience and success in product leadership roles across several SaaS and technology companies. Blake comes to GTreasury from Zapproved, where she served as the Vice President of Product. During her tenure at the e-discovery software provider, she led high-level strategy development, product definition, and market-facing thought leadership and vision. Before Zapproved, Blake was responsible for defining next-generation cloud services offerings as the Vice President of Product Management at Metal Toad, an AWS Consulting Partner. Blake has also held product management and leadership positions at WebMD Health Services, Jive Software, and Walker Tracker.

As GTreasury’s Chief Product Officer, Blake will lead the company’s global product and UX teams in developing and delivering innovative new solutions for GTreasury’s customers and partners. From modern automated treasury and transaction management to AI-powered SmartPredictions™ cash forecasting and visibility, GTreasury’s SaaS platform empowers treasury teams and the office of the CFO with the future-proof technology and capabilities required to drive confident financial decision-making. GTreasury has also continued to expand its broad ecosystem of connected partner technologies, via API integrations with ERPs, banks, and other external providers where instant data connectivity maximizes customer efficiencies.

“GTreasury has built its reputation as a leading treasury and risk management platform by harnessing innovative cloud, AI, machine learning, and emerging technologies that move our industry forward,” said Victoria Blake, CPO, GTreasury. “Just as importantly, GTreasury has always focused on product usability and ensuring that its powerful tools are always easily accessible and seamlessly connected for the teams that rely on them. I look forward to building on what GTreasury has created over the past three decades, and delivering even more next-generation tools to make CFOs and treasury teams more successful.”

Ashley Pater is now the General Manager of Hedge Trackers after more than a decade of leadership roles within GTreasury. Pater most recently served as GTreasury’s Chief Product Officer, where she was responsible for aligning product vision and strategy to the company’s business objectives. Pater previously held leadership positions in GTreasury’s marketing and account management functions, focusing on building global brand awareness, lead generation, event management, and cross-sell programs.

Pater will oversee daily business operations and lead growth strategy around Hedge Trackers’ FX, interest rate, and commodity price risk management services and consulting. Pater will also ensure alignment and integration opportunities within the broader GTreasury organization. Hedge Trackers offers best-in-class expertise and technical depth in meeting today’s unprecedented demand for effective hedging strategies, identifying exposure, managing risk, and meeting compliance and audit requirements. Under Pater’s leadership, Hedge Trackers will focus on bolstering its risk management expertise and bringing new solutions to market across the company’s risk product suite.

“Combining the strengths of GTreasury and Hedge Trackers makes us the clear market leader when it comes to both our treasury risk management products and our consulting acumen,” said Ashley Pater, General Manager, Hedge Trackers. “Today’s CFOs and financial leaders understand that risk management and hedging capabilities are critical to navigating volatile markets and achieving larger business goals. I’m excited to further our solutions and insight to equip customers with the solutions required for effectively and cost-efficiently managing their risk.”

“Both Victoria and Ashley possess the clarity of vision required to advance our GTreasury and Hedge Trackers products to meet our customers’ evolving needs today and well into the future—and both bring relevant, experienced, and proven leadership to accomplish those goals,” said Renaat Ver Eecke, CEO, GTreasury. “I’m glad to welcome Victoria and Ashley into their new roles and look forward to what’s to come from GTreasury and Hedge Trackers.”

About GTreasury

GTreasury is committed to connecting treasury and digital finance operations by providing a world-class SaaS treasury and risk management system and integrated ecosystem where cash, debt, investments and exposures are seamlessly managed within the office of the CFO. GTreasury delivers intelligent insights, while connecting financial value chains and extending workflows to third-party systems, exchanges, portals and services. Headquartered in Chicago, with locations serving EMEA (London) and APAC (Sydney and Manila), GTreasury’s global community includes more than 800 customers and 30+ industries reaching 160+ countries worldwide. Visit GTreasury.com

16-06-2022 | treasuryXL | Refinitiv | LinkedIn |

Demand for real-time data is growing fast as financial firms face regulatory, trading, operational and competitive challenges. Rob Lane, head of real-time feeds at Refinitiv, discusses the changing data needs of banks and buy-side firms and how the cloud is helping improve access to a key source of competitive advantage in pursuit of more informed and agile decision-making.

13-06-2022 | Eurofinance | treasuryXL | LinkedIn

Featuring keynote speakers, Guy Verhofstadt and Göran Carstedt…

The 31st annual EuroFinance International Treasury Management returns in-person this September 21st-23rd in Vienna. With treasury changing like never before, join more than 2000 attendees, including 150 world-class speakers for transformative insights and the year’s best networking.

Learn from the experiences of more than 150 best-in-class treasurers including:

– Abraham Geldenhuys, VP and group treasurer, Kongsberg Automotive

– Yang Xu, SVP, corporate development and global treasurer, Kraft Heinz

– Alex Ashby, Head of treasury – Markets, Tesco

– Debbie Kaya, Senior director of treasury, Cisco Systems, Inc.

– Daniel Melski, VP finance and treasurer, Church & Dwight Co., Inc.

– Angel Cheung, Assistant treasurer, John Lewis Partnership

For more information and to register, visit: https://www.eurofinance.com/international

TreasuryXL contacts can claim a 10% discount with code: MKTG/TXL10 on top of the early-bird price which expires on July 29th – a combined saving of over €2000. Register here today.

We hope to welcome you in Vienna.

The EuroFinance Team

EuroFinance, part of The Economist Group, is a leading global provider of treasury, cash management and risk events, research and training. With over 30 years of experience, our mission is to bring together the brightest minds and most influential voices in treasury. Through in-depth research with 1,000 corporate treasury professionals every year, we have a unique insight into the trends and developments within the profession and an unrivalled global viewpoint.

Marianne Ford

Senior Marketing Manager

EuroFinance

Economist Impact

[email protected]

31-05-2022 | treasuryXL | Gtreasury | LinkedIn |

Source: Gtreasury

Original Broadcast: April 19, 2022

Gain on-demand access and learn how to take the first steps toward creating a hedge program. HedgeTrackers, Juan Enrique Arreola, and GTreasury’s Evan Mahoney outline:

Featured Speakers:

Juan Enrique Arreola, CPA

Client Services Manager

HedgeTrackers

Evan Mahoney

Product Owner

GTreasury

24-05-2022 | treasuryXL | Refinitiv | LinkedIn |

Fixed income volatility looks like it will be around for a while, due to whipsaw-like changes in the overall economic environment. In such an environment, firms need to have the right evaluated pricing to ensure they are pricing their portfolios at fair value levels and that they are complying with regulations.