3 Ways Treasury Can Save Money & Boost Revenue in 2023

29-12-2022 | treasuryXL | TIS | LinkedIn |

As 2023 approaches, many treasury teams are actively evaluating their operations to identify areas in need of improvement during the year ahead. As these analyses are performed, TIS has compiled a short list of projects that treasury should consider undertaking in order to save costs, boost revenue, and drive further efficiency for their companies.

This blog serves as a precursor to TIS’ recent whitepaper, 5 Ways Treasury Can Save Money & Boost Revenue in 2023. You can download the full whitepaper using this link to review the full list of strategies and tips.

Introduction

Given their position at the helm of global cash, payments, and working capital activity, modern treasury teams play a vital role in controlling the various operational, financial, and technological costs that impact their companies. From monitoring and reducing banking and transaction fees to preventing payments fraud, managing daily liquidity, optimizing working capital, and developing short-term debt or investment strategies, today’s treasury groups are often in the ideal position to analyze their company’s cash flows and make improvements to boost revenue or save costs.

However, because most treasury teams have a relatively small headcount and are tasked with an ever-growing list of responsibilities, it is critical that practitioners maximize their available resources and focus on projects that will have largest impact on their company. This is especially true in today’s volatile economic environment, where cutting costs and maximizing revenue is more important than ever.

Given this context, it is likely that treasury groups will be seeking to undertake a variety of cost-savings or revenue-boosting projects in the months and years ahead. In-line with these expectations, this blog will highlight three strategic ways in which treasury teams can have a positive impact on their company’s bottom line in 2023. For extended analysis, you can also download our full whitepaper for additional strategies and tips.

- Rationalize Your Bank Partner & Account Landscape

- Simplify & Streamline Your Back-Office Technology Stack

- Deploy Payment Smart-Routing Tools for Cross-Border & Domestic Transactions

- Strengthen Your Treasury Security to Limit Losses from Fraud (See Whitepaper)

- Optimize Cash & Working Capital to Improve Short-Term Debt & Investments (See Whitepaper)

1. Rationalize Your Bank Partner & Account Landscape

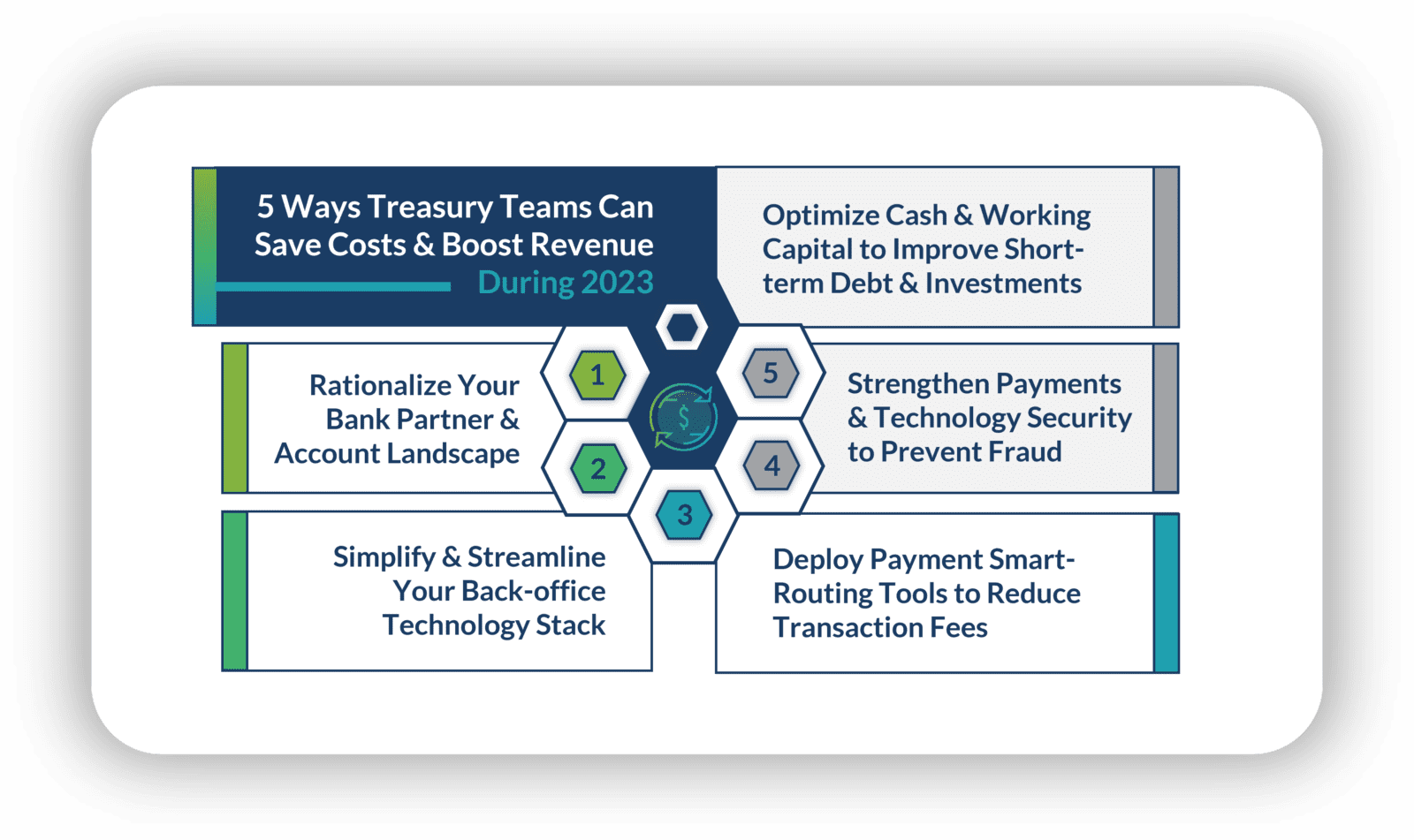

Today, it is common for global companies to work with numerous banks across different regions and entities. In fact, a 2022 TIS survey of over 250 treasury practitioners found that 40%+ of companies were actively using more than 10 banks globally. But while organizations obviously need a certain number of bank relationships to accommodate their geographical and operational scale, a larger than necessary group can result in higher costs, fragmented visibility, siloed workflows, and obscure points of communication.

For some treasuries, rationalizing bank relationships can be an effective way of reducing costs. By concentrating on a smaller number of relationships with a select group of core institutions, companies may be in a better position to negotiate more favorable pricing for their banking services. A more streamlined relationship structure can also improve operational efficiency by limiting the number of banking systems and connections required, reducing annual maintenance or service costs, and increasing transparency over all the related operations.

In addition to analyzing each bank relationship, it’s also important to consider the number of bank accounts in use. Because the number of accounts can easily become inflated over time through organic growth and M&A activity, many multinational corporations end up with more accounts than they want or technically need. In 2021, a Strategic Treasurer survey showcased that nearly 40% of companies used more than 100 bank accounts. Furthermore, 38% of companies indicated the number of bank accounts they used were increasing, and 20% of practitioners had identified previously unknown bank accounts attached to their company within the past 2 years (2019-21).

In the long run, companies with excess numbers of accounts that have not been closely monitored will be confronted with excess manual labor, inefficient cash management structures, and higher-than-necessary costs. It will also be much more difficult for treasurers to maintain visibility and control over the company’s cash and to detect fraud or compliance exposures.

Given these challenges, a streamlined bank account structure can not only reduce bank account fees, but also help to minimize idle cash balances and support more efficient cash management. As such, treasurers may be able to save money by rationalizing both the number of banks and accounts that they maintain.

2. Simplify & Streamline Your Back-Office Technology Stack

Similar to how a company’s banking structure grows more complex over time, so too does the back-office technology structure that treasury groups rely on to manage operations.

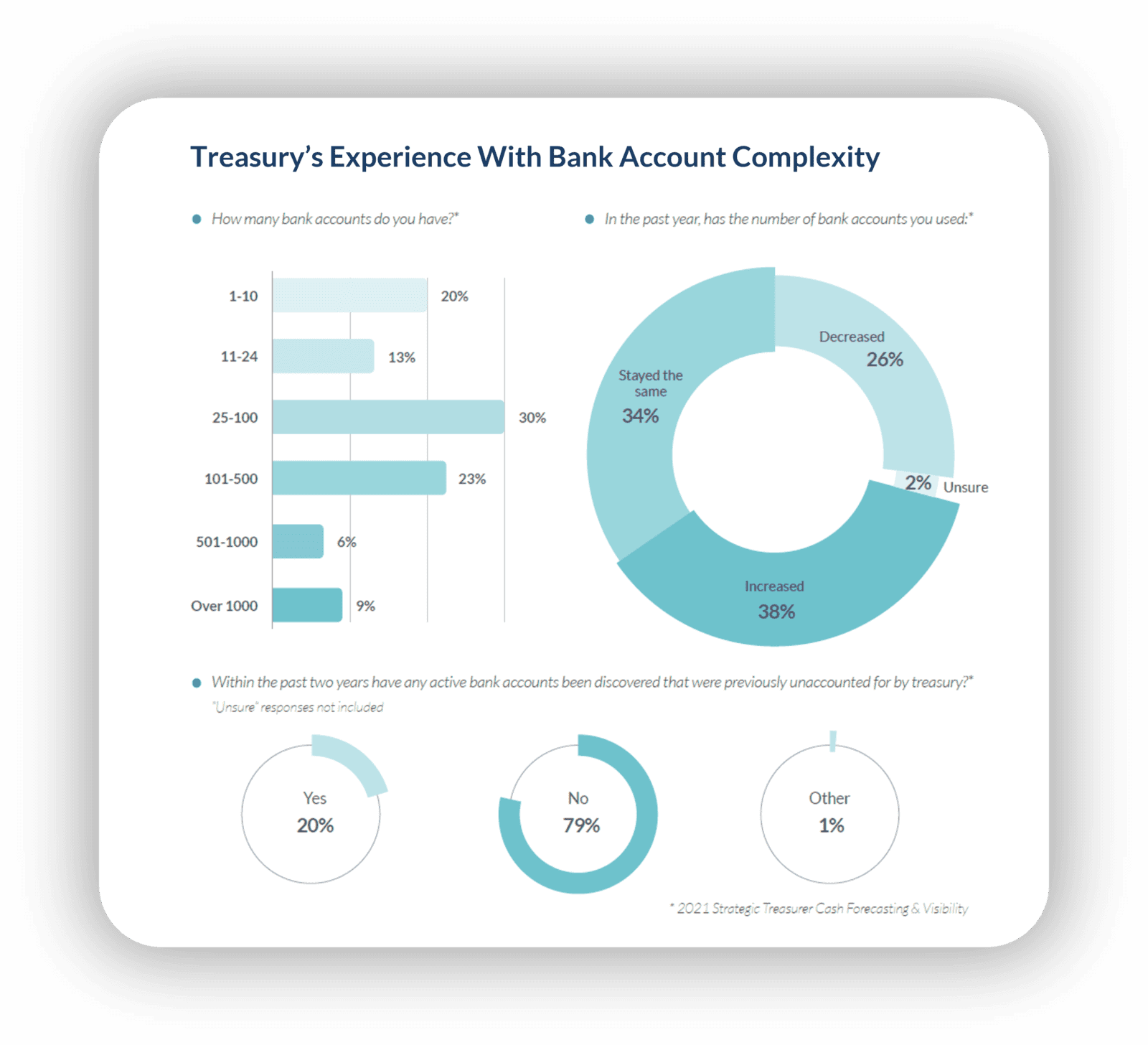

While modern-day treasury software is undeniably critical for today’s practitioners to automate and streamline their processes, such solutions are not always implemented or integrated in an efficient manner. Sometimes the configuration is never completed, or various features are inactive and not functioning as intended. In the long run, a common result of company growth is to wind up with a large assortment of spreadsheets, banking portals, ERPs, and TMS solutions that are collectively causing redundant and fragmented workflows, overly manual processes, a lack of integration or interoperability, and unnecessary subscription and maintenance costs.

In recent years, industry data has demonstrated the effect that unnecessary technology complexity can have on companies. In fact, data from Strategic Treasurer found that 3 out of 5 companies that purchased a TMS were using less than 80% of the functionality they implemented. In addition, one of TIS’ recent research initiatives found that 38% of treasury and finance respondents were using more than 15 different treasury, vendor or payment systems – with two thirds using more than five systems. With this amount of diverse technology in place, it’s easy to see how processes can become inefficient and inconsistent, and how data can become siloed and difficult to consolidate.

In order to promote greater automation and transparency and to reduce overall technology costs, treasury teams with an excess number of systems should strongly consider a consolidation project. A simpler and more unified technology structure can result in more efficient processes, greater transparency, and improved decision-making as a result of more accurate information. Simplifying treasury’s technology stack can also result in other benefits such as improved reporting, reduced IT reliance, more secure fraud controls, and more standardized compliance management.

3. Deploy Payment Smart-Routing Tools for Cross-Border & Domestic Transactions

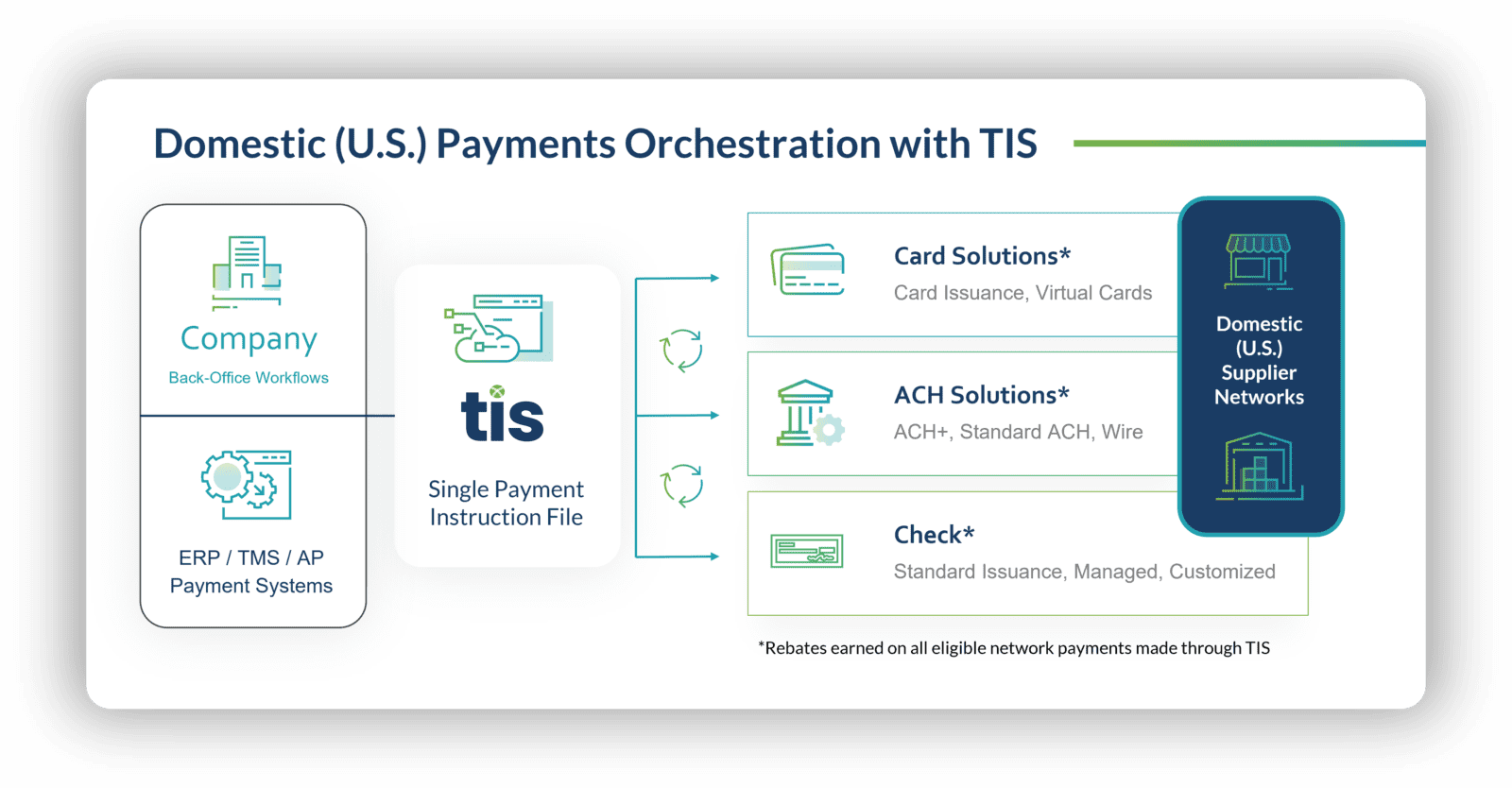

Considering that many companies today operate across multiple countries and regions, it makes sense that treasury teams are managing payments using a broad variety of currencies, channels, and methods. For example, a true multinational company will likely leverage ACH, check, wire, cards, and a variety of other options to send and receive payments. They will also probably use a diverse range of banking channels and financial messaging formats to transmit payments data, along with an equally diverse number of integration and service-level partners to assist with the process.

So how can treasury simplify these payment workflows?

When it comes to cross-border payments, one helpful consideration would be to execute transactions at the local level (i.e. in local currency), rather than relying on traditional correspondent banking or FX conversion services. Because many cross-border payment networks charge exorbitant fees for swapping currencies and delivering funds, companies that regularly transfer money between different countries and regions could save substantially by leveraging a more specialized service.

On the other end of the spectrum, there are also plentiful opportunities to optimize the use of domestic payment methods. In the U.S. for example, switching from physical checks (still a common instrument) to ACH can save time and effort, while other options like virtual cards may offer rebate or cash-back rewards. For companies that have a large network of suppliers and partners in the U.S., joining a rebate program or converting paper-based payments to ACH and virtual cards can provide substantial efficiencies and cost-savings, especially when such projects are executed at scale.

Final Thoughts: How Can TIS Help Treasury Unlock New Cost-Savings Opportunities?

In today’s uncertain and volatile economy, it’s essential that companies take every opportunity to minimize costs and maximize revenue. As we’ve seen with treasury, there are numerous areas where cost-savings and revenue-generation projects can be pursued. Whether it’s through bank and technology rationalizations or improved payments execution and liquidity management strategies, treasury teams have numerous options at their disposal to impact the bottom line. Moreover, the benefits associated with many of these projects often create efficiencies outside of pure costs savings and include enhanced workflow automation, streamlined data management, and the elimination of error-prone, non-compliant, and fraud-exposed processes.

For organizations interested in pursuing any of these strategies or projects further, we strongly encourage you to consider how the TIS solution can help foster the desired outcomes.

At a high level, TIS helps organizations simplify and streamline their global payments and liquidity management operations. Our cloud-based platform empowers businesses to optimize critical functions surrounding cross-border and domestic payments, bank connectivity, cash forecasting, fraud prevention, payment compliance, and more.

Today, corporations, non-profits, and institutions all leverage TIS to transform how they connect with global banks and financial systems, collaborate on payment processes, execute outbound payments, analyze cash flow & compliance data, and promote working capital efficiency. Ultimately, the TIS technology platform enables businesses to improve operational efficiency, lower risk, manage liquidity, gain strategic advantage – and achieve enterprise payment optimization.

For more insight on ways treasury can save money and boost revenue in 2023, download our full whitepaper.