The unregulated DeFi market has experienced remarkable growth in 2021. DeFi use cases bring a number of benefits and may remove a number of the shortcomings of the traditional financial ecosystem.

Next to that the attitude of a growing group of new generation consumers is changing triggered by higher yields and the emergence of alternative digital and crypto assets. This paper attempts to answer a number of questions such as: what does DeFi mean for the traditional financial system?; should traditional financial institutions worry and why?; should they adapt to the new Defi environment?; what steps could be taken?; and finally, what will the new financial ecosystem look like?

INTRODUCTION

Decentralised finance or DeFi caught a lot of attention in 2021 from both regulators and traditional banks. The advent of this, until now unregulated, DeFi system has raised a new wave of investors and possibilities that the financial markets never envisioned. This has led to a massive inflow of liquidity since the summer of 2021. This paper will go into more detail as to what this could mean for the traditional financial world. The main questions are: will DeFi be sustainable in the long run and should traditional banks worry? Or is DeFi a new chance for the traditional banks to solve their present shortcomings by bridging the gap between CeFi and DeFi?

SHORTCOMINGS OF THE TRADITIONAL FINANCIAL MARKET

To understand the new DeFi world and its spectacular growth, the roots of the problem with the current financial system need to be examined. For a long time, traditional finance has been largely reliant on intermediaries, like banks, insurance companies and stock exchanges, thereby governed by strict regulation. For their operational needs and day-to-day transactions regular consumers need to deal with a raft of financial middlemen to get access to everything from loans and mortgages to trading stocks and bonds. They are then governed by strict regulation and controls. A business would have to complete anti-money laundering and ‘know your customer’ checks for every source of capital. These rules have been increasing to the point that compliance is often one of the biggest cost centres for many banks. Given the various diferences in national regulations, conducting a cross-border money transfer through a financial institution may be a long process with possible delays, making it more expensive. As a result, the current market is not as efficient as desired, especially when it comes to inclusiveness and accessibility. This financial system is also not transparent about what is happening, with customers having no control over their assets. This keeps the risk and control of money, financial products and financial services at the centre of these systems.

NEW GENERATION CONSUMERS: MILLENNIALS AND GEN Z

Triggered by these shortcomings and upcoming technological financial innovations, as well as the lack of attractive yields in traditional financial products, a growing group of consumers, especially the Millennials and Gen Z, is fundamentally changing their attitudes. They are increasingly looking for alternative loans and assets to invest in. Many consumers are thereby searching for systems that are more flexible and less restrictive than the traditional ones. These new technologies have led to changes in financial products. Many of the existing traditional assets move to digital or have digital equivalents. A growing group of consumers is increasingly looking for and experimenting with these more attractive financial assets, thereby driving the under current of interest in DeFi.

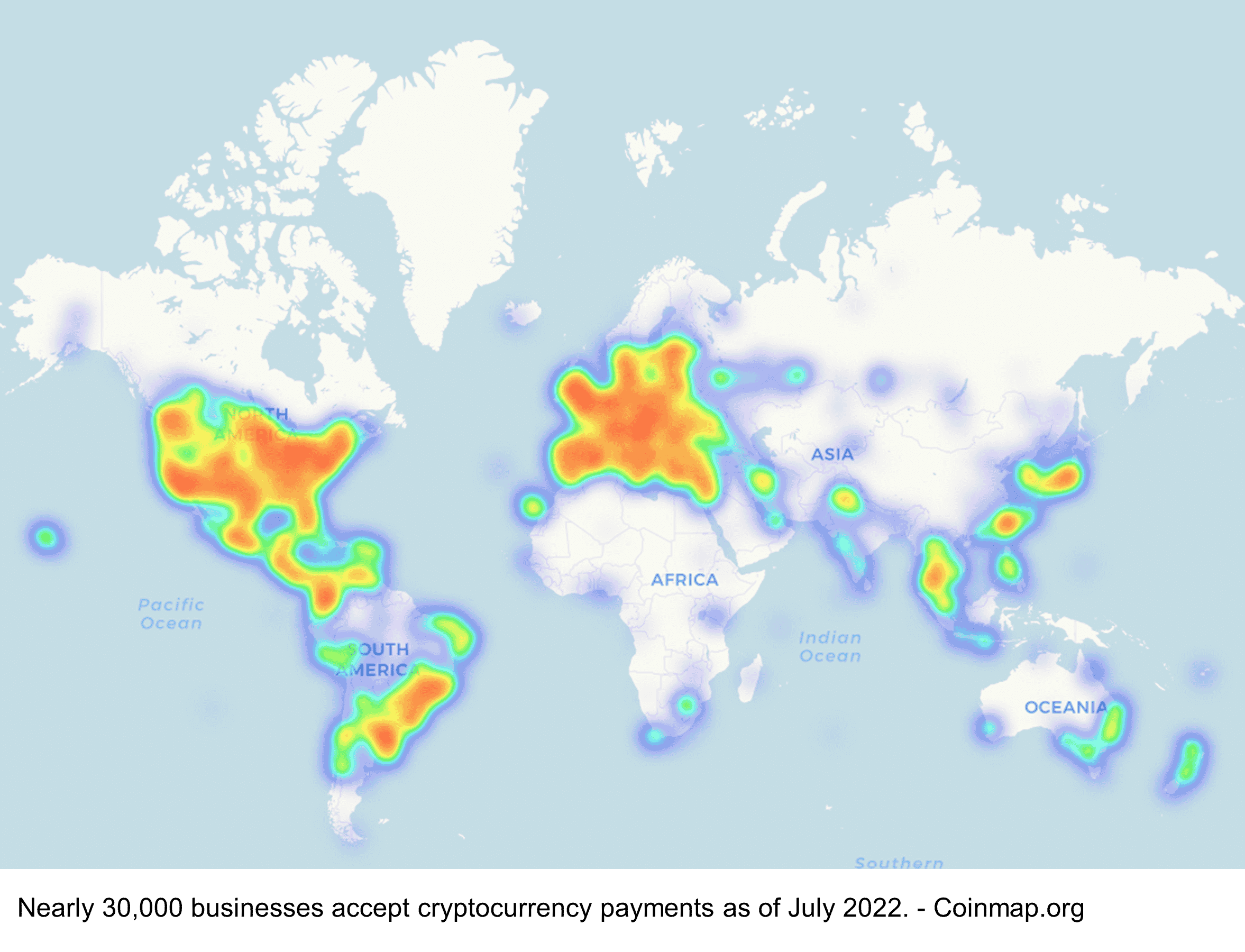

In order to provide investors with more secure and easier access to crypto-assets, other platforms seek to bridge the gap between blockchain-based finance and traditional capital markets. Some companies are currently exploring this new marketniche by providing crypto-services to those who want to ‘take a safer road’, preferring to turn to ‘regulated’ institutions that trade and store crypto-assets on their behalf. In a way, these platforms create a bank-like environment meant to give crypto-beginners a sense of security — albeit a distorted one, as the companies’ accounts have been hacked more than once.

WHAT IS DEFI?

Decentralised Finance, (1) or DeFi for short, encompasses a new type of emerging financial ecosystem enabling decentralised financial applications, such as trading, borrowing and lending activities, powered by public blockchain or distributed ledger technology (DLT) networks and using cryptocurrencies. DeFi refers to replicating traditional financial services used today in a decentralised way. The goal of DeFi is to create an open and transparent financial ecosystem that can be accessible (via the internet) to everyone anywhere across the globe. DeFi allows users (buyers, sellers and borrowers) to interact directly with each other, so peer-to-peer, via decentralised platforms without a sign-up process. This is by building trust in the technology and the governance behind it. DeFi seeks to improve the efficiency of financial transactions by replacing traditional middlemen with automated or smart contracts built on blockchains. These are coded, self-executing agreements where users directly interact with the application. From borrowing platforms to stable coins (disposable tokens), the DeFi ecosystem consists of a vast network of integrated protocols and financial instruments.

Users could access DeFi products through decentralised applications (DApps), or other programs called peer-to-peer protocols, which are web-based applications powered by smart contracts and secured by blockchain technology. These require no access rights for easy lending, borrowing or trading of financial tools. As a result, anyone can transfer or lend money to another party without a bank, making these transactions easier, more affordable and more accessible. The vast majority of these DeFi platforms and most applications are hosted on the Ethereum network, but many alternative public networks are emerging.

DEFI USE CASES/APPLICATIONS

DeFi is making its way into a wide variety of simple and complex financial transactions (2). They encompass nearly everything that can be done at a bank with regular old (non-crypto) currency. These range from DeFi-based lending and borrowing including overcollateralised loans, decentralised trading, staking to yield-aggregating or yield farming (earning) and liquidity mining. Margin trading and insurance and even NFTs or non-fungible tokens are also possible through DeFi protocols. DeFi developers are actively exploring and building more and new services to the ecosystem.

Overcollateralisation

This segment of the DeFi lending and borrowing space is rapidly growing. The lender and the borrower come together on a DeFi lending platform and execute smart contracts. By using DeFi lending protocols, crypto holdings can be used to obtain a loan. Most DeFi lending protocols do not allow for traditional credit checks on potential borrowers.

Traditional finance loans in DeFi however are commonly secured by overcollateralisation.

In the absence of a credit-approval process, posting collateral is typically essential to mitigate credit and fraud risks. The borrower gives his crypto as collateral and obtains a loan from the platform, while the lender gives his fiat money to the platform to earn some interest. Borrowers leverage their trading by holding an existing asset in a vault and use the borrowed asset to trade or compose more complex lending, borrowing and staking activities with the same collateral base.

Staking

A typical example of DeFi use cases is staking, (3) a way of earning rewards for holding certain cryptocurrencies. This involves ‘staking’ (lending or investing) digital assets into a proof-of-stake platform, a consensus mechanism, and earning a percentage-rate reward over time. This usually happens via a ‘staking pool’, which can be thought of as being similar to an interest-bearing savings account, ensuring that all transactions are verified and secured without a bank or processor in the middle. Staking enables money to be borrowed against this stake and a small amount of interest to be paid, which is probably going to be beaten by the appreciation in the staking earnings. It eliminates almost all of the traditional finance concerns that people have.

Yield farming

Another DeFi use case and one of the most promising is yield farming. (4) Yield farming involves providing liquidity or lending out cryptocurrency to a DeFi protocol that puts it in a smart contract-based (trading or lending) liquidity pool in exchange for interest or trading fees plus liquidity provider tokens that can then be staked in a yield farm to earn additional yield. These returns are expressed as an annual percentage yield (APY). Often the amount of interest earned or paid is less important than the amount of governance tokens one can earn by lending or borrowing (or both). Users earn tokens by locking cryptocurrencies in smart contracts running on the exchange’s trading plat forms. This protocol essentially means that a crypto-holder can farm for more crypto-tokens by using the existing tokens. There are a lot of diferent and sometimes very complex strategies to do this type of farming. However, the most popular one is where a platform consistently moves the user’s tokens between a number of lending platforms in search for a higher return on a blockchain like Ethereum.

Liquidity mining

Another area that is likely to grow in importance is liquidity mining. Providing liquidity is hugely important for the healthy running of decentralised exchanges (DExs), although it is currently held back by the threat of impermanent loss (where providers risk losing some of their initial investment due to price changes). Reducing impermanent loss is imperative to the development of liquidity mining. New formulae for automatic market makers that reduce impermanent loss are being developed, and the results look promising.

Prediction markets

Prediction markets are platforms where individuals can make predictions on the realisation of future events. These markets allow people to bet on the price of a currency, stock prices or the results of a future event like sporting events or elections and more. DeFi opens these markets for participation. In DeFi, prediction markets are intermediary-free, more accessible and typically have lower fees compared to centralised prediction markets.

THE DEFI ECOSYSTEM

With the emergence of DeFi, a completely new ecosystem of platforms, working applications and protocols is developing through which borrowers, lenders and investors can undertake bank-like transactions with out banks. Decentralised platforms entered the financial scene including decentralised banks (lending and borrowing), decentralised exchanges, decentralised insurances, etc. This has also attracted a growing number of fintech companies, challenger banks and neobanks or cryptobanks that are disrupting the traditional financial system across the world with more agile, cheaper and more inclusive services. DeFi banks: Lending and borrowing Lending platforms are one of the most popular DeFi applications. Because borrowers do not need personal checks, they can access loans faster and geographical barriers do not apply, making loans more obtain able. All they must do is deposit collateral. Lenders can lock cryptocurrency into these platforms to earn interest, while users can borrow stablecoins by putting up collateral — 150 per cent of the amount borrowed is common to account for price volatility. There are various platforms that deliver decentralised lending and borrowing services mostly using the Ethereum network. These include protocols like Aave, Bancor, Compound and MakerDAO, with tens of billions in market size.

Decentralised exchanges

DeFi also gave birth to decentralised exchanges or DExs that are popping up at a growing rate. These exchanges benefit from being independent and not being controlled by any regulatory authority. Right now, most cryptocurrency investors still use centralised exchanges like Coinbase or Gemini. At DExs however there is no company operating it. With the emergence of decentralised exchanges, holders of crypto do not need to leave the crypto space to swap their tokens. Decentralised exchanges allow users to exchange or swap tokens with other assets, without a centralised intermediary or custodian. The extra cost on each transaction is another negative aspect of centralised exchanges (CExs), which DExs address, where there are fewer parties taking a cut of a transaction.

DExs also do not require users to deposit funds to start trading. They facilitate peer to-peer financial transactions with the help of smart contracts and function according to defined pricing mechanisms and let users retain control over their money. The most prominent example of a DEx is Uniswap, which allows people to trade crypto-tokens and swap tokens (5) that run on the Ethereum network. Other examples include Curve, PancakeSwap and dYdX.

DeFi insurances

Thanks to the popularity of decentralised banks and exchanges there are now even crypto-insurances that may insure their DeFi investment for a percentage of the yield they generate. They offer insurances that cover bugs in smart contracts. Decentralised insurances are still in origin stages. One example is Nexus Mutual, which is designing a decentralised alternative to insurance by allowing virtual communities to come together to pool their funds and share risks. As these platforms are built on self executing smart contracts, more options would be created sometime in the future, bringing further opportunities for the public. It is anticipated that larger and more sophisticated insurance models may emerge in the DeFi space in the years to come.

Decentralised asset management, another evolving class of service offered by DeFi is decentralised asset management. This trading or creating of complex financial products and management of assets nowadays falls into the sector of traditional investment banks. Decentralised asset management intends to make investing faster, less expensive and more democratised. Transparency delivered by DeFi promises to make information accessible and secure, composable to enjoy hyper-customisation of portfolios and trustless to allow access to historically illiquid assets and manage their investment regardless of location. Ampleforth is an asset management protocol of DeFi designed to be synthetic and smart commodity-money. It aims to provide a non-collateralised digital asset that helps traders and investors diversify their crypto portfolios. Ampleforth adjusts its tokens’ supply daily to match the market demand using a smart contract.

THE PRESENT STATE OF THE DEFI MARKET

The DeFi market has shown spectacular growth over the past two years. DeFi growth accelerated since mid-last year when services became more mainstream for the crypto-community. Decentralised finance has thereby developed into a complex ecosystem of platforms, working applications and protocols through which borrowers, lenders and investors can under take bank-like transactions without banks. Today, billions of US$ have been put into the DeFi-ecosystem, locked on the various DeFi platforms (6).

According to DeFi Pulse, the total value locked in DeFi contracts that was injected in diferent DeFi protocols/services as of the end of last year was almost US$100bn compared to US$500m in early 2020 — a staggering 1,000 per cent growth in the past two years. The recent hype around DeFi apps is driven by the growth of lending and borrowing protocols, especially those built on the Ethereum network. Lending currently represents nearly half of the DeFi market. There are hundreds of examples of DeFi applications on the Ethereum ecosystem today. The majority of these are based on DeFi lenders Aave, Compound and Maker showing the concentration of lending and borrowing markets within DeFi. This demand is especially evident amongst Millennials and Gen Z who will expect such services to be offered.

ASSESSING THE PROS AND CONS OF DEFI

DeFi is quickly emerging as a transparent and permissionless way for users to interact directly with each other. The DeFi system offers a number of benefits for crypto-traders and investors that are currently not provided by the conventional financial intermediaries, including speed, efficiency and lower cost. DeFi may thereby eliminate many of the traditional finance concerns that people have.

Despite the various benefits and opportunities, the DeFi industry is still in a nascent stage, and has not been stress-tested by long or widespread use. It faces many challenges much related to its non-regulated stance and the resulting lack of consumer protection that need to be tackled for a real break through. These challenges still make many traditional banks and consumers reluctant to enter the DeFi space.

More accessible versus attraction of malicious players

DeFi could greatly reduce the barriers to entry. By eliminating the need for centralised financial institutions and intermediaries, being replaced by self-executing programs, DeFi makes financial services more accessible and more inclusive, regardless of credit history, networth, geographical location or class. The anonymity of DeFi users and the absence of checks however could attract malicious actors that may use DeFi services to launder money and fund criminal operations and fraud.

Faster and more (cost) efficient versus congestion (7)

DeFi may enable to handle the management of finance in a faster, more efficient way, eliminating the high costs associated with regulation and poor infrastructures. The lack of intermediaries and the use of smart contracts could greatly reduce operational costs and delays. Furthermore, decentralised finance services are available 24/7. As a result, DeFi may surpass the present banking system in terms of speed. But there are some negatives such as the concentration risk. Decision-making power on DeFi blockchains runs the risk of being concentrated in a small group of large investors. Concentration can facilitate collusion and limit blockchain viability. Large validators could also congest the blockchain with artificial trades between their own wallets or risk insider trading.

Financial sovereignty control versus lack of consumer protection

Financial sovereignty is another advantage of decentralised finance. As intermediaries do not need to be relied on, people have full control over their assets and view their storage location and use. The existing lack of consumer knowledge could make it a breeding ground for fraud and manipulation by malicious developers, while the anonymity of DeFi users could attract actors that may use DeFi services to launder money and fund criminal operations and fraud. With DeFi being unregulated there is however no consumer protection if something goes wrong.

Higher yields versus market risks DeFi may give users incentives for their financial activities. DeFi offers more opportunities than traditional markets to earn higher yields, while the absence of intermediaries may considerably reduce the interest on loans procured on DeFi platforms. Consumers that currently participate in DeFi do so at a great(er) risk and may sufer losses. First, there is the investors’ risk, the sheer volatility of the crypto-asset markets. Cryptocurren cies are often subject to extreme volatility in the valuations of various digital assets. If there is a downturn, the crypto-assets used as collateral may sharply decline in value and some investors may see their positions liquidated.

Read here the article in which Carlo provides his opinion on what the expected conclusion is of crypto volatility for corporate Treasury

Stable coins versus illiquidity

Stable coins are increasingly being used to facilitate transactions on DeFi platforms. The growing use of stable coins may contribute to more stability. There are possible vulnerabilities with stablecoins. Stablecoins like Tether (USDT) risk liquidity mismatches because they are backed by commercial paper, which are short-term securities with mostly illiquid secondary markets. The present cryptomarket is also very illiquid. Every small quantity of ‘buy’ or ‘sell’ of these assets may hugely impact their value. Given the typically (over) collateralised nature of the activities, volatility in the valuations of various digital assets posted as collateral could translate into volatility in the valuations of the digital assets acquired.

Address cybersecurity versus security risk

DeFi also has the potential to address cyber security challenges. The decentralised blockchain makes financial transactions secure and provides more transparency for users, maintaining a high level of privacy. This is through the protocols that provide the assets, allowing anyone to inspect the code or the product, reducing the margin for human error. While a blockchain may be nearly impossible to alter, the lack of regulation could make other aspects of the DeFi system, like the open source of smart contracts, vulnerable for hacks, cryptocurrency investment scams, fraud and mishaps, which can lead to funds’ theft. Smart contract risks, such as bugs in the code, could lead to losses for users, as demonstrated by certain protocols in recent months.

SHOULD BANKS WORRY?

The debates around decentralised finance are heating up. If DeFi could become main stream, it might pose big challenges to traditional banks. DeFi may prove a disruptive force for traditional financial companies and would have a great impact on how banks operate in the future. It will certainly revolutionise the way finance would be handled. DeFi also has the potential to change the structure of financial systems, completely shake up and potentially even replace the current financial system.

DeFi: Still a tiny market

But within the present environment that would be a step too far. Numerically DeFi does not pose an imminent threat to traditional lenders. While the DeFi market has grown significantly in historical terms, encompassing remittance, trading, lending, borrowing and various other types of transactions, their market size is still very small compared to traditional banking. The decentralised finance sector currently represents only a tiny 0.1 per cent of the trillion-dollar traditional finance industry. Its potential for disrupting the larger financial system in the short term remains low.

DeFi: Upcoming solutions

In the meantime, a lot of work is already being done to overcome these hurdles. Thereby changes are being made towards a more acceptable view of DeFi by both consumers and traditional banks.

Within the DeFi space

Within the DeFi space there is a growing number of initiatives that are especially aimed at removing hurdles such as collateral requirements and volatile digital assets. Companies including Aave are working on permitting uncollateralised loans akin to traditional finance. And in 2022 there will be increasing interoperability between DExs, which is vital for improving liquidity. The German financial services firm Paycer is developing a bridge protocol to combine DeFi and cross-chain crypto services to integrate them with traditional (centralised) finance (CeFi) services. This should support full interoperability across multiple blockchains.

Education

Also on the education issue, there is a massive effort to upgrade the level. There is a growing number of educational institutions that are trying to improve the education of potential DeFi users and lower the high knowledge barriers. This will certainly help traditional bankers and regulators to become familiar with blockchain technology. And there are initiatives such as DeFi for the People that can help industries identify how to integrate DeFi into their existing business models.

Compliance

There is a growing consensus from both the traditional financial world and DeFi parties that DeFi products and services must be compliant, secure and appropriately audited and monitored to ensure users’ security and privacy. More DeFi platforms featuring KYC tools and compliant reporting systems to protect the DeFi market from regulatory uncertainties and to lure traditional financial institutions are being seen. Concordium (8) and Verum Capital AG are collaborating to launch the first lab focused on developing regulated decentralised finance products.

Formal regulation

Formal regulation is expected to come to the DeFi market in 2022 and beyond. Multiple policymakers and regulators world wide are already keeping a close eye on the growth of DeFi and its potential negative impacts and are making up their minds. A positive signal is the growing trend among regulators worldwide to develop a collaborative approach.

The EU’s upcoming Regulation of Markets in Cryptoassets (MiCA) (9) is expected to have strong implications for the DeFi sector. There is increased scrutiny from the US Securities and Exchange Commis sion and the US government, which will require protocols and platforms to significantly improve. But it is very likely that they will also come with regulatory solutions to ensure consumer protection while the innovative potential of DeFi may bring overall benefits to finance.

WHY SHOULD BANKS REACT?

DeFi is here to stay and is expected to fundamentally change traditional banking. Bringing more real-world assets and financial products on-chain will certainly expand in the DeFi ecosystem, attracting more investors and traders alike. New types of DeFi assets, more regulatory clarity and lower costs for transacting will further increase mainstream adoption of DeFi. It is yet to attract more traditional financial institutions. But once greater access to DeFi gets easier, traditional banks might have a real reason to worry. Should recent DeFi trials prove successful, and more product offerings take off, these protocols could start competing with traditional banks, presenting a main threat for them. Ignoring this trend might lead to a wake-up call in the future but by then it may be too late (10, 11). DeFi and the benefits it brings to the industry should be seen an opportunity rather than a threat for traditional banks. This goes especially for those banks that are willing to adapt. Financial institutions should therefore understand DeFi and start making big changes to their existing business model and fix those issues that DeFI corrects.

THE BANKING INDUSTRY IS AWAKENING

The banking industry, especially the larger institutions, increasingly sees DeFi as a potentially significant growth engine and disruptive force, challenging traditional banking. As DeFi further grows in size, and thus economic importance, they are increasingly seeking involvement in this sector, thereby exploring how they might engage with DeFi and the crypto-markets.

Most already have large crypto research divisions investigating to understand the ins and outs of DeFi and the various use cases. They are considering the advantages and risks of DLT solutions, thereby monitoring developments in the DeFi market and are beginning to see DeFi’s potential to overhaul the inflexibility of present processes. Because of heightened consumer and institutional investor demand for DeFi triggered by much better results compared to stretched valuations and low yields in conventional markets, established banks and hedge funds are increasing their exposure (12) to the DeFi ecosystem.

WHAT STEPS SHOULD BANKS TAKE?

But to be effective, what steps should the traditional financial sector take in order to survive? As on the scale of global finance, DeFi is still tiny, they should react in a phased way (13). Traditional finance should accept some DeFi products for existing customers, embrace DeFi and help shape the regulatory environment, create bridges and develop middle-way options and finally cooperate with the DeFi industry through partnerships with leading fintech firms.

Meet customers’ DeFi demands

A first step for traditional banks is to allow consumers wider access to DeFi via their banking services. Many customers are looking for more flexible, beneficial and less controlled ways to meet their financial wishes. If banks want to embrace DeFi, they need to embrace this shift by acknowledging that both DeFi and crypto are here to stay. DeFi’s superior yield and transparency should not be seen as a disadvantage, but more as an asset to banks and other financial institutions. The main condition is that they move quickly enough to custody digital assets and offer users the ability to earn returns on those assets through DeFi. Banks will primarily compete to offer users the best access to DeFi in the near future. For that, financial infrastructures should be prepared to interface with smart contracts and blockchains now. This will require financial institutions to allocate and train separate teams dedicated to managing this new asset class and adopt DeFi products that provide the best yield.

Serve new generation customers: Millennials and Gen Z

Another way to get involved in the DeFi ecosystem and to get ahead of the DeFi curve is to engage or partner with the group of new generation customers that are looking for more sophisticated products. These are increasingly being served by challenger and cryptobanks. DeFi could be seen by traditional banks as the next step in providing their new customers with the type of financial services they want to have. Just like in the 1990s when the internet was introduced. This group of risk-taking investors such as Millennials and Gen Z, which is nowadays underserved, increasingly sees value in digital and crypto-assets instead of the traditional low-return assets offered by traditional banks. Looking ahead, a next step will be offering asset management tools that simplify managing crypto for the wider retail investor market. Given the complexity of investing in digital assets, the development of asset management funds that both democratise and streamline crypto-investment seems a logical next step for banks.

Proactively embrace DeFi

Traditional banks could also align themselves with the DeFi activities and be more proactive. This may ensure having an active and prominent role in shaping future regulation via technical instruments. There are various options for banks to take a more proactive approach to DeFi. These may include developing so-called greenfield DeFi propositions in collaboration with the DeFi community, and collaborating with regulators to work out how to build regulation while still preserving the decentralised nature of DeFi.

For banks, viewing DeFi through an innovationlens is key to enable DeFi to fulfil its potential at large. For that they need to evolve their own internal compliance work flows to connect their banking services and the wider fiat economy to the opportunities that DeFi is likely to offer. One potential way forward is to shift the culture within banks’ compliance departments away from the present risk-averse approach to an innovation-first approach. This could be done by breaking down silos and encouraging compliance teams to work with engineers, designers and product people to test different compliance frameworks and try to innovate within those spaces.

Bridging the gap

As DeFi becomes mainstream, there will be a growing need to make this ecosystem compatible with traditional finance (14). Traditional banks could try to create a bridge between the traditional centralised financial services ecosystem (CeFi) and the new DeFi world. This will be done by developing credible and trustworthy pathways between both financial ecosystems.

Up until now, any significant moves to develop a bridge between traditional finance and cryptocurrency have come from centralised crypto-players like Coinbase and DeFi Alliance. These are establishing themselves as the kind of bridge-building industry thought leader and pioneer that banks should strive to reach. Coinbase is stimulating major banks to follow suit and offer an equivalent product allowing customers interested in cryptocurrency trading to have a wider choice of platforms. Another interesting player in this sector that focuses on bridging CeFi to DeFi is the Alkemi Network. This platform features an institution-grade liquidity network, offering CeFi institutions a professional avenue to invest in DeFi. Alkemi’s flagship product, ‘Alkemi Earn’, is a lending and borrowing platform that allows institutions to access DeFi through its permission pool. This particular pool features a KYC framework and compliant reporting systems to enable institutions to navigate the — up until now still obscure — DeFi market.

FUTURE FINANCIAL ECOSYSTEM: CONVERGENCE CEFI-DEFI

Decentralising financial products at scale is increasingly becoming a reality. It is still in the early stages and although DeFi is promising, it still has some way to go before it is widely accepted by customers and financial institutions. But in the end DeFi could open a completely new ecosystem. What will that look like?

To survive in the long term, traditional financial institutions should move and adjust to the new financial realities and start preparing (15) by adopting some DeFi principles and follow a phased approach. They should find ways to integrate DeFi into their systems and achieve coexistence.

In the short and medium term, CeFi and DeFi will behave as competitive or oppositional forces, which both have their own advantages. Banks could try to start bridging the gap by adopting compliant ecosystems, transforming the stream of old money into new digital and crypto-assets. But DeFi’s distance from the traditional finance system is also likely to narrow as participants in traditional markets look to expand into crypto, thereby strengthening the links between both (16).

Ultimately the two may converge in a ‘competitive battle’, whereby the blockchain based principles that DeFi relies on are likely to become fused with the underlying architecture of global finance. Banks should think of the emergence of the internet in the 1980s and 1990s and the rise in the number of fintechs. After some time needed to adjust to the new situation most of these fintechs were absorbed by the big financial institutions. That might now also be the scenario.