15-12-2022 | treasuryXL | Kyriba | LinkedIn |

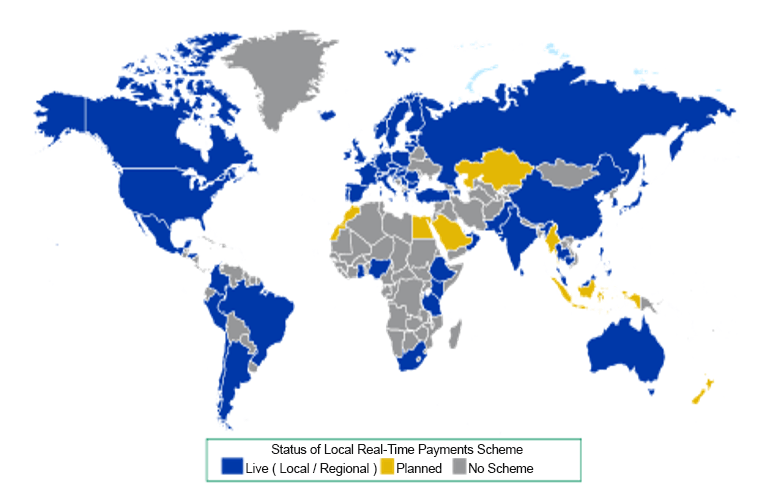

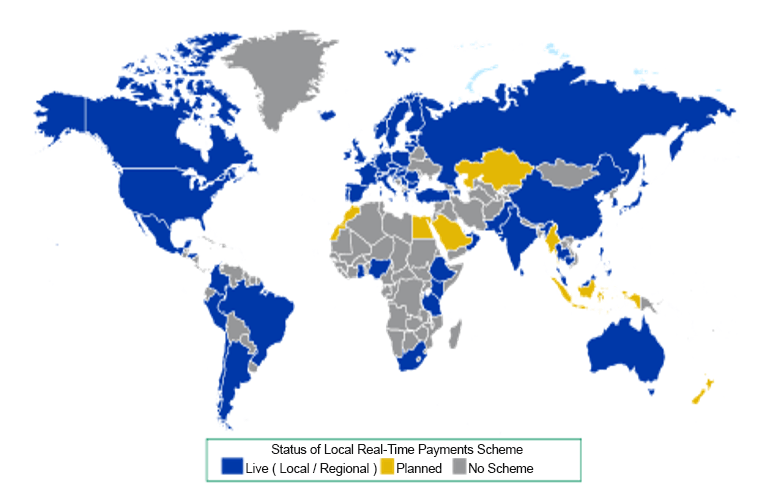

If you are reading this, you are likely already exposed to the hype surrounding real-time payments. Whether you believe in the hype or not, it is inevitable that real-time payments will become ubiquitous globally in the near term.

By Rishi Munjal

VP, Product Strategy, Payments

Source

The last two decades have shown that countries with a strong mandate for real-time payments tend to have robust adoption. For example, emerging economies like India and Brazil that have implemented central bank mandates are outpacing developed nations like the U.S in terms of customer adoption.

In 2017, The Clearing House launched the RTP® network, the U.S.’s first real-time payment infrastructure. However, the adoption of real-time payments in general remains low, currently representing 0.9% transaction volume and 0.5% spend, according to the ACI Prime Time for Real-Time report. Specifically, for B2B payments the adoption is even lower. In this blog, I will explore three simple reasons a corporation should consider real-time payments as part of its payment mix. I will stay away from industry-specific use cases, as these were covered in my previous blog.

1. Rebalance your payment mix towards lower-cost and comparable payment types.

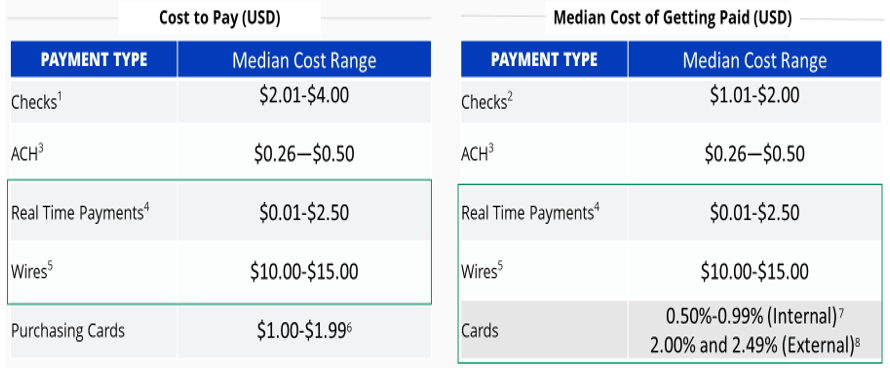

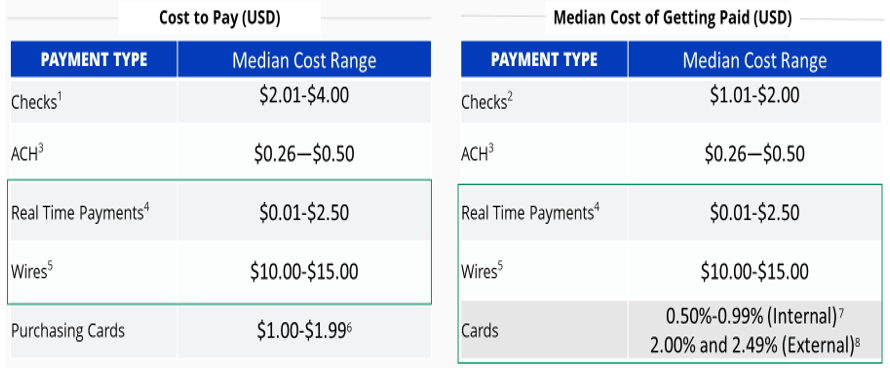

While finance organizations strive to keep the costs of operations low, they often only consider direct costs of payments. This practice creates a distorted comparison that can become a reason for inaction. Thus, it is important to measure both direct costs (e.g., provider fees, card interchange, etc.) and indirect costs (e.g., labor, technology, and support costs).

Using industry benchmarks provides a good starting point. The 2022 AFP Payments Cost Benchmarking Survey indicates that the median cost range for sending and receiving RTP® is comparable to ACH and cheaper than wires. Replacing qualifying volume of wires with RTP® can save tens of thousands of dollars, if not more, on an annual basis. You can realize these cost savings without giving up on irrevocability—a key benefit of wires. Kyriba clients’ success stories show tangible cost and productivity gains from such a strategy. If you are receiving card payments, you can save on interchange, which can be as high as 2.5%. With real-time payments, you get instant access to good funds and avoid chargebacks.

Median cost range to pay and get paid

Source: AFP® Payments Cost Benchmarking Survey, 2022

2. Improve cash visibility and liquidity.

Complementing real-time payments with real-time balance and transaction reporting improves cash visibility. This can be especially important if you make a lot of contingent payments. This includes business activities that are dependent on treasury receiving funds. For example, treasury may want to wait until certain funds have been received before releasing a particular payment. Cash visibility can be beneficial if you are being charged intraday credit or your bank does not permit intraday overdrafts.

Wider businesses may also benefit by triggering business activities based on contingent payments. For example, a supply chain team may want to hold on to a shipment until payment is received, accelerating their logistics process. In scenarios that need cash advance or cash-on-delivery, the buyer can make a real-time payment after inspecting the goods. Both parties win. The buyer reduces operational risk, and the seller reduces inventory and improves their working capital position.

With real-time payments, you are no longer beholden to the cut-off times, weekends and holidays. This means that payments can be made as late as possible. So, companies can meet emergency payments to meet any shortfall, and keep lower precautionary balances.

3. Speed up payment digitization and get the most value from your investments in modernization.

Payment processes are complex, and digitizing payments takes time. There are multiple reasons for this. Payment processes for large organizations often involve many roles; initiating, authorizing, and reconciling payments are typically handled by different parties, thereby drawing things out. Approval workflows can also be very complex, involving globally distributed teams. Technology teams may still have direct ownership of managing payment formats and bank connectivity.

When it comes to payment digitization, the U.S. has been behind other countries. Paper checks still account for 42% of payments disbursed by organizations, according to AFP research. The ubiquity of checks, inertia, and in some cases, tradition, continue to hold U.S. B2B payments back.

During the COVID-19 pandemic, payment digitization became even more essential. And since B2B payments are moving away from paper checks, then it only makes sense to complete those transactions as quickly and cheaply as possible.

Real-time payments leverage modern technology, especially APIs, as they transmit data instantly without the need for file downloads. By complementing real-time payments with automated bank account validation and payment policy screening corporates can set aside suspicious transactions for review while all other payments travel seamlessly. The value of payments modernization, including embracing real-time payments, lies in the endless possibilities it will bring to your future business growth.

Conclusion

Don’t dismiss real-time payments simply because they are new. Kyriba offers the most comprehensive coverage of real-time payments globally and we have taken an API-first approach, allowing CFOs and treasurers to inject real-time data-driven decision making into all financial operations. Whether you are an existing customer seeking to introduce real-time payments into your payment mix or a prospective customer seeking to digitize payments and treasury operations, we are ready to assist you in your journey. Contact us today.

Status of Real-time Payments Globally

Source: Prime Time for Real-Time ACT Worldwide,2022

Footnotes:

- Calculated total cost for issuing a paper check on a per Item Basis (in-house or outsourced)

- Calculated total cost for receiving a paper check on a per item basis

- Initiating and receiving ACH transaction (internal and external costs)

- The median transaction cost for initiating and receiving RTP payments on a per item basis

- Calculated cost for sending and receiving wire payments on a per-item basis

- Total calculated cost for outgoing payments made (including personnel, IT technology, compliance, audit, etc.) via a card (procurement, T&E, and virtual) per transaction

- The internal median cost range for receiving credit card transactions (including personnel, IT technology, file connectivity, encryption, audit, PCI DSS compliance, etc.)

- The external median cost range for receiving credit card transactions (including issuer/acquirer/processor interchange, assessment, monthly fees, etc.)