GTreasury Innovation Lab Launches with Goal of Accelerating the Development and Deployment of New Treasury Technologies

17-02-2022 | treasuryXL | Gtreasury | LinkedIn |

CHICAGO, Ill. – February 17, 2022 – GTreasury, a treasury and risk management platform provider, today announced the launch of the GTreasury Innovation Lab. Expanding and formalizing the culture of technology innovation that GTreasury has always supported within the company, the Innovation Lab is structured to bring significant and differentiated impact to customers through brand new advances in treasury management.

The technology team at GTreasury continuously recognizes potential opportunities for treasury innovation. The company has traditionally held twice-annual hackathons to explore unique and creative ways to advance treasury technology and integrations. Now with the launch of the GTreasury Innovation Lab, each member of GTreasury’s technology team will have a dedicated cycle within the lab, gaining a purpose-built and regular outlet for putting ideas to the test. GTreasury developers also constantly absorb feedback from the customer support team, which gives them insight into the specific challenges that treasurers face. Those insights inform developers’ innovative approaches to increase the capabilities, usability, and overall efficiency of the solutions within the GTreasury platform, both for customers and GTreasury’s internal team that supports them.

“GTreasury has always been forward-looking with the technology and integration capabilities that can enable treasury and finance teams to do more and do it more efficiently,” said Ciarán O’Neill, Director – Innovation Lab, GTreasury.

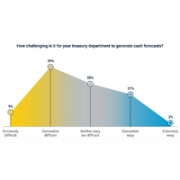

“We keep one eye on where customers are right now and one eye on where they want to be. Our focus is on making sure that we’re always leveraging the latest technologies and offering future-proof solutions – it’s that philosophy that has led to pioneering creations like SmartPredictions™, our AI-fueled cash forecasting tool. The launch of the GTreasury Innovation Lab accelerates our pursuit of the innovations that it takes to develop and deliver powerful and compelling technological advances to our customers, and we’re excited to get going.”

Technologies born in the GTreasury Innovation Lab will progress through a systemic process designed to ensure the viability of a new solution. Developers at the lab first nurture initial ideas into working proof of concepts. Lab members then vote to select the solutions with the most potential to provide demonstrable day-to-day value for treasury teams. Solutions next enter a validation phase, where ideas are presented to internal stakeholders and customer representatives, including early adopters of a beta product. Validated solutions then move to a production development team to be fully built and integrated as stable enterprise-grade components of the GTreasury platform.

The GTreasury Innovation Lab already has a slate of high-potential solutions in ideation, including many in areas where the introduction of AI/ML capabilities offers tremendous potential. Initial areas for exploration include advances around BI reporting, risk analysis modules, and a reconcilement module offering more automated and accurate reconcilement between forecasted and actual treasury payments.

About GTreasury

GTreasury is committed to connecting treasury and digital finance operations by providing a world-class SaaS treasury and risk management system and integrated ecosystem where cash, debt, investments and exposures are seamlessly managed within the office of the CFO. GTreasury delivers intelligent insights, while connecting financial value chains and extending workflows to third-party systems, exchanges, portals and services. Headquartered in Chicago, with locations serving EMEA (London) and APAC (Sydney and Manila), GTreasury’s global community includes more than 800 customers and 30+ industries reaching 160+ countries worldwide.