Sibos 2022 | How did our expert Philip Costa Hibberd experience the event?

19-10-2022 | Philip Costa Hibberd | treasuryXL | LinkedIn |

We sent our expert Philip Costa Hibberd to the SIBOS conference to discover and explore the World’s Premier Financial Services event.

Last week, the SIBOS conference took place in Amsterdam. Sibos 2022 brought together more than 10,000 participants in Amsterdam and online, as this event returned in-person for the first time in three years.

Philip is delighted to share his experience with you. Happy reading!

What is Sibos?

The Sibos conference is an annual event organized by Swift that brings together leaders in the payments, banking, and financial technology industries. The conference provides a forum for attendees to discuss the latest trends and developments in the industry, but – as it turns out – it is mostly used as a venue where bankers meet other bankers with the occasional FinTech thrown in the mix.

During the 4 days of the 2022 edition, I learnt that little focus is given to the needs of the corporate treasurer. Throughout the conference, a few interesting recurring themes emerged nonetheless, which I’ll describe in the paragraphs that follow.

Purpose of the financial industry

Queen Maxima – acting as the “United Nations Secretary-General’s Special Advocate for Inclusive Finance for Development” – kicked off the opening plenary by speaking about the importance of financial inclusion and access to banking services for all.

The first priority is to make sure we do no harm […] but we have a chance today of moving beyond doing no harm to actually doing good. So, beyond transaction volume and customer acquisition can we create the rails for transformative change to help users become more financially healthy?

Sadly the answer I heard from the bankers speaking on stage during the sessions that followed was not promising. “Maximising shareholder value” was still the dominating mantra… which – as experience teaches us – has seldom led the banking industry to “doing no harm”, let alone “doing good” in the past.

Banks vs FinTechs

A bit more hope for the industry “doing good” came from the voice of FinTechs on stage. As it turns out, a mantra based on “innovation and disruption” makes it easier to attract scarce resources (such as talent) and ironically deliver shareholder value as a consequence.

It was interesting to observe the evolution of the Bank-FinTech relationship. The change in how banks perceive FinTechs today compared to a few years ago was remarkable. Once seen as a threat, FinTechs are today considered an ally by banks.

When asked “Are FinTechs Friend or Foe?”, bankers gave answers as:

“Partnership with FinTechs is our main strategy”.

“Partnership with FinTechs is crucial. They bring agility and they are a matter of survival for us”.

It was hardly a surprise then to learn on day 2 of the conference about BNP Paribas’ acquisition of Kantox, a leading fintech for automation of currency risk management. The relationship between banks and FinTechs will probably only get warmer and tighter from here… but only time will tell if that is good news for us.

Regulation-driven innovation

Besides FinTechs, another often cited source of innovation for banks was “the regulator”.

Singapore was the most cited example of successful regulator-driven innovation. Its central bank has been encouraging innovation in the financial sector with generous grants to adopt and develop digital solutions, AI technology, cybersecurity capabilities, etc. On top of that, it has developed an exceptionally accommodating regulatory framework. It has for example introduced a “regulatory sandbox” for FinTechs and banks to test their products and services in a live environment without them having to be concerned with compliance hurdles (at least for the delicate initial phases of innovation).

There are hopes that Singapore’s success will be taken as an example by other regulators across the globe, but the most basic expectation from the industry is for regulators to at least set guidelines to improve standardization across the market. As nicely put by Victor Penna, there is still a lot of work to be done:

“Can you imagine if I sent an email from Singapore to Belgium and they couldn’t process it? That is exactly what is happening today with payments. This has to change.”

One last often cited trend where regulators are expected to play a dominant role in innovations, are Central bank digital currencies – CBDC in short.

CBDC (Central bank digital currency)

CBDCs are digital currencies issued by central banks. Typically central banks have two kinds of liabilities:

- Cash: takes a physical form and is available to the general public

- Central bank deposits: which take a digital form but with limited access

CBDCs are a third form of liability that complements cash and central bank deposits: they take a digital form and are directly available to the general public.

More than 100 central banks are estimated to be working on their own projects. They are important in the context of innovating the financial sector because they have the potential to provide greater efficiency and transparency in financial transactions. Additionally, CBDCs could help to reduce the cost of financial services and increase access to financial services for underserved populations.

There is still little consensus today on what exactly the impact will be, not least because of the fragmentation of all the initiatives. For example, when it comes to the digital Euro project, the impact on corporate treasury payments is expected to be limited. The project is still in the validation phase, but the assumption is that even if/when the project were to move into the realization phase (decision expected in September 2023) usage will be limited by design with the introduction of low limits to the maximum balances which could be held (exact limits need to be defined, but think of a few thousand euros max).

Realtime banking and 24/7/365

Banks have invested a lot in the technological backbone needed to support open banking and instant payment requirements across the world and seem to be puzzled by the modest adoption. The ambition is to move away from batches, cut-off times, and end-of-day statements in favour of instant payments 24/7 and provide information-on-demand via APIs.

From a treasury perspective, this brings some challenges. Moving to APIs can be hard, especially if you have a fragmented ERP/TMS/Banking landscape. But the biggest challenge is probably the way that we organize our work and our processes. As jokingly put by Eddy Jacqmotte group treasurer at Borealis:

“Instant Treasury is nice: but I don’t like the idea of instant treasury on Saturday and Sunday”.

AI and (big) data

The ever-decreasing cost of storage and processing information, combined with the ever-increasing flow and value of user data has transformed the “AI” and “(big) data” brothers from geeky kids in the corner to rockstars in the centre stage.

Besides the obvious use cases such as fraud detection, sanction screening, reconciliation, payment repair, etc. the new trend is to use AI to generate new tailored content and to feed it to users to measure their interest in a specific topic and nudge their behaviour. Instead of asking you directly if you are interested in a mortgage, the algorithm might casually inform you about the price per square meter of properties in the neighbourhood where you go for coffee every weekend. If you interact with the prompt, the algorithm will take notice and will keep on feeding you with “property-related” information, until you find yourself asking for a mortgage…or showing interest in something else that the bank can do for you.

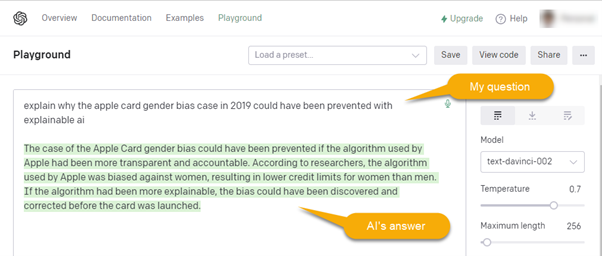

Sounds sketchy? It might be, that’s why another trend in this area has been making its way to the foreground: Explainable AI.

Explainable AI is a form of AI that can provide understandable explanations for its predictions and decisions. This is important especially in the financial industry because it can help to build trust with customers and regulators and avoid (or at least make explicit and controllable) unwelcome biases.

For example, the Apple Card / Goldman Sachs scandal in 2019 could have been prevented if the algorithm used by Apple had been more transparent and accountable. According to researchers, the algorithm used by Apple was biased against women, resulting in lower credit limits for women than men. If the algorithm had been more explainable, the bias could have been discovered and corrected before the card was launched.

In essence: AI is powerful, but transparency is key. On that note, I have a confession to make: the previous paragraph was written by an AI and not by me…

Thanks for reading!

Eurofinance remains THE event for corporate treasurers | By Pieter de Kiewit

12-10-2022 treasuryXL | Pieter de Kiewit | Treasurer Search LinkedIn

Throughout covid times the organizers of Eurofinance remained active and were able to create interesting web-based events. Still, general opinion in last weeks’ event in Vienna was that there is nothing like the live thing. The programme was packed with interesting content, the event floor with interesting companies and visitors.

By Pieter de Kiewit

Communication leading up to the event and the venue, the Wien Messe, radiated experience in events of this size. The numbers of representatives and visitors were impressive. Luckily, the venue is big enough to not nerve the visitors who have to get used to large crowds again.

The programme was spread out over the very large room for plenary meetings, five large rooms for parallel session with presentations & panel discussions and “open rooms” on the trade floor. Key note speakers like Guy Verhofstadt and Goran Carstedt were able to enthuse with stories beyond the scope of treasury, others covered topics about treasury technology, both practical & visionary and treasury organization, for example about my personal favourite, the treasury labour market.

For many, the trade floor was easily as interesting as the content. Visitors gained market information, for example preparing for a TMS selection and implementation. Also reuniting with old treasury friends and getting to know new ones, was relatively easy during well catered breaks. Some of the visitors created new legends during the Thursday night afterparty that is not covered by this looking-back-blog.

As treasuryXL ambassador I visited the various partners of the platform present and received positive feedback on the event. So Cobase, Kyriba, TIS, CashForce, Nomentia, Refinitiv and CashAnalytics, we hope to see you again in Barcelona again and welcome a number of new ones.

Hasta luego,

Thanks for reading!

Interview Haia Aaraj, Recruitment Consultant at Treasurer Search

11-10-2022 | treasuryXL | LinkedIn |

Speaking about a rockstar within recruitment for treasury you think about Haia. She started working for Treasurer Search as a Recruitment Consultant at the beginning of this year and celebrated many successes with the team since then.

Haia is a down-to-earth, spontaneous and proactive human being with a hilarious sense of humor! You will be very lucky to work with her as someone who is searching for a next treasury adventure or if your company is in need of a treasurer.

We wanted to know Haia a bit more and we asked her the following questions. Happy reading!

7 questions for Haia, let’s go!

INTERVIEW

1. Treasurer Search is a recruitment business for treasury based in the Netherlands. What is your role within the company? And can you tell us more about your background?

I’m a recruitment consultant at Treasurer Search, so I’m mainly responsible for assignments from our clients to hire treasury professionals (from A to Z), and here we’re talking about Juniors up to executive level assignments. About my background, I have a Bachelor in Sociology and a high Technical Diploma in Management. I started in recruitment since 2016 doing some internships, and officially started as a recruitment assistant at a medical centre, then a company in Dubai where I made my way to the upper level and I left as a Recruitment manager. I moved to the NL and started at Treasurer Search in Feb, 2022.

2. How would you describe Treasurer Search in 3 words?

Well-connected / Transparent / Professional

3. What is, in your perception, the biggest benefit for clients and candidates to work with Treasurer Search?

They will be working with Recruiters who are experienced in both recruitment and treasury, so we know who a good cash manager or group treasurer is. At the same time, Treasurer Search provides a transparent recruitment process, no surprises or hidden info, alongside the smoothness in communication.

4. You started at Treasurer Search with zero knowledge about Treasury 8 months ago. Now you are a Rockstar in matching the right candidate with a client. What’s your secret?

In today’s world, everyone can learn whatever they want in no time, the resources available are at a wide range. For me it was mainly reading, attending online courses, and of course, learning from the experts in this field.

5. How do you stay informed about the recruiting industry combined with treasury trends?

Attending as much helpful webinars as possible. Also following the stars in both industries is very helpful because you need to stay up-to-date, don’t you?

6. What do you think is the most rewarding aspect of being a treasury recruiter?

Being a treasury recruiter widen your aspects of how the financial management works. You forget about traditional roles in business finance and you learn treasury is way more than the basics that the public knows.

7. What are you most proud of in your career at Treasurer Search so far?

When I started at Treasurer Search I was new to the country, and the treasury. This is where my colleagues played the big part and helped a lot through time. Now I’ve integrated well in the society as well as learned a lot about treasury. Mainly, I’m proud of my colleagues who played an essential part in this big movement for me.

Want to connect with Haia? Click here

Thanks for reading!

Kendra Keydeniers

Director Community & Partners, treasuryXL

Group Treasurers’ Exchange | Designed for Group Treasurers, by Group Treasurers

06-10-2022 | IQPC Exchange | treasuryXL | LinkedIn |

EUROPE’S PREMIER INVITATION-ONLY EVENT FOR GROUP TREASURERS

At the 10th annual Group Treasurers’ Exchange, 60 Group Treasurers, Directors and Heads of Treasury will be coming to Berlin on November 15-16 to discuss how innovating the treasury function will mitigate risk and bolster profitability.

Designed for Group Treasurers, by Group Treasurers, the GT Exchange Europe 2022 offers a unique and exclusive format specifically tailored to unpack the issues that are most relevant. This invitation-only meeting is exclusively attended by a select group of pre-qualified senior treasurers responsible for creating an efficient and innovative treasury function. Attendees will benefit from an experience packed with networking with likeminded peers navigating the same industry challenges in a relaxed, consultative, and friendly environment.

The Exchange is attended by senior strategic leaders and decision-makers from major Treasury departments across Europe. Every attendee is personally invited and registered to ensure the right level of seniority and relevance to the event’s key themes.

Group Treasurers, Directors and Heads of Treasury can capitalise on a closed-door event with no press, full of one-to-one meetings, intimate breakout sessions, think tanks, roundtable discussions & more!

This innovative two-day event will cover key challenges facing an innovative treasury function, with expert speakers attending from a variety of top companies, including:

- Roche

- General Mills

- C&A

- SVP Worldwide

- Galeria

- Orange

- Axpo Group

Topics discussed at the 2022 Exchange include:

- Payments, Liquidity Management, Taxation and Regulation

- Future of the Treasury Department

- Promoting Innovation and Risk

- Prioritising ESG Initiatives

- Relationship Management

- Digitalisation and Financial Efficiency

- Cash Forecasting

- Cost Elimination and Fraud Prevention

- Value Creation Through Liquidity Strategy

- Cross-Department Collaboration

- New Technologies for the Treasury Department

If you’re a qualifying attendee and want to attend the #GTEU Exchange, request an invitation here

LIVE SESSION | My Treasury Career Development & How the Register Treasurer education contributed

29-09-2022 treasuryXL | Treasurer Search | LinkedIn

Are you thinking about how you can shape your treasury career and in need for inspiration? There are plenty of education opportunities, but in what education will you invest?

You are invited to join our next Live Session. Registration is Now Open for:

𝐌𝐲 𝐭𝐫𝐞𝐚𝐬𝐮𝐫𝐲 𝐜𝐚𝐫𝐞𝐞𝐫 𝐝𝐞𝐯𝐞𝐥𝐨𝐩𝐦𝐞𝐧𝐭 & 𝐇𝐨𝐰 𝐭𝐡𝐞 𝐑𝐞𝐠𝐢𝐬𝐭𝐞𝐫 𝐓𝐫𝐞𝐚𝐬𝐮𝐫𝐞𝐫 𝐄𝐝𝐮𝐜𝐚𝐭𝐢𝐨𝐧 𝐂𝐨𝐧𝐭𝐫𝐢𝐛𝐮𝐭𝐞𝐝

There is no standard career path for treasurers but one can learn from the choices and developments of the successful ones.

In this webinar two graduated Register Treasurers will share their stories:

- 🌟 Jurgen Wessel RT is interim Head of Treasury of SHV and has experience in a variety of international companies at HQ and treasury hub level.

- 🌟 Frank van der Hoeven RT van der Hoeven used to be a banker, moved to the corporate side and currently is Treasury Manager at IMCD, well-known for many successful acquisition and integration processes.

They will tell you about how they moved between various stations and will pay special attention to the added value of their post academic degree: The Treasury Management and Corporate Finance programme (RT Programme) at the Vrije Universiteit Amsterdam (VU Amsterdam).

Everyone is welcome to this webinar. This webinar is extra relevant for those who consider joining the RT programme.

🌟Moderator: Pieter de Kiewit of Treasurer Search

🌟Duration: 45 minutes

We can’t wait to welcome you next week!

Best regards,

Kendra Keydeniers

Director, Community & Partners

What is Pricing Risk (FX Risk) and how to deal with it?

22-09-2022 | Harry Mills | treasuryXL | LinkedIn

Also known as pre-transaction risk, pricing risk occurs between a transaction being priced and agreed upon. It materialises when exchange rates change after a quote has been delivered, either impacting the sales margin or incurring a re-price. treasuryXL expert Harry Mills, founder & CEO of CEO Oku Markets, will explain to us what Pricing Risk is all about, and how to deal with it.

By Harry Mills

Who experiences pricing risk?

Businesses experience pricing risk to a greater or lesser extent depending on the nature of their business, their marketplace, and their sales and purchasing cycles. We find it helpful to consider the following initial points when assessing pricing risk:

- Is the transaction FX-denominated, influenced, or relatively insensitive?

- What is the timeline between quoting and agreement?

- What impact would a +/- 5% or 10% FX move have on margins?

A transaction is “FX-denominated” when it is in a currency other than the firm’s functional currency. An example is a UK business providing a quote to an Irish business for an export sale denominated in euros (instead of GBP).

How much influence? An example…

You’ll likely have an intuitive idea of the level of influence that fluctuations in FX rates have on your transactions, but consider a UK company that designs and builds high-end bespoke summer houses (why not?):

- The company imports unfinished timber and metal fixings priced in dollars, and sources glass and other furnishings and materials from within the UK

- The per-unit cost of production will be affected by movements in the GBPUSD exchange rate because timber is a major cost

- But the basket of production costs also includes the UK-sourced materials, shipping, labour (design and build), amongst others (warehousing, storage etc.)

- So we can see that a 5% drop in GBPUSD wouldn’t result in a 5% increase in production costs – understanding this relationship and ratio is critical

“Businesses should understand the precise impact of currency fluctuations on their costs and/or revenues to determine their FX sensitivity, especially concerning pricing risk”

Harry Mills, Founder & CEO Oku Markets

One-Size doesn’t fit all

Getting to grips with pricing risk can be fairly straightforward for FX-denominated transactions with a straight-through and linear FX impact on the price, but most businesses have a more complex setup.

Many businesses are converting from a just-in-time to a just-in-case stock strategy. which can bring complexity and may add to pricing risk. It’s our view, here at Oku Markets, that there is no one-size-fits-all approach for currency management, so here’s a few areas to think about:

- Stock cycle and costing method

- Pricing strategy and flexibility

- FX price sensitivity (as detailed above)

- The competitive environment and market practices

Pricing risk can impact procurement and sales, although we mostly think about the pricing that we are delivering. What about the pricing we receive, as customers? It’s not uncommon for Chinese exporters to add a large buffer to their prices to factor in fluctuations and depreciation in the USDCNY exchange rate. Read more about China and the yuan.

So it’s worth considering and asking your suppliers and international partners about how they manage FX – is there an opportunity for increased transparency and better terms by tackling the problem together?

FX Risk Map

It might be helpful to visualise the lifecycle of a transaction to identify when currency risk occurs. Again, there is no one-size template for this – every business’ FX Risk Map will look a little different, but here’s a basic setup to get started with:

- Pricing Risk: the FX risk between quote and agreement

- Transaction Risk: the FX risk between agreement and settlement

- Translation Risk: the FX risk between accounting (PO/invoice) and settlement

Dealing with Pricing Risk

Three ways you can reduce pricing risk and deliver more consistent results are:

- Include a quote expiry date – limiting the time reduces risk

- Add an FX buffer to the price – 5% is typical for short periods

- Build an FX clause into the quote – transparency means no surprises

The most appropriate route or combination of mitigating actions is unique to each business. An online travel company delivering live holiday prices will require higher frequency updates to FX rates and a tighter quote expiry date and FX buffer when compared to a company providing quotes for custom-designed summer houses.

When it comes to an FX buffer, we suggest considering the volatility of the currency pair and adjusting for the relevant quote period.

Let us help you quantify your FX risk

Quantifying currency exposure requires thought and specialist skills and expertise. Most FX brokers lack the capabilities to do this properly, resorting instead to emotionally-charged deal-making which can result in poor outcomes for clients.

We’re proud to work transparently with our clients, and we work hard to break the asymmetry of knowledge and information in the FX market.

You can contact us for a review of your currency processes and for our guidance and suggestions at [email protected] or 0203 838 0250.

Thanks for reading 👋

Harry Mills, Founder at Oku Markets

Where did the treasury applicants go? | By Pieter de Kiewit

19-09-2022 treasuryXL | Pieter de Kiewit | Treasurer Search LinkedIn

As treasury recruiters, we should know enough about corporate treasury to do intakes and screen candidates. Also, we should know the latest about what’s happening in the field of recruitment and so we read the publications of Geert-Jan Waasdorp of The Intelligence Group. I would like to share his latest, very interesting article and build the treasury connection.

By Pieter de Kiewit

Labour market pressures are not equally distributed among all employers.

I left a link if you want to read the full article but this is roughly what he says. There is a huge growth in people working since before covid. In parallel, there is a huge decline in active applicants. This pressure in the labour market is not evenly distributed among all employers. The ones that can find new employees can do so because of a strong employer brand and increased investments in own or external recruitment. Also, they are willing to decide quick and offer a better package.

So what does this mean if we project these findings on the corporate treasury labour market? My personal observation is that treasury staff is, on average, less driven by the company brand and more by the job content than candidates from other job types. We learned this working for clients like Tesla and Nike. Employer branding specifically towards treasurers would also be hard, I cannot envision a corporate recruiter promoting his manufacturing company at Eurofinance.

How to adapt?

The obvious low-hanging fruit is that the hiring manager, already at the start of the process, has to organise and choose a mindset in the following: being able to decide quickly, from fewer candidates than before, and offering more than the old standard. Even highly skilled recruiters sometimes underestimate these aspects over time.

The judgement if the internal recruitment team is equipped to tackle the search or whether an external one should do the job – we, Treasurer Search – I will not elaborate on here. What I do want to mention is another obvious source that can be opened. For some of us that are considered a paradigm shift: bringing treasury talent in from abroad, from within the EU or even sponsoring a work permit. I am aware that some of us consider this topic highly political. What I can tell, both from our own organisation, as well as from successful placements with our clients, that this can be a very successful solution. In the Dutch labour market already the majority of candidates placed by us is non-Dutch. This is not a plea to open the borders and not be critical. Regretfully we have examples where this solution did not lead to success as coming to The Netherlands can be hard for the new employee. But also locally found candidates can fail in their new job.

My conclusion is that indeed, the world is different, as is the labour market. And given current demographic developments I do not expect a shift back. Luckily there are solutions but we will have to accept the consequences and cannot lean back. Those that do will shrink and go extinct.

Good luck in your search,

Pieter

Thanks for reading!

Quickly refresh your treasury knowledge? Download our eBook: What is Treasury?

08-09-2022 | treasuryXL | LinkedIn |

This eBook compiled by treasury describers all aspects of the treasury function. This comprehensive book covers relevant topics such as Treasury, Corporate Finance, Cash Management, Risk Management, Working Capital Management.

This eBook was prepared by treasuryXL based on the most useful best practices offered by Treasury professionals throughout the previous years. We compiled the most crucial information for you and wrote clear, concise articles about the key topics in the World of Treasury.

We took a deeper dive into each of the above-mentioned treasury functions and highlight:

- The purpose of each named Treasury function (What is?)

- What specialists do

- Examples of Activities

- Summary of Frequently Asked Questions and answers

- Conclusion

How to receive the eBook ‘What is Treasury’ for Free?

We simply giveaway two presents for you! By signing up for our newsletter you will automatically receive the following in your inbox:

- On Fridays, our Coffee Break weekly newsletter will land in your inbox. In this weekly newsletter, we will highlight the whole week full of the latest treasury news within our community.

- The 41 pages eBook, What is Treasury?

Subscribe, Join, Download and Relax.

Welcome to our community and have fun reading!

Director, Community & Partners at treasuryXL