Minor Treasury Management at Hogeschool Utrecht increasingly successful

| 15-8-2017 | Pieter de Kiewit | treasuryXL |

In July 2017 our expert Pieter de Kiewit wrote an interesting article about the minor treasury managment of Hogeschool Utrecht (University of Applied Sciences).

In July 2017 our expert Pieter de Kiewit wrote an interesting article about the minor treasury managment of Hogeschool Utrecht (University of Applied Sciences).

Hogeschool Utrecht started with this program three years ago and Pieter had been asked by Frans Boumans, lecturer and researcher at Hogeschool Utrecht, to contribute to create the curriculum. Pieter also assisted in finding both guest lecturers and companies providing internships. He will give a presentation to students about labour market opportunities for treasury experts on September 20th, 2017. In his article Pieter continues:

Programs like these do exist at universities in Europe and other countries. The university of Chicago has a strong reputation and we recruited two candidates from France with an extensive academic treasury curriculum. In the Netherlands the Register Treasurers post graduate program is the obvious academic way to go for a treasurer. You can only enter with experience and a degree. Graduating at master level in treasury in the Netherlands is not (yet?) organised.

By now, the Hogeschool Utrecht program has more applicants than seats. Students, not only from Utrecht, but also from other cities enroll. Their backgrounds vary from accounting, audit to business control. They find positions in SMEs, bigger corporates and the financial services industry. Recently Treasurer Search found a permanent position for a graduate with a treasury minor (again). Before we did not recruit graduates as our focus did not match the Dutch educational system. Graduates with treasury expertise were hardly available.

As from September we will continue our cooperation. Together with the people of treasuryXL we will create a brief survey in order to find out what is “hot in corporate treasury”. The results of this survey will be used to have student write papers. Interesting stuff! If you want to contribute or know more about this program you can contact Frans directly ([email protected]) or through Treasurer Search. The structure is set but for good input there is always room.

I hope all this is the preparation for an academic treasury track in The Netherlands. Time will tell.

Pieter de Kiewit

Owner Treasurer Search

More articles of this author:

Fintech recruitment considerations

If you are not a treasurer with the ambition of a dentist

Banker to corporate treasury transfer – A topic as relevant as ever

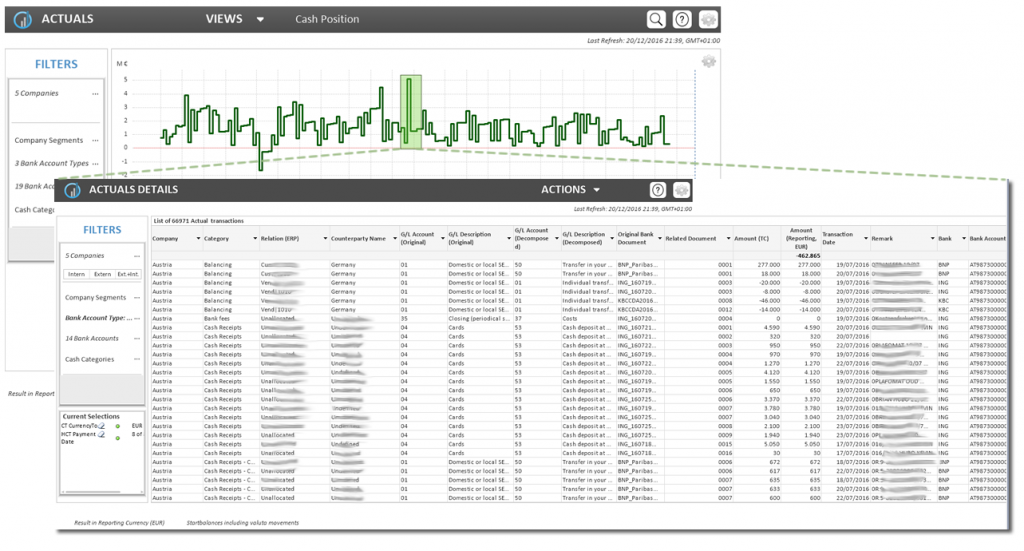

How do strategic professionals decide on the best path to success for their company? The key for strategic finance professionals and the best path to success lies in transparency and real-time reporting across company-wide cash flow and liquidity levels, bank transactions, customer and supplier relations and working capital.

How do strategic professionals decide on the best path to success for their company? The key for strategic finance professionals and the best path to success lies in transparency and real-time reporting across company-wide cash flow and liquidity levels, bank transactions, customer and supplier relations and working capital.

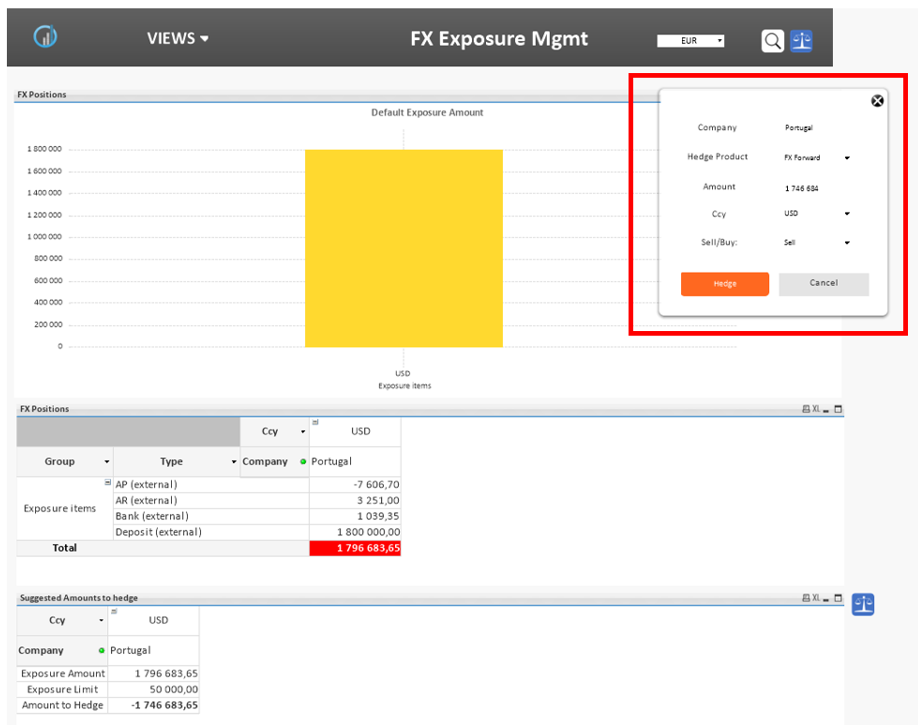

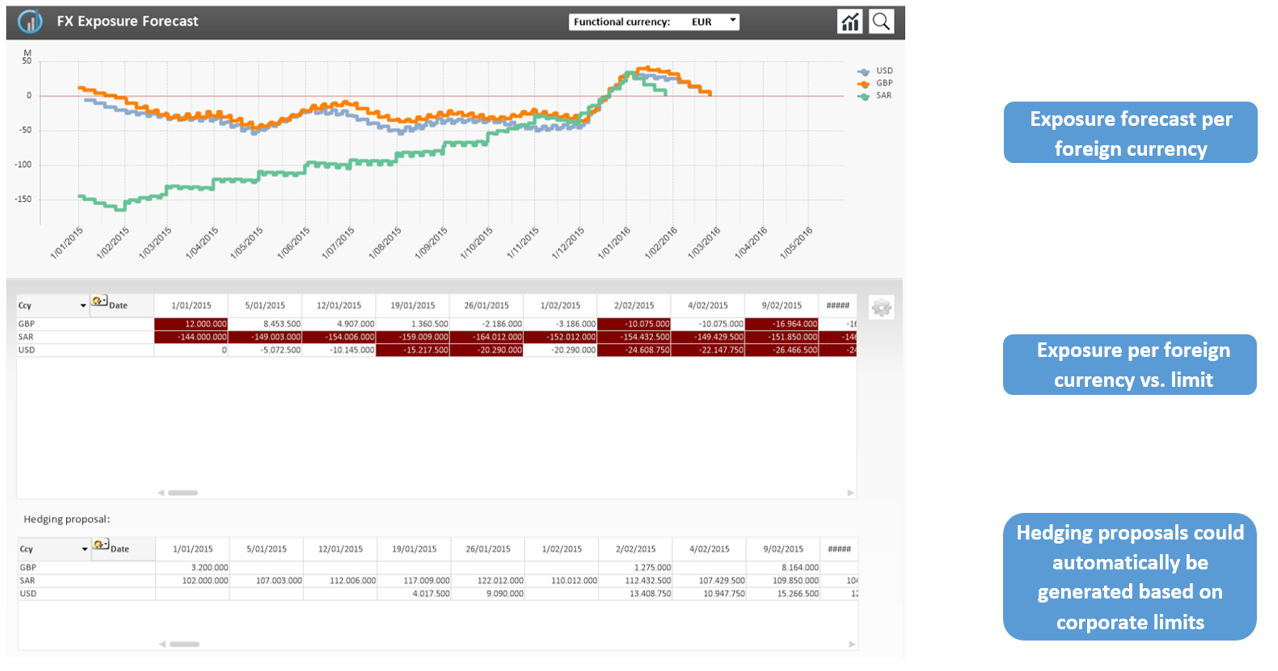

While the role of the treasurer is changing, it becomes increasingly challenging to maintain the current workflows and simultaneously take on new demanding tasks. One of these often manual and time-consuming tasks is risk management. As seen in, among others, this year’s Global Treasury Benchmark Survey of PwC, the registration and management of financial instruments stands among the top 3 challenges on the agenda of the surveyed treasurers. In this article, we take a more in-depth look at possible optimizations in some key treasury workflows.

While the role of the treasurer is changing, it becomes increasingly challenging to maintain the current workflows and simultaneously take on new demanding tasks. One of these often manual and time-consuming tasks is risk management. As seen in, among others, this year’s Global Treasury Benchmark Survey of PwC, the registration and management of financial instruments stands among the top 3 challenges on the agenda of the surveyed treasurers. In this article, we take a more in-depth look at possible optimizations in some key treasury workflows.

FX Exposure Management – Future positions & exposures

FX Exposure Management – Future positions & exposures

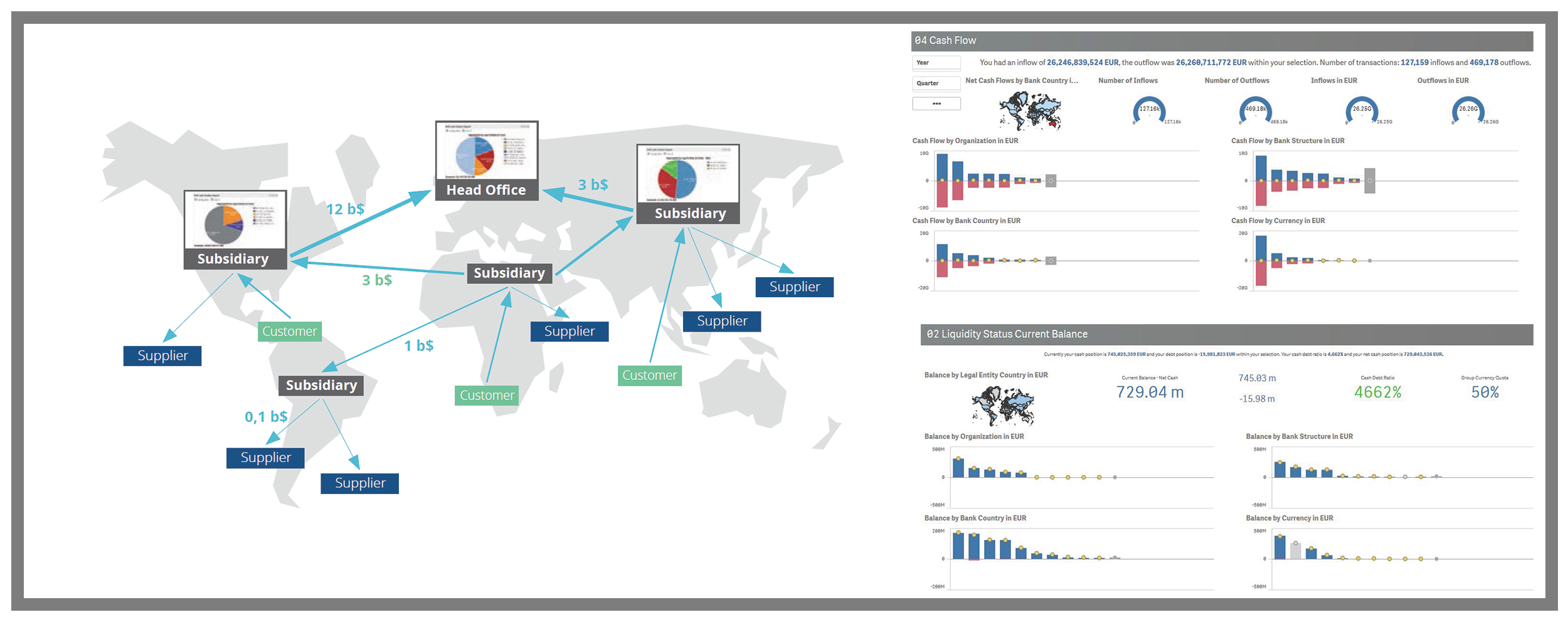

From now on, Faber-Castell will be organising its cash flow forecasting, accounts and derivatives with TIP. Regardless of where in the world, TIP allows the many subsidiaries of the multi-national to forecast and plan without major time inputs. Data capturing is decentralised while data analysis is centralised.

From now on, Faber-Castell will be organising its cash flow forecasting, accounts and derivatives with TIP. Regardless of where in the world, TIP allows the many subsidiaries of the multi-national to forecast and plan without major time inputs. Data capturing is decentralised while data analysis is centralised. Hubert Rappold – CEO at

Hubert Rappold – CEO at  E-invoicing is more than just a PDF that you send via e-mail. It’s a fully-automated process that enables receivers to get the invoice directly into their financial system. In this blog our expert Mark van de Griendt van Power toPay/Unified Post has summed up some of the key benefits for senders and receivers of electronic invoices.

E-invoicing is more than just a PDF that you send via e-mail. It’s a fully-automated process that enables receivers to get the invoice directly into their financial system. In this blog our expert Mark van de Griendt van Power toPay/Unified Post has summed up some of the key benefits for senders and receivers of electronic invoices.

Mark van de Griendt – Cash Management Expert at

Mark van de Griendt – Cash Management Expert at

In their first session

In their first session

Proferus

Proferus Cashforce Cash forecasting 2.0

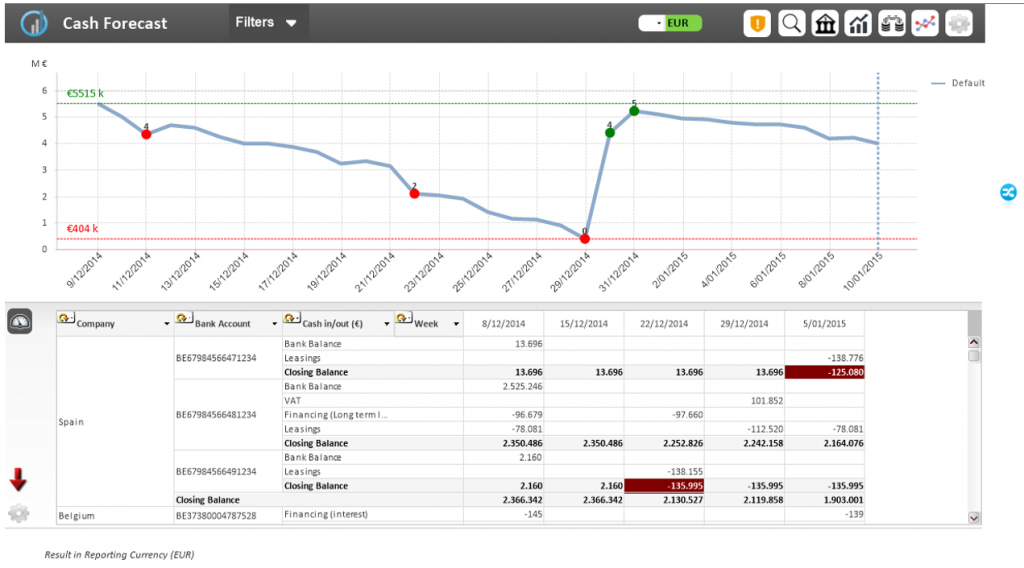

Cashforce Cash forecasting 2.0 How do strategic professionals decide on the best path to success for their company? The key is in transparency and real-time reporting. If it comes to the responsibility of the treasurer or financial professional this means deciding about company-wide cash flow and liquidity levels, bank, customer and supplier relations and working capital.

How do strategic professionals decide on the best path to success for their company? The key is in transparency and real-time reporting. If it comes to the responsibility of the treasurer or financial professional this means deciding about company-wide cash flow and liquidity levels, bank, customer and supplier relations and working capital.

GMU, het formaat wat al jaren door ING wordt gebruikt als formaat voor de bankafschriftinformatie, wordt vanaf 1 juli niet meer door ING aangeboden. Dit formaat wordt al tientallen jaren door ING geleverd en wordt ‘ingehaald’ door formaten die uitgebreidere (incasso) informatie kunnen geven. Wat houdt deze verandering precies in? En wat zijn oplossingen voor het verdwijnen van GMU?

GMU, het formaat wat al jaren door ING wordt gebruikt als formaat voor de bankafschriftinformatie, wordt vanaf 1 juli niet meer door ING aangeboden. Dit formaat wordt al tientallen jaren door ING geleverd en wordt ‘ingehaald’ door formaten die uitgebreidere (incasso) informatie kunnen geven. Wat houdt deze verandering precies in? En wat zijn oplossingen voor het verdwijnen van GMU? GMU-converter

GMU-converter